In the early hours of January 3, local time in Venezuela, the U.S. military simultaneously entered from the air and ground, taking control of several key military facilities and escorting President Nicolás Maduro to the United States.

Precision airstrikes, armed ground control, the abduction of a head of state… According to the widely accepted definitions in international law, this constitutes a military invasion of a sovereign nation.

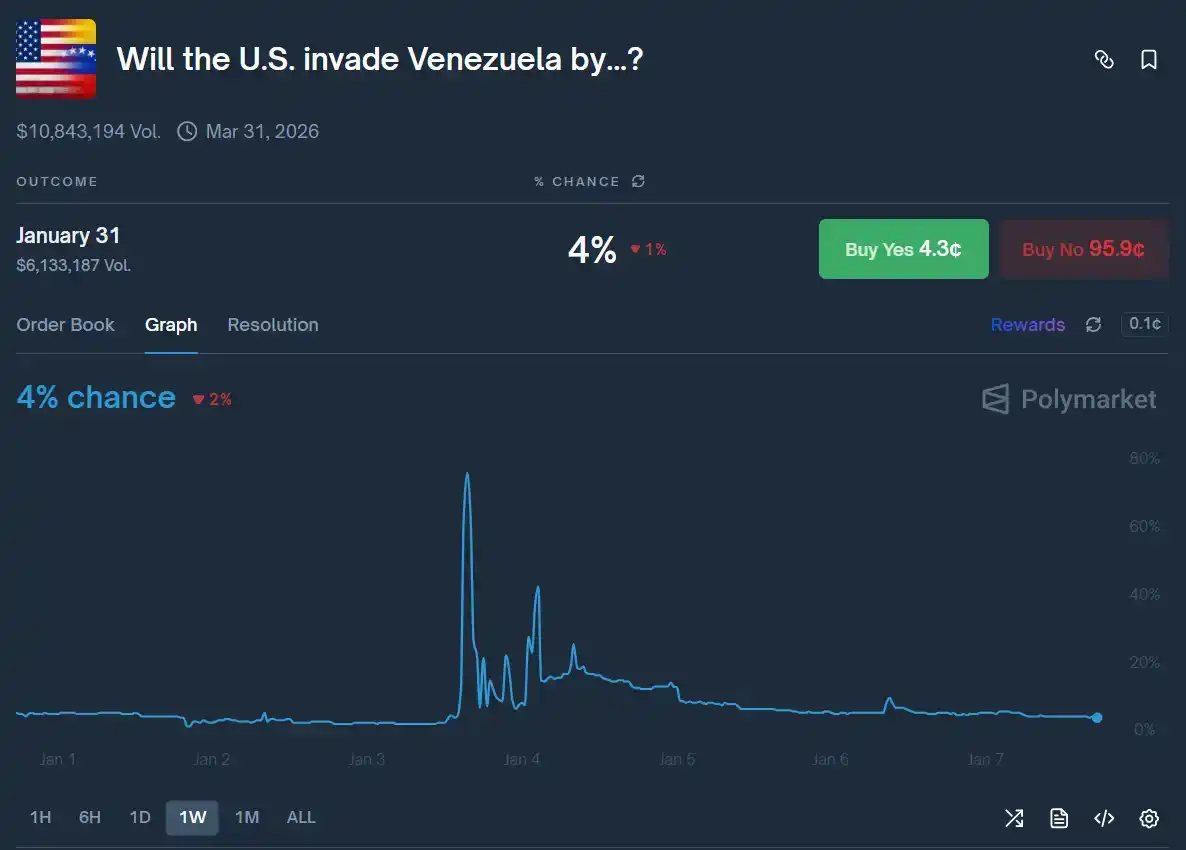

On the other side, in the world's hottest prediction market, Polymarket, a group of traders has already begun to celebrate their own victory in anticipation of this attack.

They had bet before the incident that the U.S. military would invade Venezuela, and the smoke and gunfire reported in the news seemed to be a pre-celebration of their high-odds massive profits.

At that moment, no one would think that they had already become losers the moment they participated in the trade.

The news reported globally had seemingly never happened on Polymarket.

The market "The U.S. will invade Venezuela before January 31, 2026" had a straightforward definition of invasion before the attack occurred: "A military offensive by the U.S. military aimed at establishing control."

After the attack, the probability of this market surged from 2% to 80%. This trading model of probability, which is equivalent to odds, allowed traders who bet before the attack to welcome substantial unrealized gains.

