Original Title: "A Single Day's Doubling Cannot Hide 98% of the Collapse, Polymarket Will Not Be Parcl's Lifeline"

Original Author: Sanqing, Foresight News

On January 5, the real estate RWA protocol Parcl partnered with the prediction market giant Polymarket. This collaboration will introduce Parcl's daily housing price index into Polymarket's newly launched real estate prediction market series. The two parties will launch prediction products centered around the housing market, with settlements based on the housing price index published by Parcl.

Image - Parcl Twitter announces partnership with Polymarket (translated)

Polymarket will be responsible for the listing and operation of the market, while Parcl will provide independent index data. Stimulated by this news, the PRCL token performed strongly on that day. According to Bitget market data, PRCL reached a high of 0.05217 USDT, with a daily increase of 94.21%, and an intraday peak increase of about 138%.

The Indelible "Airdrop Disaster"

For many long-time users, the name Parcl is associated with "betrayal." Although its project team claims in the technical document that its mission is to "break the asymmetry of real estate data and empower users," the token issuance in April 2024 became a turning point for community trust.

After a long points activity, PRCL opened below its initial value, and over the next few days, more than $120 million was withdrawn from the protocol, with TVL plummeting over 60%.

For a long time, the performance of Parcl's token has been severely disconnected from its narrative, with the PRCL price dropping below $0.02 by the end of 2025, a decline of about 97.6% from the April 2024 peak of $0.737.

Now, it is attempting to "whitewash" its identity through collaboration with Polymarket, packaging itself as a premium data platform and oracle for real estate.

Is the Daily Updated Housing Price Index Real?

Parcl's selling point is its housing price index released by Parcl Labs, which can provide "daily updated" city-level housing price data. In its white paper, Parcl claims that its data has a high correlation of 0.98 with the traditional Case-Shiller index.

There is insufficient transparency regarding data sources. The official emphasizes having a 24/7 operational data acquisition process to maintain a high-quality, real-time real estate data ecosystem. However, specific details about the original data suppliers and their weights are not disclosed in the documentation.

The data source relies on listing information. Parcl's real-time nature largely depends on active listing information rather than just completed sales.

Listing prices often represent sellers' optimistic expectations and are usually higher than actual transaction prices. This data structure may cause the index to appear more aggressive during market uptrends or to generate greater volatility during consolidation periods.

Lack of independent verification and institutional recognition. Although Parcl has a filtering mechanism for outliers (such as only taking samples from the 35% to 65% percentile), the daily updating mechanism heavily relies on the immediate input of massive data.

Compared to the Case-Shiller index, which is widely cited by official institutions like the Federal Reserve, Parcl currently mainly relies on self-certification and endorsements from partners.

