CoinW Research Institute Weekly Report (2025.12.29 - 2026.1.4)

CoinW Research Institute

Key Points

The total market capitalization of global cryptocurrencies is $3.22 trillion, up from $3.06 trillion last week, representing an increase of approximately 5.23% this week. As of the time of writing, the cumulative net inflow of the U.S. Bitcoin spot ETF is approximately $57.08 billion, with a net inflow of $459 million this week; the cumulative net inflow of the U.S. Ethereum spot ETF is approximately $12.5 billion, with a net inflow of $161 million this week.

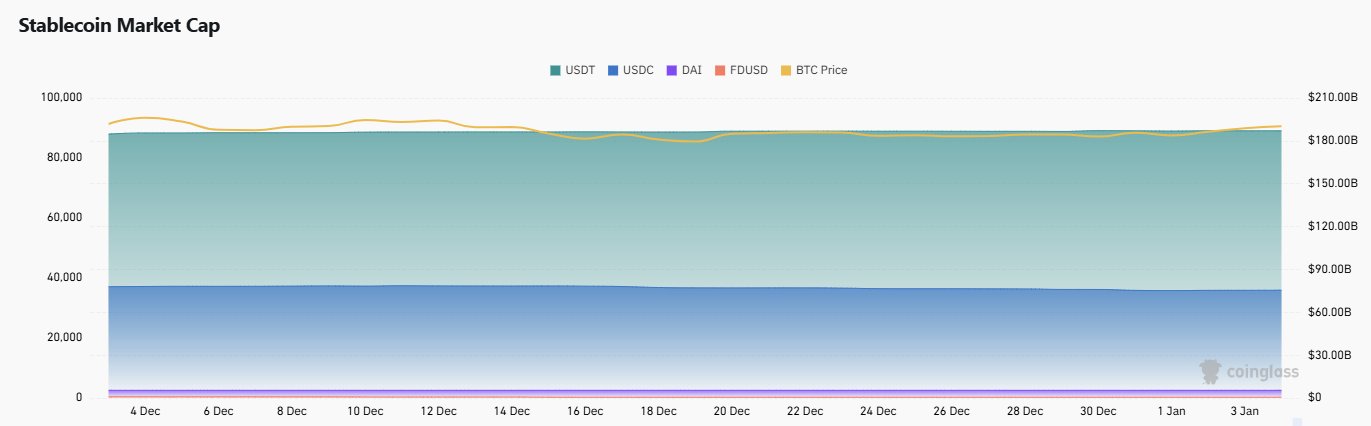

This week, the total market capitalization of stablecoins is $312 billion, down from $313 billion last week, a decrease of 0.32%. Among them, the market capitalization of USDT is $187 billion, accounting for 59.9% of the total stablecoin market capitalization; followed by USDC with a market capitalization of $75.44 billion, accounting for 24.2%; and DAI with a market capitalization of $5.36 billion, accounting for 1.7%.

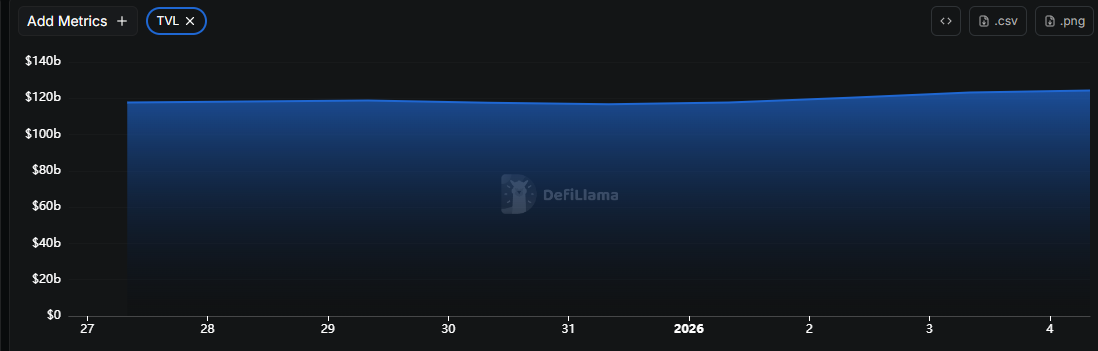

According to data from DeFiLlama, the total TVL of DeFi this week is $124.3 billion, up from $118.2 billion last week, an increase of approximately 5.16%.

