Have you ever been frustrated by cross-border transfer fees as high as 8%? Have you missed business opportunities waiting 3-5 business days for a traditional international payment to clear? Or lost 2-5% of your money to hidden exchange rate markups while traveling abroad?

Behind these pain points lies a massive $36.3 trillion market—the annual on-chain settlement volume of stablecoins, which surpassed the combined total of Visa and Mastercard in 2024. Yet, surprisingly, their penetration rate in the real economy's payment sector is less than 6%. This stark contrast reveals a trillion-dollar market opportunity: whoever bridges the "last mile" between stablecoins and the real economy will define the next generation of global financial infrastructure.

I. Market Pain Points: The Disconnect Between Digital Assets and the Real Economy

According to World Bank data, the average cost of sending remittances globally in 2023 was about 6.2% of the transaction amount. These costs primarily stem from:

● Fixed Fees: Typically between $15 and $50 per transaction, depending on the bank and amount.

● Currency Conversion Spreads: Bank exchange rates often include a hidden markup of 2% to 5%.

● Correspondent Bank Fees: Intermediary banks may charge $10 to $30 per transaction, often opaquely.

Simultaneously, approximately 1.4 billion adults worldwide remain unbanked. However, GSMA reports indicate that mobile internet access is rapidly expanding in these regions, providing a gateway to financial services via smartphones. In many emerging markets like Argentina and Turkey, persistently high inflation rates (often exceeding 10% or more) severely erode the purchasing power of local currencies, fueling explosive demand for dollar-pegged stablecoins as a store of value.

Yet, the application of stablecoins remains stuck in an awkward paradox of "on-chain boom, offline desert":

● High User Experience Barrier: Technical concepts like private key management, gas fees, and cross-chain operations deter average users.

● Lack of Payment Scenarios: Only about 6% of offline merchants accept cryptocurrency payments.

● Regulatory Uncertainty: Global compliance frameworks are still under development, creating concerns over user asset security.

● Fragmented Liquidity: Stablecoins on different blockchains operate like "data silos," leading to high exchange costs.

This core contradiction in digital finance lies between the high cost and inefficiency of traditional financial services and the significant obstacles to stablecoin's real-world application. Solulu targets this critical pain point, building a bridge connecting the massive on-chain liquidity of stablecoins with the broad needs of the real world, transforming stablecoins into an everyday payment tool for everyone.

II. Solulu's Solution: Five Integrated Financial Infrastructure Solutions

1. Global Multi-Currency Stablecoin Exchange Hub: From Aggregation to Leadership

Solulu platform is designed to be the entry point to its ecosystem and a core hub for global stablecoin liquidity, built on three technical pillars:

Deep Liquidity Integration

The platform integrates liquidity through a multi-layered approach: strategic cooperation with top market makers and financial institutions to provide deep initial liquidity; a built-in intelligent routing system that automatically finds the best price across multiple decentralized exchanges (DEXs) and liquidity pools upon user request; and its own Liquidity Pool Program to build a core, platform-native liquidity depth, enhancing price stability and market resilience.

Multi-Chain Asset Support

Solulu natively supports a diversified blockchain ecosystem. It currently offers comprehensive coverage across eight major networks, including Ethereum, BNB Chain, Polygon, Arbitrum, Optimism, Base, Solana, and TRON, ensuring a unified and seamless cross-chain experience. Its technical architecture is highly flexible and scalable, fully prepared for the smooth future integration of next-generation networks like Avalanche and Sui.

Enterprise-Grade API Services

To foster ecosystem collaboration, the platform provides high-availability, low-latency exchange APIs for exchanges, wallets, and other financial institutions, aiming to meet the large-scale integration needs of institutional users and partners.

2. Virtual U Card System: Redefining the Crypto Payment Experience

Virtual U Card Core Parameters

The card issuance process achieves minute-level responsiveness, allowing users to generate a virtual card within 1 minute of completing KYC verification. The card supports stablecoin top-ups from 8 mainstream public chains, including Ethereum, BNB Chain, Polygon, Arbitrum, Optimism, Base, Solana, and TRON. In terms of spending scenarios, the card already covers online merchants in over 100 countries and regions worldwide. Its fee structure is explicitly far lower than traditional cross-border transaction card rates, maintaining a significant cost advantage for users.

Multi-Layered Security Architecture

The security architecture employs dynamic protection mechanisms: support for one-click dynamic CVV code reset within the App; flexible spending limit management; instant freeze/unfreeze response capabilities; and a 7x24-hour real-time transaction alert and monitoring system.

Practical Use Case

This feature offers a revolutionary solution for cross-border financial scenarios. For example, an overseas Filipino worker can use their USDT earnings from abroad for family expenses in Manila directly through the Solulu U Card. This process seamlessly connects on-chain assets to offline consumption, with fee costs significantly optimized compared to traditional remittance models.

3. International Trade Settlement Network: Reshaping Global Trade Finance

Solulu targets the disruptive potential of stablecoins in cross-border trade. Its solution systematically addresses the pain points of speed, cost, and transparency in traditional trade settlement.

