Written by: Prathik Desai

Translated by: Block unicorn

Preface

We have just returned from an extended holiday. We originally planned a short year-end break, but it was extended a few more days before we got back to our desks.

Now we are re-energized and ready to continue bringing you the latest developments in Web 3.0. As we have done for many years, we will continue to provide you with in-depth analysis, quantitative assessments, and cryptocurrency literature reviews that we find interesting and worth sharing on a weekly basis.

Rather than rushing to recap the most significant news or comments surrounding prices and candlestick charts, I prefer to start the new year in a more measured way. Therefore, I will share some themes that I am focusing on in 2025 and believe will shine in 2026.

These themes are not exhaustive; they merely represent the topics I have been most interested in within the cryptocurrency and Web3 space over the past year.

Let’s get started…

Prediction markets will exist long-term

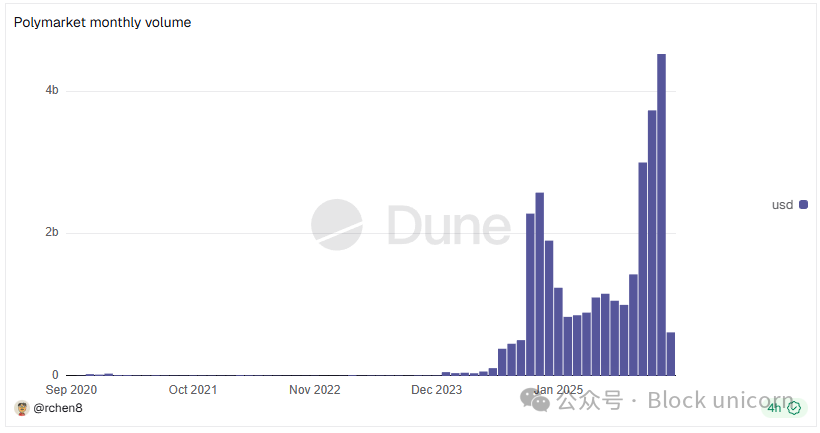

I remember seeing news every day about the odds fluctuations between Kamala Harris and Donald Trump during the last 45 days leading up to the 2024 U.S. presidential election. The names Polymarket and Kalshi frequently appeared in news reports. In October and November 2024, Polymarket's monthly betting volume soared to $2.3 billion and $2.6 billion, respectively, both exceeding previous cumulative betting amounts.

Trading volume peaked on election day and then declined to an average of about $1 billion per month until September 2025. Very few could predict how prediction markets would evolve over the next three months. From October to December 2025, the top two prediction markets—Polymarket and Kalshi—set historical highs, surpassing trading volumes from the same period last year.

Although many have been writing obituaries for prediction markets since early last year, they have solidified their positions by offering products that cater to public interest: gambling based on personal speculation skills (which many euphemistically refer to as "speculative monetization"). They simplified trading to: "Do you think this will happen?" Bettors can choose "yes" or "no."

What has driven this phenomenon? A major factor is sports, followed by political, economic, and cryptocurrency-related events.

While the number of new accounts and daily active users in prediction markets declined from December 2024 to September 2025, regular sports events kept the daily open contract volume stable at around $100 million during this period.

There has never been a shortage of sports events in the world. This, combined with occasional economic, political, and financial announcements, may continue to bring new markets to prediction platforms. When this reality is combined with natural time spans, round-the-clock trading, clear predictive viewpoints, and ultra-fast settlement speeds, prediction markets will be ubiquitous.

This explains why brokerages, wallets, and consumer platforms are all trying to integrate prediction features. They understand that once speculation is simplified to just a click away, it can effectively attract user participation and monetize it.

Last year, we saw leading cryptocurrency companies Robinhood (HOOD) and Coinbase (COIN) integrate prediction markets in some form.

In March 2025, HOOD directly launched a prediction market center within its app, allowing customers to trade on the outcomes of real-world events, including college sports. Just a week before the end of the year, COIN announced its entry into the prediction market, as part of its product launch plan aimed at achieving the vision of a "universal exchange."

