Original Title: Two Kites Dancing In A Hurricane

Original Author: 0xsmac

Original Compiler: SpecialistXBT

Editor's Note: This article examines the current prosperity of prediction markets with a sharp perspective. The author points out that today's prediction markets are falling into the "local optimum" trap reminiscent of Blackberry and Yahoo. While the binary options model adopted by mainstream prediction markets has gained significant traffic in the short term, it is plagued by structural issues of liquidity scarcity and low capital efficiency. The article proposes the evolution of prediction markets towards a "perpetual contract" model, providing constructive deep thinking for achieving a true "market for everything."

Why do companies find themselves chasing the wrong goals? Can we fix prediction markets before it's too late?

"Success is like a strong drink, intoxicating. It is not easy to navigate the fame and flattery that come with it. It can corrode your mind, making you start to believe that everyone around you is in awe of you, that everyone desires you, and that everyone's thoughts revolve around you." — Ajith Kumar

"The cheers of the crowd have always been the most beautiful music." — Vin Scully

Early success can be intoxicating. Especially when everyone tells you that you won't succeed, this feeling is even stronger. Screw the haters, you are right, and they are wrong!

But early success carries a unique danger: you may have won the wrong rewards. While we often joke that "playing stupid games wins stupid prizes," in reality, the games we participate in are often evolving in real-time. Therefore, the factors that lead you to victory in the first phase may very well become stumbling blocks to winning greater rewards as the game matures.

