Written by: Lucas Tcheyan, Vikram Singh

Compiled and Organized by: BitpushNews

Note: "Leviathan Moment" originates from Hobbes' metaphor for absolute state power, referring to a decisive turning point in the birth of a powerful order. Here, the x402 protocol is likened to providing countless autonomous AI entities with a unified "payment language" and "transaction rules" for the first time. This means that value exchange between AI and AI, as well as between AI and humans, will transition from a chaotic, inefficient "primitive state" to a new phase that is standardized, trustworthy, and capable of automation. It is not only a technological upgrade but also a fundamental reshaping of the underlying operational logic of the entire AI economy.

Introduction

Artificial Intelligence Agents (AI Agents) are poised to fundamentally change the landscape of the internet. The continuous advancement of AI has enabled intelligent agents to serve as programming assistants, shopping advisors, planning tools, and experts in various fields. They represent a powerful new paradigm of human-computer interaction, primarily by significantly reducing the necessity for humans to directly operate browsers and search engines.

In the report "Understanding the Intersection of Cryptocurrency and Artificial Intelligence" published by Galaxy Research in 2024, we view AI agents as one of the most promising growth directions and point out that they "are well-suited for cryptocurrency scenarios—users (or the agents themselves) can create wallets to transact with other services, agents, or people." At that time, the field of agents was still in its infancy, primarily limited by three factors: the intelligence level of underlying AI models, the infrastructure supporting them to perform complex tasks, and the regulatory clarity needed to implement beyond Web3 native scenarios.

In just over a year, the progress in these three areas has been remarkable:

- The rapid improvement in AI intelligence levels has enabled agents to perform "long-cycle reasoning" and autonomously execute complex tasks with unprecedented reliability.

- The agent toolchain has made significant strides, including the release of foundational protocols such as Model Context Protocol (MCP), Agent-to-Agent (A2A) Protocol, Agent Payments Protocol (AP2), and the x402 standard.

- The regulatory environment has become increasingly clear, especially regarding stablecoins, accelerating the integration of crypto payment channels with traditional systems.

These advancements collectively open the door for the widespread adoption of AI agents utilizing blockchain for payments. One of the most promising developments driving this trend is the emergence of x402 and related payment standards. These standards allow agents to directly use stablecoins or other crypto assets to pay for services and data. For simplicity, we will refer to such protocols collectively as Agentic Payment Standards (APS).

In short, APS opens the door for agents to the complete economic landscape of the internet. Through APS, agents can:

- Become smarter (by accessing external data)

- Become more powerful (by paying for resource costs)

- Be more collaborative (by transacting with other agents)

In addition to functional expansion, APS also serves as a bridge between on-chain and off-chain economies, enabling any business to sell to the fastest-growing user category on the internet—namely, AI agents—and accelerating the adoption of stablecoins in the payment sector.

By reconstructing the business model of APIs (Application Programming Interfaces, the standard way software requests data or services), APS also has the potential to enhance the capital efficiency of a long-overlooked economic engine. Beyond the economic aspect, APS has brought fundamental changes to the programming user experience in API key management. These changes make it easier to develop new applications.

This article focuses on x402, one of the leading emerging on-chain agentic payment standards. We will examine x402 within the broader APS landscape, exploring its early applications, use cases, and comprehensively analyzing whether blockchain can become the backbone of the emerging agentic economic finance.

x402 Standard

Background

In May of this year, Coinbase launched the x402 standard, a protocol that enables encrypted transactions in web interactions using HTTP (the basic language for communication between servers). Previously, web transactions relied on traditional payment rails (such as Visa and Mastercard), while x402 opened the door to intelligent payments, allowing the use of stablecoins and cryptocurrencies to access digital services.

x402 refers to the status code "HTTP 402 Payment Required," which is included in the original specifications of the internet web protocol. Although HTTP included the 402 status code from the beginning, it remained largely idle due to a lack of supporting infrastructure. Instead, complementary payment infrastructures relying on traditional payment rails were established by companies like PayPal and Stripe. While this infrastructure facilitated the growth of e-commerce and significantly reduced payment friction, it detached from the inherent network capabilities of the internet.

Source: x402 White Paper

The key breakthrough brought by x402 is that it has become much simpler for anyone (human or agent) to pay for online services. According to the development team, the standard aims to "allow value to flow seamlessly across the internet like information, regardless of whether the actors are individuals, applications, or agents." The most common manifestation of this is the simplification of the API request process. As the Coinbase team succinctly pointed out: "Let's eliminate API keys."

