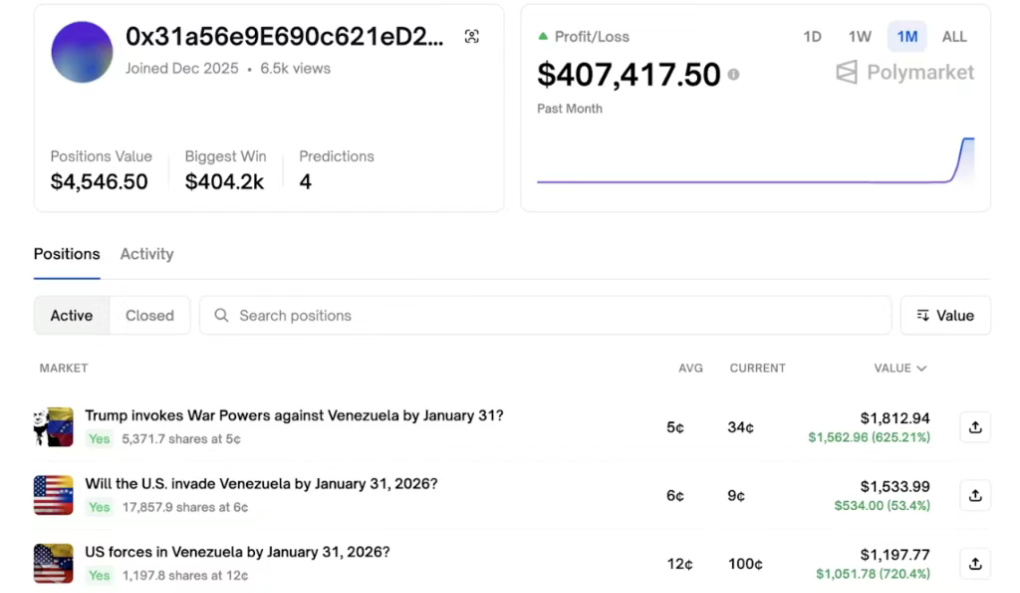

A mysterious Polymarket account accurately bet $32,500 before the Venezuelan president's arrest, making a staggering $400,000 profit within 24 hours, yielding over 1200%—this perfect gamble ultimately triggered a legislative storm.

At the end of December 2025, a newly created Polymarket account made four trades, all betting that the U.S. would take action against Venezuela. The account purchased a contract stating "Maduro will step down by January 31" at around $0.07.

When U.S. President Trump officially announced the arrest of Maduro, this account had already profited over $400,000. Market data showed that the price of the relevant contract began to rise unusually hours before Trump's official announcement. Almost simultaneously, a user named "AlphaRaccoon" accurately bet on an unlikely winner just before Google released its annual trending searches, making over a million dollars in a single day.

1. Controversy Ignited

Prediction markets continued to thrive in 2025, with a combined trading volume of $1.44 billion on the Kalshi and Polymarket platforms in September alone. However, this growth was accompanied by increasingly serious insider trading controversies.

● On October 10, 2025, the day the Nobel Peace Prize was announced, the "2025 Nobel Peace Prize Winner" market on Polymarket showed significant anomalies. About 11 hours before the results were announced, the odds for Maria Corina Machado, which were originally only 3-5%, suddenly skyrocketed to over 70%.

● At least three accounts heavily bet on Machado's victory, ultimately profiting around $90,000. This directly sparked a major debate about insider trading in prediction markets.

○ One side argued that allowing insider information trading could raise market accuracy to 92% by accelerating information aggregation. George Mason University economist Robin Hanson has stated that if the goal of prediction markets is to obtain accurate information, then insider trading should be permitted.

○ The other side emphasized that this is a clear case of insider information leakage and fraud, which would severely undermine the participation enthusiasm of ordinary investors.

2. Legislative Initiation

● In response to the ongoing insider trading controversies, New York State Democratic Congressman Richie Torres decided to take action. He plans to introduce the "2026 Financial Prediction Market Public Integrity Act." This bill aims to prohibit federal officials from trading in prediction markets using significant non-public information. The proposal explicitly applies to federally elected officials, political appointees, and executive branch employees.

● When these officials possess or may obtain significant non-public information through their positions, they will be prohibited from trading contracts related to government policies or political outcomes in prediction markets.

● Torres's spokesperson stated that the recent events in Venezuela highlight the urgency of this legislation. The bill aims to clarify that such behavior is illegal under federal law.

3. Regulatory Dilemma

Prediction markets currently face a regulatory gray area in the U.S. These market models lie somewhere between futures exchanges and gambling sites, with regulators treating them more like the latter.

● The insider trading laws enforced by the U.S. Securities and Exchange Commission do not apply to prediction markets. Prediction market contracts are event contracts regulated by the Commodity Futures Trading Commission (CFTC).

