Original Title: "The Fastest Expanding Stablecoin Recently is Actually a Pawn of the Trump Family"

Original Author: Nicky, Foresight News

In the currently stable landscape of the stablecoin market, the USD stablecoin USD1 launched by WLFI is attempting to break through by leveraging resources from the Trump family and aggressive ecological strategies.

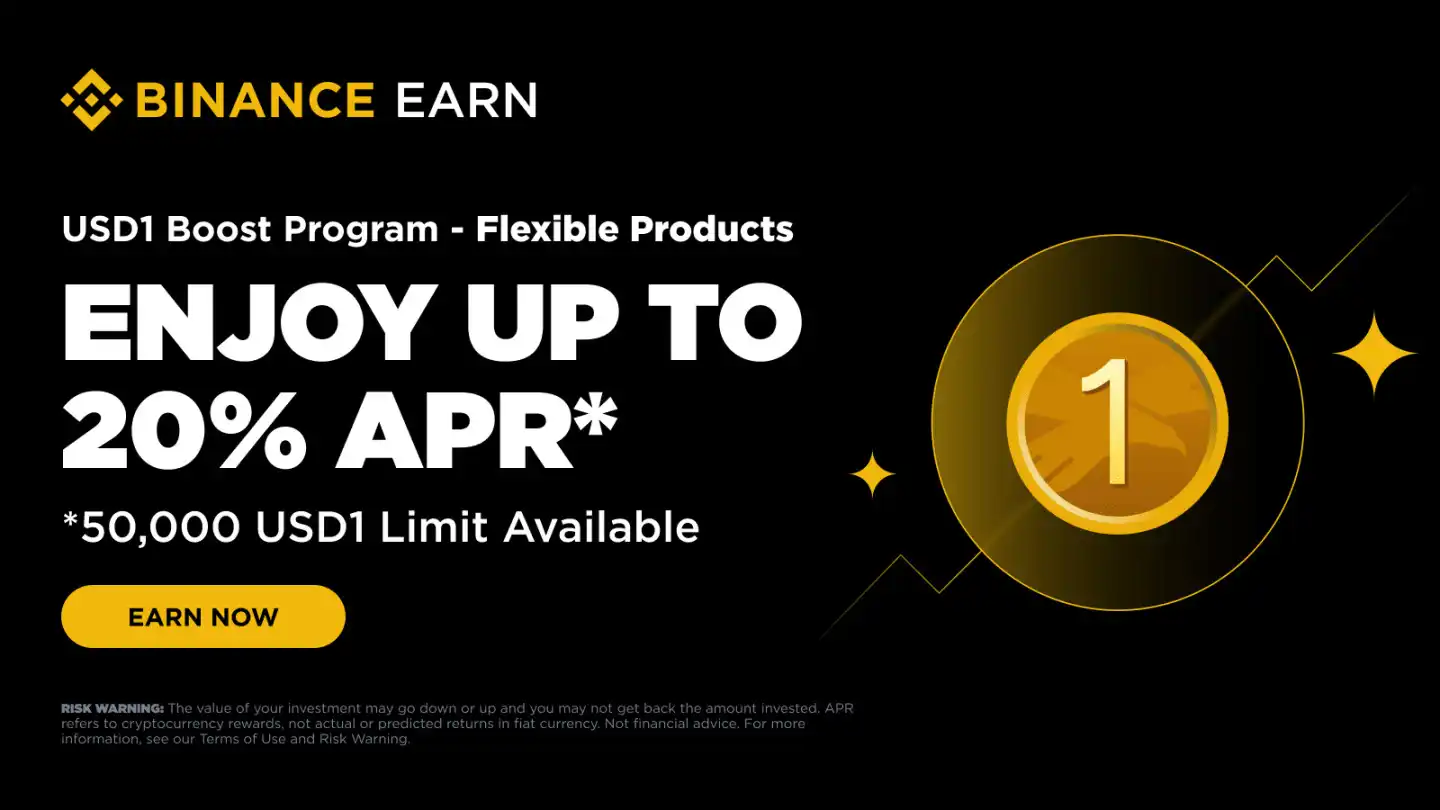

Recently, WLFI has utilized treasury funds to incentivize adoption and partnered with Binance to launch a high-yield financial product with an annualized return of 20%, causing the issuance of USD1 to surpass 3 billion dollars recently, with a single-day growth exceeding 7.6%.