In 2026, sports events are likely to remain the main driver of stable trading volumes in prediction markets, while occasional macroeconomic events will bring temporary spikes in trading volume. How cryptocurrency consumption platforms integrate prediction markets into their existing ecosystems may be crucial for attracting more users.

Privacy-protected stablecoins can make blockchain great again

For a long time, privacy has been the moral argument for cryptocurrencies. The staunchest supporters of cryptocurrencies crave privacy and defend it in the name of resisting surveillance.

At the same time, most blockchains have inherent privacy vulnerabilities. These blockchains offer high transparency and maximum composability, which only heightens the privacy concerns of skeptics regarding cryptocurrencies.

Because of this, despite the advantages of stablecoins in terms of settlement speed and costs below $1, the business world has not adopted them for everyday business transactions.

I wrote about this last month:

"Every stablecoin transfer permanently records a ledger entry on the public chain. Anyone can view the flow of dollars in real-time, with final confirmations taking just seconds and transaction fees being almost zero."

Public ledgers excel in settlement but also expose information to a high degree.

"Stablecoins are faster and cheaper than the systems they compete with, yet those responsible for payroll and vendor payments remain skeptical about adopting a blockchain route."

This situation began to change in 2025.

New privacy solution developers no longer equate privacy with anonymity but instead offer privacy chains with selective disclosure. They focus on hiding truly important information while retaining the benefits of public settlement.

They allow businesses to execute transactions privately, settle on public ledgers, and disclose only the information needed for audits or other requirements.