While mainstream media around the world reported "the U.S. attacks Venezuela," the market suddenly saw multiple bets on "no," confidently asserting "the U.S. did not invade Venezuela." This caused the probability to drop to a low of 7%.

Even after Trump shamelessly stated "run Venezuela" following the attack, as of the time of this article's publication, the market had still not settled, and the probability had dropped to 4%.

This globally impactful military invasion seemed as if it had never happened on Polymarket.

"Tailored" rule updates: Using wordplay to deny an invasion

If one were to look for evidence on Polymarket that an invasion indeed occurred, there is some: hours after the attack, the platform officially released a rule supplement:

This market refers to U.S. military operations intended to establish control. President Trump's statement that they will "run" Venezuela while referencing ongoing talks with the Venezuelan government does not alone qualify the snatch-and-extract mission to capture Maduro as an invasion.

In simple terms: U.S. military entry and bombing do not count as an invasion. Trump's words about invasion, occupation, and operation do not count as an invasion. Capturing a president does not count as an invasion.

But still, the statement stands: "Military actions aimed at establishing control count as an invasion."

It seems that writing job requirements in such a meticulous manner has never been done before; traders who placed bets while analyzing military situations did not need to consider these currently non-existent hidden clauses.

Meanwhile, traders who bet during the period when "no" odds surged (mostly whales) relied on the tailored rule updates to achieve significant profits once again.

A similar scenario occurred in another market "The U.S. and Venezuela will have military conflict within 2025." On December 26, 2025, Trump publicly stated in an interview that the U.S. had destroyed an important facility within Venezuela.

Several mainstream media outlets subsequently reported on the matter, with CNN noting that the operation "was planned and executed by the CIA."

Shortly after the incident, the platform released a rule supplement stating that "actions executed by non-military intelligence agencies do not qualify."

Coincidentally, the CIA falls under the category of non-military intelligence agencies.

In the absence of any formal clarification from the U.S. government regarding the attribution of the action, Polymarket precisely excluded a military strike from the settlement scope based on "anonymous sources" in CNN's report.

Why were the rules changed? Digging into the "prediction market" ties of the Trump family

As losing traders gathered in forums to protest, a more fundamental question emerged: Why would Polymarket risk its reputation by modifying rules in plain sight?

The clues point to unusual names at the top of the platform.

Despite its decentralized facade, Polymarket is a private company regulated by the U.S. Commodity Futures Trading Commission (CFTC). A pivotal investment that changed its fate occurred last August:

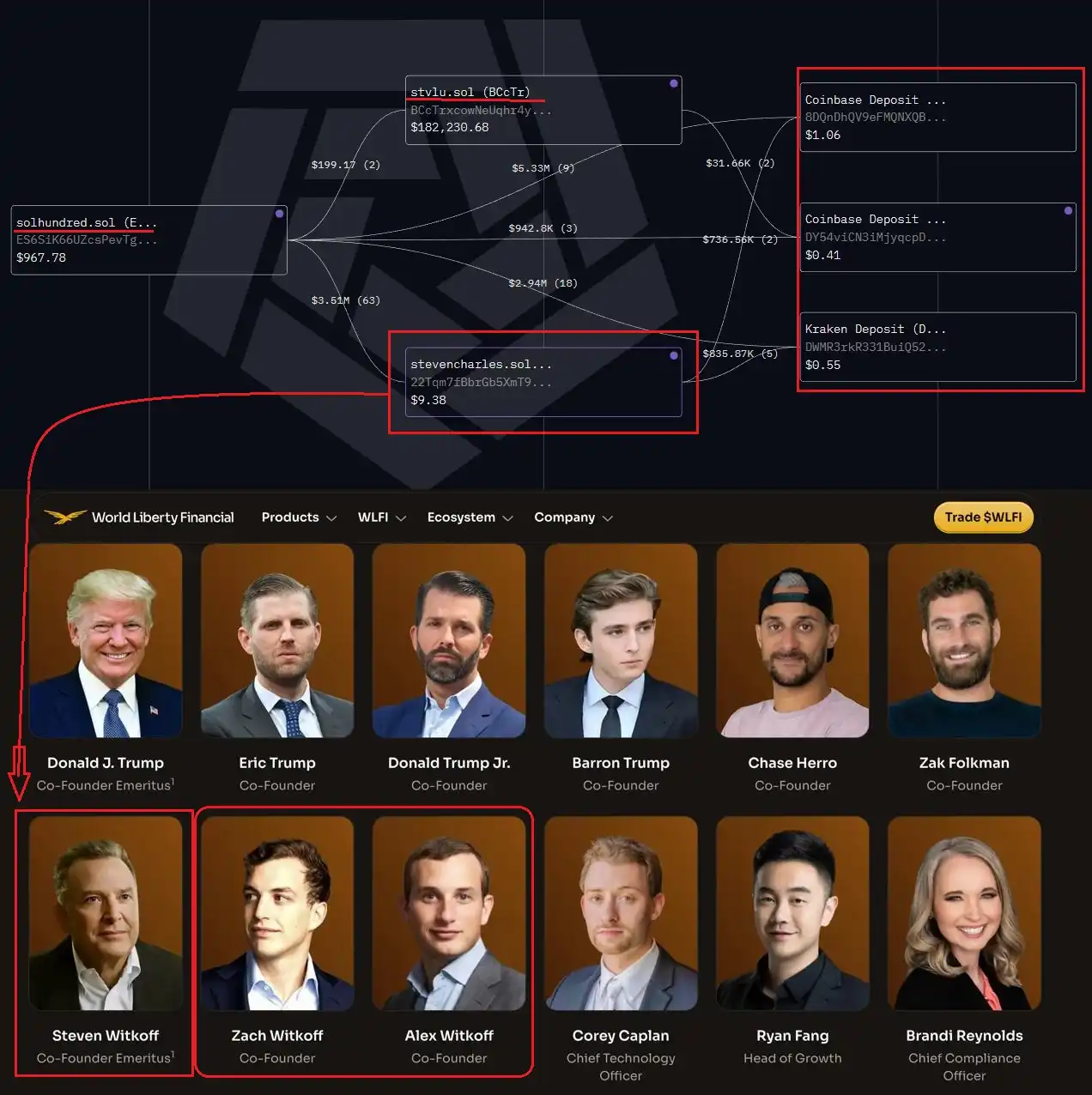

Donald Trump Jr. — the eldest son of the current U.S. president — officially invested in Polymarket through his private investment company, and he subsequently joined the company's "advisory board."

The coincidences on the timeline are intriguing: after Trump Jr. invested, Polymarket, which had long operated in a regulatory gray area, quickly obtained operational approval from the CFTC, thus legalizing its operations in the U.S.

All five top commissioners of the CFTC are directly appointed by the president.

"This is just a normal business investment," some commentators attempted to downplay the connection, "the Trump administration has always supported cryptocurrency innovation."

The next step is to verify whether those around Trump are profiting from Polymarket by exploiting information asymmetry.

From on-chain data to the White House social circle: When "coincidences" become too numerous to be mere coincidences

Let’s turn our attention back to three hours before the raid occurred.

In another related market "Maduro will step down before January 31, 2026," a new wallet address with no prior trading history suddenly injected $30,000 into the market, betting entirely on "yes." As Maduro was escorted onto the plane, this $30,000 turned into over $400,000 within hours.

The account's behavior pattern is highly suspicious: newly registered, single deposit, betting on only one market within a specific time window, and immediately withdrawing profits afterward. This operation completely treats the prediction market as a personal ATM.

Who is this "insider"?

On-chain analyst @Andrey_10gwei discovered that the funds of this insider account could be traced back to an account with the domain "stevencharles.sol" by comparing the amounts of cryptocurrency deposited and withdrawn on the exchange.

Steven Charles?

Upon opening the website of WLFI, a core member organization managed by Trump Jr., it can be found that the first person on the second row is one of the co-founders of the company, also a New York real estate developer who provided campaign funding to Trump, and the two have had a friendship spanning nearly 40 years.

(cr: https://x.com/Andrey_10gwei/status/2007904168791454011?s=20)

His full name? Steven Charles Witkoff. Perfectly matching the on-chain domain "stevencharles."

A mysterious account that turned $30,000 into $400,000 in three hours, an on-chain funding source named "stevencharles," and a business tycoon closely related to the presidential family who can directly influence Polymarket.

Three events with nearly zero probability linked together can no longer be explained as mere coincidence.

Conclusion

Branded as a decentralized fair trading platform, Polymarket may just appear to ordinary people as a financial tool to profit from betting on outcomes.

However, perhaps in corners unseen by the average person, it has long since become a tool for those who can arbitrarily redefine right and wrong, frequently using rule updates and unequal information asymmetry to repeatedly siphon off people's assets.

How long the average person can survive here entirely depends on the desires and moral boundaries of elite groups.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。