Original Title: The New Market Regime

Original Author: David Attermann

Original Translation: SpecialistXBT

Editor's Note: Why has there been no "altcoin season" in this cycle? The author points out that the old market paradigm driven by high leverage and speculation has completely ended, replaced by a new regime dominated by compliance thresholds and institutional capital. In this new landscape, investment logic will shift from capturing liquidity spillovers to selecting long-term value assets with real utility and regulatory adaptability.

The following is the original content:

Since 2022, the poor overall performance of altcoins reflects a shift in underlying structures rather than a typical market cycle.

The liquidity framework that once broadly transmitted capital across the risk curve has collapsed and has never been rebuilt.

In its place is a new market structure that changes the way opportunities are generated and accessed.

The collapse of Luna in 2022 dismantled the liquidity framework that once transmitted capital down the cryptocurrency risk curve. The market did not suddenly collapse on October 10; it had already broken years earlier, and everything that has happened since has been merely aftershocks.

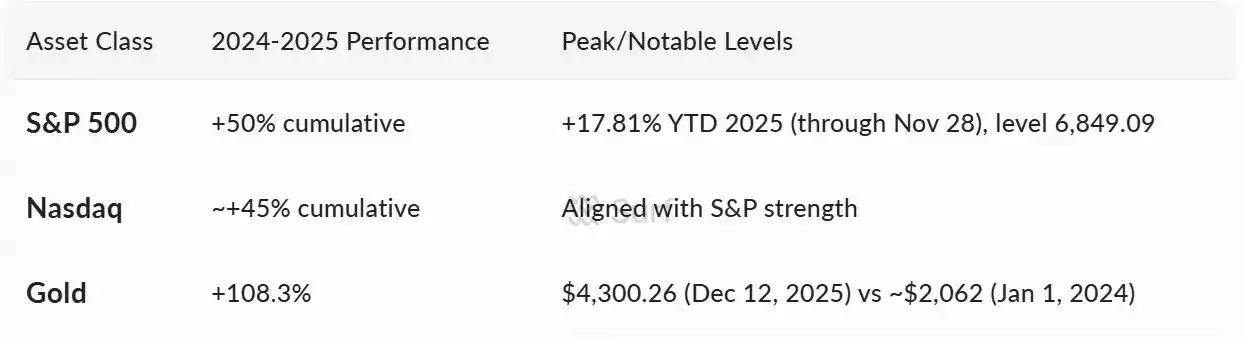

The post-Luna era has ushered in the most favorable macro, regulatory, and fundamental backdrop in cryptocurrency history. Traditional risk assets and gold have soared, but the long-tail assets of the crypto market have not. The reason is structural: the liquidity system that once drove broad asset rotation no longer exists.

This is not the loss of a healthy growth engine. It is the disintegration of a market structure that fundamentally mismatches with durable value creation.

2017-2019:

2020-2022:

From May 2022 to present:

(Note: "OTHERS" = total market capitalization of the crypto market excluding the top ten tokens)

Despite the most favorable macro backdrop, altcoins remain stagnant

In the years following the collapse of Luna, particularly in 2024-2025, the crypto industry has encountered an unprecedented combination of favorable macro conditions, regulatory policies, and fundamentals. Under the market structure prior to Luna, these forces would typically trigger deep rotations along the risk curve. However, what has puzzled crypto investors is that this has not occurred in the past two years.