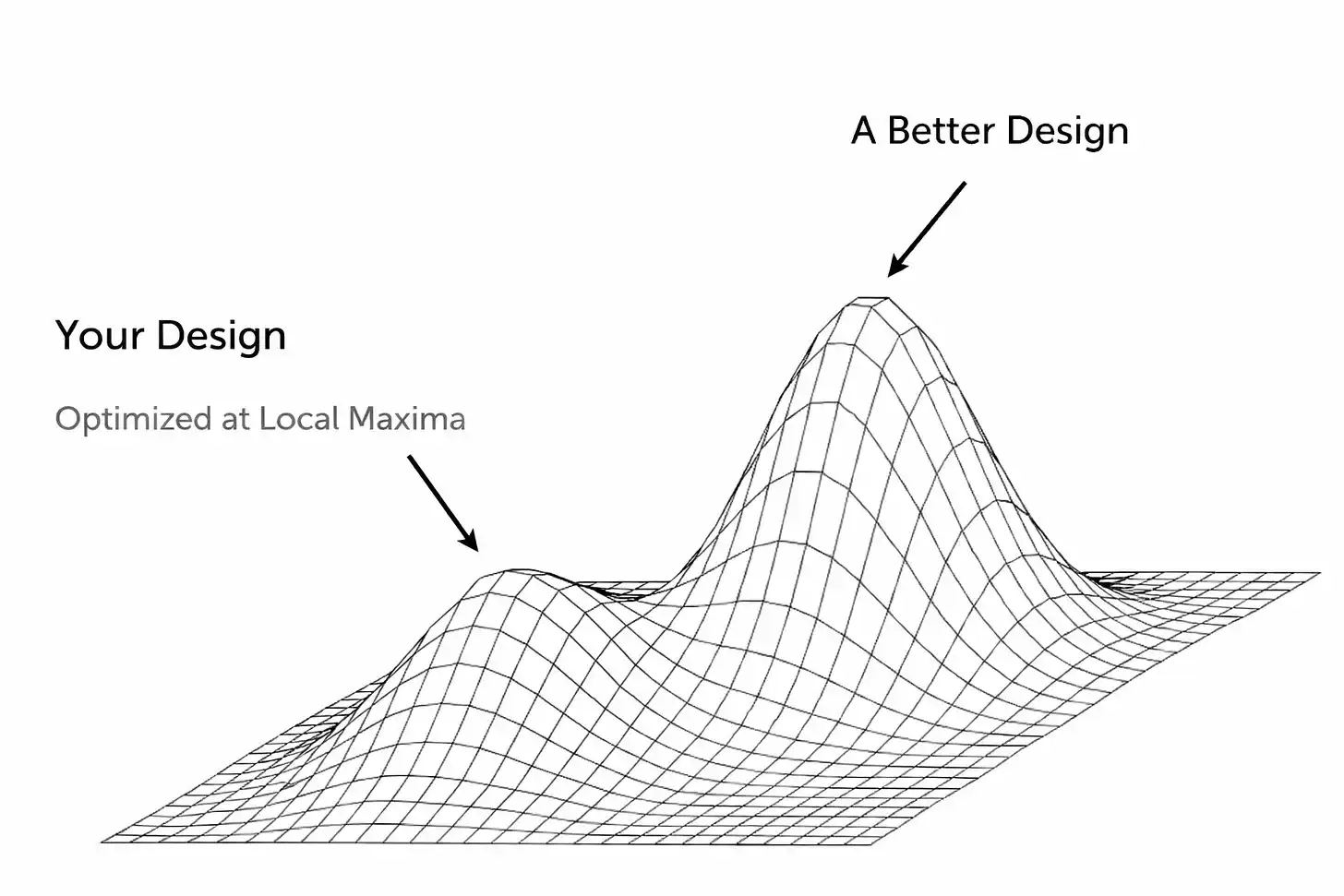

One manifestation of this outcome is that companies unknowingly fall into a "local optimum." The feeling of winning is so good that it can lead you to lose your way, even blocking self-awareness and preventing you from seeing the true situation you are in.

In many cases, this may just be a mirage, an illusion supported by external factors (such as economic prosperity leading to a flood of disposable income for consumers). Or, the product or service you built may indeed work well, but only within a specific scope or under certain conditions, unable to scale to a broader market.

The core conflict here is that to pursue the true ultimate prize (i.e., the global optimum), you need to step down from the current peak. This requires immense humility. It means making difficult decisions: abandoning a core feature, completely restructuring the tech stack, or personally overturning a model you once thought was effective. What makes all this more challenging is…

Most of the time, you have to make this decision while people (mainly investors and the media) are telling you "how great you are"! Many who previously said you were wrong are now rushing to validate your success. This is an extremely dangerous situation because it breeds complacency at the very moment you need to make radical changes.

This is precisely the situation prediction markets find themselves in today. In their current form, they will never achieve mass market adoption. I do not want to waste ink arguing whether they have reached that status (after all, there is a huge gap between knowing something exists and having a real demand to use it). Perhaps you disagree with this premise and are now ready to close the page or read the rest with resentment. That is your right. But I will reiterate why this model is broken today and what I believe such platforms should look like.

I do not want to sound too much like a tech industry person; I will not reiterate the "innovator's dilemma," but classic cases like Kodak and Blockbuster are prime examples. These companies (and many others) achieved great success, which created an inertia against change. We all know how the story ends, but simply throwing up our hands and saying "we need to do better" is not constructive. So, what specifically led to these outcomes? Do we see these signs in today's prediction markets?

Sometimes, the obstacles lie at the technical level. Startups often build products in a specific subjective way that may work in the initial stages (the fact that a startup can do this is already a significant achievement!), but soon it becomes a future architectural shackle. Wanting to continue expanding after an initial explosion or adjusting product design means threatening some seemingly effective core components. People naturally tend to solve problems through incremental fixes, but this quickly leads to the product becoming a patchwork. Moreover, this only delays the acceptance of the harsh truth: what is truly needed is a complete rebuild or reimagining of the product.

Early social networks experienced this when they hit performance ceilings. Friendster was a pioneer of social networks in 2002, connecting millions of users with "friends of friends." But trouble arose when a specific feature (viewing friends within "three degrees of separation") caused the platform to crash under the load of calculating exponential connections.