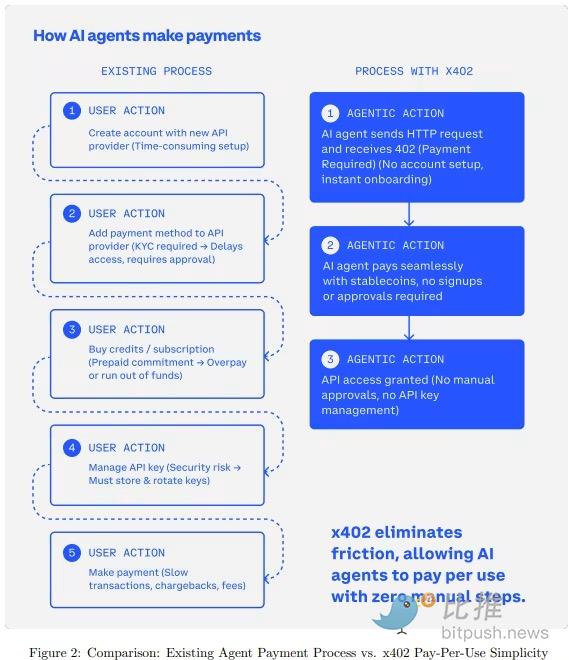

Payment Process

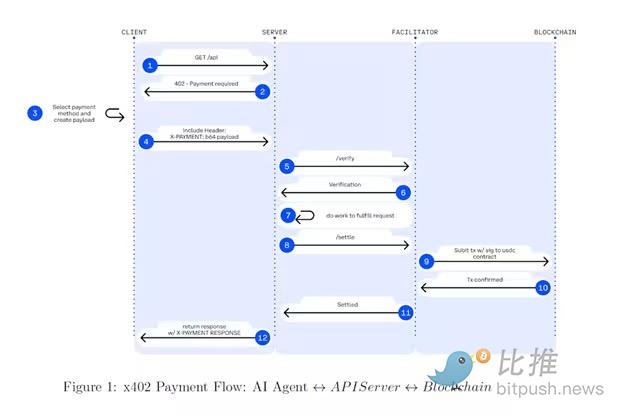

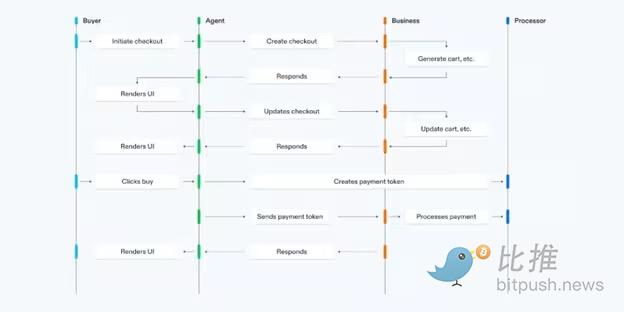

The payment process of x402 is easy to understand and consists of four main components:

Client: The agent (or user software) initiating the service request.

Server: The service provider that returns the 402 request and ultimately delivers the paid resources.

Coordinator: Executes and/or verifies the payment.

Blockchain: The settlement layer where the transfer of stablecoins/crypto assets actually occurs.

Source: x402 White Paper

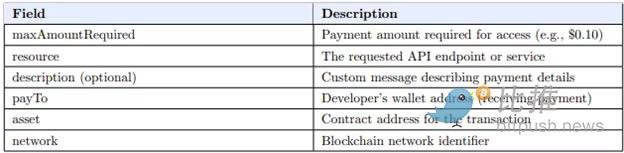

The agent sends a request to the server to obtain a certain product or service (e.g., a streaming subscription or an e-book), and the server returns a "payment required" request (HTTP 402). This request includes fields such as the required amount, accepted token types, the wallet address for sending payment, and the blockchain where the payment occurs.

The agent then responds to the payment request, providing all necessary information and authorizing the payment with a cryptographic signature. Finally, the coordinator processes the actual payment for the service on the blockchain and confirms it to the server, which then returns the requested service to the agent.

This is the standard payment process adopted by x402, but it can also undergo many different modifications. For example, if the agent controls its own wallet and can transact on the blockchain, it can submit payment and verification directly to the server without relying on a coordinator. However, coordinators have been used so far because they simplify the process by abstracting the complexities of wallet management, gas payments, and network selection in blockchain interactions. In this regard, coordinators are similar to traditional payment service providers, but the difference is that they do not hold funds or control the private keys of the wallets involved in transactions at any time. Instead, the agent controlling the wallet authorizes the content ("send up to X dollars from the payer's wallet to the payee's wallet") while leaving the method (which chain, how much gas fee, etc.) to the coordinator to handle.

x402 V2

On December 11, Coinbase released x402 V2, a significant upgrade based on feedback from usage over the past six months. V2 begins to transform x402 from a relatively simple but effective intelligent payment specification into a more modular standard designed to adapt to the evolving blockchain environment and support a wider range of payment use cases.

At a high level, x402 V2 expands the protocol across three key dimensions. First, it introduces a unified payment interface that supports multiple blockchains and various assets through a single format while integrating with legacy payment rails via coordinators. Second, it adds wallet-based authentication and reusable access sessions, allowing clients to avoid repeated on-chain interactions for subsequent requests—reducing latency and supporting higher-frequency use cases. Third, it implements automatic service discovery, allowing coordinators to index endpoints, pricing, and routing information without manual configuration.

These changes collectively enable x402 to support more complex business models, including subscriptions, prepaid access, usage-based billing, and multi-step agent workflows.

x402 Intelligent Payment Technology Stack

The x402 technology stack is gradually taking shape. The speed of project and infrastructure releases is exponential, and we have summarized as many projects as possible in the diagram below (this may not be exhaustive, and this article does not endorse any projects, it is for reference only).

The flow of value in the x402 payment technology stack begins at the agent layer, passing down through the coordination layer, execution layer, and settlement layer, and then being relayed back up as access to fulfilled services.

First, the agent or application initiates a task that requires access to paid services, such as querying an API, retrieving proprietary data, or invoking another agent. The agent determines what it needs and under what constraints (including price, latency, preferred chain, or budget).

The coordination layer shapes how the agent broadcasts intent, discovers services, exchanges context (relevant information needed to complete the task), and coordinates workflows before payment occurs. It embeds additional functionalities into the agent workflow beyond payment and settlement protocols, including service discovery mechanisms, intent signaling, constraint enforcement (rules or limitations such as budget, time, or permissions), context management, and multi-step or multi-agent coordination.

Once the terms are established, the agent initiates payment through the coordination layer. The coordinator (a service operated by a third-party provider) handles the routing, verification, and execution of the transaction, abstracting away blockchain-specific complexities and interfacing with legacy payment rails when necessary.