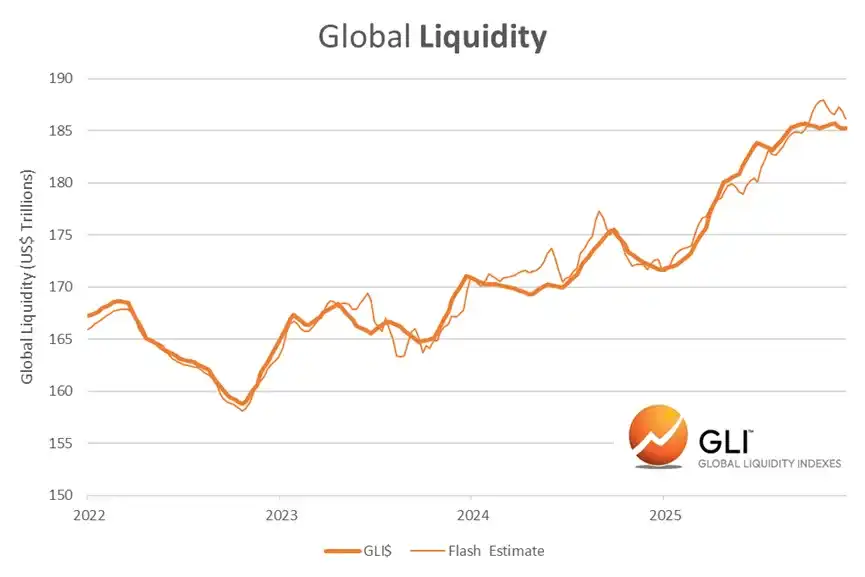

Ideal Liquidity Conditions

Global liquidity expansion, declining real interest rates, and central banks shifting to a risk-on mode have led traditional risk assets to reach new highs.

Strong Regulatory Momentum

The long-standing regulatory clarification process as a threshold for large allocators has accelerated:

The U.S. has welcomed its first government supportive of cryptocurrencies.

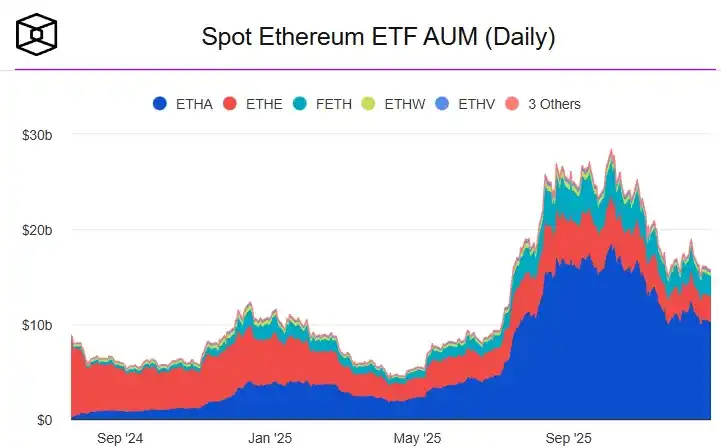

Bitcoin and Ethereum spot ETFs have launched.

- The ETP framework has achieved standardization (which can be said to have paved the way for the DAT boom mentioned later).

MiCA has established a clear and unified handling scheme.

The U.S. has passed the stablecoin bill (GENIUS Act).

The Clarity Act is just one vote away from passing.

On-chain Fundamentals Reach Historic Highs

Activity, demand, and economic relevance have all surged significantly:

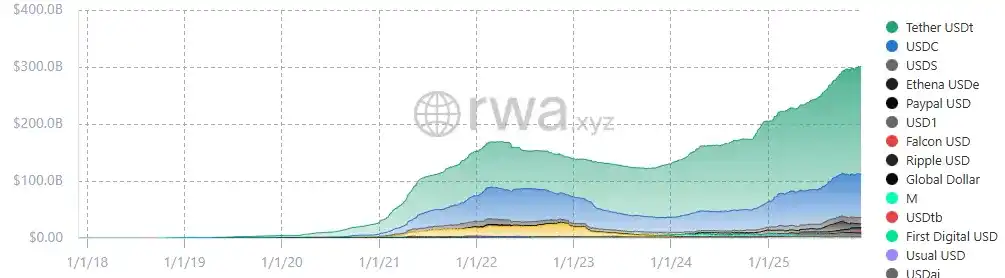

- The stablecoin market has surpassed $300 billion.

