1. Market Transformation: From Speculative Experiment to Mature Asset Class

Digital assets are undergoing a profound transformation from marginal speculation to mainstream financial instruments. By 2025, Bitcoin and the overall digital asset market are expected to perform steadily, but the underlying infrastructure and institutional participation have quietly restructured. Traditional banks, payment institutions, and government departments are accelerating their layouts, with the first U.S. cryptocurrency-specific regulations being implemented, a European framework coming into effect, and even state-level Bitcoin strategic reserves emerging.

Pension funds, endowment funds, sovereign wealth funds, and central banks are beginning to allocate digital assets, marking a transition from the "disillusionment trough" to a substantial industrial reshaping phase. This process is akin to the container revolution—initially not widely recognized, but gradually reconstructing the global trade system.

Digital assets are redefining the valuation, transfer, and custody of financial assets through programmable settlement, 24/7 liquidity, and borderless infrastructure.

2. Acceleration of Institutionalization: Improvement of Financial Products and Market Structure

- Exchange-Traded Products (ETP) as a Bridge

● The U.S. spot Bitcoin ETP, launched in 2024, reached an asset management scale of $124 billion by December 2025, with about 25% coming from institutions.

● The ETP options market is expanding simultaneously; during the market volatility in the fall of 2025, the open interest for put options reached $40 billion, and Nasdaq has applied to increase the position limits for leading Bitcoin ETP options to release more liquidity.