Smart Contract Empowerment

The platform develops standardized "Trade Smart Contract" templates. Buyers and sellers can lock funds in a smart contract, which automatically executes payment when pre-set conditions (like receipt of an electronic bill of lading) are met. This records key transaction milestones on-chain, enhances transparency, and works to drastically shorten the settlement cycle.

Deep Industry Collaboration

Furthermore, Solulu has established a deep partnership with the Web3 cross-border e-commerce platform Caviar, aiming to jointly build a stablecoin-centric e-commerce ecosystem that combines Solulu's settlement capabilities with Caviar's mature e-commerce network.

4. Liquidity Pool Program: Building a Value-Sharing Ecosystem Mechanism

The Liquidity Pool Program is a key driver of the Solulu ecosystem, functioning to build a "co-construct the ecosystem, share the income" value cycle, providing sustainable returns for liquidity providers.

Precisely Designed Yield Model

Participants engage by staking stablecoins in different tiered liquidity packages. The yield model includes:

● Base Yield: Earn a market-competitive daily stablecoin yield.

● Arbitrage Quota: Participants receive an additional arbitrage quota for purchasing the future platform token SOLU at a preferential price.

Team Collaboration & Risk Control

The program includes an invitation reward mechanism, allowing users to earn incentives. Simultaneously, mechanisms like yield caps ensure the system's long-term health and stability.

5. Social Finance: A Paradigm Fusion of Payment and Communication

To make exchanging value as simple and natural as passing information, Solulu created the "Solulu Chat" module, seamlessly integrating bank-grade payment functionality into an instant messaging experience.

Core Social Payment Features

● Stablecoin Red Packets: Send designated amount digital red packets in single or group chats, perfect for holiday celebrations or community incentives.

● Group Fund Pools: Create smart contract-powered "group wallets" for collective activities or projects, with all income and expense records transparent to members.

● Integrated Payment Experience: Users consulting with merchant support can directly complete purchases within the chat interface via a structured payment card, drastically shortening the transaction path.

Strategic Ecosystem Value

By embedding payments seamlessly into the high-frequency social scenario, Solulu Chat aims to build powerful user stickiness, lower the barrier to Web3 entry, and bring sustained vitality and network effects to the platform.

These five core businesses are not simply stacked but form the solid pillars of the Solulu ecosystem. They interlock to create a complete closed loop from asset exchange to practical application, from individual consumption to corporate settlement: the Exchange Hub provides the entry point, the U Card unlocks spending scenarios, Trade Settlement serves business needs, the Liquidity Pool ensures system liquidity, and Social Finance enhances user engagement through high-frequency interaction. This combination precisely targets industry pain points, transforming stablecoins from trading assets into practical tools and laying a solid foundation for building the next-generation financial infrastructure.

III. Token Economics: The Flywheel Effect of Value Capture

The SOLU token economic model is meticulously designed to deeply bind the token's value to the healthy development of the platform's ecosystem, creating a self-reinforcing positive feedback loop. Through carefully planned distribution mechanisms, diverse utility scenarios, and a powerful deflationary policy, it ensures long-term participants share in the platform's growth.

Distribution Mechanism: Demonstrating Transparency and Long-Termism

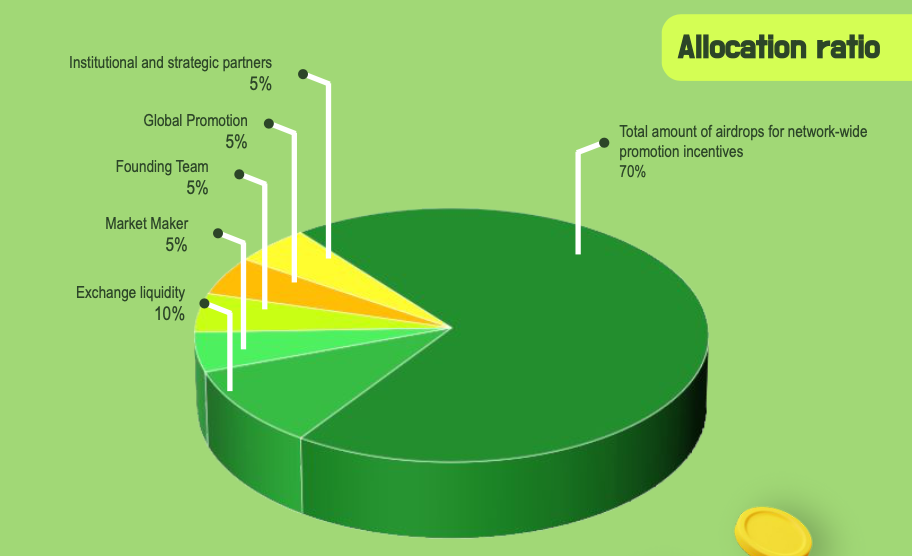

The token allocation plan is extremely transparent, with each portion serving the ecosystem's long-term development:

● Ecosystem Building as the Core (70%): The vast majority of tokens are for full-network promotion incentives, gradually released through community activities and airdrops, ensuring the ecosystem has sustained growth momentum.