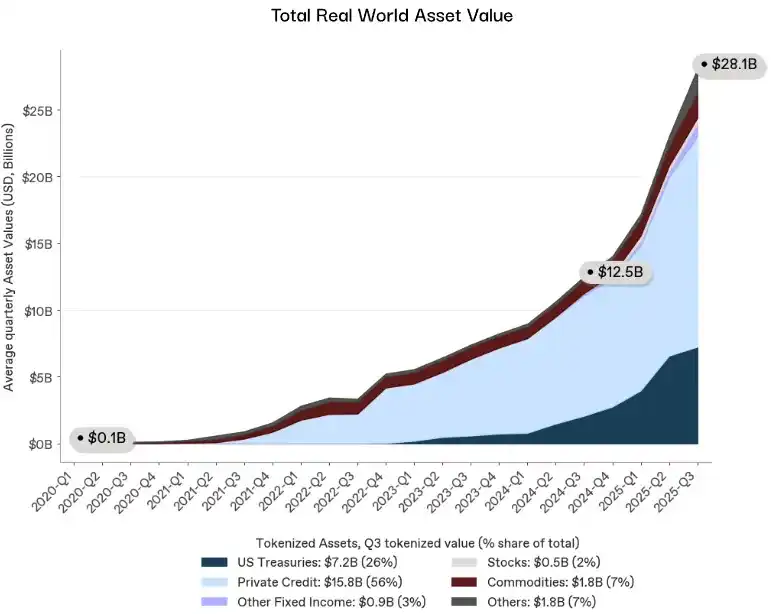

- RWA (Real World Assets) has exceeded $28 billion.

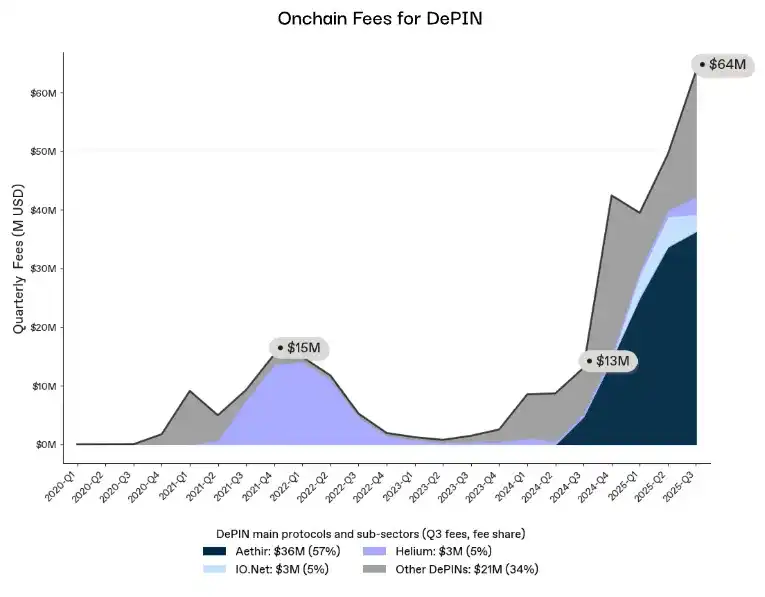

- DePIN revenues have rebounded.

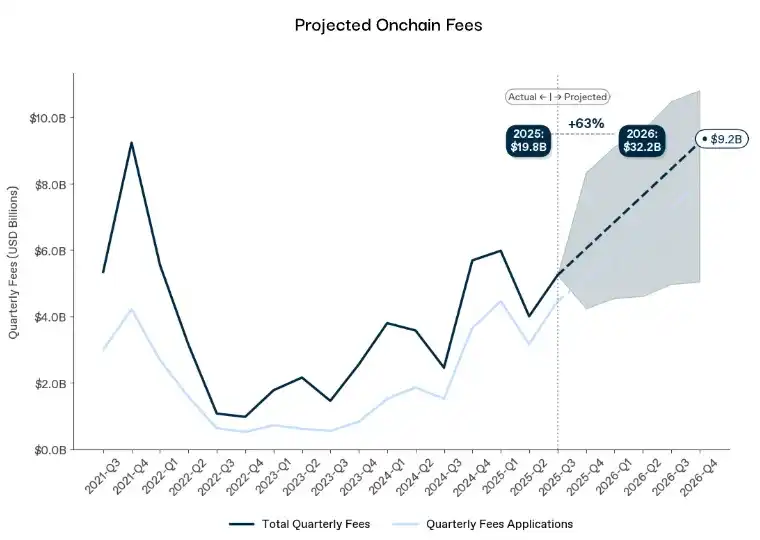

- On-chain fees are reaching new highs.

This is clearly a structural issue

This is not a failure of demand, narrative, regulation, or macro conditions. It is the consequence of a broken liquidity transmission system. The market structure that dominated from 2017 to 2021 no longer exists, and no macro, regulatory, or fundamental forces can revive it.

This does not mean a lack of opportunities, but rather a change in the way opportunities are generated and captured; over time, this change will prove to be decisively favorable.

The previous market did indeed produce larger nominal "pump" events, but it was structurally unstable. It rewarded reflexivity rather than fundamentals, rewarded leverage rather than utility, and fostered manipulation, insider advantages, and extractive behaviors, all of which are incompatible with institutional capital or mainstream adoption.

