After a long period of silence, Virtuals Protocol has announced its return with a strong bullish candle. The price of VIRTUAL rebounded strongly at the beginning of 2026, not only surpassing the 1 mark but also recording an increase of over 70% in less than 6 days.

This is not merely a case of speculative trading; behind it is a strategic upgrade by Virtuals Protocol targeting the AI Agent launch track—evolving from a single launch platform to a layered management "Agent capital market."

Why is the single launch model unsustainable?

The Crypto world in 2024 was still exploring how to play with AI Agents. At that time, Virtuals had a very clear idea—first, let the market run. The core logic is to allow agents to exist on-chain, trade publicly, and carry real economic value.

In the first half of 2025, the industry's pain points shifted. The implementation of the Genesis mechanism successfully addressed fairness issues: it abandoned the "first come, first served" barbaric model and instead allocated shares based on "contribution," fundamentally breaking the monopoly of snipers and small groups over AI agent ownership.

However, the Virtuals team gradually realized that fairness is just the starting point, not the end goal. Excellent ecosystem builders need not only a fair starting line but also a "munition depot" to support long-term development.

Thus, in the second half of 2025, the Unicorn mechanism was born. It transformed the abstract concept of "belief" into concrete incentive rules: each Unicorn project starts with a low valuation, allowing early participants to reap asymmetric returns; while the founding team's financial returns are deeply tied to the project's actual growth, thereby compelling long-termism and shared responsibility.

As the ecological landscape continued to expand, Virtuals discovered a more realistic contradiction: different AI Agent projects are not starting from the same line. Some are just a highly potential meme idea that needs to be launched quickly to validate the market; some require standardized "regular army" strategies that need sufficient funding to support technical development; and others are already leading projects with built-in traffic that need entry methods that match their scale.