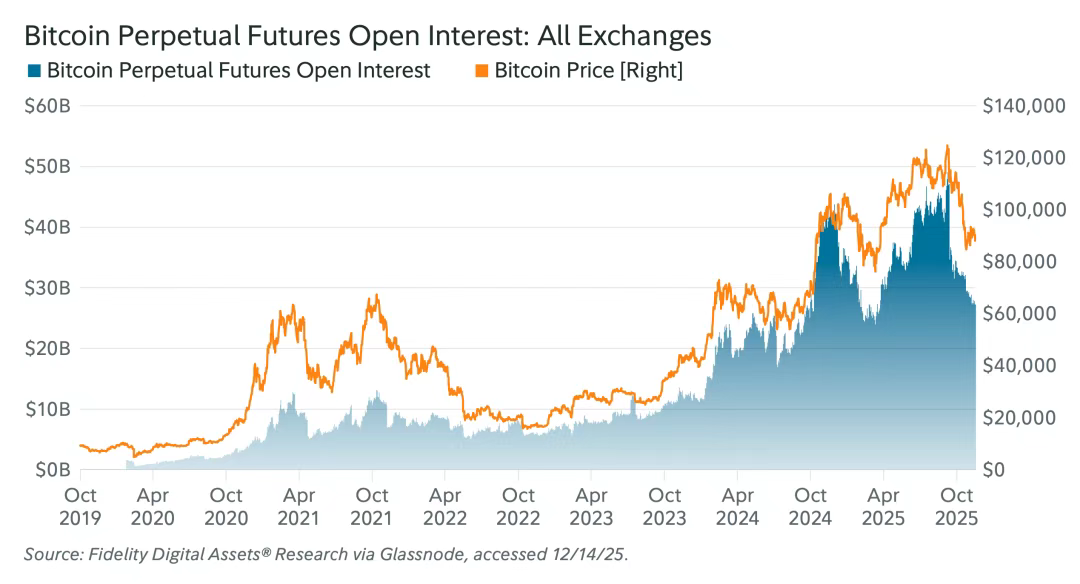

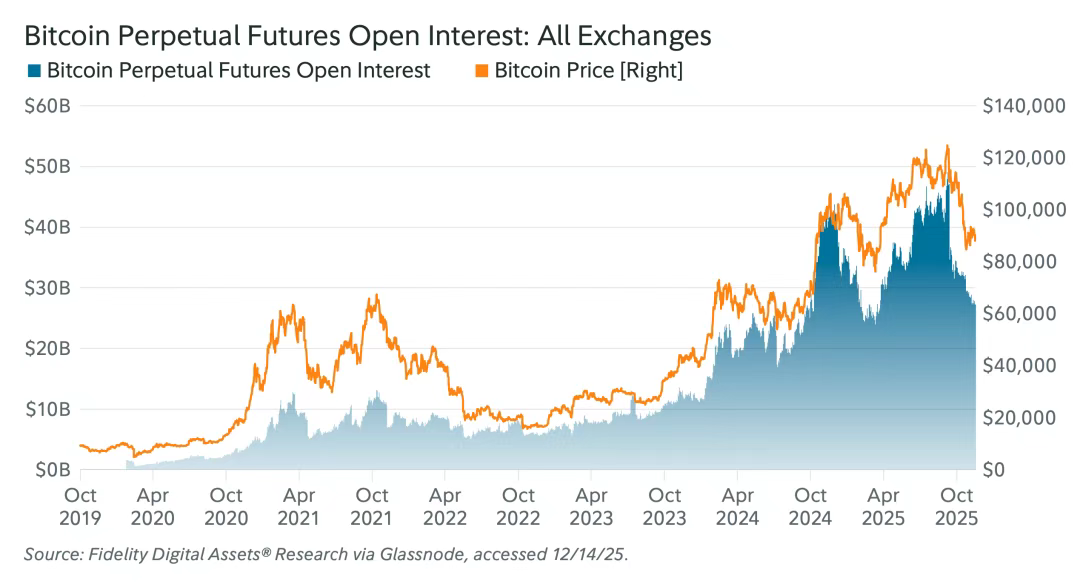

- Deepening of the Derivatives Market

● The scale of Bitcoin futures and options has significantly increased. The CME Bitcoin futures open interest reached $11.3 billion, on par with native exchanges like Binance;

● Cash settlement and contract designs familiar to institutions help traditional capital enter more smoothly. Perpetual contracts still dominate, but the options market has enormous growth potential—during the volatility in October 2025, Bitcoin options open interest surpassed $60 billion, exceeding perpetual contracts for the first time.

- Traditionalization of Financial Services

Banks are beginning to offer lending services backed by ETPs for institutional clients, and structured products are emerging. The U.S. Commodity Futures Trading Commission (CFTC) is piloting the use of Bitcoin and Ethereum as collateral, gradually embedding digital assets into the traditional financial system.

3. Evolution of Token Rights: From Governance Symbols to Substantial Value

The year 2026 may become a key year for the "mainstreaming of token holder rights." Previously, tokens were often disconnected from underlying businesses, lacking cash flow rights and capital return mechanisms, leading institutions to view them as trading chips rather than long-term assets. The current trend is reversing:

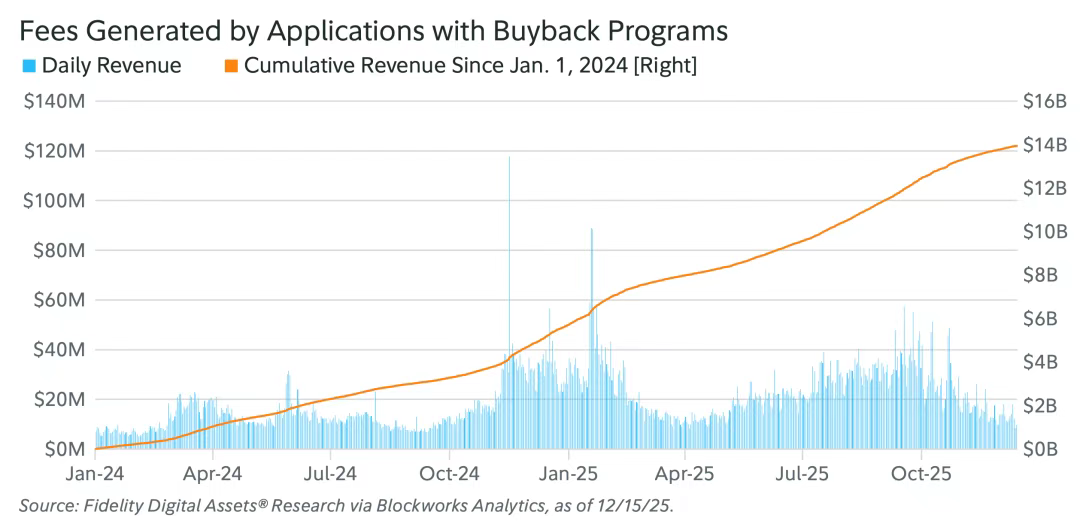

- Income Buyback Mechanisms Establish Value Links

Projects like Hyperliquid and Pump.fun allocate most protocol income for automated token buybacks, establishing a transparent connection between trading volume and token demand. DeFi blue-chip projects like Uniswap and Aave are also launching similar plans, using part of their fees to buy back tokens, essentially providing value returns to token holders.