What exactly went wrong?

Market liquidity consists of three layers: capital providers, distribution channels, and leverage amplifiers. The collapse of Luna dealt a devastating blow to all three.

Liquidity Engine Stalled

From 2017 to 2021, altcoin seasons were driven by a concentrated group of balance sheet providers willing to deploy capital across thousands of illiquid assets:

Cross-exchange market makers.

Offshore lenders providing unsecured credit.

Exchanges subsidizing long-tail markets.

Proprietary trading firms hoarding risk.

Then Luna collapsed. Three Arrows Capital (3AC) went bankrupt. Alameda's risk exposure was revealed. Genesis, BlockFi, Celsius, and Voyager all faced crises. Offshore market makers retreated entirely. Capital providers disappeared, and no new entrants with comparable balance sheet size, risk tolerance, or willingness to engage in the long-tail market emerged.

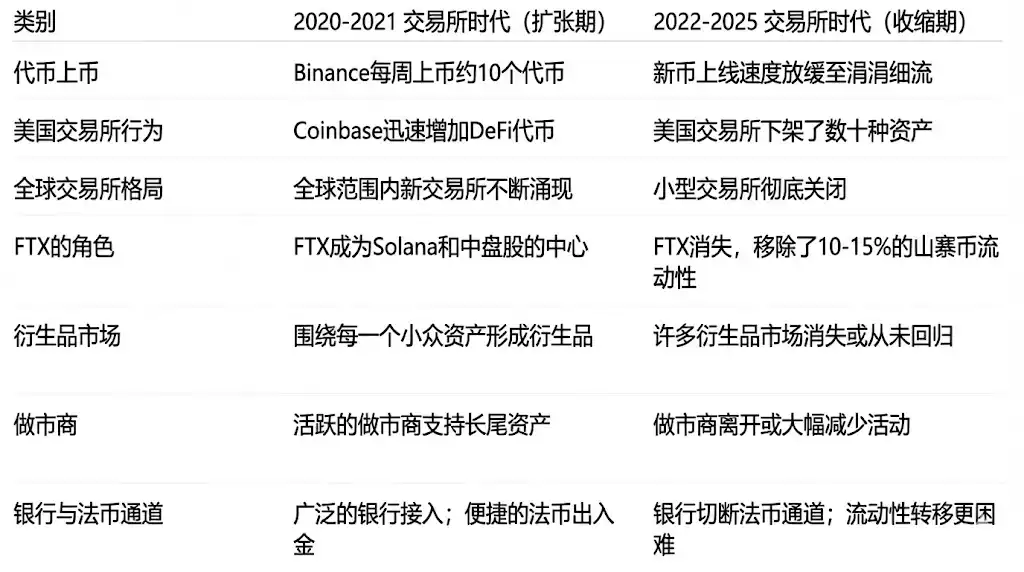

Distribution Channels Broken

More important than the capital itself is the mechanism for distributing capital. Before 2022, liquidity naturally flowed down the risk curve as a few intermediaries continuously moved it:

Alameda smoothed prices across exchanges.

Offshore market makers quoted thousands of trading pairs.

FTX provided highly efficient execution.

Internal credit lines transferred liquidity between assets.

When the crisis of Luna spread to 3AC and FTX, this layer of intermediaries vanished. Capital could still enter the crypto space, but the pipelines that once delivered it to the long-tail market were severed.

Liquidity Amplifiers Failed

Finally, liquidity is not only supplied and channeled, but it is also amplified. Small liquidity inflows could leverage the market because collateral was aggressively reused:

Long-tail tokens were used as collateral.

BTC and ETH were leveraged into altcoin baskets.

Recursive on-chain yield cycles.

Multi-exchange re-hypothecation.