The currency layer defines the content of the transfer—typically stablecoins—enabling predictable pricing and programmable settlement suitable for high-frequency, machine-native transactions. USDC has so far been the primary form of payment, but theoretically, any cryptocurrency can be used.

Finally, the blockchain layer executes and finalizes the transaction, providing cryptographic settlement and an auditable record. Confirmation information is then relayed back up the technology stack, allowing service providers to deliver the requested resources to the agent.

Emerging Crypto Use Cases

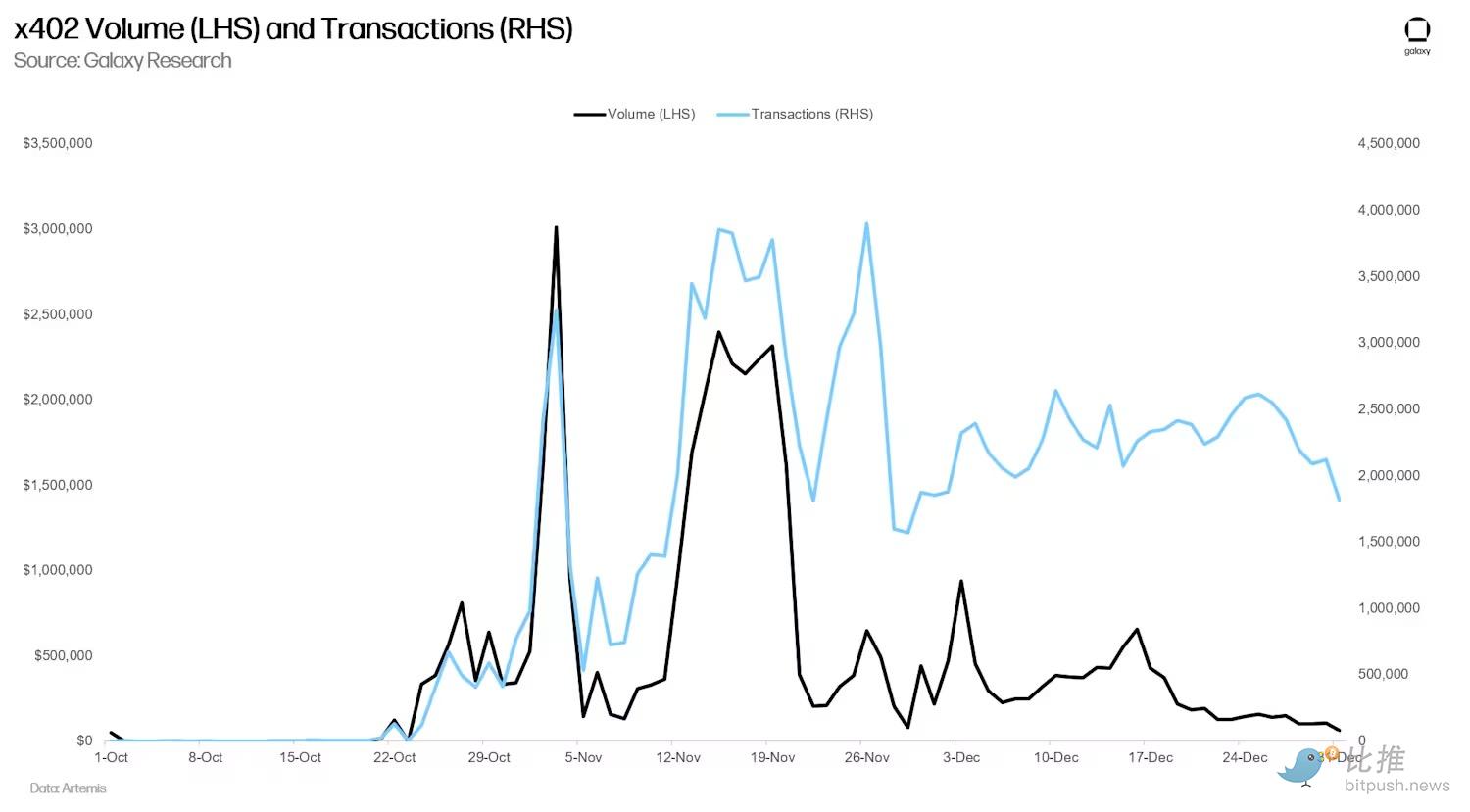

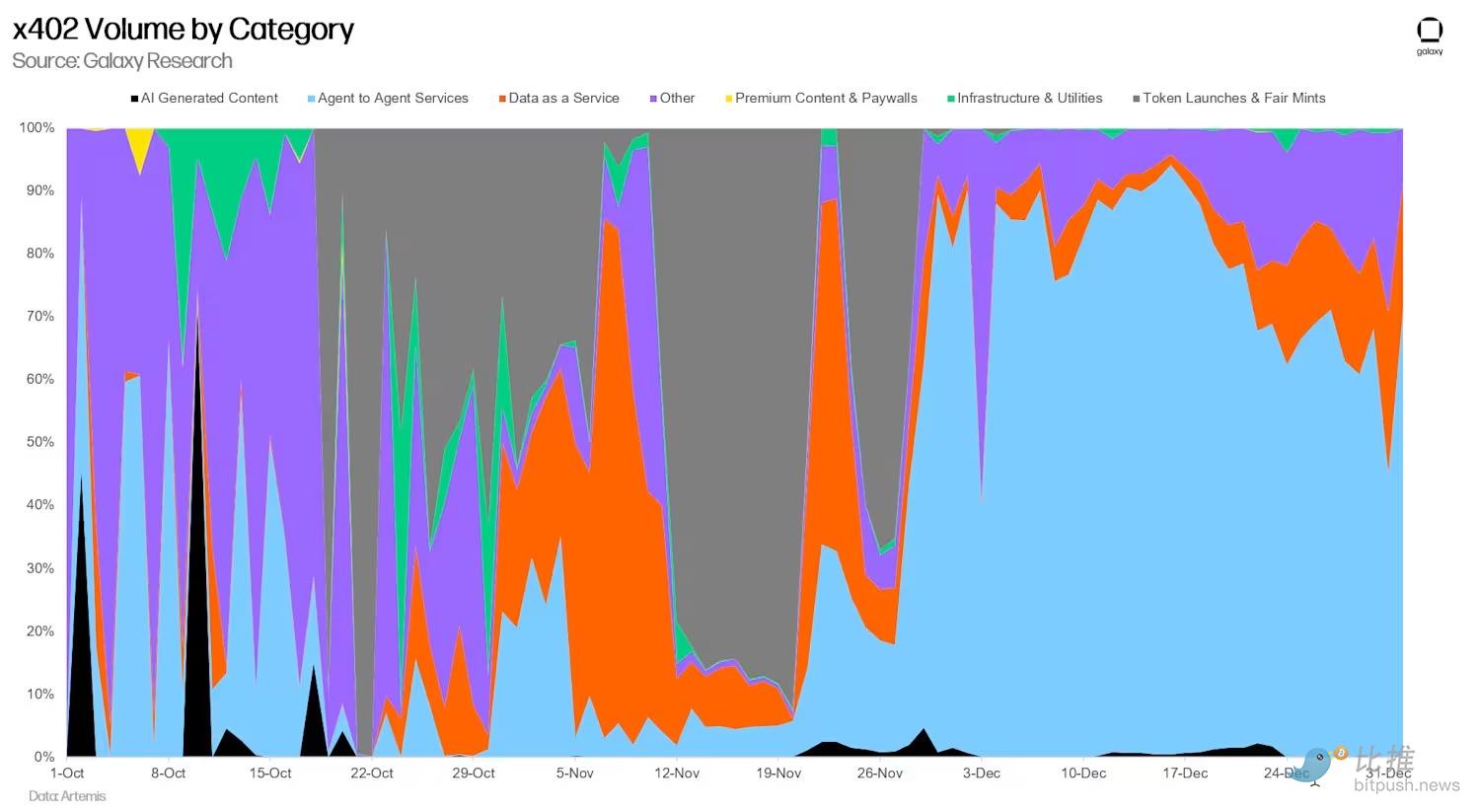

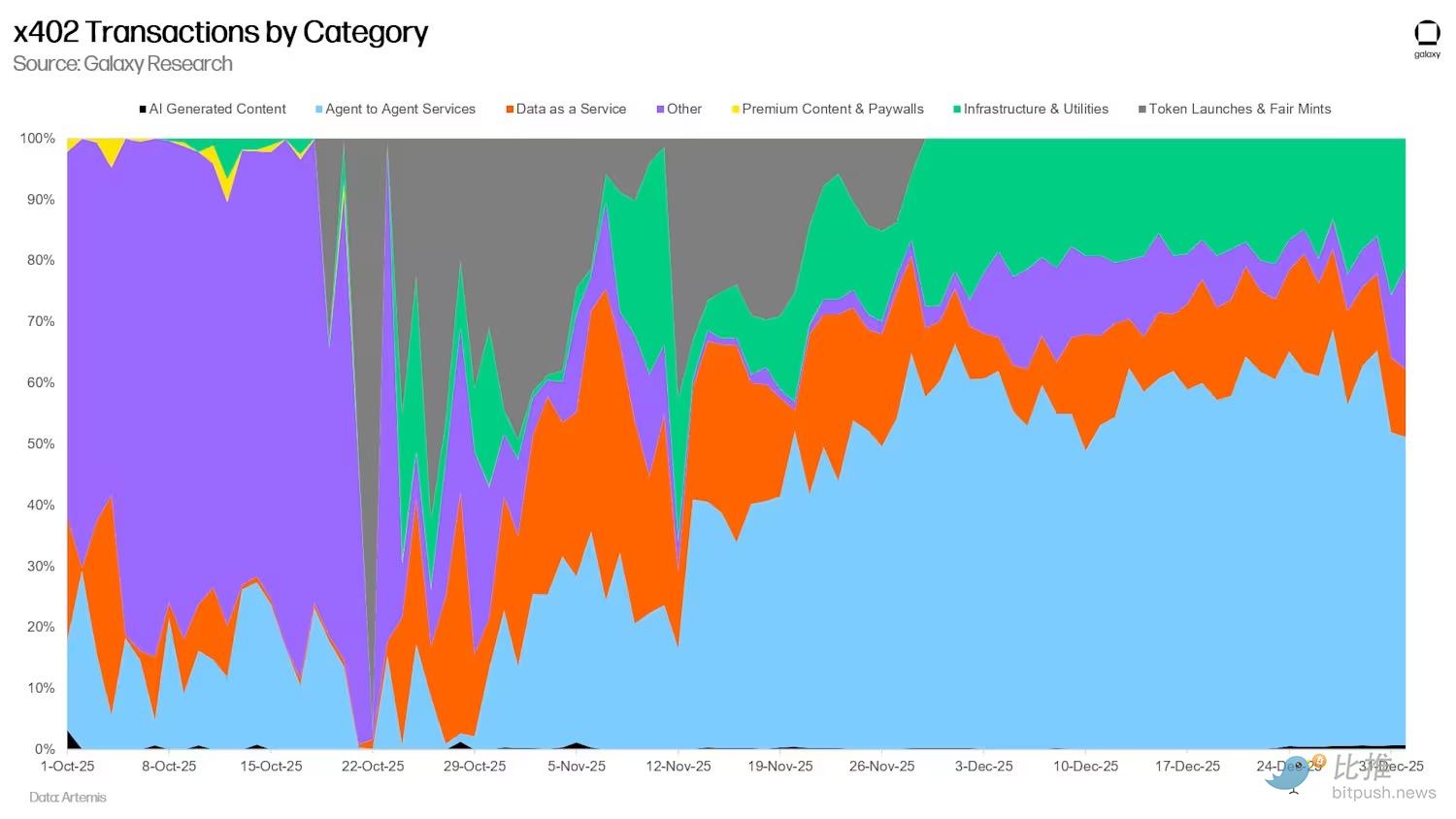

As we previously mentioned, x402 activity experienced an initial surge in late October and early November, after which the activity gradually decreased.

Source: Artemis Analytics

As is often the case with the introduction of primitives in the crypto space, initial adoption and interest were primarily driven by speculative activity, with the peak at the end of October caused by teams using x402 to mint and purchase Memecoins. However, since then, the volume and number of transactions for agent-to-agent