- Formation of a "Three-Layer Structure" for Token Rights

● Fair Distribution: The new generation of token issuance emphasizes fairness, reducing insider low-price allocations and opaque lock-ups, attracting a broad range of participants with simple rules.

● Performance Attribution: Token unlocks will be linked to on-chain performance metrics (such as revenue and price), replacing purely time-based attributions, aligning internal incentives with business growth.

● Effective Governance: Exploring models beyond "one token, one vote" (such as Futarchy), allowing market competition to determine proposal value, making governance an investable right.

- Market Differentiation and Institutional Entry

Tokens with rich rights will be more favored by institutions due to their ease of modeling and analysis, comparable to equity indicators like dividend yield and earnings growth. Layer-1 public chains like Solana and Ethereum may benefit from hosting more rights-based tokens. In the future, fully on-chain, clearly defined "token IPOs" may emerge, further attracting traditional capital.

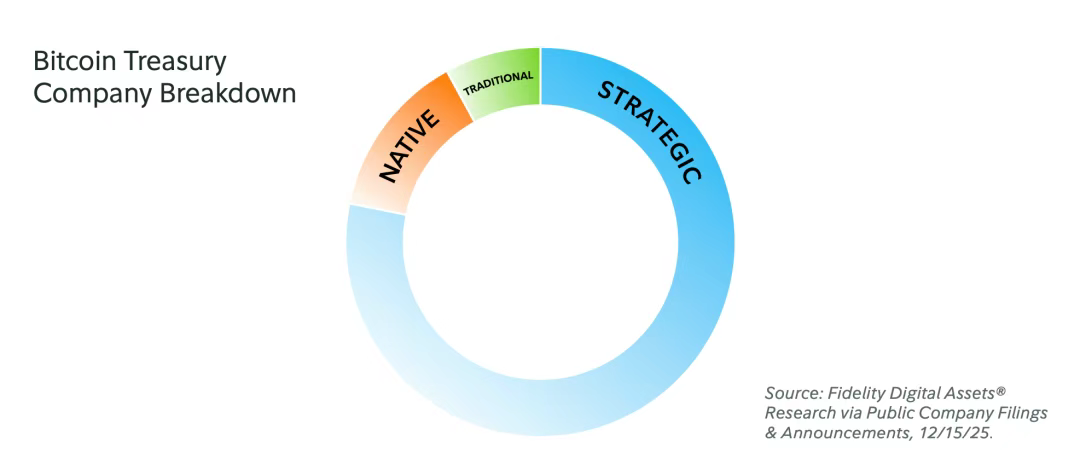

4. Corporate Bitcoin Holdings: Formation of Three Types of Players

The Bitcoin holdings of publicly listed companies continue to grow. By the end of 2025, 49 companies held over 1,000 Bitcoins, covering nearly 5% of the total supply. These companies can be divided into three categories:

Native Companies (18): Mostly mining companies that accumulate Bitcoin naturally through operations, with an average holding of about 7,935 Bitcoins.

Strategic Companies (12): Companies that center their strategy around Bitcoin reserves, with an average holding of up to 12,346 Bitcoins, accounting for nearly 80% of the total holdings of the 49 companies.

Traditional Companies (19): Companies that allocate part of their funds to Bitcoin, with an average holding of 4,326 Bitcoins.

Mining companies are facing new changes: the demand for AI hosting and competition for energy infrastructure in Bitcoin mining. Some miners have signed long-term AI hosting agreements (such as Cipher Mining with Amazon and Iren with Microsoft) because their returns may exceed those from mining. If more miners shift to AI, the overall Bitcoin network hash rate may flatten, but the overall income of miners may become more resilient, potentially leading to a more decentralized mining landscape.