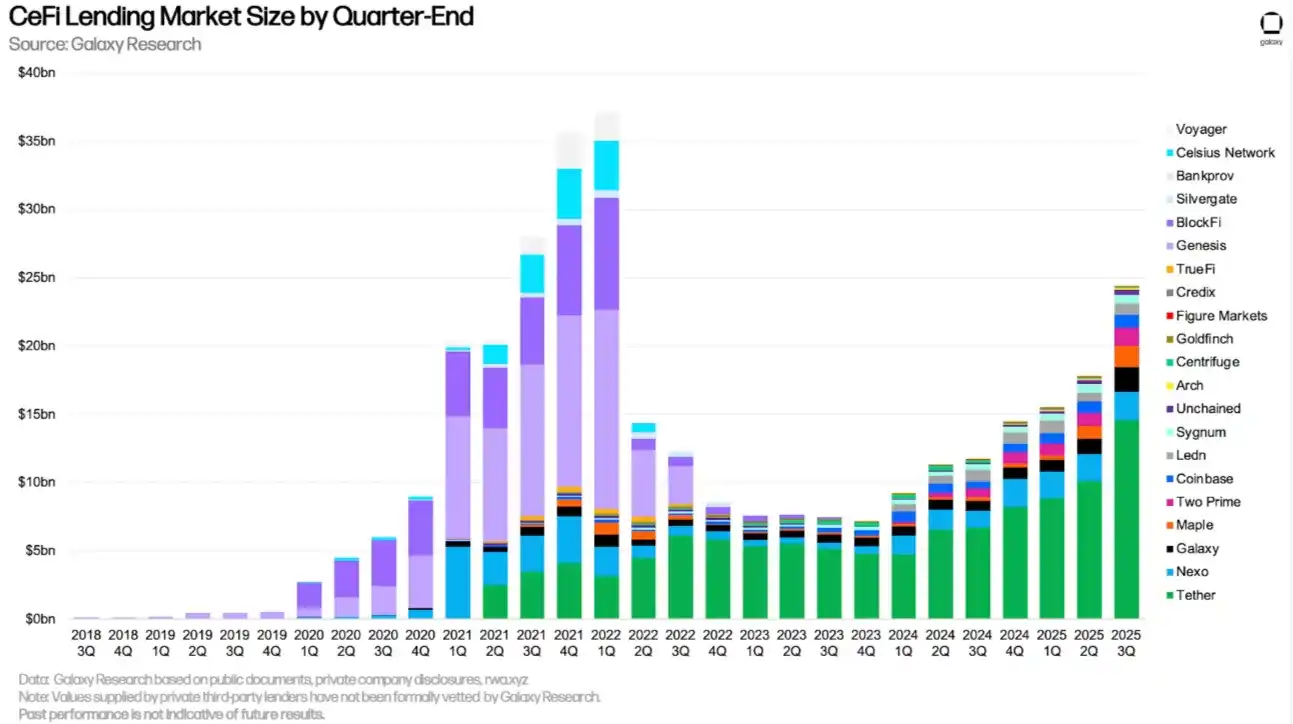

After Luna, this system quickly disintegrated, and regulators froze the remaining parts:

SEC enforcement actions limited institutional risk exposure.

SAB-121 kept banks out of custody businesses.

MiCA implemented strict collateral rules.

Institutional compliance departments restricted activities to BTC and ETH.

While lending volumes in leading CeFi (centralized finance) have somewhat recovered, the underlying market has not. The lenders that defined the previous generation of the system have disappeared, replaced by a system that is more risk-averse and almost entirely concentrated on top assets. Lending has re-emerged without a long-tail credit transmission mechanism.

This system can only operate when the growth rate of leverage exceeds the rate of risk exposure; this dynamic is destined for ultimate failure.

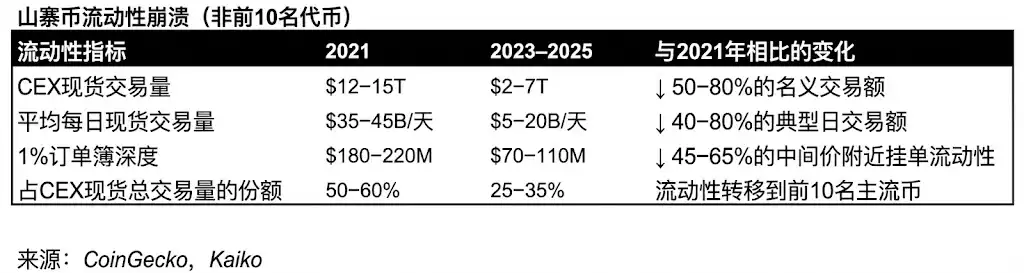

Structural Decline of Altcoin Liquidity

Once the engine stalls, the pipelines break, and the collateral amplifiers shut down, the market enters an unprecedented state: a structural liquidity decline lasting for years. This is followed by a completely different market.

