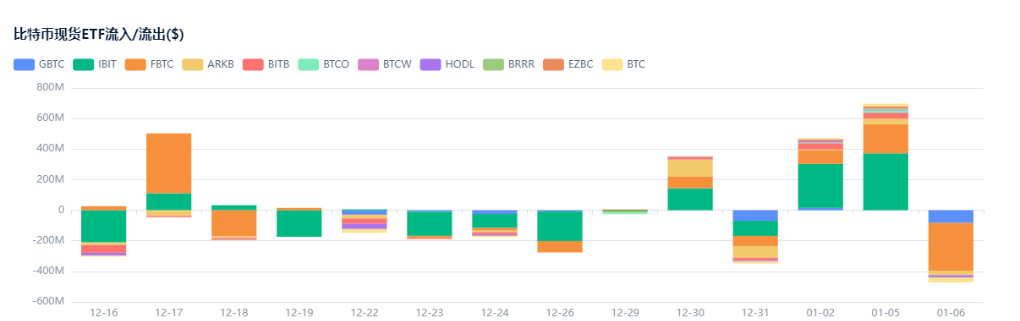

Institutional funds are flooding in like a tide. In just two days since the opening of the new year, the U.S. Bitcoin and Ethereum spot ETFs have attracted over $1.5 billion. The Fear and Greed Index has rebounded from a low point to a neutral level, signaling a subtle shift in market sentiment.

On January 2, 2026, the net inflow for the U.S. spot Bitcoin ETF reached $471.3 million, setting a record for the highest net inflow in 35 trading days. Meanwhile, the Ethereum spot ETF also performed strongly, recording a $168 million net inflow.

In just two trading days of the new year, the total net inflow for Bitcoin and Ethereum ETFs has surpassed $1.5 billion. The market sentiment indicator, the "Fear and Greed Index," has also risen to a neutral level of 45, marking a significant warming of the market atmosphere.

1. Capital Flows and Market Sentiment

● At the beginning of the new year, the cryptocurrency market has welcomed a strong inflow of institutional funds. According to Farside Investors data, on January 2, the net inflow for the U.S. spot Bitcoin ETF reached $471.3 million. Among them, BlackRock's IBIT contributed $287.4 million, becoming the biggest winner of the day. This figure marks the highest single-day net inflow since November 11, 2025.

● The Ethereum spot ETF also performed impressively, with a net inflow of $168 million on January 2. BlackRock's ETHA product had a net inflow of $102.9 million, while Fidelity's FETH product contributed $21.8 million.

● This trend of capital inflow continued on January 3, with a total of over $1.16 billion in net inflows for Bitcoin ETFs and more than $340 million for Ethereum ETFs over the two days.

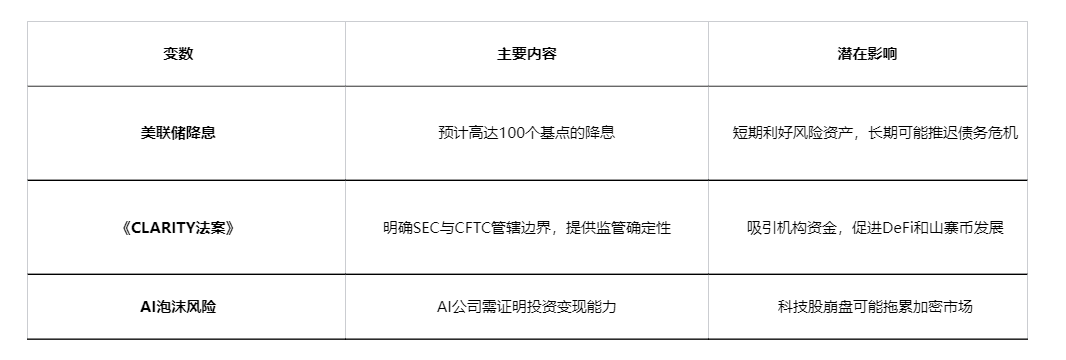

2. Three Major Macroeconomic Variables

The trajectory of the cryptocurrency market in 2026 will be deeply tied to three major macroeconomic variables, which will determine whether the bull market can continue.

● Federal Reserve Rate Cuts have become a focal point for the market, with widespread expectations that the Trump administration will appoint a dovish Federal Reserve chair in 2026, potentially leading to rate cuts of up to 100 basis points. K33 Research points out that this expansionary policy environment will benefit scarce assets like Bitcoin. However, whether rate cuts can truly stimulate consumption and investment remains uncertain.

