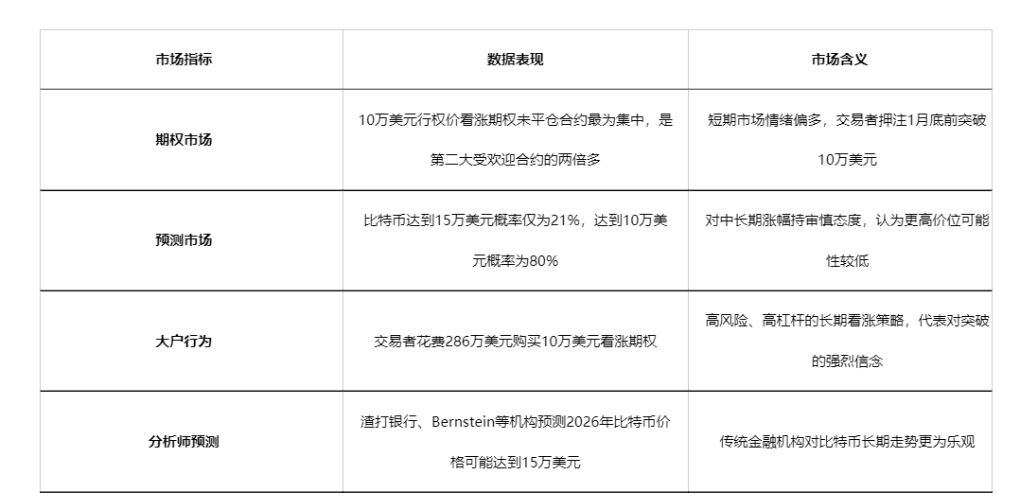

Options traders are betting millions of dollars on a breakout by the end of the month, while participants in the prediction market are calmly calculating probabilities, presenting a starkly different outlook on the same price target across the two markets.

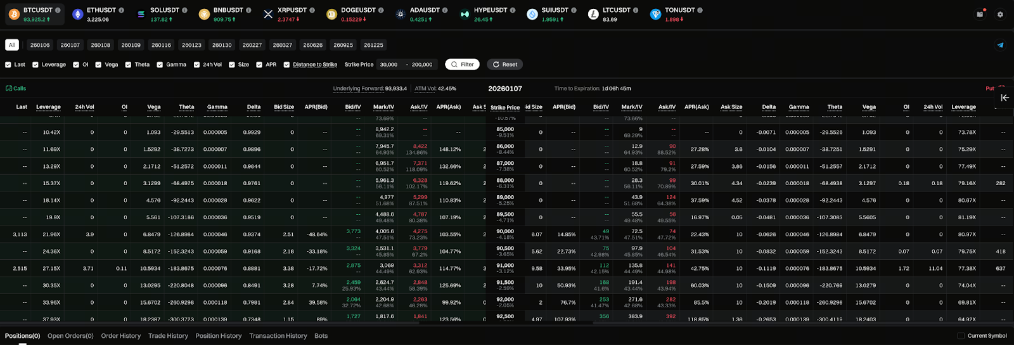

At the beginning of January 2026, Bitcoin's price hovered around $92,000. At the same time, data from the Deribit trading platform showed that a trader spent $2.86 million to purchase Bitcoin call options with a strike price of $100,000, expiring on January 30.

Just a few days later, on the decentralized prediction platform Polymarket, the probability of "Bitcoin reaching $150,000 before 2027" was only 21%—the same price target, two different market tools, showcasing completely different sentiments and expectations.

1. Market Shift

The sentiment in the Bitcoin market is undergoing a subtle yet crucial shift. After a sharp decline in the fourth quarter of 2025, the cryptocurrency market showed signs of stabilization at the beginning of 2026. Professional traders and analysts observed that while the market structure still leans bearish, the most pessimistic downside expectations have significantly softened.

This change in sentiment is particularly evident in the options market. A substantial amount of capital is flowing back into call options with a strike price of $100,000, indicating that some market participants are preparing for a breakout rally in Bitcoin.

2. Data Signals

Data from the Deribit platform shows that as of early January 2026, the number of open contracts for Bitcoin call options with a strike price of $100,000, expiring on January 30, is the most concentrated. Its nominal total value is more than double that of the second most popular options contract during the same period, which has a strike price of $80,000 and expires on the same day. The market is showing clear interest in the $100,000 level.

At the same time, on the decentralized prediction platform Polymarket, the probability of "Bitcoin reaching $100,000 before January 2026" is only 49%. While there is relatively high confidence in reaching $100,000, the likelihood of hitting higher price levels is significantly lower.

3. Movements of Large Players

● On December 31, 2025, a notable trade appeared in the Deribit options market. A trader spent $2.86 million to purchase 3,000 Bitcoin call options with a strike price of $100,000, expiring on January 30, 2026.

● This is not an isolated event. As early as July 19, 2025, a user spent $4.737 million to buy the same type of call options for the end of the year with a strike price of $100,000. Such large trades are typically executed by institutions or high-net-worth experienced traders. The core logic of these "lottery-style" strategies is to pay a high premium to capture potential extreme upside gains in the future.