5. Bitcoin Technical Controversies: Scalability and Quantum Threats

- "Garbage Data" Debate and Fork Risks

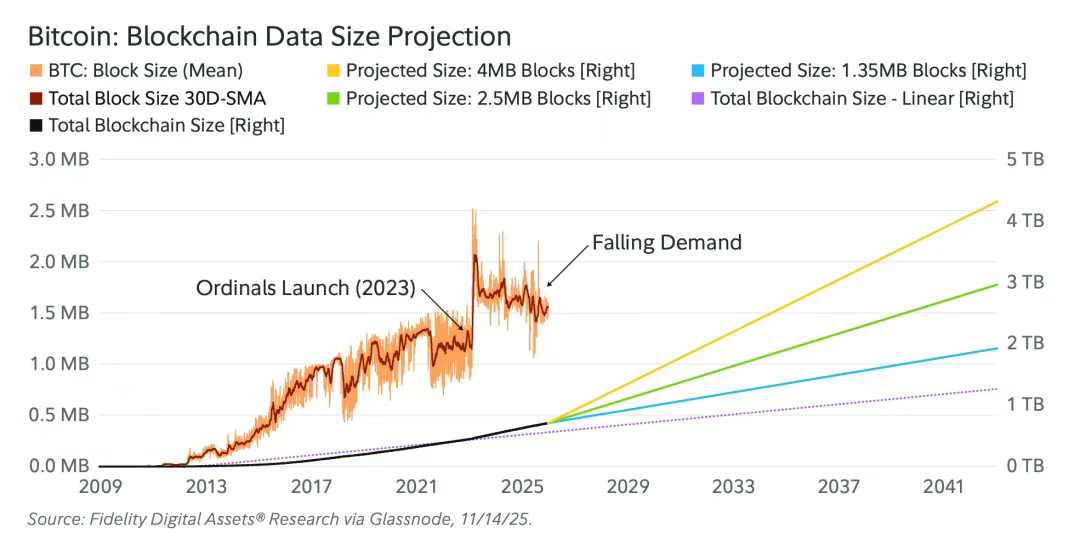

The Bitcoin Core v30 adjustment of the OP_RETURN data size policy has sparked a debate on whether Bitcoin should carry non-financial data. Opponents have launched the Bitcoin Knots version, advocating for limiting non-financial data to reduce on-chain burdens. The number of nodes for both sides was once close (Core v30 at 15%, Knots at 11%); if the disagreement escalates to a soft fork at the consensus layer, it could pose a risk of network split.

- Proactive Response to Quantum Computing Threats

The BIP-360 proposal aims to make the Bitcoin network resistant to quantum computing attacks (Shor's algorithm). Currently, about 6.6 million Bitcoins are at potential risk due to exposed public keys. The community's attitude is positive, with "proactive preparation" becoming a consensus. More quantum protection solutions and custody services may emerge in 2026, but users also need to be wary of frauds escalating under the guise of "quantum security."

6. Macroeconomic Outlook: Liquidity Push and Coexisting Uncertainty

- Bullish Momentum

● Liquidity Easing: The global monetary policy shift, the end of quantitative tightening (QT), and the historical positive correlation between M2 money supply growth and Bitcoin prices.

● Fiscal Expansion: The U.S. debt has reached $38 trillion, with interest payments nearing a trillion, and policies may lean towards resolving debt through growth while maintaining deficit spending.

● Capital Rotation: The scale of money market funds has reached $7.5 trillion; if interest rates decline, some funds may flow into digital assets and other risk assets.

- Downside Risks

● Sticky Inflation: Inflation rates remain above central bank targets, and monetary policy may remain restrictive, suppressing risk appetite.

● Leverage Cleansing: The flash crash in October 2025 led to large-scale deleveraging, and market sentiment remains cautious.

● Strong Dollar: The continued strength of the dollar may suppress global liquidity, and concerns about geopolitical conflicts and stagflation have not been fully alleviated.