The team refused to scale back this feature, instead focusing on new ideas and flashy partnerships, even as existing users threatened to leave for MySpace. Friendster reached a local peak of popularity but could not cross it because its core architecture was flawed, and the team refused to acknowledge, dismantle, and fix it. (By the way, MySpace later fell into its own "local optimum" trap: it was built on a unique user experience of highly customizable user homepages and focused on music/pop culture communities. The platform was primarily ad-driven and ultimately became overly reliant on its ad portal model, while Facebook emerged with a cleaner, faster, and "real" identity-based network. Facebook attracted some early MySpace users but undoubtedly appealed more to the next large wave of social media users.)

The persistence of such behavior is not surprising. We are all human. Achieving some superficial success, especially as a startup with a high failure rate, naturally leads to self-inflation. Founders and investors begin to believe in the performance they boast about and double down on the formula that brought them to this point, even as warning signals flash brighter and brighter. People easily ignore new information or even refuse to face the reality that the current environment is different from the past. The human brain is fascinating; with enough motivation, we can rationalize many things.

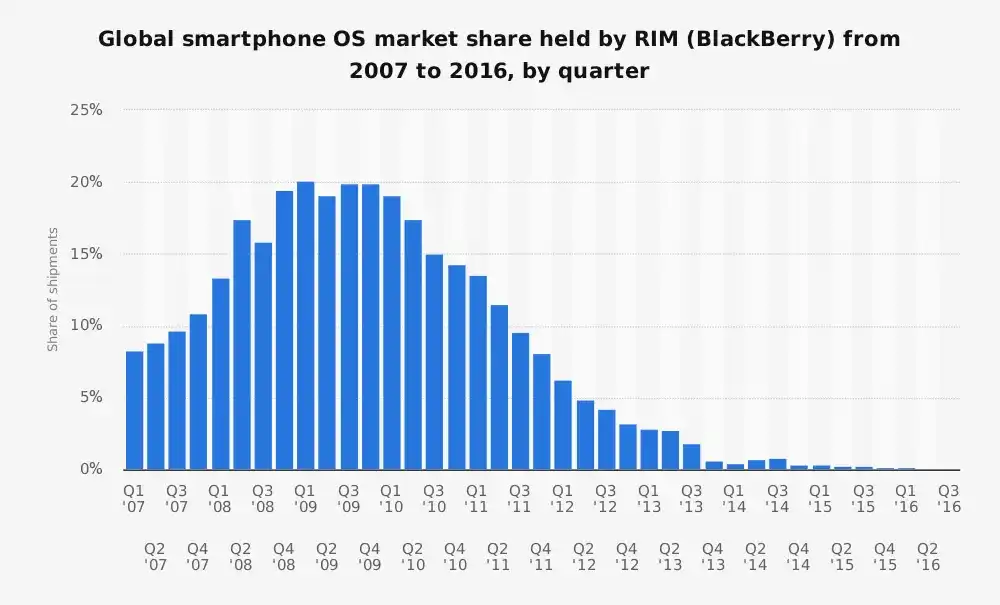

Stagnation of Research In Motion

Before the iPhone was released, Research In Motion (RIM) and its Blackberry phones were the kings of smartphones, holding over 40% of the U.S. smartphone market. It was built on a specific vision of smartphones: a better PDA (personal digital assistant) optimized for enterprise users, specifically for email, battery life, and that beloved physical keyboard. However…

The world changes, fast as lightning.

One point that may be underestimated today is that Blackberry excelled in serving its customers. Because of this, when the world changed dramatically around them, RIM could not adapt.

It is well known that its leadership team initially dismissed the iPhone.

"It’s not secure. The battery drains too quickly, and it has a terrible digital keyboard." — Larry Conlee, RIM COO

They then quickly became defensive.

