Cryptocurrency Market Performance

Currently, the total market capitalization of cryptocurrencies is $3.09 trillion, with BTC accounting for 58.43%, which is $1.8 trillion. The market capitalization of stablecoins is $30.75 billion, having increased by 0.18% in the last 7 days, with USDT accounting for 60.46%.

Among the top 200 projects on CoinMarketCap, most have risen while a few have fallen, including: BTC with a 7-day increase of 1.21%, ETH with a 7-day increase of 1.7%, SOL with a 7-day increase of 7.8%, RENDER with a 7-day increase of 48.86%, and VIRTUAL with a 7-day increase of 44.49%.

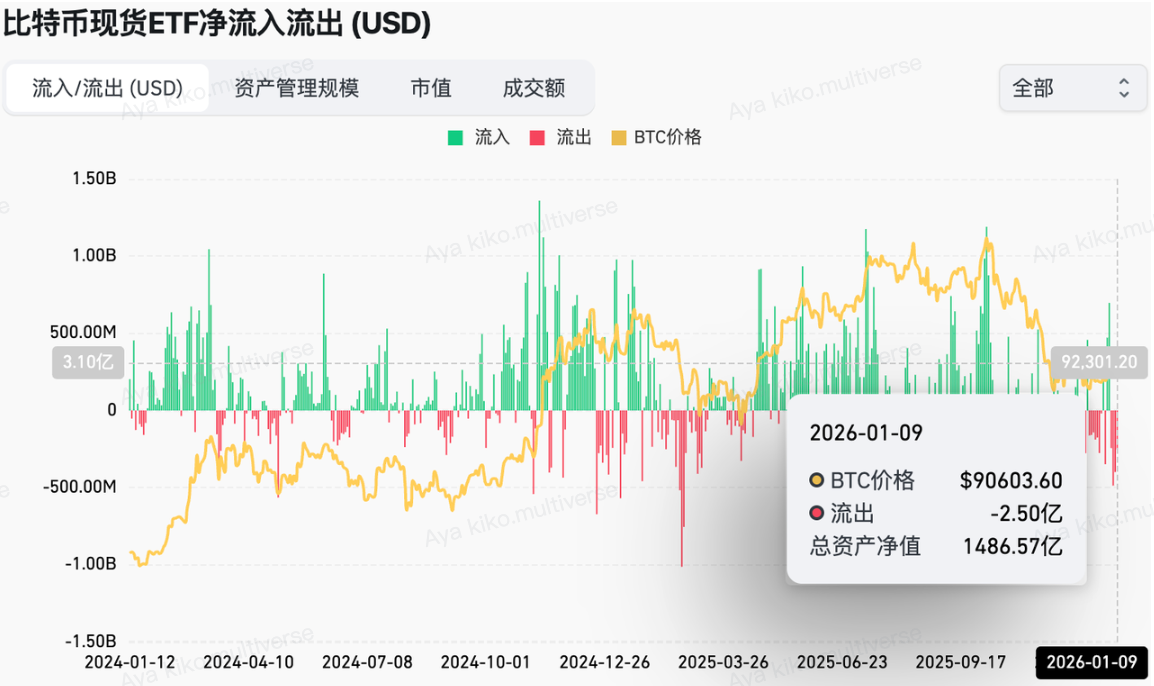

This week, the net outflow from the U.S. Bitcoin spot ETF was $681 million; the net outflow from the U.S. Ethereum spot ETF was $68.1 million.

Market Forecast (January 12 - January 18) :

The current RSI index is 47.56 (neutral range), and the fear and greed index is 26 (the index remains the same as last week, generally in the fear range), while the altcoin season index is 56 (neutral, higher than last week).

BTC core range: $89,500-94,000

ETH core range: $3,100-3,350

SOL core range: $116-145

Next week, the cryptocurrency market is expected to maintain a strong oscillating pattern, with macroeconomic events being the decisive variable.

Macroeconomics (Decisive Factors):

Federal Reserve Chair Nomination: This is the most important macro variable. Market rumors suggest that the nomination may be announced during the week of January 12. If the final candidate is perceived as "pro-crypto" or "dovish," it could serve as a strong catalyst for market growth.

U.S. CPI Data (to be released on January 12): This will directly affect market expectations regarding inflation and future interest rate paths.

Regulatory and Policy Dynamics:

Digital Asset Market Structure Bill (Clarity Bill): The progress of relevant votes in the U.S. Senate is a key focus for the market.

Next week, the market will seek direction amid the tug-of-war between macro events and expectations of improved liquidity. The best strategy is to remain cautious before key events unfold and to wait for the market to respond clearly to news before formulating subsequent plans based on price acceptance at key levels.