services, data-as-a-service, and infrastructure and utility have begun to capture an increasingly larger market share.

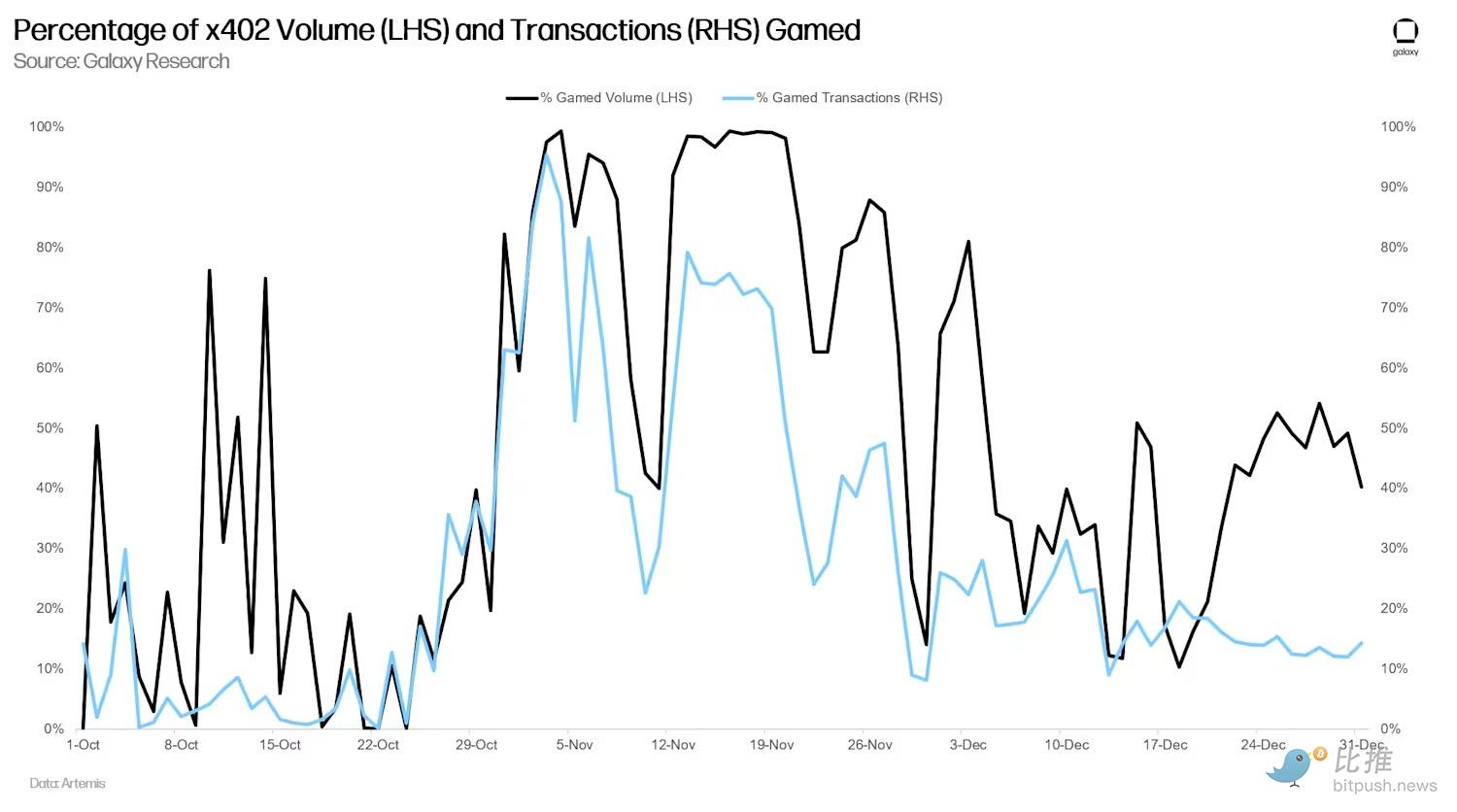

This is the essence of permissionless products in the crypto space. Initial speculative use cases attract users, which in turn attract developers who begin to experiment with the technology and build applications that go beyond speculative use cases. In fact, after filtering out all gamified transactions (defined by Artemis Analytics as obvious self-trading or wash trading), it shows that since early December, such transactions have dropped to below 50%.