4. Market Comparison

The options market and the prediction market exhibit a clear divergence. Options traders are actively positioning for a breakout at $100,000, while Polymarket traders remain cautious about higher price levels.

● In terms of market nature, the options market is a highly specialized financial derivatives trading venue, trading standardized future buying and selling rights contracts. In contrast, prediction markets like Polymarket are essentially decentralized information aggregation platforms, trading probabilities of specific event outcomes.

● Regarding participant composition, the options market is primarily composed of professional traders, hedge funds, and institutional investors, involving complex strategies and large amounts of capital. Participants in prediction markets are more diverse, including professional analysts, ordinary retail investors, and industry observers.

● The difference in time frames is key to the divergence in signals. The options market's focus is very clear and short-term—traders are almost entirely focused on whether the $100,000 level can be breached before January 30. In contrast, prediction market participants are assessing the likelihood of reaching $150,000 over a longer time frame, such as by 2027, requiring consideration of broader long-term variables, including macroeconomic cycles, regulatory policy evolution, and technological development progress.

● The content reflected in market signals is also distinctly different. The heat in the options market indicates that traders are actively positioning for short-term price breakout opportunities; this "lottery-style" betting, while costly, could yield significant leveraged returns. The calm probabilities in the prediction market reflect the collective wisdom of the market regarding the potential for larger long-term gains, leaning more towards value assessment rather than short-term speculation.

● The purposes of trading also differ significantly. Options trading is often driven by hedging, speculation, or structured product construction for professional financial purposes, while prediction market trading is more about expressing opinions, hedging real risks, or pure information arbitrage.

The divergence between the two markets provides market observers with a more nuanced perspective—while professional traders are leveraging high bets on short-term breakouts, a broader range of market participants remains cautious about long-term significant increases. This divergence itself may contain important market information: the coexistence of expectations for a short-term technical rebound and long-term fundamental uncertainties.

5. Influencing Factors

● Multiple factors are shaping the complex situation in the current Bitcoin market. Changes in the macroeconomic environment are significant variables; decisions by the Federal Reserve regarding interest rates, balance sheet expansion, and the movement of the dollar index could trigger a broad rebound in risk assets.

● Regulatory progress is also crucial. The advancement of important cryptocurrency legislation in the U.S.—the GENIUS Act and the CLARITY Act—could pave the way for broader institutional adoption. President Trump is expected to announce a new Federal Reserve chairperson in the coming weeks, which is also seen as a potential catalyst by the market.

● Technical factors cannot be overlooked. Bitcoin's return above $90,000 is primarily driven by technical factors; the $90,000 level was a significant resistance point, and once it stabilizes above this level, it could likely trigger short covering and momentum-driven buying.

6. Institutional Perspectives

● Professional research institutions have differing views on Bitcoin's trajectory in 2026. Matrixport analysis indicates that bearish sentiment among BTC and ETH options traders is weakening, but the options market is still pricing in downside risks rather than a sustained bullish reversal.

● Glassnode data shows that options trading activity has cooled over the past month, with a noticeable decrease in capital flow, indicating a weakening confidence in the prospects for an increase. The 25D skew (the implied volatility of put options minus the implied volatility of call options) remains positive, meaning that the pricing of put options is still higher than that of call options.

● The head of over-the-counter trading at Wintermute believes that while there is still some bearish premium in the current curve, it has significantly softened. The market seems to no longer expect the most pessimistic downside scenario, and the situation is stabilizing slightly.

7. Future Outlook

● Market observers have differing opinions on Bitcoin's short-term trajectory. The CEO of mixed trading platform Rails believes that retesting the $100,000 to $106,000 range is not impossible, which is common in bearish structures. However, for Bitcoin to turn bullish, it needs to reclaim and stabilize above $106,000 on a weekly basis to attempt to challenge historical highs again.

● Several analysts warn that even if the macroeconomic environment improves and Wall Street's interest in risk assets grows, the next significant breakthrough for Bitcoin may not occur until 2026.

● Analysts from institutions like Standard Chartered, Strategy, and Bernstein predict that Bitcoin's price will reach $150,000 in 2026, while more optimistic analysts like Tom Lee from Fundstrat expect the price to be between $200,000 and $250,000.

Bitcoin's price hovers around $92,000, and options market traders are holding their breath for the unveiling moment at the end of the month. Data from the Deribit platform shows that the open interest for $100,000 call options, expiring in just three weeks, has reached astonishing heights, while the 49% probability of a breakout on Polymarket hangs like a suspended coin.

The crypto market is always oscillating between greed and fear, but this time, investors are faced with two entirely different scripts.

Join our community to discuss and grow stronger together!

Official Telegram community: https://t.me/aicoincn

AiCoin Chinese Twitter: https://x.com/AiCoinzh

OKX benefits group: https://aicoin.com/link/chat?cid=l61eM4owQ

Binance benefits group: https://aicoin.com/link/chat?cid=ynr7d1P6Z

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。