RIM arrogantly believed that this new phone would never attract its enterprise customer base, which was not entirely unfounded. But this completely missed the revolutionary shift of smartphones beyond being "email machines" to becoming "universal devices for everyone." The company suffered from severe "technical debt" and "platform debt," common symptoms of companies that achieve early success. Their operating system and infrastructure were optimized for secure messaging and battery efficiency. By the time they accepted reality, it was too late.

There is a viewpoint that companies in such situations (the greater the initial success, the harder the evolution, which is one reason Zuckerberg is considered the "GOAT/Greatest of All Time") should operate with an almost schizophrenic mindset: one team focused on leveraging current success, while another team is dedicated to disrupting it. Apple may be a prime example of this, as they allowed the iPhone to cannibalize the iPod market and then let the iPad cannibalize the Mac market. But if this were easy, everyone would have done it by now.

Yahoo

This may be a presidential mountain-level "missed opportunity." Once upon a time, Yahoo was the homepage for millions of people on the internet. It was the gateway to the internet (one could even say the original "universal app") — news, email, finance, games, you name it. It viewed search as just one of many functions, to the extent that Yahoo did not even use its own search technology in the early 2000s (it outsourced search to third-party engines and even used Google for a time).

Today, it is well known that its leadership team missed multiple opportunities to deepen search capabilities, most famously the chance to acquire Google for $5 billion in 2002. In hindsight, it is obvious, but Yahoo failed to understand what Google knew: search is the foundation of the digital experience. Whoever owns search will own internet traffic and, in turn, advertising revenue. Yahoo overly relied on its brand strength and display advertising while disastrously underestimating the massive shift towards a "search-centric" navigation method and later the personalized content streams of social networks.

Remember this guy?

Please forgive me for using a cliché, but in a bubble market, "a rising tide lifts all boats." The cryptocurrency space has experienced this deeply (see Opensea and many other examples). It is hard to determine whether your startup has real traction or is merely riding an unsustainable wave of momentum. What makes the situation even murkier is that these periods often coincide with a surge in venture capital and speculative consumer behavior, obscuring potential fundamental issues. The comical rise and fall of WeWork illustrate this well: easily accessible capital led to massive expansion, masking a completely broken business model.

Strip away all the branding and lofty rhetoric, and WeWork's core business model is very simple:

Long-term lease office space → Spend money on renovations → Premium short-term sublease.

If you're not familiar with this story, you might think, well, this sounds a lot like a short-term landlord. That is its essence. A real estate arbitrage trade disguised as a software platform.

But WeWork was not necessarily interested in building a lasting business; they optimized for something entirely different: explosive growth and valuation narratives. This worked effectively for a short time because Adam Neumann was incredibly charismatic and could sell a vision. Investors bought into it wholeheartedly, fostering a specific type of growth that was completely detached from reality (in WeWork's case, this meant opening as many office buildings as possible in as many cities as possible, regardless of profitability, i.e., "lightning expansion," locking in large long-term leases, and scoffing at the critical viewpoint of unit economics, believing "we can grow our way out of losses"). Many outsiders (analysts) saw through its essence: it was a risk-inverted real estate company with unstable clients, and the business itself was inherently built with structural losses.

Most of the above is a retrospective analysis of a failed company. In a sense, this belongs to "hindsight bias." But it reflects three different insights into failure: companies fail because they cannot progress technologically, fail to identify and respond to competition, or fail to adjust their business models.

I believe we are now witnessing the same scene playing out in prediction markets.

The Promise of Prediction Markets

The theoretical prospects of prediction markets are enticing:

Leveraging the wisdom of the crowd = Better information = Turning speculation into collective insight = A market for everything

But today's leading platforms have reached a local peak. They have unearthed a model that can generate some traction and trading volume, but this design cannot achieve the true vision of "everything being predictable and liquid."

