2026 is destined to be a big year for Perp DEX airdrops.

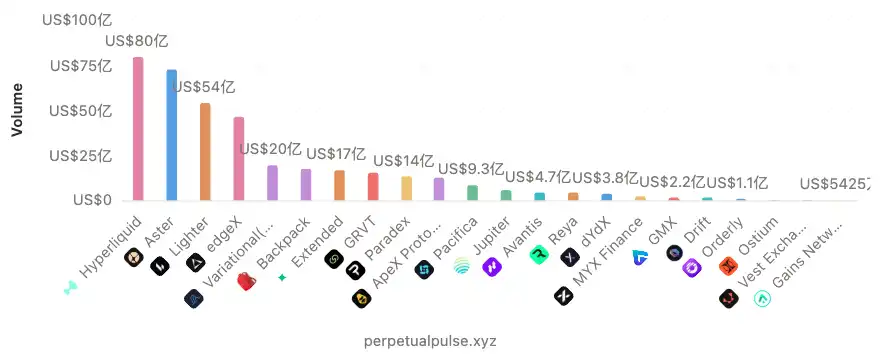

From Hyperliquid, Aster, to the recent TGE of Lighter, every Perp DEX that issued tokens during this cycle has been as lively as a festival during their airdrops. After Lighter concluded, the data volume of the second-tier Perp DEXs also began to show significant growth. According to data from perpetualpulse, the leading trading volume among the unissued Perp DEXs includes edgeX, Variational, Extended, GRVT, and Paradex.

In the new year, competition in the Perp DEX space has entered a more intense phase, with everything from trading fees to various activities and subsidies, and even projects starting to criticize each other. Faced with the different point systems and scoring strategies of numerous Perp DEXs, how should ordinary users choose? How can they maximize point weight with limited funds? How can they avoid being exploited?

In this article, Rhythm BlockBeats will analyze the differences and characteristics of four popular second-tier Perp DEXs in the market: Variational, Extended, Paradex, and StandX, from four dimensions: team background, core mechanisms, data performance, and interaction strategies, and provide some summarizing content combined with the practical experiences of community KOLs.

Variational

Variational Omni is one of the Perp DEXs that I have been closely following.

Since the introduction of loss refunds, Kaito Yaps rewards, and the point system, Variational's data has skyrocketed: as of December 26, 2025, cumulative spread revenue reached $7.6 million; as of January 3, 2026, cumulative trading volume surpassed $100 billion. There are also many discussions on Crypto CT about trading and scoring strategies, such as posts by dTfN (@deTEfabulaNar_) and Tony (@T0nyCrypt0).

The team background of Variational is quite solid, with the two core founders being alumni of Columbia University, who previously co-founded a quantitative investment company that was acquired by Genesis Trading. After leaving Genesis in 2021, they founded Variational, continuously iterating on machine learning, quantitative market making, and decentralized derivatives design. In 2024, Variational completed a $10.3 million seed round financing led by Bain Capital Crypto and Peak XV Partners, with follow-on investments from Coinbase Ventures and Dragonfly Capital.

For Lucas and Edward, who experienced the fallout from FTX, how to amplify systemic shocks in extreme market conditions is a problem that needs to be solved and is also the source of Variational's design philosophy. In July 2025, Edward appeared on the "Flirting with Models" podcast, systematically explaining the idea of "how OTC derivatives can go on-chain"—a deep discussion where he integrated Bayesian frameworks, market-making games, and on-chain mechanisms. His personal homepage quant.am and Lucas's homepage lucasschuermann.com continue to update relevant research. For more team background information, you can refer to my previous article "How does Variational, produced by Columbia University and with 0 fees, generate revenue?," so I won't elaborate further here.

What I want to elaborate on is understanding Variational's spread mechanism and arbitrage logic based on its product characteristics to enhance and optimize interaction strategies.