The most attractive and likely to be sustainable use cases in the long term are those that leverage x402 to provide differentiated products that may not be achievable through legacy payment rails. This primarily includes services that are costly on traditional rails due to transaction fees, as well as use cases that require internet-native currencies, since legacy systems are constrained by limited programmability, slow settlement times, and reliance on non-native intermediaries.

Currently, these services are mainly dominated by providers supporting one-off API calls, which would typically require subscriptions. For example, trading agents can pay on-demand to call the blockchain data provider Nansen or the API of AI analysts to supplement their crypto analysis. In addition to data access, x402 also enables agents to programmatically pay for infrastructure services (such as computing resources), which are difficult to price or automate using subscription-based or manual intermediary payment models. Leading decentralized AI lab Nous Research has enabled x402 payments to access its Hermes 4 model.

Despite the promising outlook, these examples largely remain speculative proofs of concept, showcasing the capabilities of the infrastructure rather than the growth drivers needed for the large-scale adoption of x402. This is not meant to diminish any individual project or its potential, but rather to acknowledge that most on-chain products are still primarily aimed at a crypto-native audience and only represent a portion of potential applications. The next section will explore more use cases and the broader conditions needed for the scaling of intelligent payment standards.

Context and Data Access

One of the most striking non-crypto-native use cases for intelligent payment standards is paid access to online context and data. As AI agents increasingly rely on external information to perform tasks, it becomes crucial to programmatically purchase content access on a per-request basis.

Cloudflare provides an early example of how this model might emerge. As a major infrastructure provider hosting and protecting much of the internet's content, Cloudflare has been mediating interactions between websites and automated traffic. In 2024, it launched a "pay-per-crawl" mechanism that allows bots and crawlers to pay for access instead of being directly blocked.

Subsequently, Cloudflare indicated plans to integrate this infrastructure with x402 (the company has partnered with Coinbase to establish the x402 Foundation), enabling agents to pay directly for access using internet-native payment rails. If standardized, this approach could transform bot mitigation from an access control issue into a pricing and market-based mechanism. In short, an old problem has now become a potential revenue opportunity.

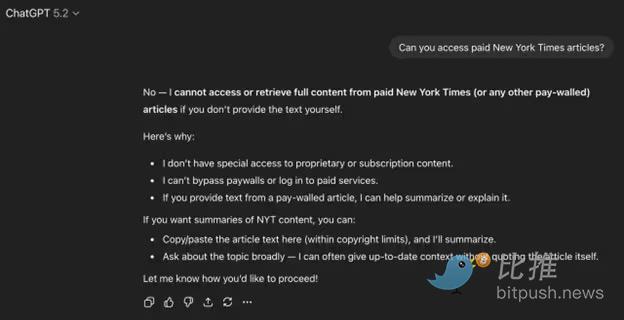

This model naturally extends to paid content and proprietary data. Today, large language models primarily rely on internal training data and freely available sources (like Wikipedia).

However, high-quality information is often locked behind subscriptions or paywalls—such as news media, research databases, and analytics platforms. Under the current paradigm, accessing this data requires users to leave the agent interface, purchase a subscription (even for one-time use), and manually transfer information, leading to a poor user experience and inefficient capital allocation.

Intelligent payment standards offer an alternative. Users can allocate a clear budget to agents, allowing them to pay for access to content behind paywalls on a per-request or per-token basis. For example, an agent needing access to a single article can submit an x402 request with a small payment attached, retrieve the relevant content, and complete the task without the user needing to purchase a full subscription. While this model may compress the single-user profit margins of content providers, the increased volume of queries and more granular pricing may offset these effects over time.

In summary, context and data access represent a category where intelligent payments provide significant improvements over legacy payment systems. It also illustrates how the adoption of standards like x402 may originate outside of the crypto-native environment, embedded within infrastructures that already coordinate interactions between agents, content, and the web.

E-commerce

One of the most discussed areas for the adoption of intelligent payments is e-commerce. Intelligent commerce is expected to grow rapidly over the next decade, with B2C revenue estimated to reach $3 trillion to $5 trillion by 2030. As a result, this sector has attracted significant attention from existing payment networks and processing institutions, many of which are now actively developing payment infrastructures aimed at agent-native solutions.

However, in e-commerce, the adoption of x402 faces a more competitive environment than API-native or micropayment-driven use cases. Retail transactions are typically of higher value and less sensitive to transaction fees, reducing the relative advantage of ultra-low-cost blockchain settlements. More importantly, existing payment providers already control the commercial and regulatory infrastructure that merchants rely on, and they are rapidly expanding these capabilities to support autonomous agents without the need for on-chain primitives.

- Visa's Intelligent Commerce suite (launching in early 2025) enables consumers to configure Visa card credentials into AI agents for end-to-end shopping, integrating with platforms like OpenAI and Anthropic.

- PayPal's Agentic Commerce Services (October 2025) allow PayPal merchants to sell products through agent interfaces like ChatGPT while retaining fraud detection, buyer protection, and merchant workflows.

- Stripe's Agentic Commerce Protocol (ACP), co-developed with OpenAI and announced in mid-2025, defines a standardized way for AI agents to initiate and complete purchases with merchants while minimizing changes to Stripe integration.

- Mastercard's Agent Pay (April 2025) tokenizes consumer credentials, enabling AI systems like Microsoft Copilot to autonomously execute purchases, with an early focus on subscriptions, loyalty redemptions, and programmable payments.

In some cases, these initiatives may reduce the demand for blockchain-based payment protocols by extending traditional payment rails into agent-native processes; in other cases, they may form complementary solutions. For example, the two most notable intelligent payment standards currently gaining adoption are Google's AP2 and Stripe's ACP. While not yet the primary implementation for either, x402 can be integrated to facilitate stablecoin payments through either (e.g., via A2A for transactions between two agents, or via ACP for merchants).