● In May 2025, the CFTC dropped its appeal against Kalshi's political contracts, confirming their legality but adding transparency disclosure and anti-manipulation requirements. Kalshi has obtained compliance licenses under CFTC regulation for all 50 states.

● Polymarket, on the other hand, transformed into a regulated entity by acquiring the Florida-based derivatives exchange QCX, gradually expanding into the U.S. market. This regulatory positioning makes traditional insider trading laws difficult to apply directly.

A 2025 report by KPMG warned that betting on event contracts using significant non-public information could severely distort market integrity and easily trigger a chain collapse in a regulatory vacuum.

4. Global Differences

There are significant differences in regulatory attitudes toward prediction markets worldwide.

● The U.S. relatively clearly classifies them as event contracts for regulation.

● The attitude in Europe is more cautious. The European Securities and Markets Authority mentioned prediction markets in the 2025 Markets in Financial Instruments Directive II rules, requiring investment firms to optimize order execution policies. The Markets in Crypto-Assets Regulation further includes prediction markets within the licensing framework for crypto asset service providers, emphasizing anti-money laundering compliance.

● The UK's Financial Conduct Authority directly prohibits retail trading of binary options. Many Asian countries even classify prediction markets as gambling.

This fragmented regulation exacerbates the risks associated with prediction markets. Most countries or regions either directly ban such derivative contracts or impose strict entry licenses.

5. Industry Response

● In the face of legislative pressure and public scrutiny, prediction market platforms and related companies have begun to proactively respond. The Kalshi platform stated that its internal policies have long prohibited insiders from trading using undisclosed privileged information.

○ The platform's rules explicitly prohibit insiders or decision-makers from trading based on significant non-public information. Polymarket has yet to comment on the proposed bill.

● At the corporate level, compliance management is also being strengthened. KPMG partner Conway Dodge revealed that the number of companies consulting on whether to include prediction markets in their compliance policies has at least doubled in the past six months.

● Robinhood and Coinbase have updated their policies to explicitly prohibit employees from participating in prediction market trading. OpenAI and Anthropic have also stated that the company has rules prohibiting employees from profiting from confidential information on any platform.

● At the industry level, companies like Kalshi and Coinbase recently announced the establishment of a new industry organization to promote the development of national standards for preventing insider trading in prediction markets.

6. Market Paradox

Prediction markets face a fundamental paradox. Their value precisely comes from information asymmetry. Coinbase CEO Brian Armstrong has candidly acknowledged this contradiction.

● He stated, "If people want to know whether the Suez Canal will reopen, then allowing a naval officer on a ship in the canal to bet on it would make market predictions more accurate. But on the other hand, the integrity of the market must be maintained."

● This contradiction has found a compromise solution in internal prediction markets within companies. Companies like Google and Anthropic have established internal prediction markets that allow employees to "bet" on project progress and other issues. However, these internal markets do not involve real money and are not open to the outside. This approach leverages collective intelligence while avoiding the risks of insider trading.

7. Future Challenges

As the 2026 U.S. midterm elections approach, the trading volume of prediction contracts related to political outcomes is expected to increase significantly, which may further expose regulatory loopholes. The introduction of the "2026 Financial Prediction Market Public Integrity Act" marks a critical moment as prediction markets transition from a fringe financial innovation to the mainstream regulatory spotlight.

● George Kanelos, a lawyer at Milbank LLP, pointed out that even if it does not constitute insider trading in the sense of U.S. securities law, profiting from confidential information in prediction markets may still violate employees' legal obligations to their employers.

● Such behavior constitutes fraud, akin to embezzlement, as it secretly exploits information for personal gain. For ordinary investors, prediction markets indeed represent a brand new way to play, with vast imaginative potential.

● However, retail investors should focus more on areas they are familiar with rather than simply engaging in "gambling" bets. Prediction markets need more calm voices and thoughtful consideration.

Before Maduro's arrest, the trading records of that anonymous account were clearly traceable on Polymarket; when the Google trending searches were released, AlphaRaccoon's positions surged from the bottom to the top. When these trades, precise to the minute, are no longer seen as luck or foresight but are suspected to be tools for cashing in on power, the law finally begins to scrutinize this gray area.

Richie Torres's proposal acts like a scalpel, attempting to cut through the surface of prediction markets to excise the tumor of insider trading, while the entire industry holds its breath, waiting for the outcome of this incision.

Join our community to discuss and grow stronger together!

Official Telegram community: https://t.me/aicoincn

AiCoin Chinese Twitter: https://x.com/AiCoinzh

OKX benefits group: https://aicoin.com/link/chat?cid=l61eM4owQ

Binance benefits group: https://aicoin.com/link/chat?cid=ynr7d1P6Z

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。