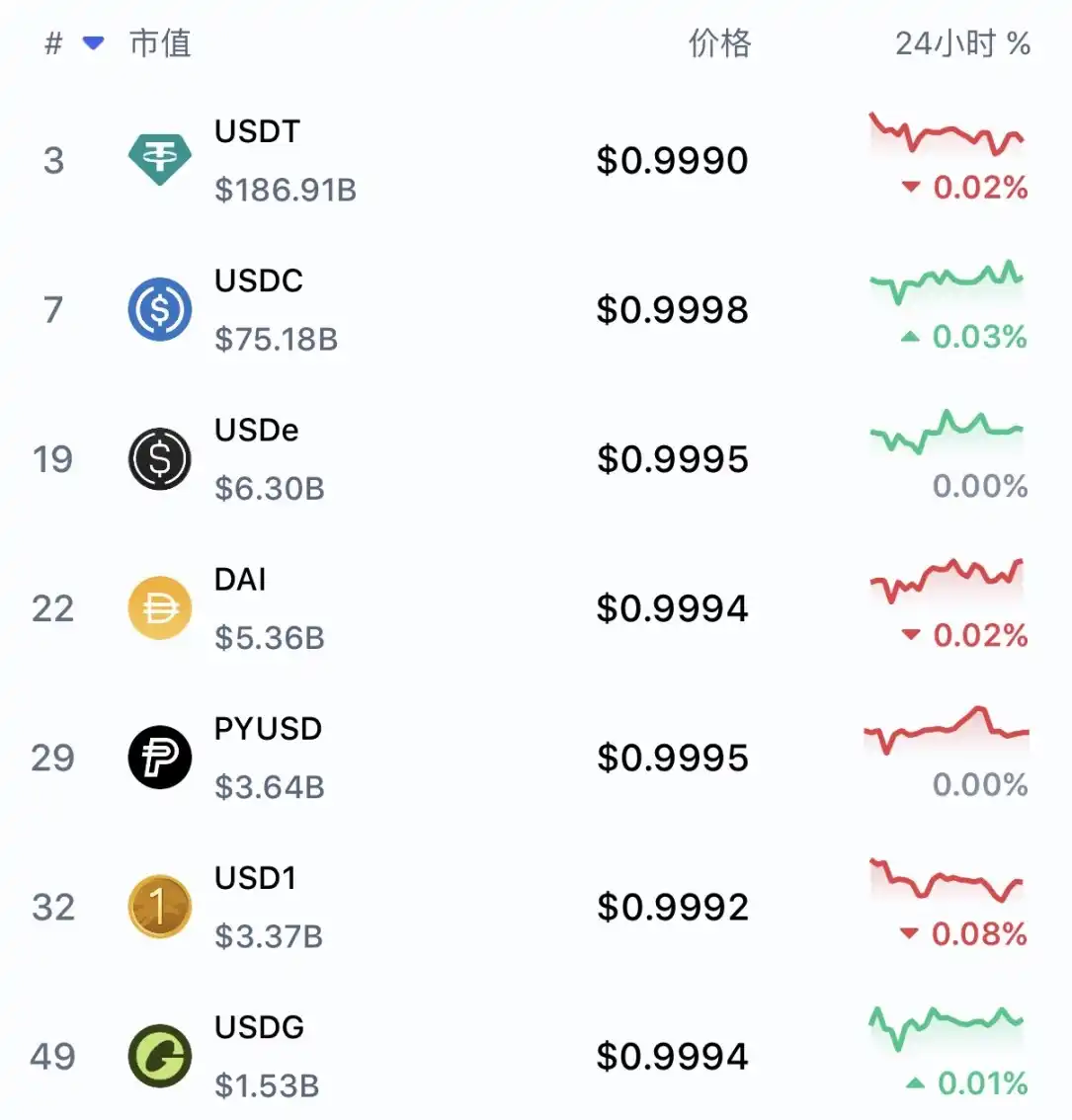

According to CoinMarketCap data, as of now, the market capitalization of USD1 is 3.37 billion dollars, ranking sixth among stablecoins, accounting for approximately 1.8% of USDT's total market capitalization and 4.48% of USDC's total market capitalization.

At the level of centralized trading platforms, USD1 has gained relatively complete trading support, having been listed on trading platforms such as Binance, Coinbase, and Upbit. For example, on Binance, USD1 currently has 14 trading pairs, covering assets such as BTC, ETH, SOL, BNB, as well as XRP and ASTER.

From the trading data of the past three days, the trading volume of the BTC/USD1 trading pair is approximately 5.13 billion dollars, while the trading volume of the ETH/USD1 pair is about 38.9 million dollars. In comparison, during the same period, the trading volume of BTC/USDT is about 5 billion dollars, and ETH/USDT reached 3.59 billion dollars; the trading volume of BTC/USDC is about 1.44 billion dollars, and ETH/USDC is approximately 1.06 billion dollars.