Market Depth Collapses

Historically, depth always recovers because the same players rebuild it. But without them, the depth of altcoins can no longer return to what it was.

The depth of long-tail assets has decreased by 50-70%.

Spreads have widened.

Many order books have effectively been abandoned.

The cross-exchange price smoothing mechanism has disappeared.

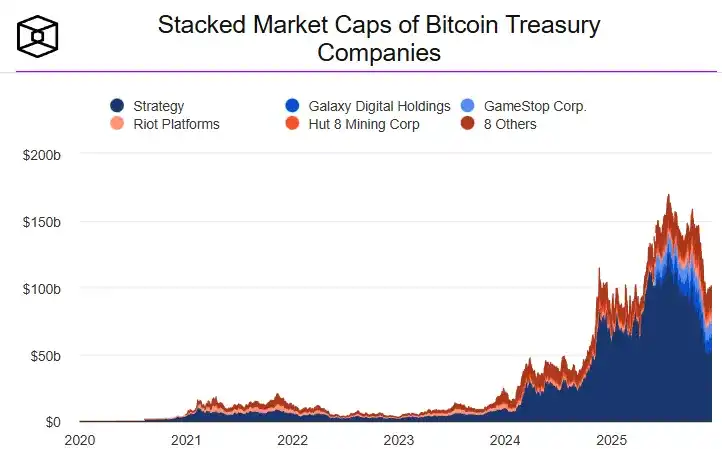

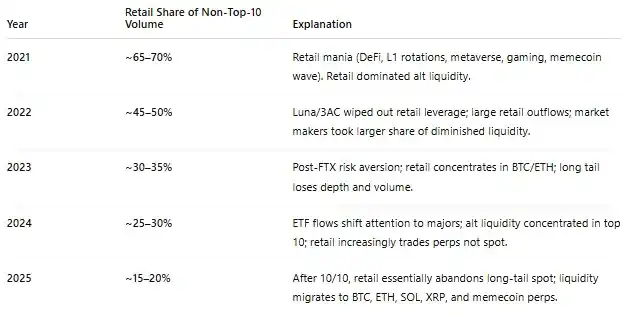

Demand Shifts to the Top

Liquidity has migrated upstream and has not flowed back down.

- Institutional compliance departments prohibit long-tail exposure, sticking to mainstream assets like BTC and ETH.

- Retail investors are exiting.

- ETFs and DAT are only focusing on blue-chip tokens with sufficient existing liquidity.

The Collision of Crazy Token Issuance with a Market Lacking Buyers

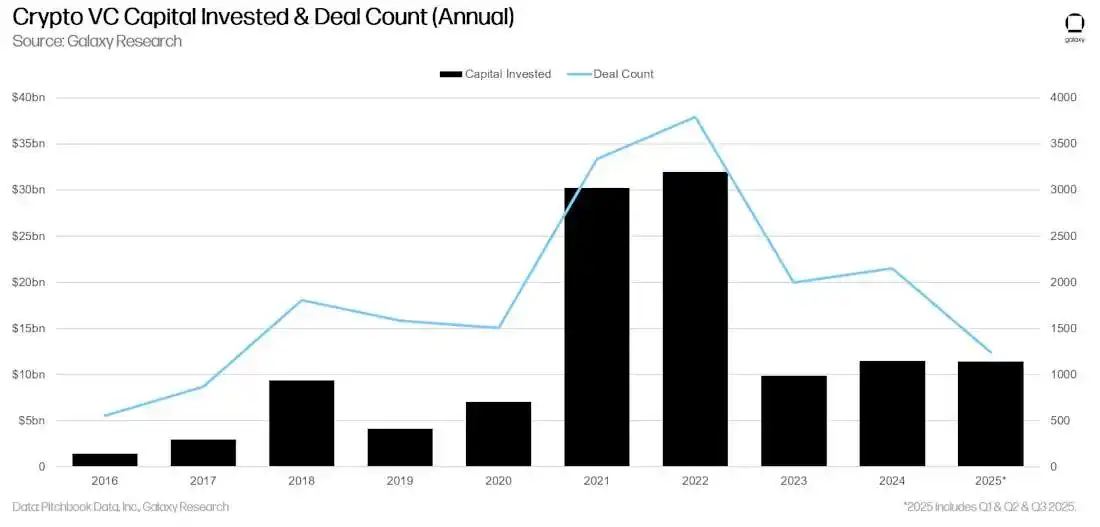

The peak of VC activity in 2021/2022 created a massive future supply wave.