Three launch mechanisms to meet diverse needs

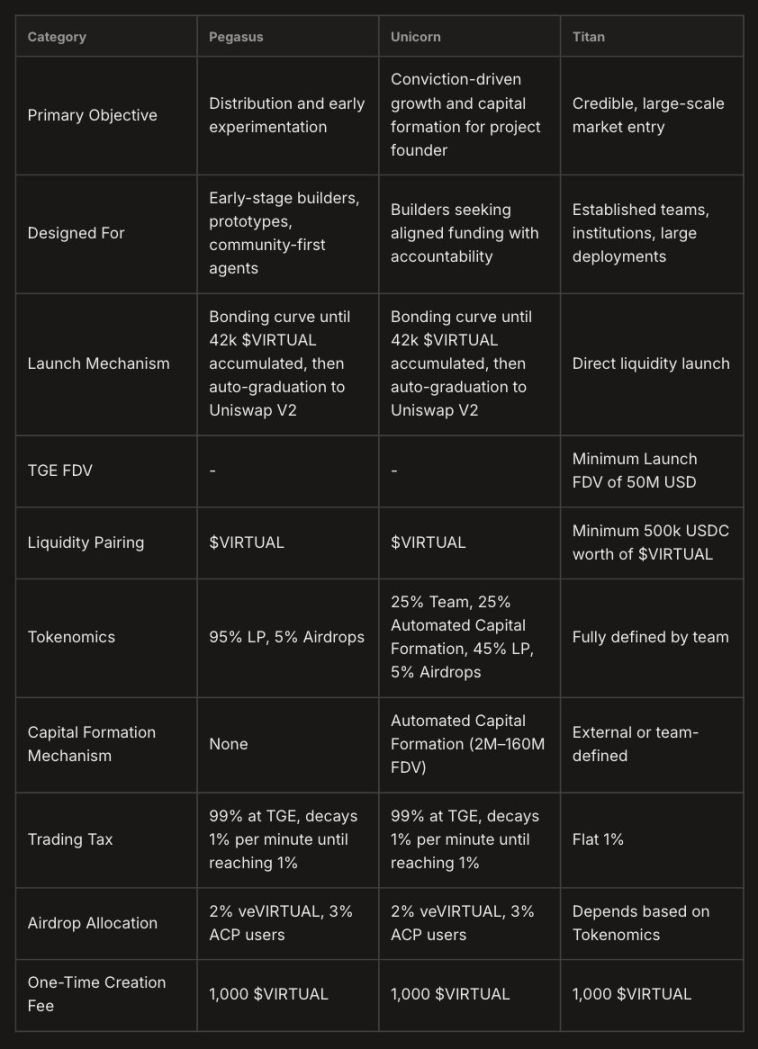

Virtual Protocol stated: a single issuance model cannot adapt to the complex needs of the ecosystem. Therefore, the team has specifically launched three launch mechanisms: Pegasus, Unicorn, and Titan, to build a unified and flexible agent launch framework.

The brilliance of this upgrade by Virtuals lies in the fact that it no longer attempts to define "what is a good Agent," but rather tailors the survival soil for Agents at different stages.

Pegasus: Born for MEME and Inspiration

Pegasus is a purely market-oriented testing ground, designed for early projects that pursue "quick and efficient" results. Whether it's a flash of inspiration or a lightweight Agent focused on community consensus, it can quickly launch through Pegasus.

Under this mechanism, 95% of the project tokens will be directly injected into the liquidity pool, and if the team needs tokens, they must purchase them from the open market. This design may seem harsh, but the logic is very clear: whether the market recognizes this Agent or its underlying idea is most directly voted on with real money.

Core Features:

- Lightweight launch structure.

- Supply distribution: 95% of the token supply is allocated to the liquidity pool, with no team reserves, no pre-sales, and only 5% reserved for ecological airdrops (of which 2% is allocated to veVIRTUAL and 3% to ACP users);

- Price discovery: A joint curve is used to provide a transparent price discovery mechanism.

- Transaction tax: The design of the Pegasus transaction tax is interesting, starting at 99% at TGE, then decreasing by 1% every minute until stabilizing at 1%. This is an extremely aggressive anti-sniping mechanism. This means that if scientists and robots want to jump the gun in the first second, they are essentially giving money to the pool.

- Graduation mechanism: Automatically graduates after reaching a liquidity threshold (42,000 VIRTUAL) and goes live on Uniswap V2.

Pegasus is suitable for early projects where "ideas outweigh execution." It does not require a complete white paper, a luxurious team background, or institutional endorsement to test market reactions.

Unicorn: Providing an Ascending Channel for "Power Players"

Unicorn is essentially the current launch mechanism of Virtuals. Under the Unicorn model, project parties cannot access funds in the early stages. Only when the Agent proves its value in the market (reaching a certain FDV market cap) will the protocol release funds to the team in batches through the "automatic capital formation mechanism."

In short, for developers aiming for long-term engagement, financing is no longer a "one-time deal," but a "bet between entrepreneurs and the market": only by delivering tangible results can they gain market funding recognition.

Core Features:

- Structured token economics: Unlike the Pegasus mechanism, the token economics for projects launched through Unicorn are: 25% allocated to the team, 25% for automatic capital formation, 45% allocated to LP, and 5% for airdrops. Unicorn provides more space for teams and capital formation mechanisms.

- Automatic capital formation mechanism: This is Virtuals' trump card. Financing is not given all at once, but is released based on performance when the market cap reaches between 2 million and 160 million, unlocking in stages based on project performance, compelling the team to continuously deliver value.

- Launch mechanism: Still uses Bonding Curve, automatically migrating to Uniswap V2 after reaching 42,000 VIRTUAL. This ensures a smooth transition of early liquidity.

- Transaction tax: Similar to the Pegasus transaction tax design, starting at 99% at TGE and then decreasing by 1% every minute until stabilizing at 1%.

The Unicorn mechanism is suitable for teams that need financial support, are willing to accept long-term market assessments, and adhere to long-termism.