This comparison reflects a relatively clear reality: although USD1 has availability on trading platforms, its liquidity scale in mainstream asset spot trading is still significantly lagging behind USDT and has an order of magnitude difference compared to USDC. At least at this stage, USD1 resembles a stablecoin that has been introduced to the market rather than a foundational settlement asset that has formed a natural trading preference.

The rapid growth in the issuance of USD1 is closely related to incentive measures. On December 24, 2025, Binance launched a fixed annual financial product for USD1, with a maximum annualized return of 20%. Before the start of the activity, the issuance of USD1 was about 2.7 billion tokens, which then quickly climbed and surpassed 3 billion tokens in a short period.

On January 5, 2026, WLFI officially announced that a governance proposal regarding "utilizing part of the unlocked treasury funds to incentivize USD1 adoption" had been approved, with 77.75% of votes in favor. This proposal marks that WLFI will continue to promote the use cases of USD1 through more direct resource investment.

During this period, the market also experienced brief fluctuations related to liquidity structure. On December 24, 2025, a large market order briefly pulled down the BTC/USD1 quote, causing the price to rapidly spike to 24,111.22 dollars near 87,000 dollars, with a daily volatility of 73%.

On December 26, according to informed sources, due to Binance's financial activity attracting a large number of users to exchange USDT for USD1, USD1 once experienced a premium of about 0.39%. Some funds subsequently obtained USD1 through the lending market and gradually sold it in the spot market to meet demand. Due to the initial thin liquidity of the BTC/USD1 trading pair, this caused a rapid spike. CZ explained that this trading pair was not included in any index, so it did not trigger liquidation, and the related fluctuations more reflect that the liquidity of the new trading pair has not yet been fully established.