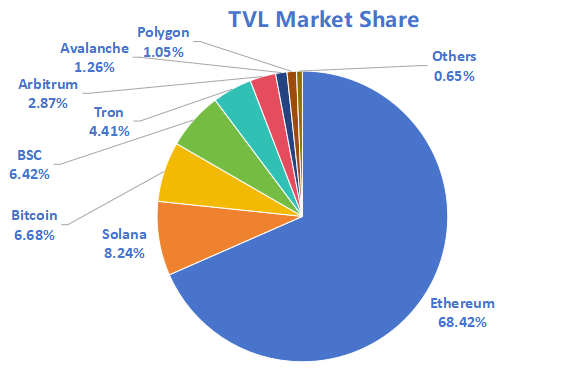

When categorized by public chains, the top three public chains by TVL are Ethereum, accounting for 68.42%; Solana, accounting for 8.24%; and Bitcoin, accounting for 6.68%.

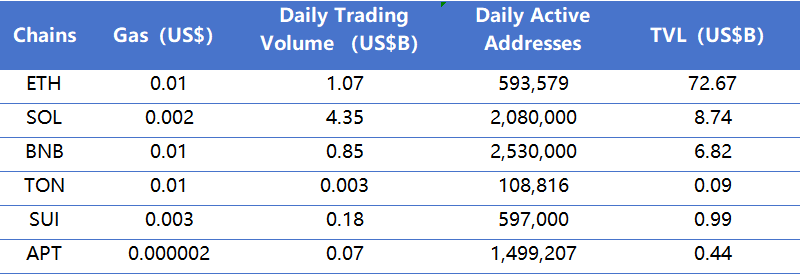

This week, the on-chain activity of public chains shows significant differentiation, with trading and user activity continuing to concentrate in high-frequency ecosystems. In terms of daily trading volume on on-chain DEXs, Solana saw the largest increase, rising approximately 45.5%; BNB Chain saw the largest decrease, falling approximately 42.2%; Ethereum rose approximately 27.4%; Ton saw slight growth but remains at a low volume; Sui and Aptos fell approximately 30.8% and 12.5%, respectively. In terms of transaction fees, the overall Gas level remains stable, with only Sui seeing a slight increase, while other public chains are basically flat compared to last week. In terms of daily active addresses, Solana saw the largest increase, rising approximately 9.5%; Aptos saw the largest decrease, falling approximately 10.2%; Ton also fell about 9.6%; Ethereum and BNB Chain grew approximately 8.8% and 5.9%, respectively; Sui saw slight growth. In terms of TVL, Sui had the most significant increase, rising approximately 7.6%; Ethereum rose 6%; Solana and BNB Chain saw slight growth; Ton and Aptos remained stable overall.

New Project Focus: Kumbaya is a DEX built on MegaETH, focusing on cultural consensus and community cohesion, primarily promoting the issuance, discovery, and trading of cultural tokens; Reflect is a synthetic currency trading protocol based on Solana, aiming to provide high-yield, low-volatility "dollarized" financial products for global users; CipherOwl is a programmable smart layer for institutional-level crypto applications, aimed at providing automated, controllable, and transparent compliance infrastructure for public institutions, financial institutions, and protocol developers.

Table of Contents

Key Points

I. Market Overview

Total Cryptocurrency Market Capitalization / Bitcoin Market Capitalization Ratio

Fear Index

ETF Inflow and Outflow Data

ETH/BTC and ETH/USD Exchange Rates

Decentralized Finance (DeFi)