On the surface, both show signs of success; no one doubts that. Kalshi reports that the industry's annualized trading volume will reach about $30 billion this year (we will discuss later how much of this is organic growth). The industry is experiencing a new surge of interest in 2024-25, especially as the narrative of on-chain finance combined with the gamification of trading further penetrates the cultural zeitgeist. The excessive marketing of Polymarket and Kalshi may also be related to this (in some cases, aggressive promotion does indeed work).

But if we peel back the onion and dig a layer deeper, we find some warning signs indicating that growth and PMF may not be as they appear. The elephant in the room is liquidity.

For these markets to work, they need deep liquidity, meaning a large number of people willing to bet on one side of the market so that prices make sense and reveal true price discovery.

Kalshi and Polymarket struggle with this point, except for a few very high-profile markets.

The massive trading volume is concentrated around major events (U.S. elections, highly anticipated Federal Reserve decisions), but most markets exhibit extremely wide bid-ask spreads and almost no activity. In many cases, market makers are even reluctant to execute trades (one of Kalshi's founders recently admitted that their internal market makers are not even profitable).

This indicates that these platforms have yet to crack the puzzle of expanding market breadth and depth. They are stagnating at a level: performing decently in a handful of hot markets, but the long-tail vision of a "market for everything" has not been realized.

To cover up these issues, both companies resort to incentives and unsustainable behaviors (sound familiar?), which are typical signs of touching a local optimum and natural growth being insufficient (by the way, in this specific market dynamic, I have a feeling that most people think these two are the only major competitors.

I don't think this is necessarily important at this stage, but if both teams believe this, then if one is seen as "leading" in this assumed "two-horse race," it poses a survival threat to the other company. This is a particularly unstable position, in my view, based on a false assumption).

Polymarket launched a liquidity rewards program to try to narrow the spreads (theoretically, if you place orders near the current price, you will be rewarded). This helps make the order book look tighter and indeed provides a better experience for traders by somewhat reducing slippage. But this is still a subsidy. Similarly, Kalshi launched a trading volume incentive program, essentially offering cash back based on users' trading volume. They are paying people to use the product.

Now I can feel some of you shouting, "Uber subsidized for a long time!!!" Yes, incentives themselves are not bad. But that doesn't mean they are good! (I also find it interesting that people always like to point to exceptions to the rules without looking at the pile of corpses.) Especially considering the current dynamics of prediction markets, this will quickly turn into a hamster wheel that cannot stop before it's too late.

Another fact we need to know is that a significant portion of the trading volume is fake trading. I think it's pointless to argue about the exact proportion, but clearly, fake trading makes the market appear more liquid when, in reality, it is just a few participants frequently operating to gain profits or create market hype. This means that natural demand is actually weaker than it appears.

"Last Trader Pricing"

In a healthy, well-functioning market, you should be able to place bets close to the current market odds without significant price fluctuations. But today, this is not the case on these platforms. Even medium-sized orders can significantly impact the odds, clearly indicating insufficient trading volume. These markets often only reflect the movements of the last trader, which is precisely the core of the liquidity issue I mentioned earlier. This status quo indicates that while a small group of core users maintains some market operation, these markets are overall neither reliable nor liquid.

But why is this the case?

The pure binary trading market structure cannot compete with perpetual contracts. This is a cumbersome approach that leads to fragmented liquidity, and even if these teams try to solve this problem through workaround solutions, the effect is at best clumsy. In many of these markets, you will also encounter a strange structure where there is an "other" option representing unknown factors, but this introduces the problem of splitting emerging competitors from that basket into their own independent markets.

The binary nature also means you cannot provide real leverage in the way users want, which in turn means you cannot generate valuable trading volume like perpetual contracts. I see people arguing about this on Twitter, but I am still shocked that they cannot recognize: betting $100 on a 1-cent probability in prediction markets is not the same as opening a $100 position with 100x leverage on a perpetual contract exchange.