Although both Variational and Lighter have zero fees, their profit mechanisms are completely different: Lighter charges market maker fees, while Variational profits through an Omni Liquidity Provider spread arbitrage mechanism. (The spread is the difference between the buy and sell prices, and it is also the transaction cost for users entering a trade; the smaller the spread, the lower the transaction cost).

In simple terms, there is only one market maker on Variational, which is Variational itself. When users open a position, Variational acts as the sole market maker and counterparty, setting a spread of 4-6 basis points, while simultaneously opening a reverse position on external trading platforms for hedging, capturing the internal and external price differences as profit. Many traders have also verified this core logic through various control group tests: the larger the spread, the higher the profit for Variational, and the higher the point weight obtained by users. So how can one maximize point weight? A straightforward scoring strategy is that the larger the spread, the better. So how can we increase the spread?

Based on the principles discussed earlier, we know that ways to reduce the spread include: trading mainstream cryptocurrencies like BTC or ETH; choosing time periods with good liquidity.

Conversely, to increase the spread, one can: trade small cryptocurrencies, as the spreads for illiquid altcoins are larger than for mainstream coins; additionally, one can choose time periods with low liquidity, such as weekends or Asian nighttime. This way, the weight will be relatively high, and on this basis, one can further increase the number of trades, holding duration, single trade amount, etc., to expand trading volume data.

By using these methods, one can achieve higher point weight under the same trading volume, thereby occupying a more favorable position in airdrop distribution.

Extended

Another Perp DEX often mentioned alongside Variational is Extended, and currently, many interaction strategies involve using Extended and Variational for arbitrage.

Extended is a Perp DEX with a strong traditional finance gene, with team members primarily coming from Revolut, a European fintech unicorn valued at $33 billion. Extended's CEO, Ruslan Fakhrutdinov, was responsible for Revolut's crypto business operations and previously worked as a consultant at McKinsey; the CTO has served as an architect for four crypto exchanges, including Revolut; the CBO is a former chief engineer for Revolut's crypto division and a contributor to the Corda blockchain.

This Perp DEX built by the former Revolut team has completed a $6.5 million financing round led by StarkWare, with angel investors including Revolut executives and Lido co-founder Konstantin Lomashuk. In August 2025, Extended officially launched on the Starknet mainnet. As of January 6, 2026, the cumulative trading volume reached $108.6 billion, with a TVL of $142 million and open contracts worth $206 million.

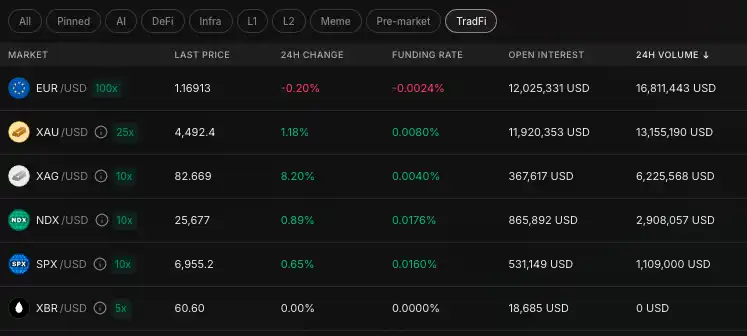

The product design of Extended currently appears to be quite complete, covering not only mainstream cryptocurrencies but also six types of TradFi assets: S&P 500, Nasdaq indices, EUR/USD forex, precious metals like gold and silver, and commodities like oil. From the OI distribution, gold trading has consistently ranked in the top 5 on Extended, indicating a significant real demand for TradFi assets.

In addition, Extended has a highlight in its design of the XVS (Extended Vault Shares) treasury, where up to 50% of the XVS balance can be directly counted as collateral for leveraged trading, meaning that the collateral itself is also earning interest, significantly enhancing liquidity. Extended's roadmap plans to increase this to 90%. As of the time of writing, the APR for Extended's treasury XVS over the past 30 days is 16%, with a TVL of $77 million, accounting for nearly 50% of Starknet's total TVL.