Below, we outline Stripe's push in intelligent commerce to better illustrate this model.

Stripe's Push for Intelligent Commerce

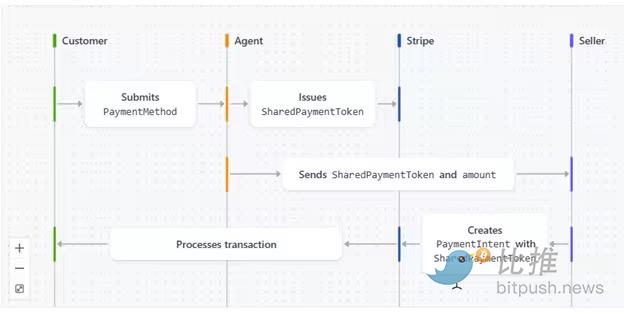

Stripe's ACP is an open standard that defines how AI agents, merchants, and payment systems communicate during the checkout process. ACP standardizes the checkout dialogue—such as product selection, pricing, confirmation, and completion—without specifying how funds are ultimately settled. It acts as a coordination layer for checkout rather than the payment rail itself and is agnostic to payment processors, meaning merchants can adopt the protocol without changing payment providers.

To support secure payment authorization within this framework, Stripe introduced Shared Payment Tokens. Although the term "token" is used, SPTs are not crypto assets and do not represent independent payment rails. Instead, they serve as scoped payment authorizations, allowing agents to authorize merchants to make limited deductions using any infrastructure of their preference. This means the underlying settlement can take any form, from credit cards to bank transfers to stablecoins.

Shared Payment Token Payment Process

Together, ACP and SPT enable agents to participate in e-commerce while retaining the protections merchants rely on, including fraud detection, dispute resolution, refunds, regulatory compliance, and customer support. Stripe further packages these components into its Agentic Commerce Suite, providing a one-stop service for merchants looking to support agent-driven purchases without redesigning their payment tech stack.

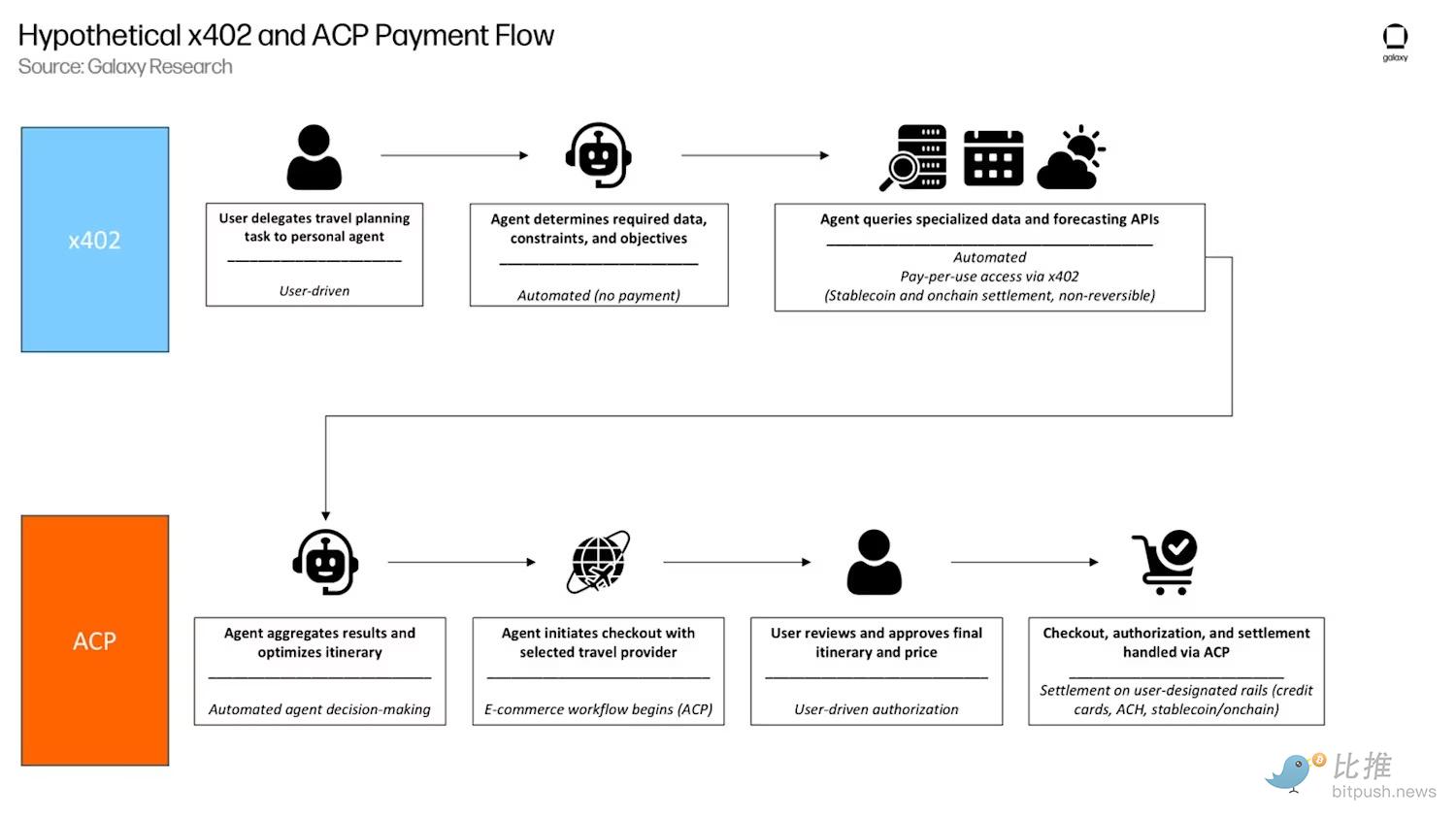

How x402 and ACP Work Together

The distinction between Stripe's intelligent commerce tech stack and x402 primarily lies in scope and transaction context.