The inconvenient truth here is that to solve this fundamental problem, you need to redesign the underlying protocol to allow for generalization and treat dynamic events as first-class citizens. You must create an experience similar to perpetual contracts, which means you must address the jump risk present in binary outcome markets. This is evident to anyone actively using perpetual contract exchanges and prediction markets — and unbeknownst to these teams, these are precisely the users you need to attract.

Addressing jump risk means redesigning the system to ensure asset prices move continuously, meaning they do not just arbitrarily jump from, say, a 45% probability to 100% (we have already seen how frequently and openly these events are manipulated/insider traded, but that is another topic I do not want to open right now. Please stop committing crimes.).

If this core limitation is not addressed, you will never be able to introduce the leverage needed to make the product attractive to users (those who can bring real value to your platform). Leverage relies on continuous price fluctuations to safely close positions before losses exceed collateral, thus avoiding sudden fluctuations (e.g., jumping from 45% to 100%) that clear one side of the order book. Without this, you cannot timely margin call or liquidate, and the platform will eventually go bankrupt.

Another core reason these markets do not work under the current structure is the lack of a native multi-outcome hedging mechanism. First of all, as it stands, there is no natural way to hedge because these markets resolve to YES/NO, and the "underlying" is the outcome itself. In contrast, if I go long on a BTC perpetual contract, I can short BTC elsewhere to hedge. This concept does not exist in today's prediction market structure, so if market makers are forced to bear direct event risk, it becomes extremely difficult to provide deep liquidity (or leverage). This again reinforces why I believe the argument that "prediction markets are a new thing, and we are in a high-growth phase" is naive.

Prediction markets will eventually settle (i.e., they will actually close at resolution), while perpetual futures clearly do not. They are open-ended. A design similar to perpetual contracts can change the market by incentivizing active trading, making its functionality more continuous, thereby alleviating some common behaviors that make prediction markets less attractive (many participants simply hold until resolution rather than actively trading probabilities). Additionally, since prediction outcomes are one-time discrete results, and while oracle pricing also has issues, at least it is continuously updated, making the oracle problem in prediction markets even more pronounced.

Behind these design issues is a capital efficiency problem, but this seems to be well understood at this point. Personally, I believe that "earning stablecoin yields" with invested funds does not bring about substantial change. Especially considering that exchanges will provide this yield regardless. So what is the trade-off being made here? If every trade is prepaid in full, that is certainly good for eliminating counterparty risk! And it can also attract a portion of users.

But this is disastrous for the broader user base you need, as this model is extremely inefficient from a capital perspective and will only significantly increase participation costs. This is particularly bad when these markets need different types of users to operate on a large scale, as these choices mean that the experience for each user group will be worse. Market makers need substantial capital to provide liquidity, while retail traders face enormous opportunity costs.

There is certainly more to unpack here, especially around how to attempt to solve some of these fundamental challenges. More complex and dynamic margin systems will be necessary, particularly considering factors like "time until the event occurs" (the risk is highest when the event resolution is near and the odds are close to 50/50). Introducing concepts like leverage decay as the resolution approaches is also necessary, and early tiered liquidation levels would help.

Drawing from traditional financial brokerage models to achieve instant collateralization is another step in the right direction. This will free up capital for more efficient use and allow for simultaneous orders across markets, updating the order book after execution. Introducing these mechanisms first in scalar markets and then expanding to binary markets seems to be the most logical order.

The point is, there is a vast amount of design space that has yet to be explored, partly because people believe today's model is the final form. I just don't see enough people willing to confront the existence of these limitations first. Perhaps it is not surprising that those who recognize this are often the types of users these platforms should want to attract (aka perpetual contract traders).

But what I see is that their criticisms of prediction markets are mostly brushed aside by enthusiasts, who are told to look at the trading volume and growth numbers of these two platforms (absolutely real and organic numbers, uh-huh). I hope prediction markets can develop, I hope they can be accepted by the public, and I personally believe that a market for everything is a good thing. Most of my frustration stems from a widely accepted view that today's version is the best version, but clearly, I do not agree with that view.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。