When these projects issue tokens in 2024-2025, they will collide with a market that lacks all absorption mechanisms. The damaged system cannot withstand continuous selling pressure.

(As the 2021-2022 venture capital issuance cycle clears, token unlocks are expected to normalize by 2026, which will alleviate a key structural resistance to long-tail liquidity.)

The conditions that once drove altcoin seasons have been systematically dismantled. So, where do we stand today?

Investing in the New Landscape

The period after 2022 has been painful for altcoins, but it represents a decisive break from a market structure that is fundamentally unsuitable for scaling. What follows is not a normal market pullback, but a regime defined by a lack of reflexivity and leverage-driven liquidity. This absence continues to define the market today.

In the current structure, even fundamentally strong assets are trading under conditions of persistent illiquidity. Price movements are dominated by weak order books, limited credit, and broken routing, rather than fundamental performance. Many assets will stagnate for the long term. Some will not survive. This is the inevitable cost of operating without artificial liquidity or balance sheet amplification.

Substantial change will only occur once regulatory changes take place.

The upcoming Clarity Act is a key turning point for the altcoin market structure. It unlocks access to vast pools of capital: regulated asset management firms, banks, and wealth platforms manage hundreds of trillions of dollars, and without clear legal classifications, custody rules, and compliance certainty, their mandates prohibit them from holding risk exposure.

Until capital can participate, the altcoin market will remain trapped in a regime of insufficient liquidity. Once participation is possible, the market structure will change fundamentally.

Major financial institutions are already positioning for this shift:

- BlackRock is establishing a dedicated digital asset research function, covering tokens as they would stocks.

- Morgan Stanley is doing the same.

- Bloomberg is also on board.

- Cantor Fitzgerald has begun publishing stock research-style reports on individual tokens.

This institutional build-out marks the beginning of a new market regime. The capital unlocked by regulatory clarity will not flow in through offshore leverage, reflexive rotations, or retail momentum. It will enter slowly and selectively through familiar institutional channels. Allocation decisions will be driven by qualifications, durability, and scaling potential—rather than narrative speed or leverage amplification.

The implications are clear: the old altcoin script is outdated. Opportunities will no longer come from systemic liquidity waves. They will come from specific assets that can endure long-term liquidity shortages through fundamentals and can demonstrate institutional allocation rationality once compliant capital is permitted to participate.

In the past, these filtering criteria were optional. Under the new regime, they are mandatory.

Persistent Demand: Does the asset capture recurring, non-discretionary demand, or is it only active when incentives, narratives, or speculation exist?

Institutional Qualification: Can regulated capital own, trade, and underwrite the asset without legal or custody risks? Regardless of technological advantages, assets outside institutional mandates will remain constrained by liquidity.

Rigorously Defined Economic Models: Supply, emissions, and unlocks must be predictable and constrained. Value capture must be clear. Reflexive inflation is no longer tolerated.

Proven Utility: Is the product used because it provides differentiated and valuable functionality, or does it survive on subsidies while waiting for relevance?

Beyond stablecoins and tokenized assets (which continue to capture attention), blockchain-based systems are also being integrated into healthcare, digital marketing, and consumer-grade AI, operating quietly beneath the surface.

These applications are rarely reflected in token prices and are largely overlooked, not only by mainstream society but even by many Web3 practitioners themselves. Their design is not meant to be flashy or viral; their appeal is subtle, embedded, and easily missed.

However, the shift from speculation to reality has begun: infrastructure is online, applications are real, and novel differentiation has been validated. As market participants increasingly turn to institutional allocators and regulated capital, the quiet adoption and the gap with valuations will become harder to ignore.

Ultimately, this gap will close.

Taking a Step Back, We Did It

I first fell down the cryptocurrency rabbit hole in 2014, when I clearly realized that blockchain is not just digital currency; it is a disruptive technology for data networks.

Ten years later, ideas that once felt abstract are now operating in the real world.

Software can finally be both secure and useful: your data is controlled by you, kept private and protected, while still being used to provide genuinely better experiences.

This is no longer experimental. It is becoming part of everyday infrastructure.

We succeeded: not in achieving a "cryptocurrency supercycle," but in realizing the true goal.

Now it is time for execution.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。