- x402 is built for software to pay other software. Agents see a price, pay automatically, and gain immediate access to services. This applies to APIs, data, and digital tools that agents use in their workflows.

- ACP and SPT are built for purchasing physical goods or services. These purchasing processes are longer, holding merchants accountable for fraud and refunds, and typically require user approval before payment.

To illustrate how these systems coexist in practice, imagine an AI agent tasked by a user to plan and book a vacation. First, the agent evaluates potential travel dates and destinations. To do this, it queries several specialized data providers, such as a premium weather forecasting service and a demand forecasting API that predicts airfare fluctuations, which have integrated x402. The agent can programmatically discover pricing, pay for access, and retrieve this data on a per-request basis.

These calls are irreversible and do not require human intervention. After obtaining this data, the agent determines the best travel dates and begins selecting flights and hotels. At this point, the transaction shifts to the e-commerce process. The agent initiates checkout with airlines or travel platforms using ACP. Payment is authorized through SPT, allowing merchants to process the transaction while ensuring fraud protection, refunds, chargebacks, and compliance. The user reviews and approves the purchase, the booking is completed, and the order is fulfilled.

In this workflow, x402 and ACP play different but complementary roles. x402 operates upstream of the checkout process, enabling autonomous payments for resources outside traditional commercial processes.

Meanwhile, ACP handles regulated transactions, where merchants require the protections and assurances of existing payment systems, and users must provide signed consent before payment occurs. A significant breakthrough here is the agent's ability to seamlessly switch between different payment models based on context, selecting the most appropriate mechanism for each step of the task.

In addition to functional differences, there is an important structural distinction. x402 is designed as an open standard for settlement on public, permissionless blockchains, enabling agents to transact without relying on centralized intermediaries. In contrast, many intelligent payment standards led by existing institutions are open at the protocol level but primarily operate on permissioned platforms, with execution, compliance, and settlement still tightly coupled to centralized payment providers. These approaches support different use cases and trust models and are not mutually exclusive. In practice, hybrid architectures may emerge, where agents utilize permissionless rails to handle machine-native transactions while relying on permissioned systems for regulated commercial and consumer-facing payments.

Conclusion

Rather than suggesting that intelligent payments will immediately drive a comprehensive shift to on-chain payments, it is more likely that they will gradually and largely "quietly" facilitate the adoption of blockchain technology in the future. Stablecoins accelerate this transition by reducing friction in interfacing with traditional systems, while infrastructures like x402 enable new forms of experimentation that traditional payment channels struggle to support.

In the short term, adoption may be uneven. Certain use cases, particularly payments between agents and digital services, may develop rapidly, while consumer-facing e-commerce may see little change. In many cases, blockchain will operate behind the scenes, embedded in the workflows of agents rather than being directly presented to end users.

The most direct and underappreciated impact of intelligent payment standards lies not in commercial transactions but in software production. For many non-production-scale tasks, the capabilities of modern language models have reached a level where human involvement has largely become redundant. Today, the main pain points are no longer intelligence or execution, but access: purchasing API subscriptions, managing accounts, handling API keys, and paying for bundled services that are rarely fully utilized. If intelligent payment standards can eliminate these frictions—replacing subscription-based access and manual key management with "pay-as-you-go," machine-native payments—they can significantly reduce experimentation costs and compress the value of entry-level software engineering work.

From this perspective, the most striking recent application of x402 is not abstract inter-agent commerce but micropayments for API and data access. Allowing agents to pay for single API calls or discrete contextual units unlocks a more capital-efficient model for users and providers. Users no longer overpay for subscription services but can allocate a clear budget (e.g., a fixed monthly limit), enabling their agents to autonomously purchase data, analytics services, or contextual information as needed. This model better aligns incentives, improves user experience, and expands the economic "surface area" available to AI systems.

Over time, the question will shift from "Is blockchain being used?" to "Where and how is it being used?" Existing industry giants are already integrating intelligent payment capabilities, experimenting with stablecoins and blockchain rails, indicating that on-chain settlements will increasingly coexist with traditional payment infrastructures. The unresolved question is whether these activities will concentrate on permissioned chains or consortium chains controlled by centralized entities, or occur on open, permissionless networks like Ethereum or Solana. It is likely that both will exist.

More broadly, the emergence of intelligent payment standards reflects a shift in how cryptocurrencies will be adopted in the future. Blockchain infrastructure is increasingly being absorbed into existing financial and software systems rather than forming a standalone industry. In this model, success is not defined by the growth of an independent "crypto economy" but by the extent to which crypto-native "rails" quietly support applications that do not self-identify as "crypto." x402 is a clear example of this dynamic. By embedding payments directly into standard network interactions, it positions blockchain as backend infrastructure—providing programmability and global settlement capabilities without requiring users or developers to explicitly engage with cryptographic technology.

On-chain intelligent payments are unlikely to completely replace existing payment ecosystems. Instead, they will first complement them in areas where machine-native currencies have clear advantages—such as automated access to APIs, data, and digital services—before gradually entering higher-value commercial processes. In the process, they may quietly reshape how software is built, priced, and consumed, positioning blockchain as the foundational layer of an emerging agent-driven internet rather than a visible endpoint.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。