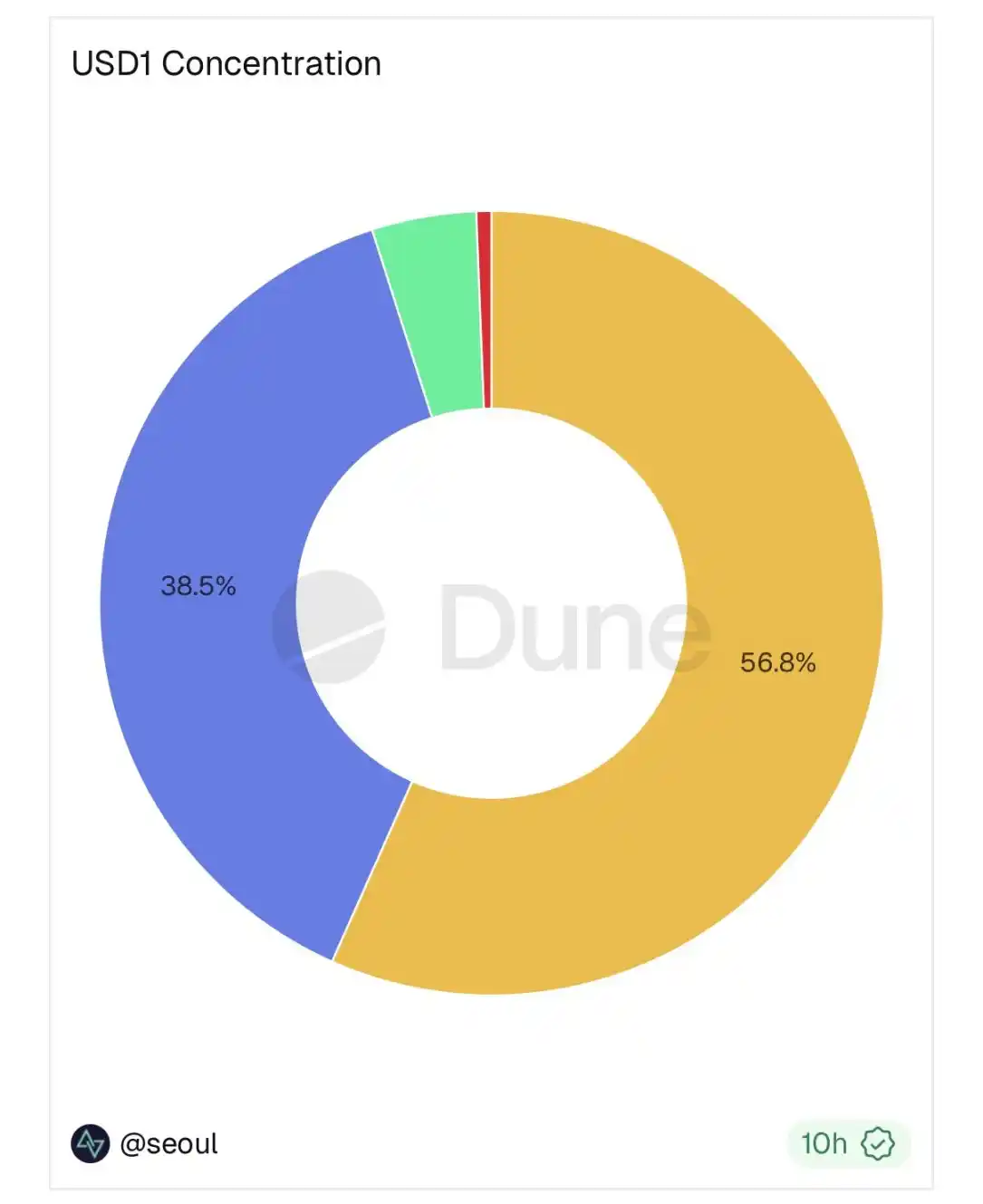

As of January 8, 2026, the market capitalization of USD1 is approximately 3.37 billion dollars. From the on-chain distribution perspective, its issuance is mainly concentrated on the BSC and Ethereum mainnet, approximately 1.91 billion dollars and 1.3 billion dollars respectively, together accounting for the vast majority of the share. In contrast, the scale of USD1 on the Solana network is about 143 million dollars, which is significantly lower. Although WLFI continues to emphasize support for the Solana Meme ecosystem in ecological narratives and cooperation directions, in terms of actual stock, USD1 currently still mainly relies on the liquidity structure of traditional EVM networks.

Compared to centralized trading platforms, WLFI is also trying to promote the use of USD1 through on-chain scenarios. In September 2025, WLFI announced a partnership with the Meme launch platform BONK.fun on Solana and the decentralized trading platform Raydium, introducing USD1 as a trading pair into the related ecosystem.

On January 6, Raydium released data showing that the trading volume of USD1 on the Solana network in the past 24 hours was approximately 295 million dollars.

In addition, WLFI also disclosed that it had purchased Meme tokens B, 1, etc., to support community development. Such collaborations provide USD1 with scenarios closer to native on-chain use, but the related demand largely still depends on community activity and periodic market sentiment, and its sustainability remains to be observed.

Additionally, on January 8, WLFI disclosed that its affiliated entity WLTC Holdings LLC has submitted an application to the Office of the Comptroller of the Currency (OCC) in the United States to establish the World Liberty Trust Company, National Association (WLTC). This institution is positioned as a national trust bank, specifically serving the issuance, custody, and related financial activities of the USD1 stablecoin.

According to WLFI's explanation, the core goal of establishing WLTC is to integrate the issuance, redemption, custody, and exchange functions with the dollar of USD1 within a single, highly regulated entity. WLFI stated that the circulation scale of USD1 has exceeded 3.3 billion dollars within a year of its launch and has been used by some institutions for cross-border payments, settlements, and fund management scenarios.

If the related application is approved, WLTC plans to provide three core services to institutional clients under the federal regulatory framework, including the minting and redemption of USD1, the inflow and outflow channels between dollars and USD1, as well as custody and conversion services for USD1 and other stablecoins. These services are intended to be launched initially with no fees.

WLFI also emphasizes that the proposed trust bank will comply with regulatory requirements, including anti-money laundering, sanctions screening, and cybersecurity, and will adopt institutional arrangements such as customer asset segregation, independent reserve management, and regular reviews. The institution will operate under a regulatory structure that complies with the GENIUS Act.

In terms of existing partnerships, BitGo will continue to be one of the important partners of USD1 after WLTC officially operates, participating in supporting its subsequent development.

