Selected News

“I’m here” market cap briefly surges past 10 million dollars, 24-hour increase of 91.2%

Claude Code high-risk privilege escalation vulnerability exploited by hackers to attack crypto users

Trending Topics

Source: Overheard on CT (tg: @overheardonct), Kaito

The following is the English translation of the original content:

Translation as follows:

[BNB]

Today's discussions around BNB mainly focus on the launch of the first Chinese meme coin on Binance spot, which the market sees as a potential signal for the "BNB meme season"; at the same time, the community is also looking forward to the upcoming "Fermi" update on January 14, which aims to achieve sub-second finality. Additionally, community members emphasized the strong growth of the BNB Chain ecosystem: the supply of stablecoins has surpassed 15 billion dollars, and key metrics such as monthly active users are significantly ahead of several competing Layer 1 networks.

[POLYMARKET]

Polymarket has become the absolute focus of today's discussions due to its milestone exclusive partnership with Dow Jones and The Wall Street Journal, integrating its trading data into mainstream institutional news feeds. Following the high volatility event triggered by the arrest of Nicolás Maduro, the platform experienced a market settlement dispute at the 10 million dollar level, accompanied by allegations of insider trading profits of 400,000 dollars, further amplifying market attention. Moreover, Polymarket has launched several new products, including the "Polymarket Times" newspaper and perpetual contracts for prediction markets, while consolidating its position as a leading prediction market platform with a top TVL.

[STBL]

STBL, led by Tether co-founder Reeve Collins, is rapidly gaining attention as a "stablecoin 2.0" protocol, focusing on RWA (real-world asset) support and decentralized yield distribution. The discussion centers on its unique structure that separates principal (USST) from yield, addressing the limitations of traditional stablecoins like USDT, allowing users to directly earn interest. Analysts are also focusing on its "money as a service (MaaS)" model, its role in the RWA ecosystem formed with projects like KAIO and Theo, and the stability brought by a dynamic anchoring mechanism driven by automated arbitrage incentives.

[POL]

Polygon (POL) has become the core of today's discussions due to accelerated institutional adoption and several fundamental milestones, particularly being recognized as the primary network for Stripe stablecoin payments and as the launch platform for Wyoming's first state-issued stablecoin $FRNT. The network's utility is further reflected in: USDC peer-to-peer (P2P) daily trading volume exceeding 1 billion dollars, and a record daily token burn reaching 0.03% of total supply. Additionally, discussions are focused on the strategic transition to the "All Stack Era" (including AggLayer) and the upcoming mainnet launch of the privacy-centric 0xMiden chain.

[ARB]

Arbitrum is leading discussions due to the delay of the DRIP incentive program and the continued warming of the "Arbitrum Everywhere" strategy, which emphasizes community collaboration and integrating blockchain infrastructure into the creator economy. At the same time, the market is highly focused on its selection as the adoption network for Wyoming's $FRNT stablecoin, its strong performance in L2 financial gas fees, and technological advancements like Arbitrum Stylus. Additionally, the upcoming Founders Club event and the successful recovery of funds by the IPOR protocol on this network have also generated extra discussion heat.

Selected Articles

In the past 24 hours, the crypto market has shown a parallel evolution across multiple dimensions. Mainstream topics focus on the renewed exposure of security incidents and fairness controversies, including attacks on trading bots and pre-deposit mechanisms being occupied by bots, sparking discussions on the credibility of infrastructure; in terms of ecological development, Solana continues to advance application landing around hardware and token incentives, Ethereum strengthens its infrastructure positioning through robust parameter upgrades and institutional product expansions, while the Perp DEX track accelerates competition through incentive design and new exchange launches.

As the boundaries between tokens and equity gradually blur, the dual structure of token + equity is becoming a common choice for application layer projects. As observed by institutions like Delphi Digital, equity is moving on-chain, and tokens are also aligning more closely with equity attributes. Mike Dudas reminds in the article that whether this hybrid model can succeed ultimately depends on whether incentives are aligned and commitments are consistently fulfilled—this is becoming a watershed for application layer projects in the next cycle.

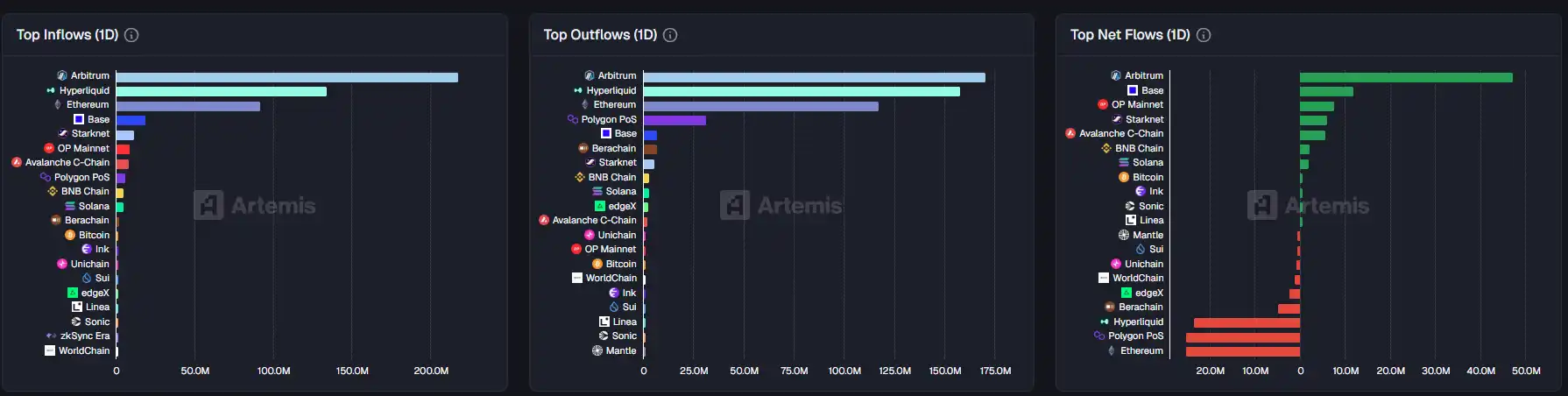

On-chain Data

On-chain capital flow situation on January 8

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。