● In terms of Regulatory Breakthroughs, the CLARITY Act is expected to pass in the first quarter of 2026, clarifying the jurisdictional boundaries of the SEC and CFTC over crypto assets. If this act becomes law, it will provide a survival space for DeFi protocols and altcoins, attracting offshore crypto companies back to the U.S. and providing structural support for the market.

● The AI Bubble Risk poses a potential threat. The surge in tech stocks in 2025 relied on rapidly expanding balance sheet strategies, and in 2026, these companies must prove their ability to monetize investments. If the market questions the free cash flow capabilities of AI companies, a tech stock crash could drag down the crypto market.

3. Differentiated Prospects for Major Cryptocurrencies

Bitcoin is solidifying its status as "digital gold," further moving towards mainstream asset allocation. Grayscale predicts that in a liquidity easing environment, Bitcoin is expected to reach a historical high in the first half of 2026.

● K33 Research directly predicts that Bitcoin will outperform stock indices and gold in 2026. Institutional demand continues to grow, with a joint report from Bitwise and UTXO Management predicting that by the end of 2026, institutional players may purchase over 4.2 million BTC.

● Ethereum is undergoing a structural transformation, shifting from a smart contract platform to institutional-grade infrastructure. Layer-2 networks have handled most of the retail activity on Ethereum, while Ethereum Layer-1 has become the backbone for settlement, staking, and security.

● Ethereum's roadmap for 2026 includes two key upgrades: "Glamsterdam" in the middle of the year and "Heze-Bogota" at the end of the year, which will optimize the execution layer and address privacy and security shortcomings.

● Solana is rapidly gaining market share in stablecoin trading and RWA (Real World Assets) due to its high-performance advantages. By the end of 2025, the RWA scale on the Solana chain had reached $873 million, primarily concentrated in U.S. Treasury-like assets.

4. ETF Boom and Institutional Participation

● Bloomberg Intelligence analyst James Seyffart predicts that 2026 will see a new wave of intensive crypto ETF issuances. He also warns that many products may be liquidated or delisted before 2027, indicating a pattern of initial crowding followed by clearing.

● For investors, this means prioritizing liquidity, high trading volume, and sustained net inflows in leading BTC and ETH funds, rather than newly launched niche products.

● Institutional participation is deepening. Morgan Stanley plans to allow advisors to allocate 0-4% of Bitcoin ETFs for clients starting January 1, 2026, and E*Trade's retail crypto trading is expected to launch in the first half of 2026.

● Bitwise predicts that net inflows for ETFs in 2026 will exceed those in 2025. With 401(k) plans opening up to digital assets, the market will see a massive potential buying spree based on 1% to 5% different allocation weights.

5. Sustainability and Risk Warnings

Despite the strong capital inflow at the start of the year, the market still faces multiple uncertainties. The cryptocurrency lobbying group had hoped the CLARITY Act would pass by the end of 2025, but the prolonged government shutdown has delayed the legislative process.

● Legislative progress in early 2026 will be a key indicator to observe market sentiment. The job market is cooling, and this trend is expected to continue into 2026.

● The "temporary" impact of Trump tariffs has led to rising costs for goods and services, and healthcare premiums will also increase. With news of layoffs, rising consumer debt, and declining disposable income, retail investor confidence may wane.

● In 2026, cryptocurrency concept stocks will show significant differentiation. Exchanges and brokers will continue to benefit from the influx of institutional funds and an expanding user base. Pure "digital asset holding companies" (DAT) may face risks, as the MSCI index may remove companies with excessively high digital asset ratios around January 15, 2026.

As Bitcoin quotes $91,337 on January 3 and Ethereum rises above $3,140, market analysts begin to reassess the potential of this industry.

K33 Research stated in its report: "We expect the benefits of regulatory victories to outweigh the impacts of capital allocation." The continued accumulation by asset management giants like BlackRock and Fidelity seems to validate the arrival of a new era—where crypto assets are no longer just speculative tools but are gradually integrating into the global financial system as an asset class.

The rebound in market sentiment indicators is merely superficial; the real transformation is occurring in the deep structures of capital flows and regulatory frameworks.

Join our community to discuss and grow stronger together!

Official Telegram community: https://t.me/aicoincn

AiCoin Chinese Twitter: https://x.com/AiCoinzh

OKX benefits group: https://aicoin.com/link/chat?cid=l61eM4owQ

Binance benefits group: https://aicoin.com/link/chat?cid=ynr7d1P6Z

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。