The commitment to raise interest rates by Bank of Japan Governor Kazuo Ueda at the New Year meeting, contrasted with the Federal Reserve's dot plot indicating a slowdown in rate cuts, paints a clear picture of global monetary policy divergence, as if the central banks of the two major economies are walking in opposite directions on different paths of economic recovery.

Bank of Japan Governor Kazuo Ueda clearly stated that if the economy and inflation continue to improve, the central bank will continue to raise interest rates. He emphasized "continuing to raise rates based on the improvement of the economy and inflation," highlighting Japan's determination for monetary normalization.

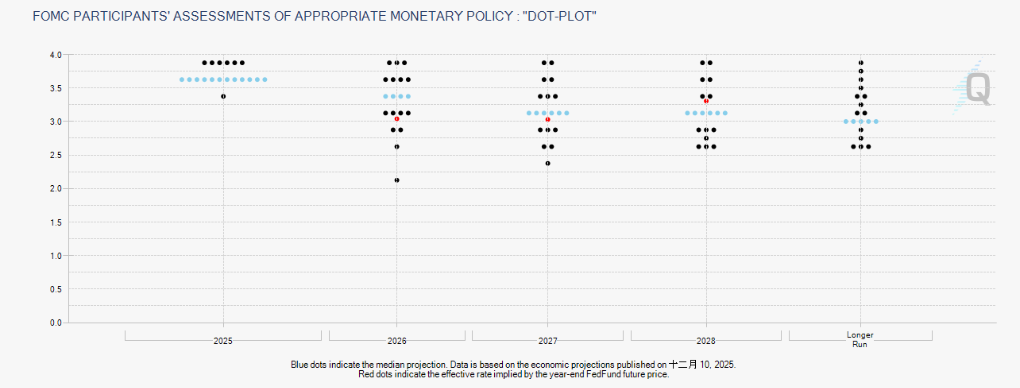

Meanwhile, after completing a rate cut in December 2025, the latest dot plot from the Federal Reserve indicates that there may only be one rate cut in 2026, forming a historic divergence in the policy paths of the two central banks.

1. BOJ's Path to Rate Hikes: From Ultra-Loose to Normalization

● Ueda firmly stated at the New Year meeting: "Japan's wages and prices are likely to rise moderately in sync, and we will continue to raise interest rates based on the improvement of the economy and inflation." This statement sets the tone for Japan's monetary policy in 2026. The current round of monetary policy normalization by the Bank of Japan is not a hasty move, but rather based on years of economic data observation and careful assessment.

● Looking back to January 2025, the Bank of Japan raised the policy interest rate from 0.25% to 0.5%, marking the first step in the rate hike cycle. By June 2025, the central bank decided to maintain the benchmark interest rate at 0.5% while announcing a long-term policy roadmap.

● Notably, the Bank of Japan announced that it would slow the pace of reducing government bond purchases starting in April 2026. According to the plan, starting in April 2026, the monthly purchase of Japanese government bonds will be reduced by about 200 billion yen each quarter, a significant slowdown compared to the previous reduction of 400 billion yen per month.

● This gradual adjustment fully reflects the cautious attitude of the Bank of Japan. Ueda explicitly stated that the bond purchase reduction plan will be "slightly cautiously advanced" to avoid unnecessary shocks to the market. As of June 2025, the Bank of Japan held approximately 560 trillion yen in government bonds, and the adjustment of such a large balance sheet requires time and strategy.

2. Challenges for the Japanese Economy: The Dual Nature of Inflation and External Risks

● Japan currently faces an inflation environment with distinct dual characteristics. In April 2025, Japan's overall inflation rate had risen to 4.6%, far exceeding the central bank's target level of 2%, primarily driven by import costs.

● However, Ueda pointed out that the core inflation rate driven by domestic demand and wage growth remains below 2%, not yet reaching a sustainable target level. This differentiation in inflation driven by internal and external factors poses a dilemma for monetary policy.

● The Bank of Japan predicts that wages and prices are likely to rise moderately in sync, which has become the core basis for its gradual rate hike policy. In the spring wage negotiations, major companies agreed to raise wages by about 5.28%, the highest increase in thirty years, providing a foundation for consumption-driven inflation.

● At the same time, the Japanese economy also faces significant external risks. Ueda specifically mentioned that U.S. trade policy is a major external uncertainty. The U.S. increase in tariffs may first impact Japan's economic performance by weakening exports, subsequently affecting corporate profits and consumer confidence, and even leading to a temporary slowdown in wage growth.

The Bank of Japan has adopted a cautious balancing strategy in weighing inflation pressures against economic growth, avoiding the suppression of the nascent recovery in consumption and investment due to overly rapid tightening of policies.