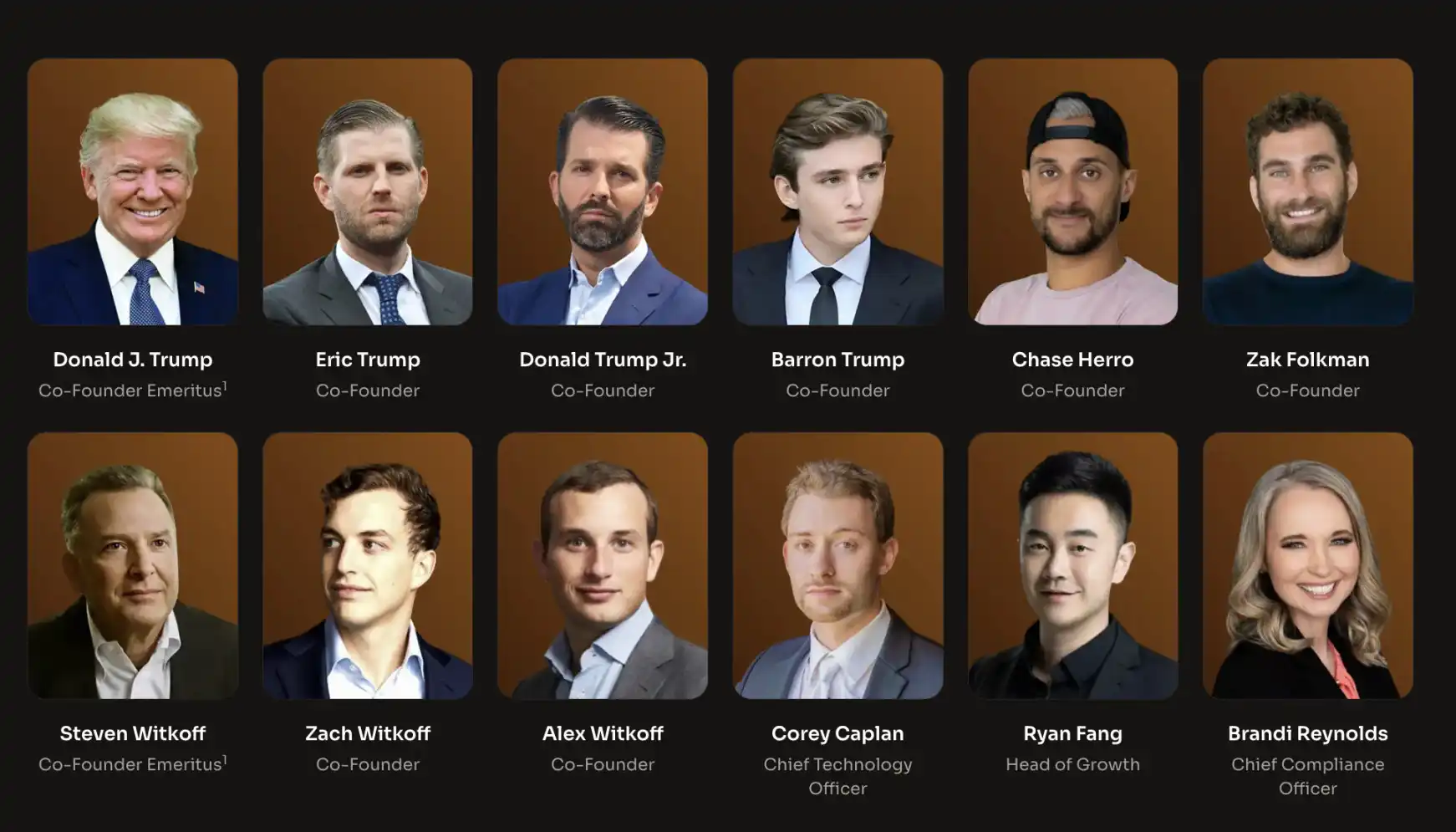

World Liberty Financial was established in 2024 and is a project focused on decentralized finance. Public information shows that this project has close ties with the Trump family in terms of structural design and market promotion, with related members playing roles in project promotion and ecological dissemination. USD1 is a dollar-pegged stablecoin launched by WLFI in March 2025, aimed at providing a settlement asset that can be exchanged 1:1 with the dollar on-chain, for cross-border payments, DeFi activities, and liquidity needs in the digital asset market.

According to information disclosed on WLFI's official website, each token of USD1 is backed by an equivalent dollar reserve, with reserve assets mainly including dollar cash, short-term U.S. Treasury bonds, and other cash equivalents. The related assets are held in custody by BitGo Trust Company and its affiliated entities, with BitGo also responsible for the issuance and redemption of USD1. Eligible BitGo customers can directly exchange USD1 for dollars at a 1:1 ratio, while other holders must complete the exchange through trading platforms that support USD1 or regulated custodians.

Similar to other centralized issuance, compliance-oriented stablecoins, USD1 also clearly lists multiple risks in its official disclosures. Its core constraints mainly focus on several aspects: USD1 is not legal tender and does not enjoy deposit insurance; direct redemption is only open to eligible BitGo customers; although reserve assets are primarily high liquidity assets, they may still face liquidity pressure in extreme situations; at the same time, changes in regulatory policies, address freezing mechanisms, and third-party platform risks may all affect the use and circulation of USD1.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。