● Team (5%) and Partners (5%) Aligned: Tokens for the founding team and strategic partners are subject to long-term lock-up mechanisms, with linear release schedules of 24 and 36 months respectively, ensuring all parties' interests are deeply aligned with the project's long-term development.●

Market Makers (5%) and Exchange Liquidity (10%): The Twin Pillars of Market Stability: Tokens reserved for exchange liquidity and market makers will be released orderly based on market development needs, maintaining a stable trading environment.

● Long-Term Brand Investment (5%): Global marketing funds are managed by the community foundation for ongoing brand building and market promotion, safeguarding the ecosystem's long-term value.

Diverse Application Scenarios: A Value Cycle Throughout the Ecosystem

SOLU is deeply integrated into every key link of the platform, creating sustained endogenous demand:

● Payment & Discounts: Future use of SOLU to pay for all platform fees with a significant discount creates direct, rigid demand.

● Governance & Voting: The token will evolve into a governance token, granting holders voting rights on key platform decisions, enabling community co-governance.

● Staking & Yields: Users can stake SOLU to share platform revenue and use it as a requirement for accessing premium features (e.g., higher-tier U Cards), incentivizing long-term holding.

● Ecosystem Incentives: As the core reward for all incentive activities (e.g., Liquidity Pool Program, referral rewards), it continuously rewards contributors to the ecosystem.

Deflationary Mechanism: A Clear Value Growth Engine

To combat inflation and drive long-term value appreciation, the model incorporates a powerful deflationary mechanism:

● Sustainable Buyback & Burn: A portion of platform profits and 100% of the transaction taxes generated from the Liquidity Pool Program will be used for regular buybacks and burning of SOLU on the open market.

● Clear Deflation Target: The project has set a clear goal to ultimately reduce the total supply from 1 billion to 210 million tokens, providing clear value expectations for long-term holders.

Ingenious Closed-Loop Logic

The SOLU token economic architecture forms a sophisticated closed-loop system that perfectly integrates platform utility, token scarcity, and user benefits. The core mechanism is this: as transaction volume and revenue on the Solulu platform grow, the scale of funds allocated for SOLU buyback and burn expands simultaneously. Continuous buyback and burn directly lead to a decreasing circulating supply of SOLU, increasing its scarcity. This rising scarcity naturally drives up the token's market value and the returns for stakers. Higher value expectations and yield potential attract more users to hold, stake, and use SOLU to participate in ecosystem building. This, in turn, injects more active trading, deeper liquidity, and broader application scenarios into the platform, further accelerating the prosperity and growth of the platform ecosystem—ultimately forming a self-driving, ever-strengthening flywheel of value creation.

IV. Compliance Layout: Securing Access in Major Global Markets

Solulu treats compliance as the cornerstone of its business development, adopting a "hub-and-spoke" strategic layout—securing core licenses in key financial hubs to radiate services to broader global markets.

Currently, the platform has successfully obtained the U.S. MSB license and is actively advancing license applications in major financial markets like New York State (MTL), UAE (VARA), Singapore (MPI), and Hong Kong (VASP). To ensure professionalism and foresight in compliance, Solulu has formed an expert team comprising former regulators and seasoned financial lawyers.

At the operational level, the platform has established a comprehensive risk management system: a tiered KYC verification system caters to users with different needs, while integration with top-tier blockchain analytics tools like Chainalysis and Elliptic enables 24/7 transaction monitoring and risk warning.

This deep investment in compliance reflects Solulu's determination to build a trustworthy financial platform—only by establishing a solid compliance foundation can it genuinely win the long-term trust of users and regulators, paving the way for the steady global expansion of its business.

V. Conclusion: Co-building a New Financial Era

Looking back at the history of fintech, every disruptive innovation follows a similar trajectory: from geek toy to mass-market tool, from fringe experiment to core infrastructure, from improving experience to reshaping ecosystems. Today, we stand on the eve of the stablecoin explosion—the policy window has opened, technological bottlenecks are being overcome, capital continues to flow in, and market demand is robust. These four factors are converging, outlining the clear contours of a new financial infrastructure.

The timing is ripe. In 2026, Solulu will focus on four core breakthroughs: the global rollout of the Virtual U Card, bridging the last mile between crypto assets and physical consumption; the full launch of social payment features, redefining the transfer experience; the pilot launch of the trade settlement network, opening new cross-border payment channels for SMEs; and the completion of the SOLU token deployment and its listing on major exchanges, finalizing the value closed-loop. These are not just product milestones but the starting gun for the entire ecosystem's explosion.

For astute investors, this is a key window to position in the next generation of financial infrastructure. For entrepreneurs seeking breakthroughs, it's a historic opportunity to reinvent cross-border trade settlement systems. For users yearning for financial freedom, it's the first real chance to achieve asset autonomy. In 2026, everyone will find their place within the Solulu ecosystem, collectively witnessing the large-scale transition of stablecoins from concept to reality.

Solulu is paving the road to this new financial world. When these infrastructures materialize, all participants will witness a brand-new financial ecosystem transition from blueprint to reality. The narrative of the new financial era is unfolding before us, and its authors are every builder who chooses to participate today.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。