3. Federal Reserve's Shift: A Subtle Change from Rate Cuts to Wait-and-See

● In stark contrast to the Bank of Japan's firm rate hike path, the Federal Reserve's policy direction seems to have undergone a subtle change after lowering the federal funds rate by 25 basis points to 3.50%-3.75% in December 2025.

● The latest dot plot shows that the median rate forecast among Federal Reserve officials for 2026 remains at the expectation of only one rate cut, creating a strong contrast with the Bank of Japan's clear rate hike path.

● There are significant internal divisions within the Federal Reserve regarding policy direction. Some officials argue that there should be no rate cuts in 2026, while acting governor Milan advocates for a substantial rate cut of 50 basis points. This division reflects the uncertainty in the Federal Reserve's judgment of the economic outlook. The latest economic forecasts indicate that the Federal Reserve has slightly raised its economic growth expectations for 2026, while inflation expectations remain high.

Guosheng Securities analysis points out that the U.S. economy is likely to experience a weak recovery in 2026, while inflation remains high, thus the economic fundamentals do not require significant rate cuts.

This judgment aligns with the guidance of the Federal Reserve's dot plot. Market expectations for the future direction of the Federal Reserve's policy also show divergence; after the meeting, the implied number of rate cuts for the entire year of 2026 in interest rate futures rose slightly from 2.0 to 2.2.

4. Divergence in Government Bond Yields and Capital Flows

Policy divergence has already had a noticeable impact on financial markets. After the announcement of the Bank of Japan's decision, the USD/JPY exchange rate fluctuated little in the short term, but government bond yields showed significant changes.

● The yield on Japan's 5-year government bonds rose 1.5 basis points to 1.025%, and the yield on 10-year government bonds also increased by 1.5 basis points to 1.465%. This change reflects the market's gradual digestion of the Bank of Japan's rate hike expectations.

Longer-term market impacts are worth noting. As the Bank of Japan gradually advances monetary normalization, global capital flows may undergo adjustments.

● Ueda promised that if long-term interest rates rise rapidly, the central bank may adopt various measures, including increasing bond purchases, to stabilize the market. This "safety valve" design aims to avoid causing severe market fluctuations during the process of monetary policy normalization.

● The Federal Reserve's policy also affects global capital allocation. After the Federal Reserve's rate cuts, if the dollar continues to weaken, funds may flow more into emerging market countries.

This reallocation of capital will have profound effects on global asset prices. Different markets have varying sensitivities to the policy changes of the two central banks, increasing the complexity of global asset allocation.

5. Global Impact: A New Landscape Under Monetary Policy Divergence

● The divergence in monetary policy between Japan and the U.S. not only affects the economies of the two countries but is also reshaping the global monetary policy landscape. This divergence reflects differences among developed economies in terms of inflation sources, stages of economic recovery, and policy space.

● For the global market, the divergence in monetary policy between Japan and the U.S. increases exchange rate volatility. Changes in the interest rate differential between the yen and the dollar will directly affect the relative value of the two currencies, thereby impacting global trade and capital flows.

● For Asian economies, this divergence brings dual effects. On one hand, Japan's monetary policy normalization may attract some capital back; on the other hand, the Federal Reserve's slowdown in rate cuts may alleviate the pressure of capital outflows from emerging markets.

● The Bank of Japan's cautious exit strategy provides important references for other central banks. In particular, how to balance inflation control with economic growth, and how to achieve monetary policy normalization under a large balance sheet, are issues of universal significance.

● It is worth noting that this policy divergence may persist for some time. The Bank of Japan expects that it will not reduce its government bond purchases to about 2 trillion yen until the first quarter of 2027. By then, the scale of Japanese government bonds held by the Bank of Japan will have decreased by about 16-17% compared to the level in June 2024.

After the policy decision was announced, the yield on Japan's 5-year government bonds rose by 1.5 basis points to 1.025%, and the yield on 10-year government bonds also increased by 1.5 basis points to 1.465%, as the market slowly digests the Bank of Japan's rate hike expectations.

While the Federal Reserve is still embroiled in debates over "whether one rate cut per year is sufficient," Ueda has already outlined a clear path for Japan's monetary normalization. This policy divergence suggests that the global capital landscape is about to undergo a new round of adjustments.

Join our community to discuss and grow stronger together!

Official Telegram community: https://t.me/aicoincn

AiCoin Chinese Twitter: https://x.com/AiCoinzh

OKX benefits group: https://aicoin.com/link/chat?cid=l61eM4owQ

Binance benefits group: https://aicoin.com/link/chat?cid=ynr7d1P6Z

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。