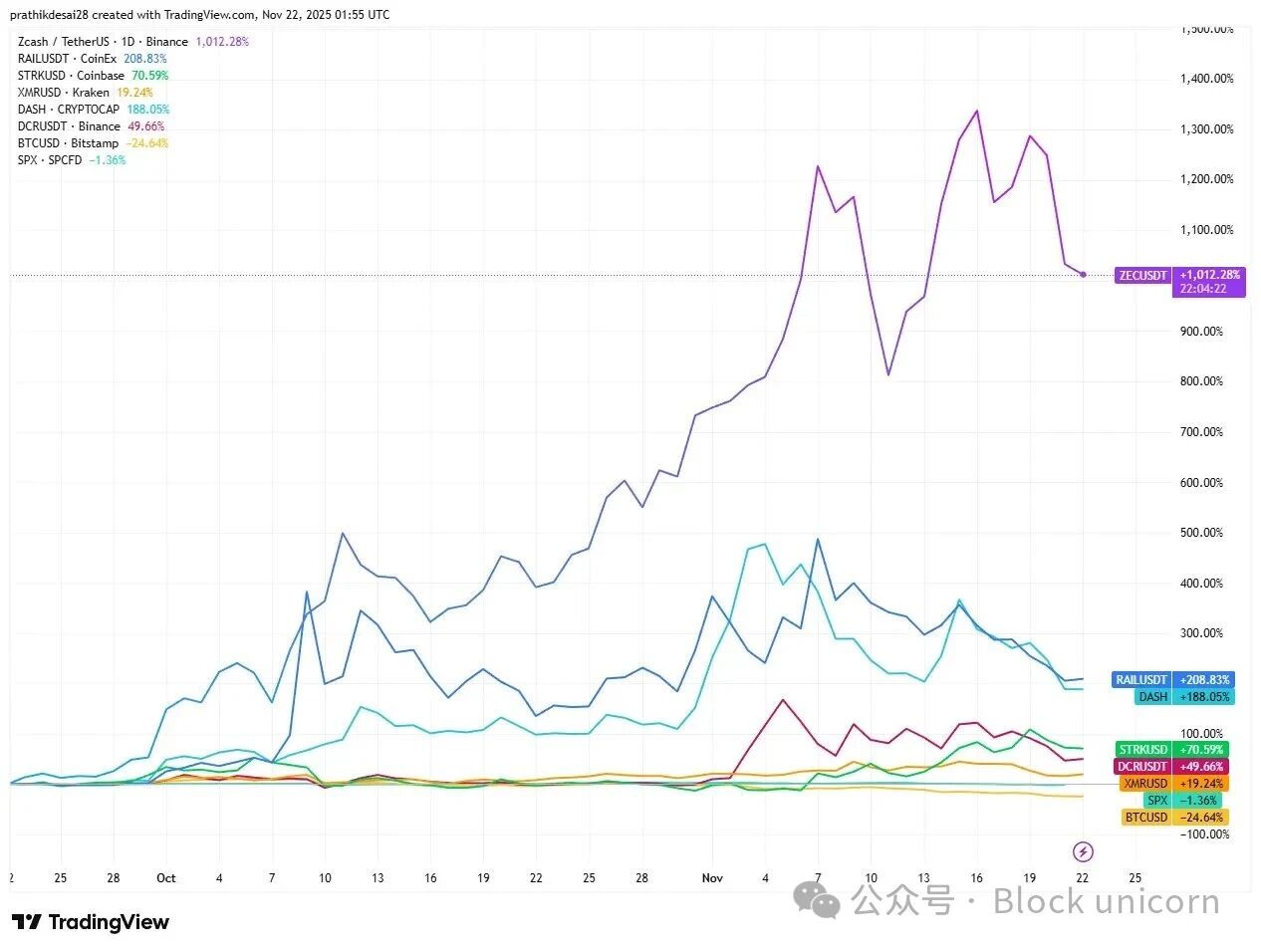

The adoption rates of technologies such as zero-knowledge (ZK) proofs, private states, encrypted mempools, and permissioned visibility have been increasing, even as the prices of their native tokens rose despite the overall cryptocurrency market crash.

Privacy protection in cryptocurrencies can help blockchain evolve from a closed experimental phase to widely adopted infrastructure.

If privacy protection is integrated into blockchain payments, stablecoins, and enterprise applications, it is foreseeable that a broader transformation in payment methods is on the horizon. No traditional payment system can do without confidentiality. No business would want to build core financial workflows on infrastructure that defaults to exposing confidential data to competitors.

In 2026, the concept of privacy is likely to shed the rebellious connotations assigned to it by early cryptocurrency advocates. Only when the concept of privacy truly transforms can we see blockchain being adopted more widely, becoming a solution to replace the slow and costly traditional systems that businesses still use.

The unbundling of cryptocurrencies is over

For most of the past decade, unbundling has been the core promise of cryptocurrencies.

Banks were broken down into various basic units, which were then further decomposed into various protocols. The mindset of builders was to dismantle large financial institutions into modular, composable building blocks, allowing users to assemble their own financial systems.

By 2025, it became clear that while unbundling was beneficial for developers and early users, it was overly cumbersome for others. Most users did not want to connect a dozen protocols to perform five basic financial tasks they wanted to repeat.

Users want to reduce friction when holding, transferring, investing, and speculating. This realization marks a reintegration of the originally fragmented cryptocurrency world.

In 2025, we witnessed top cryptocurrency companies attempting to consolidate the fragmented crypto experience into a single, coherent application. This trend was particularly evident among companies already at the intersection of distribution, compliance, and capital.

Over the years, Coinbase has accumulated businesses in custody, spot trading, derivatives (through the acquisition of Deribit), staking, wallets, payments, and developer tools. The company announced its vision for a "universal exchange," providing all users with a one-stop application, regardless of what they want to access: wallets, markets, protocols, and more.

Then there’s Robinhood. This company, which initially started as a zero-commission stock brokerage, has now expanded its business scope to include stocks, options, cryptocurrencies, gold, retirement accounts, cash management, and prediction markets. Robinhood's users are ordinary retail investors looking to manage all their finances with minimal friction. In this case, bundling becomes an economical choice.

Once protocols mature, distribution often becomes a moat. Network effects begin to manifest where attention is concentrated, making it easier for companies to monetize user behavior, thus realizing commercial value across multiple products.

This year, the cryptocurrency space will still be filled with various noise and nonsense, as well as many seemingly transformative ideas that may only last three weeks. However, some ideas we saw last year, perhaps those overlooked mundane ones, will change how businesses and individuals use blockchain and other crypto products in 2026.

This year, we will focus on these and tell their stories.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。