In terms of fee structure, Extended's taker fee is 0.025%, maker fee is 0%, and it also offers a rebate of up to 2 basis points; the liquidation fee is 0.5%; since it is deployed on the Starknet network, there is also a gas fee, but this part is subsidized by Starknet, resulting in a net fee of 0.

As mentioned earlier, Extended is often mentioned alongside Variational. Due to Extended's fee structure being more favorable to makers, my interaction tip is: place maker orders on Extended close to the market price to enjoy Extended's rebates; then simultaneously open a position in the opposite direction on Variational at the same price. When closing positions, try to ensure that the Extended account is a profit account while the Variational account is a loss account, as Variational also has a loss refund lottery mechanism.

Paradex

Paradex is another Perp DEX that I previously introduced briefly. I initially viewed it as having the potential to be the largest options DEX, and its advantages in perpetual contracts were not particularly prominent, but I have since changed this view.

Since the second half of 2025, Paradex has shown significant growth in the perpetual contract market, and as of January 6, 2026, Paradex has already surpassed $200 billion in trading volume.

As mentioned earlier, the biggest advantage of the Paradex team is its strong institutional-level experience in options and derivatives markets, which is a unique strength not shared by the teams of other projects. Paradex was incubated by the crypto institutional liquidity platform Paradigm (unrelated to the similarly named venture capital firm). Although the incubator is not the well-known top crypto VC Paradigm, but rather the crypto institutional liquidity platform of the same name, it is still worth discussing.

Founded in 2019, Paradigm provides services to institutions such as hedge funds, market makers, and family offices, and has extensive research in the crypto options and derivatives trading market. Initially, its business model involved handling over-the-counter matchmaking, delegating execution, clearing, and settlement to exchanges like FTX. At its peak, it held a 30% share of the global cryptocurrency options market, completing a $35 million financing round at a $400 million valuation, led by Jump Crypto and Alameda Research. However, after the collapse of FTX, Paradigm, as a partner, also faced significant impacts, and after a rapid decline in trading volume, it launched Paradex to rebuild its ecosystem.

Thanks to its years of research in the derivatives market, Paradex features support for perpetual contracts, perpetual futures, perpetual options, and spot trading, and it implemented a unified margin system similar to Hyperliquid even earlier. All trades are consolidated into one account, allowing any asset to be used as collateral, supporting isolated, cross, and combined margin models, greatly enhancing capital efficiency. Additionally, it is worth mentioning that Paradex currently has zero transaction fees.