Related Transactions Are Not Active

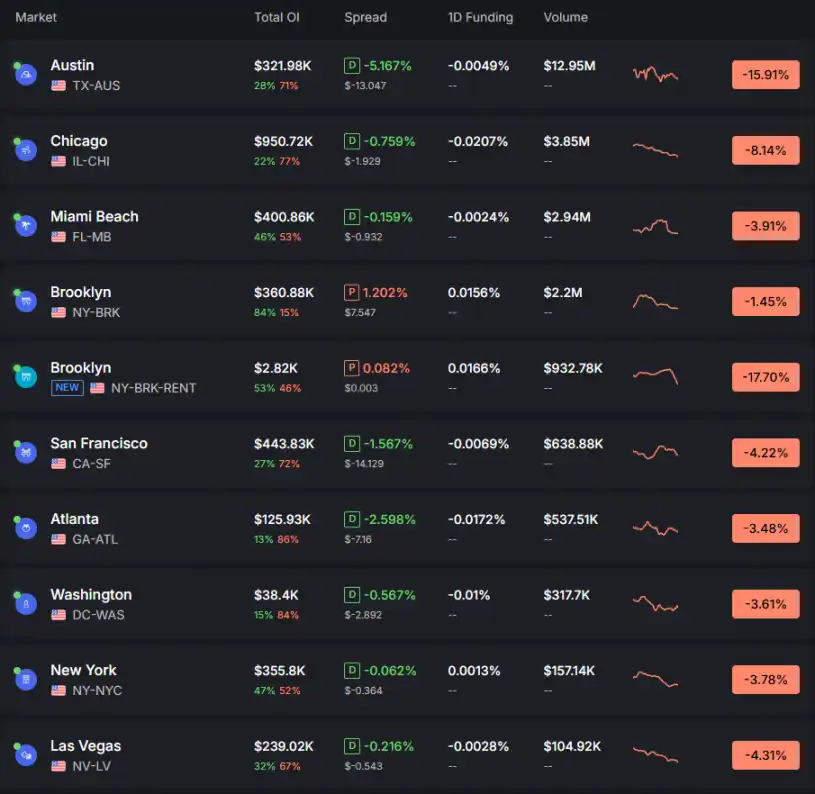

Parcl's own platform data: According to records from the past six months, only a few markets have trading volumes exceeding one million: Austin ($12.95M), Chicago ($3.85M), Miami Beach ($2.94M), and Brooklyn ($2.2M).

However, most markets have positions below ten thousand dollars, with only a few maintaining in the hundreds of thousands, such as Austin with a position of $321,000, Brooklyn with $360,000, and Chicago peaking at about $950,000.

Image - Top 10 markets by trading volume on Parcl in the past six months

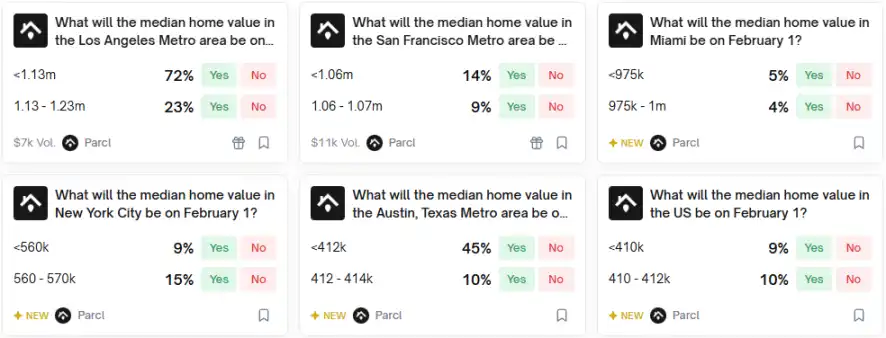

Polymarket market performance: Polymarket has currently launched six real estate prediction markets, including Los Angeles, San Francisco, Austin, Miami, New York, and the entire US.

Despite being backed by Polymarket's massive platform traffic, actual participation is extremely low. The market with the highest transaction volume is San Francisco, with a trading amount of only about $11,000 as of the time of writing, while other markets are even quieter.

Image - Polymarket real estate prediction market

The "Dangerous Game" of Regulatory Minefields

Although the collaboration aims to enhance the transparency of prediction markets, the product attributes linked to the real estate index make it a "dangerous game" on thin ice.

Since such products essentially belong to event contracts, Polymarket must strictly comply with CFTC regulations regarding consumer protection and market integrity upon its return to the US market.

These markets convert housing price fluctuations into wagerable agreements, which can easily be viewed by regulatory bodies like the CFTC as unlicensed binary options or financial derivatives.

Considering the social sensitivity of real estate data, the impact of such markets on the pricing power of actual housing prices may become one of the factors policymakers consider when assessing the need for administrative intervention. The real-time nature of real estate data may also involve privacy or data protection regulations in certain states.

Additionally, the proposed "2026 Financial Prediction Market Public Integrity Act" raises higher transparency requirements for the market. Given the high correlation between the real estate price index and policy changes such as interest rate adjustments and housing regulations, the platform will face institutional pressure to prevent insider trading and conflicts of interest.

Furthermore, the operational fairness of Polymarket's real estate prediction market objectively depends on the verifiability of the Parcl index. According to CFTC guidelines for event contracts, settlement rules must have independent verification mechanisms to prevent data manipulation risks.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。