Trump's simple statement to The New York Times, "I have made a decision in my heart," left the global financial markets holding their breath. The person who is about to take over the Federal Reserve will become the most critical variable determining the direction of the U.S. economy.

In an exclusive interview with The New York Times, President Trump stated that he has decided whom to nominate for the next Federal Reserve chair but refused to disclose the specific candidate. The incoming Federal Reserve chair will take over an institution facing unprecedented political pressure.

Current chair Powell's term will end in May 2026, and he has long been a frequent target of Trump's criticism. Whoever takes over will be at the center of the policy and political game.

01 Timing of the Decision

The timing of Trump's announcement that he has a candidate is noteworthy. Just six months ago, the White House stated that the decision regarding the nomination of the next Federal Reserve chair was not "urgent."

● Trump's sudden shift may be related to his growing dissatisfaction with current Federal Reserve chair Powell. Trump has publicly criticized Powell's Federal Reserve for being unwilling to cut interest rates, even stating that the Federal Reserve should lower rates by 3 percentage points.

● This timing may also have political strategic implications. Wall Street almost universally believes that intervening in the independence of the Federal Reserve could have a significant impact on global capital flows. By announcing a candidate early, Trump is attempting to exert greater influence over monetary policy.

02 Three Leading Candidates

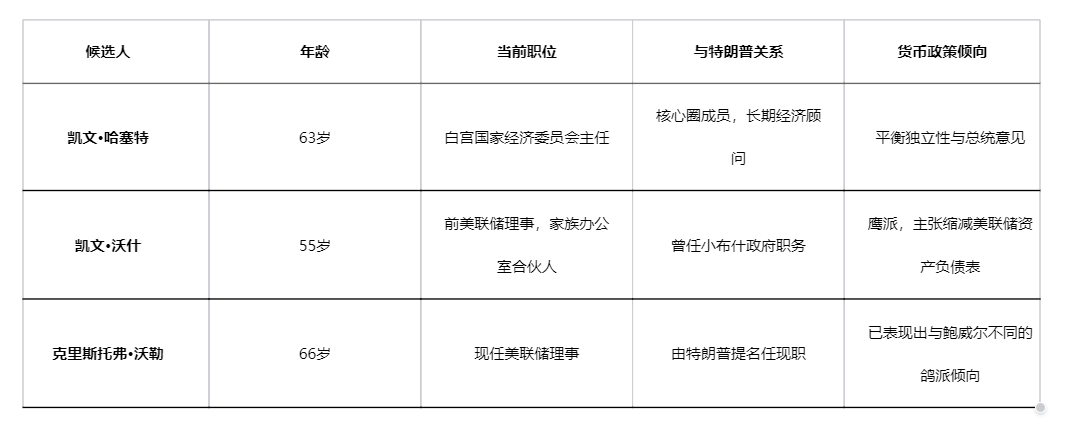

Prediction markets show that three candidates are currently in the lead: Kevin Hassett, Kevin Warsh, and Christopher Waller. One is an "insider" at the Federal Reserve, one is a core member of Trump's circle, and the other is a long-time critic of the Federal Reserve.

● Kevin Hassett, the current chair of the White House Council of Economic Advisers, is seen as the top contender. Born in 1962, his research areas include tax policy, fiscal policy, energy issues, and stock investments. Since emerging in late 2025, he has made several attempts to quell external concerns.

○ Notably, Hassett is one of Trump's core circle members and has frequently served as an economic advisor for Republican candidates in recent years. He has attempted to seek a balance between independence and loyalty, stating that Trump will have "no weight" in interest rate decisions, while also implying that he would listen to the president's opinions.

● Kevin Warsh, a former Federal Reserve governor, is currently a partner at Stan Druckenmiller's family office, Duquesne. Born in 1970, he graduated from Stanford University and holds a law degree from Harvard University.

○ Warsh's uniqueness lies in the fact that, in the 14 years since leaving the Federal Reserve, he has become a critic of the institution. He has stated that the Federal Reserve has become the largest buyer of U.S. Treasury bonds since 2008, with a balance sheet of up to $7 trillion that distorts the market.

● Christopher Waller, the current Federal Reserve governor, was nominated to this position by Trump in December 2020. Born in 1959, he has served in the Federal Reserve system for 16 years.

○ As a current governor, Waller has shown a different stance from Powell. At the July 2025 FOMC meeting, he cast a dissenting vote, believing that interest rates should be cut by 25 basis points rather than kept unchanged.

The table below compares the basic information of the three candidates:

03 Political Pressure and Independence Crisis

The primary challenge facing the next Federal Reserve chair is how to maintain the central bank's independence under Trump's ongoing political pressure. Trump has consistently expressed a desire for the central bank to act according to his wishes.

● This pressure has raised concerns on Wall Street. JPMorgan CEO Dimon has stated, "Using the Federal Reserve for political purposes could have negative consequences, completely opposite to what you hope for. It is important for them to maintain their independence."

● Historically, the independence of the Federal Reserve has been safeguarded through a series of institutional arrangements. The terms of board members last for 14 years, and the president has no authority to dismiss these members; dismissal requires a two-thirds vote from Congress.

● However, Trump's potential strategy may involve influencing monetary policy through a "shadow chair." Nominating someone for the position in advance, even before they officially take office, could exert pressure on the current Federal Reserve.

04 A Divided Federal Reserve and Policy Dilemma

The divided situation that the next chair will inherit is far beyond imagination. Research from Deutsche Bank shows that the current level of disagreement within the Federal Reserve has reached a ten-year high.

● Federal Reserve officials' predictions for the federal funds rate in 2025 show a highly polarized distribution, with the gap between the most common and the second most common predictions reaching 50 basis points. This bimodal distribution is close to historical records, indicating that the Federal Reserve has split into two major camps.

● The division stems from differing interpretations of the U.S. economic fundamentals among officials, as well as fundamental disagreements on how to balance inflation and economic growth. At the same time, the Federal Reserve faces the risk of inflation rising again. Economists at Bank of America have stated that Trump's tariffs could lead to a resurgence of inflation, thereby preventing the Federal Reserve from cutting rates in 2025.

05 Choices in Historical Context

● The turnover of the Federal Reserve chair has historically often become a key juncture for adjustments in economic policy direction. Looking back at history, there are precedents that are similar to or can be referenced in the current situation. The longest-serving chair in Federal Reserve history, William McChesney Martin, served under five different presidents for a total of 19 years.

● One of his most significant achievements during his tenure was to free the Federal Reserve from White House intervention, officially making it an independent economic policy-making body. He rejected Truman's request for intervention in the government bond market and repeatedly defied the White House's wishes in monetary policy formulation.

● Martin's famous saying, "The job of the Federal Reserve is to take away the punch bowl just when the party is getting good," reflects his monetary policy philosophy. This philosophy remains relevant today, especially as the Trump administration vigorously promotes interest rate cuts to stimulate the economy.

The odds in the political prediction market are still changing in real-time, but the frontrunners consistently revolve around two names: Hassett, loyal to Trump's economic philosophy, or Warsh, who can balance various viewpoints.

Regardless of whose name is ultimately formally submitted to the Senate, they must face a reality—the portraits of former chairs who defended the independence of the central bank are silently watching everything from the entrance of the Federal Reserve building.

Join our community to discuss and grow stronger together!

Official Telegram community: https://t.me/aicoincn

AiCoin Chinese Twitter: https://x.com/AiCoinzh

OKX benefits group: https://aicoin.com/link/chat?cid=l61eM4owQ

Binance benefits group: https://aicoin.com/link/chat?cid=ynr7d1P6Z

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。