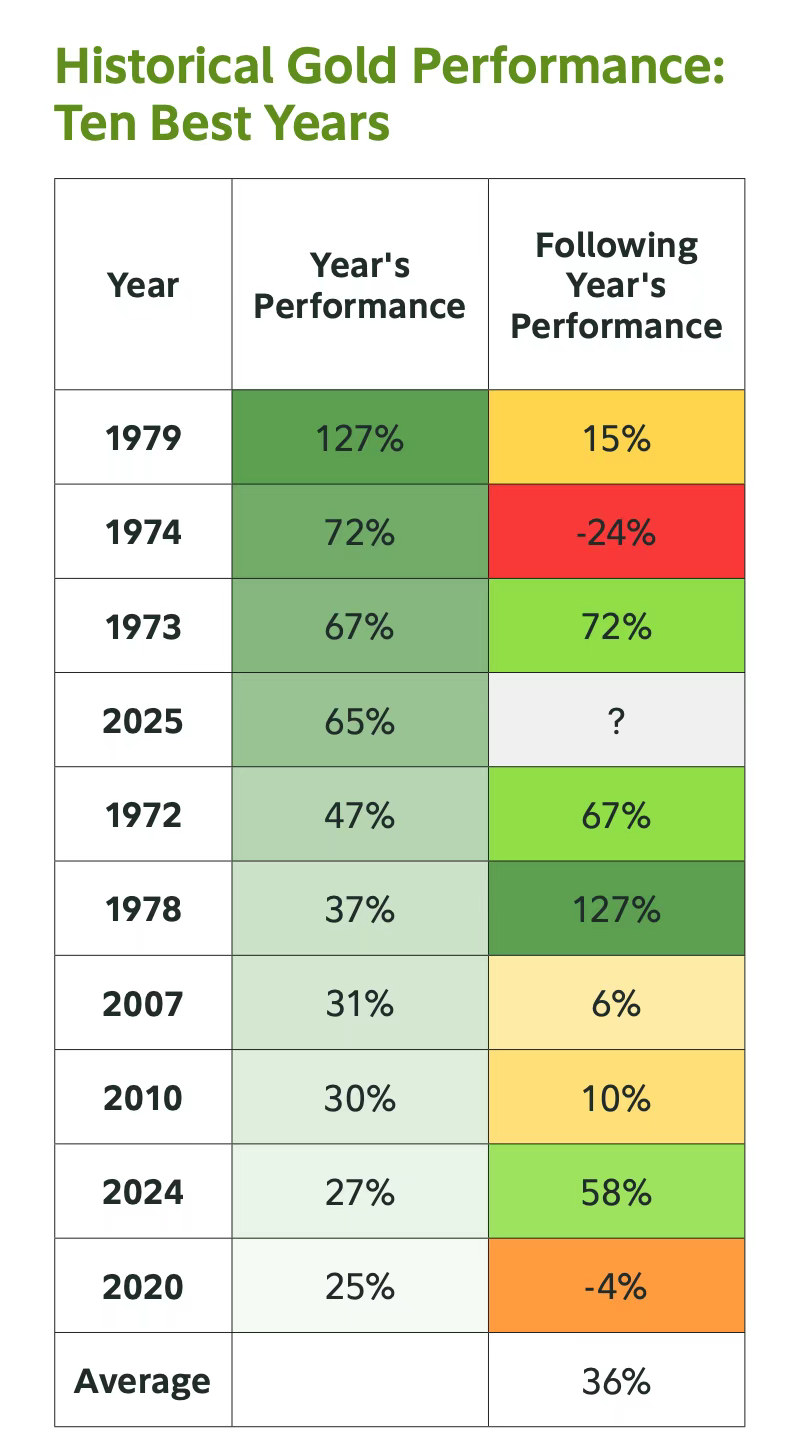

7. Gold and Bitcoin: Rotation Logic and Asset Attributes

In 2025, gold rose by 65%, marking the best performance since the 1970s. Central bank gold purchases, de-dollarization, and geopolitical risks are the main driving forces. Both Bitcoin and gold are geopolitically neutral monetary commodities, but Bitcoin has superior verifiability, portability, and programmability. Historically, the correlation between the two has been low, with clear rotation characteristics—gold often leads, followed by Bitcoin. As more institutions view Bitcoin as "digital gold," the allocation switch may become an important theme in 2026.

The digital asset market may be at a maturation inflection point in 2026: Institutional products are becoming increasingly rich, token rights are aligning with shareholder rights, corporate holdings are becoming the new norm, and technological governance is evolving amid controversies.

The macro liquidity environment provides potential momentum, but inflation, policy, and market vulnerabilities pose challenges. If Bitcoin can inherit gold's "safe haven" narrative and demonstrate superior capital efficiency and growth resilience, it may open a new cycle of value discovery.

Join our community to discuss and grow stronger together!

Official Telegram community: https://t.me/aicoincn

AiCoin Chinese Twitter: https://x.com/AiCoinzh

OKX benefits group: https://aicoin.com/link/chat?cid=l61eM4owQ

Binance benefits group: https://aicoin.com/link/chat?cid=ynr7d1P6Z

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。