The price of Bitcoin has retraced about 32% from its historical high at the beginning of 2026, with panic prevailing in the market. However, research reports from over 30 top financial institutions reveal a completely different story—crypto assets are undergoing a historic transition from "teenage turbulence" to "adult stability."

1. Market Status

● The Bitcoin market at the beginning of 2026 presents a contradictory scene. The price has dropped about 32% from the historical high of $126,000 in October 2025, entering a fluctuation range of $85,000 to $90,000.

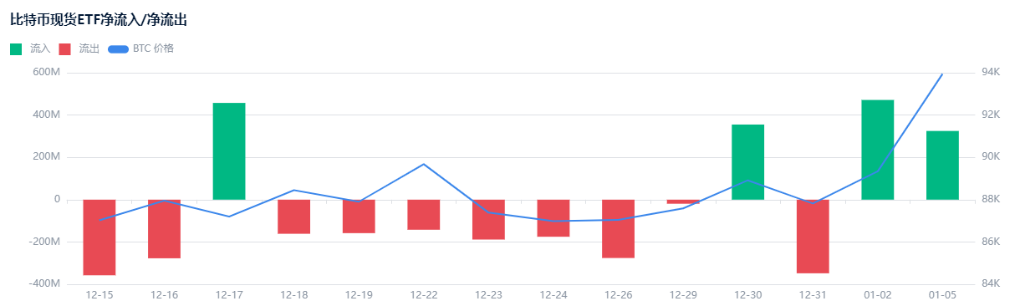

● The apparent panic contrasts sharply with the deeper logic of institutional funds. During the period from December 17 to 29, 2025, the U.S. spot Bitcoin ETF saw an outflow of $1.12 billion, but in the following trading days, it welcomed a daily inflow of $335 million.

● This volatility reflects that the market is at a critical turning point. The behavior patterns of long-term holders have shown subtle changes, shifting from distribution to brief buying, and then returning to a distribution mode. The short-term fluctuations in the market mask deeper structural changes.

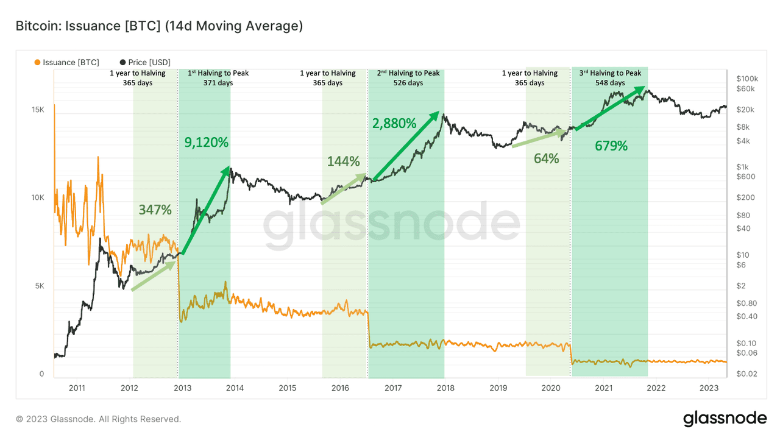

2. Traditional Cycle Theory Fails

● The four-year halving cycle theory that has long dominated the cryptocurrency market is facing unprecedented challenges. Several top institutions in their 2026 outlook reports unanimously believe that this traditional theory is failing or weakening.

● Grayscale explicitly states in its "2026 Digital Asset Outlook: The Dawn of the Institutional Era" report that 2026 will mark the end of the so-called "four-year cycle" theory.

● Instead, a new market logic driven by ETF fund flows, digital asset treasury allocations, and macro liquidity is emerging. Bernstein analysts point out: "The Bitcoin cycle has broken the four-year model and is now in an extended bull market cycle, with institutional buying being more stable, offsetting any retail panic selling."

3. Institutional Funds Reshaping Market Structure

● Institutional funds are fundamentally changing the way the Bitcoin market operates. By the end of 2025, institutions had cumulatively purchased about 944,330 Bitcoins through tools like spot Bitcoin ETFs, while miners only produced about 127,622 new coins that year, making institutional purchases 7.4 times the new coin supply.