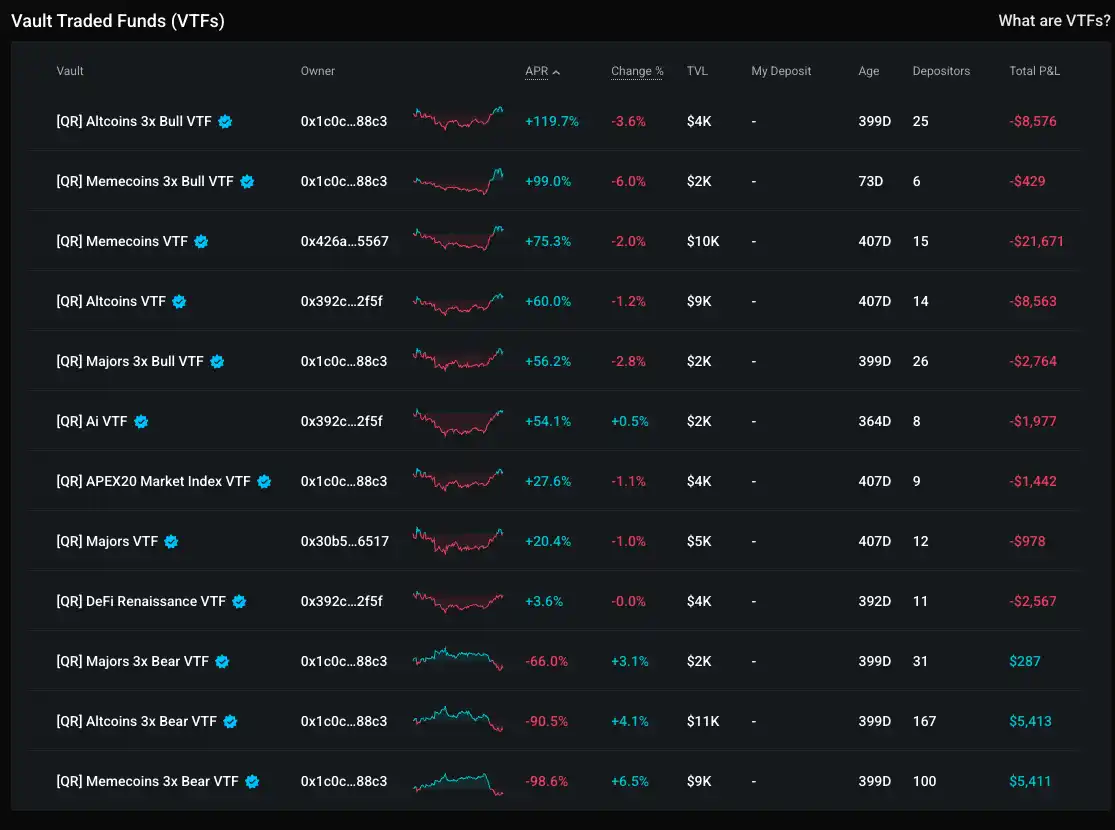

Paradex has also introduced some innovations in its treasury, with the official treasury's current APR at 13.5% and a TVL of $105.4 million. The treasury allows users to earn LP tokens based on their shares and can be combined with mainstream DeFi platforms like Pendle, Morpho, and Aave. Besides the official treasury, Paradex also offers the most diverse selection of trader treasury options among Perp DEXs, allowing traders to choose treasuries based on their trading style, P&L, management fees, commissions, APY, and TVL.

Currently, Paradex has announced its tokenomics, with 20% allocated for point airdrops, and 57.6% of tokens, including airdrops, are reserved for community rewards. The community has a strong expectation for its token issuance, which is why Paradex is often grouped with Extended, Variational, and others to form a 2026 Perp DEX farming combination.

StandX

StandX initially gained community popularity due to its Binance heritage, with CEO Aaron Gong and co-founder Justin Cheng both being core team members of Binance's Futures contract business, possessing ample CEX derivatives experience.

StandX launched its stablecoin DUSD in April last year and went live on the mainnet at the end of November. To date, it has been entirely self-funded and has not accepted any external investments. As one of its core products, DUSD offers an APY of 5.2%, with a TVL of $157 million. The TVL of StandX's treasury SLP is currently $22 million, but APY data has not yet been displayed.

Another noteworthy feature is the recently launched Maker Points, which is a pioneering "order mining" model in the Perp DEX space, referred to by many KOLs as the "Blur" of the Perp DEX sector. As long as the order is not executed, there is no cost. Limit orders must remain on the order book for more than 3 seconds to earn points. The core mechanism is that the closer the order is to the market price, the larger the size, and the longer the order duration, the more points are earned. It is best to keep the spread within 10 basis points to achieve 100% of the points. Ten basis points is 0.1%; for example, if Bitcoin is at $100,000, the order price should be between $99,900 and $100,100. Additionally, 10-30 basis points earn 50% of the points, while 30-100 basis points earn 10% of the points.

This model will significantly increase StandX's depth, and it is expected that many studios will connect to StandX's API to start running scripts. Friends with coding skills can also try using AI to run scripts, as this gameplay will be much more engaging than other Perp DEXs' real fee trading volume, with much lower costs.

StandX's mainnet has been live for less than two months, but daily trading volume has already reached a historical high of $372 million, and market discussion is also very high. Overall, it represents a more early-stage Alpha opportunity compared to several other Perp DEXs.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。