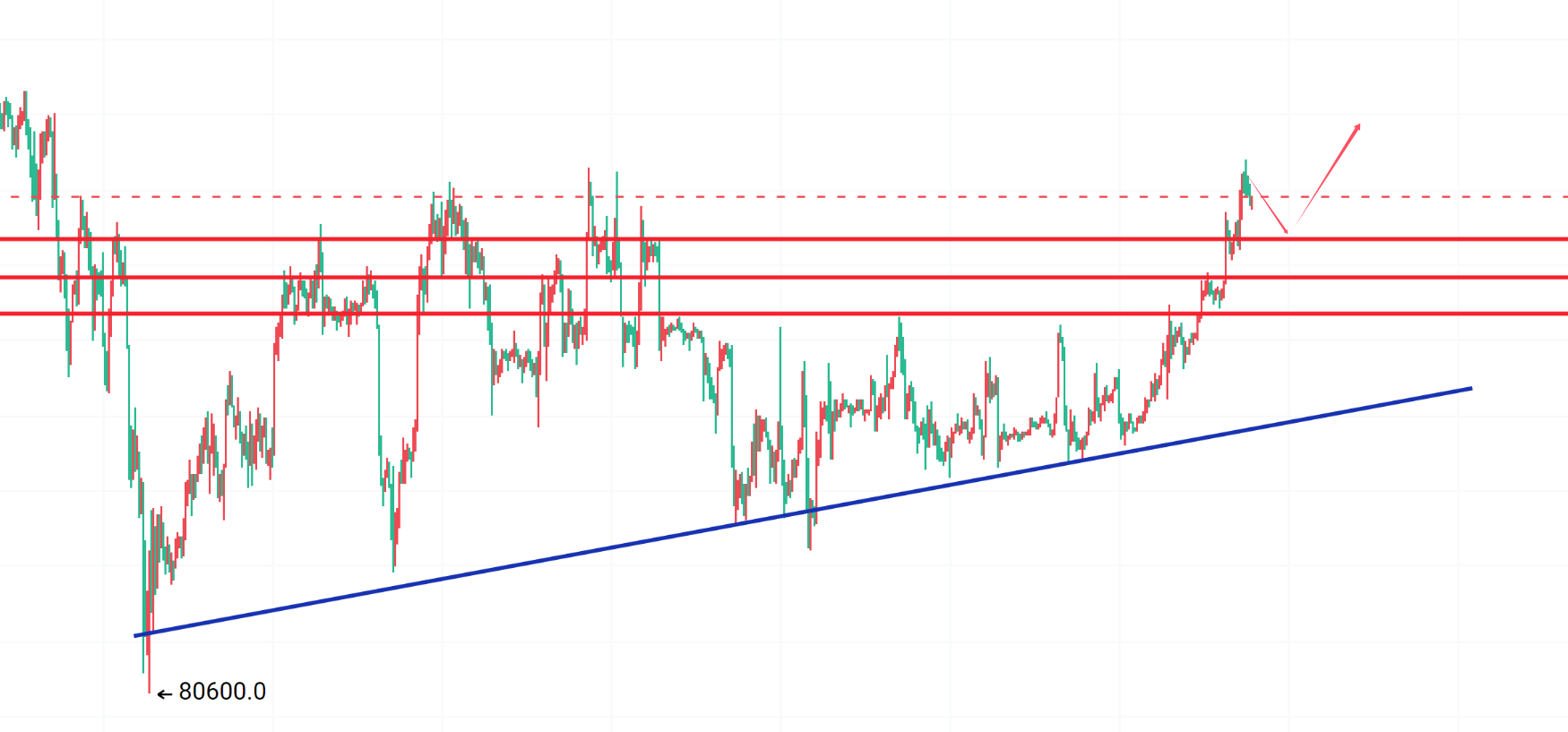

Bitcoin's market has rebounded strongly, testing the previous high of 94,500. The highest rebound reached 94,700 before pulling back, and the current price is fluctuating around 93,700. This week's strategy remains unchanged, primarily focusing on low long positions to look for rebounds. Today, we will test the breakthrough at 94,500 again. This level serves as a recent high point, a belief and defense for the bears, and a position for many short entries. The battle for low long positions here will undoubtedly be significant, and it is also a selling point for many bulls, so a pullback is normal, and repeated fluctuations are also normal. Everyone must have their own judgment! Yesterday, I wanted to enter low long positions but didn't get the chance. Fortunately, Ethereum provided an entry opportunity at 3,140, which was shared in the live broadcast last night. Following the plan, we continue to look upward, reducing positions in batches to secure a break-even loss, and that's it!

Bitcoin has formed five consecutive green candles on the daily chart, creating a rounded bottom. Currently, this is still just a rebound and not enough to form a reversal. The overall trend still favors the bears; those without short positions can be patient or participate in some low long positions. Those who are stuck in short positions need to manage their positions and forced liquidations carefully. The MACD bullish momentum is also continuing to expand, and the MA5 is accelerating upward. The price is still within the upper Bollinger Band. There is a need for a pullback during the day, but short positions are not considered; the focus is on low long positions.

On the short-term 4-hour and hourly charts, the demand for a pullback is evident, but the price is reluctant to drop, indicating a potential trap for shorts. The MACD bullish momentum is shrinking, the KDJ three lines are converging with a death cross pointing downward, and the RSI is turning down after being overbought at high levels. The hourly chart shows this more clearly, with the price currently supported at the middle band, temporarily halting the decline. The lower support levels to watch are 92,700, 91,700, and 90,700. Low long positions should be positioned around these levels, while the upper resistance levels to watch are 93,500, 94,500, and 95,500.

Ethereum also has five consecutive green candles on the daily chart, rising similarly to Bitcoin. The focus remains on low long positions, with lower support levels at 3,180, 3,140, and 3,100. Low long positions should be considered around these levels, while the upper resistance levels to watch are 3,230, 3,300, and 3,350.

Winning is about mindset, losing is about temperament. The excitement of trading lies in the experience, and the essence of trading is in waiting. Experts do not frequently trade to accumulate small profits; instead, they aim for opportunities to strike decisively. Most people care about every profit, while only a few are often in loss. Once they seize the opportunity, they can turn the tables.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。