Titan: High-Threshold Launch Path for "Regular Army"

The Titan mechanism is specifically designed for teams or institutions with established brand credibility and large-scale technical deployment capabilities, and it is the highlight of this strategic upgrade by Virtuals.

Core Features:

- High entry threshold: Minimum launch valuation of 50 million USD, and at least 500,000 USDC equivalent VIRTUAL liquidity pairing (at TGE).

- Fixed tax rate: No need to go through the 99%→1% decreasing process; from the first second of transaction launch, the tax rate stabilizes at 1%.

- Highly customizable permissions: The high threshold brings autonomy, with token economics, vesting schedules, and distribution structures completely defined by the founding team, only subject to standard protocols and compliance constraints.

- No bonding curve: Does not rely on bonding curves, phased discovery, or protocol-mandated distribution mechanisms.

- Migration support: Supports existing agent tokens to "bring capital into the group" and directly migrate to the Virtuals ecosystem.

The essence of the Titan mechanism is a bidirectional choice of "trust for efficiency." The protocol provides a VIP-level launch channel based on the project's product strength, team background, and financial reserves; while the high threshold automatically filters out speculative projects lacking strength, providing users with the first line of risk protection.

More importantly, the Titan mechanism will directly drive the buying demand for VIRTUAL—each Titan project landing means that a large amount of VIRTUAL will be purchased and locked in the liquidity pool, forming strong support for the token's value.

How to Empower the VIRTUAL Token?

From the perspective of empowering the VIRTUAL token, the three mechanisms achieve a unified underlying logic:

- Unified entry threshold: Regardless of which launch mode is chosen, the project creation fee is 1,000 VIRTUAL, standardizing costs to filter quality projects.

- Mandatory liquidity binding: All mechanisms' liquidity pairings must use VIRTUAL. This means that the success of each AI Agent project will directly bring new buying pressure and liquidity depth to VIRTUAL.

- Ecological value feedback: The Pegasus and Unicorn mechanisms mandate a 5% token airdrop, of which 2% goes to veVIRTUAL stakers and 3% to ACP users, directly rewarding loyal holders and participants in the ecosystem.

Summary

The three-tier launch framework of Virtuals Protocol represents a strategic evolution from a single fair launch model to a layered, demand-matching launch ecosystem, and is also Virtuals' value capture net.

More importantly, it truly returns the choice to ecosystem builders: no need to compromise on launch modes for financing, nor to abandon long-term development funds in pursuit of fairness. Choosing the most suitable mechanism based on project stage, team capability, and market positioning is the core embodiment of "builder-centric."

No single model can adapt to all projects, and Virtuals deeply understands this. Therefore, it focuses on "laying the track"—allowing explosive ideas to sprint in Pegasus, enabling teams focused on long-term value to gain continuous ammunition in Unicorn, and allowing large-scale giants to land steadily in Titan.

Pegasus captures traffic and creativity with a broad net, Unicorn locks in long-term builders willing to accept market assessments, and Titan anchors mature leading projects, collaboratively constructing a flexible and unified AI agent launch system. Especially with the introduction of the Titan mechanism, VIRTUAL truly becomes the "shovel" for launching quality projects.

EtherMage, a core contributor to Virtuals Protocol, revealed that currently about 4% of the VIRTUAL supply is locked in the agent liquidity pool. The team's core goal is to increase this ratio to 20%. The key to achieving this goal lies in attracting a broader range of founders and project parties to join the ecosystem.

Virtuals' ultimate ambition is to anchor the economic value created by future AI agents—from the GDP of the real world to the aGDP (Agentic GDP) of intelligent agents.

Of course, there are still many unresolved issues in ecological development: the quality of the first batch of Titan projects, the diversification paths of ACP ecological income, etc., are all worth continuous attention. The first project of Titan may be the robotic capital market XMAQUINA. Previously, in December 2025, XMAQUINA announced it would collaborate with Virtuals Protocol for the community sale of DEUS.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。