● This supply-demand imbalance creates structural market tension. BlackRock's entry through the iShares Bitcoin Trust is symbolic, prompting other financial giants to follow suit. Morgan Stanley plans to allow investment advisors to allocate 0-4% of Bitcoin ETFs for clients starting January 1, 2026. E*Trade's retail crypto trading is also expected to launch in the first half of 2026.

These developments will further push Bitcoin into the mainstream financial system.

4. Macroeconomic and Liquidity Patterns

● The macroeconomic environment is increasingly impacting Bitcoin prices. The correlation between the U.S. dollar index and Bitcoin prices may be closer than that with the broad money supply. Analysts note that Bitcoin prices have historically diverged from global M2 liquidity trends, with current price levels lagging behind the overall liquidity growth in global markets.

● The Federal Reserve's policy shift will become a key variable. The market expects the Trump administration may appoint a dovish Federal Reserve chair to replace tightening policies with expansionary ones, creating a "plentiful" liquidity environment that will benefit scarce assets like Bitcoin.

● Meanwhile, the liquidity injected by the Chinese central bank to combat deflationary pressures may also indirectly affect global high-risk asset allocations through various channels.

5. On-Chain Data and Holder Behavior

On-chain data reveals behavioral divergences among different market participants. Short-term holders (holding coins for less than 155 days) have net increased their holdings by over 220,000 Bitcoins since June 21, 2025, a 9.9% increase.

This increase is more moderate compared to the period from January to March 2025, when short-term holders supplied an additional 540,000 Bitcoins, a 25% increase.

The behavior of long-term holders is more complex. During the price adjustment period, long-term holders briefly shifted from distribution to buying, but this behavioral change did not persist.

Glassnode data shows that short-term holders of Bitcoin are currently at a significant loss compared to long-term holders, a price disparity consistent with early or mid-bear market phases in past cycles.

6. Regulatory Environment and Legislative Progress

● The improvement of the regulatory environment provides a more stable framework for institutional participation. The "Clarity Act" is expected to pass in the first quarter of 2026, and broader crypto legislation will also be signed at the beginning of the year. These legislative advancements will solidify digital assets within the U.S. capital markets, reducing regulatory uncertainty.

● The GENIUS Act is expected to be fully implemented in 2026, providing a federal regulatory framework for payment stablecoins. The clarity of regulation allows traditional financial institutions to enter this field with greater confidence. As 401(k) retirement plans gradually open up to Bitcoin ETF investment allocations, the market will see a significant potential buying spree based on different allocation weights of 1% to 5%.

7. Price Predictions and Market Outlook

Predictions for Bitcoin's price in 2026 show a concentrated but varied landscape. Most analysts' target prices are clustered in the range of $120,000 to $170,000.

● Standard Chartered maintains its prediction that Bitcoin will reach $150,000 in 2026 (previously predicted at $300,000). Bernstein's revised target for 2026 is $150,000, with a peak of $200,000 in the 2027 cycle.

● However, there are also more cautious views. Michael Tepin, CEO of Transform Ventures, predicts that Bitcoin may experience a "surrender" in 2026, dropping to the $55,000 to $65,000 range, before gaining momentum in 2027 and rising to $250,000 to $350,000 or higher in the 2028-29 bull market.

In addition to Bitcoin itself, the crypto market in 2026 will see several important trends. The tokenization of stablecoins and real-world assets is expected to move from concept validation to large-scale commercial use.

In 2025, stablecoin trading volume reached $9 trillion, rivaling Visa and PayPal. The integration of artificial intelligence and blockchain will enter a new phase. a16z crypto proposes the concept of the "agent economy," focusing on how AI agents can autonomously trade via blockchain.

Privacy technology will also return to mainstream attention in 2026. With the large-scale entry of institutions, compliance privacy solutions based on zero-knowledge proofs and fully homomorphic encryption will become a necessity.

Join our community to discuss and grow stronger together!

Official Telegram community: https://t.me/aicoincn

AiCoin Chinese Twitter: https://x.com/AiCoinzh

OKX benefits group: https://aicoin.com/link/chat?cid=l61eM4owQ

Binance benefits group: https://aicoin.com/link/chat?cid=ynr7d1P6Z

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。