Understanding Now

Review of Major Events of the Week

On January 3, after 2 PM Beijing time, a huge explosion was heard in Caracas, the capital of Venezuela, and air raid sirens sounded. Power supply was interrupted in areas near a large military base in the southern part of the city. The cryptocurrency market experienced a certain degree of decline, possibly influenced by this event;

According to a post by a CBS reporter on social media, U.S. officials revealed that President Trump has ordered strikes on targets within Venezuela, including military facilities. The post stated, "This move marks an escalation of pressure on the Maduro regime by the Trump administration early Saturday morning";

On January 6, Business Insider reported that an insider had profited hundreds of thousands of dollars by accurately betting on the political prospects of Venezuelan President Nicolás Maduro, and a congressman attempted to prevent government officials from engaging in similar operations;

On January 6, CoinDesk reported that Buck Labs launched a cryptocurrency token BUCK, positioned as a "Savings Coin" for non-U.S. users, focusing on providing passive income for dollar-denominated crypto assets rather than traditional stablecoins;

On January 7, data from Bitget TradFi showed that spot gold and silver began a strong rebound around January 3, with spot gold reaching $4,500 at one point, just $50 short of its historical high; spot silver regained $82, currently reported at $82.4, up 15% for the week, with less than a 2% gap from its previous high;

On January 8, the U.S. released December ADP employment data, showing a moderate recovery in employment. As a result, the probability of a rate cut by the CME "FedWatch" for January has dropped to 11.1%, down from 17.7% the previous day;

On January 7, Falcon Finance announced the launch of a new off-chain Bitcoin yield vault designed for Bitcoin holders who wish to earn returns without changing their long-term holdings, with an expected annual yield of 3% to 5%, paid in Falcon's USD-denominated asset USDf;

On January 8, Bank of America upgraded Coinbase's rating to "Buy," citing accelerated product expansion, strategic adjustments, and more attractive current valuations. BofA noted that Coinbase's stock price has retreated about 40% from its July peak, but product momentum is improving in the second half of the year;

On January 9, major Wall Street lobbying organization SIFMA held a closed-door meeting with several representatives from the crypto industry to discuss core differences in the U.S. cryptocurrency market structure bill and made some progress on DeFi-related terms.

Macroeconomics

On January 7, the U.S. ADP employment number for December was 41,000, below the expected 47,000, and the previous value was revised from -32,000;

On January 8, the number of initial jobless claims in the U.S. for the week ending January 3 was 208,000, below the expected 210,000, with the previous value revised from 199,000 to 200,000;

On January 9, the U.S. unemployment rate for December was 4.4%, lower than the expected 4.5%, and the previous value was 4.6%;

On January 9, according to CME "FedWatch" data, the probability of the Federal Reserve cutting rates by 25 basis points in January is 12.6%, while the probability of maintaining rates is 87.4%.

ETF

According to statistics, from January 4 to January 9, the net outflow from the U.S. Bitcoin spot ETF was $681 million; as of January 9, GBTC (Grayscale) had a total outflow of $25.365 billion, currently holding $14.711 billion, while IBIT (BlackRock) currently holds $70.249 billion. The total market capitalization of the U.S. Bitcoin spot ETF is $120.562 billion.

The net outflow from the U.S. Ethereum spot ETF was $68.1 million.

Envisioning the Future

Project Progress

The results of the second round of applications for Monad Momentum will be notified to applicants by January 13;

A special meeting for Nasdaq-listed medical technology company Semler Scientific will be held on January 13, 2026, to approve the merger proposal with Bitcoin asset reserve company Strive. After the merger, the two companies will jointly hold nearly 13,000 Bitcoins, placing the merged entity among the top five Bitcoin reserve companies globally;

The query date for the Aster Phase 4 airdrop will open on January 14, 2026, with the claim window opening on January 28, 2026;

The BSC mainnet Fermi hard fork upgrade is expected to activate on January 14, 2026, at 10:30 AM. This upgrade will shorten the block interval from 750 milliseconds to 450 milliseconds to improve network throughput and transaction processing efficiency;

BitMine plans to hold its annual shareholder meeting on January 15, 2026, at the Wynn Hotel in Las Vegas;

The MSCI index will decide on January 15, 2026, whether to exclude Strategy;

The UK's Financial Conduct Authority (FCA) has recently opened a regulatory sandbox for local stablecoin issuers wishing to test their stablecoin solutions. The application deadline for this sandbox is January 18.

Important Events

On January 13 at 21:30, the U.S. will release the December unadjusted CPI year-on-year rate;

On January 15 at 21:30, the U.S. will release the number of initial jobless claims for the week ending January 10 (in ten thousand).

Token Unlocking

Aptos (APT) will unlock 11.31 million tokens on January 11, valued at approximately $21.04 million, accounting for 0.7% of the circulating supply;

Starknet (STRK) will unlock 126 million tokens on January 15, valued at approximately $10.95 million, accounting for 4.83% of the circulating supply;

Sei (SEI) will unlock 55.56 million tokens on January 15, valued at approximately $6.89 million, accounting for 1.05% of the circulating supply;

Arbitrum (ARB) will unlock 92.65 million tokens on January 16, valued at approximately $19.55 million, accounting for 1.86% of the circulating supply;

ZKsync (ZK) will unlock 175 million tokens on January 17, valued at approximately $5.79 million, accounting for 3.16% of the circulating supply.

About Us

Hotcoin Research is the core research institution of Hotcoin Exchange, dedicated to transforming professional analysis into your practical tools. Through our "Weekly Insights" and "In-Depth Reports," we analyze market trends for you; leveraging our exclusive column "Hotcoin Selection" (AI + Expert Dual Screening), we identify potential assets and reduce trial-and-error costs. Each week, our researchers will also engage with you live, interpreting hot topics and predicting trends. We believe that warm companionship and professional guidance can help more investors navigate cycles and seize the value opportunities of Web3.

Risk Warning

The cryptocurrency market is highly volatile, and investing carries risks. We strongly recommend that investors conduct investments based on a full understanding of these risks and within a strict risk management framework to ensure the safety of their funds.

Website: https://lite.hotcoingex.cc/r/Hotcoinresearch

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。