On-Chain Data

Stablecoin Market Capitalization and Issuance

II. This Week's Hot Money Trends

Top Five VC Coins and Meme Coins by Growth This Week

New Project Insights

III. Industry News

Major Industry Events This Week

Major Upcoming Events Next Week

Important Investments and Financing from Last Week

IV. Reference Links

I. Market Overview

1. Total Cryptocurrency Market Capitalization / Bitcoin Market Capitalization Ratio

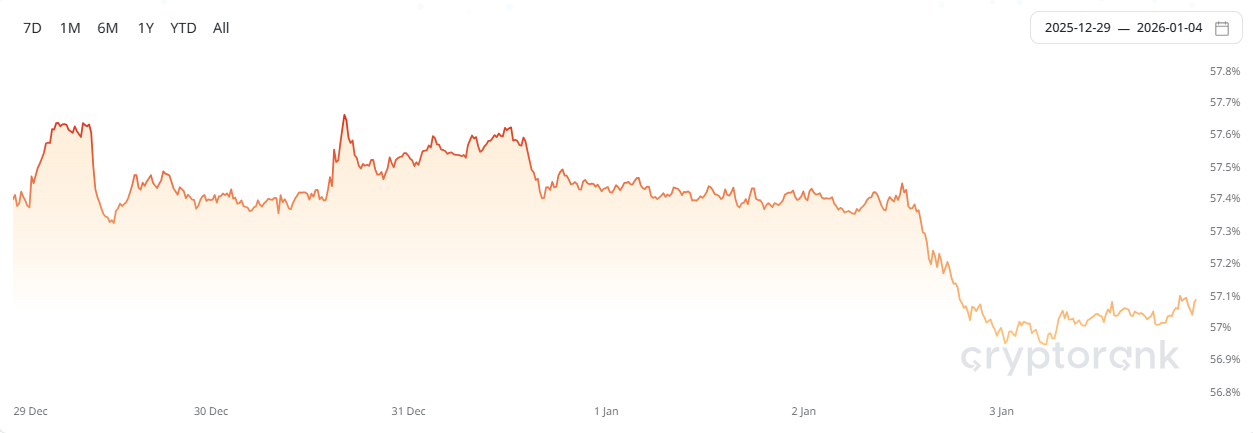

The total market capitalization of global cryptocurrencies is $3.22 trillion, up from $3.06 trillion last week, representing an increase of approximately 5.23% this week.

Data Source: Cryptorank, https://cryptorank.io/charts/btc-dominance

Data as of January 4, 2026

As of the time of writing, the market capitalization of Bitcoin is $1.83 trillion, accounting for 56.95% of the total cryptocurrency market capitalization. Meanwhile, the market capitalization of stablecoins is $312 billion, accounting for 9.7% of the total cryptocurrency market capitalization.

Data Source: Coingecko, https://www.coingecko.com/en/charts

Data as of January 4, 2026

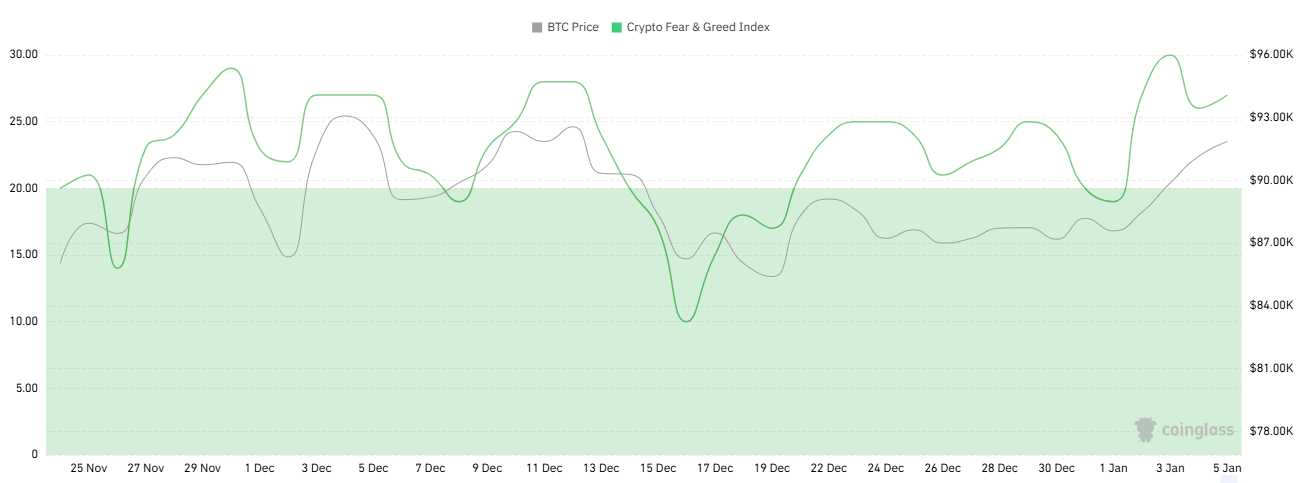

2. Fear Index

The cryptocurrency fear index is 27, indicating fear.

Data Source: Coinglass, https://www.coinglass.com/pro/i/FearGreedIndex

Data as of January 4, 2026

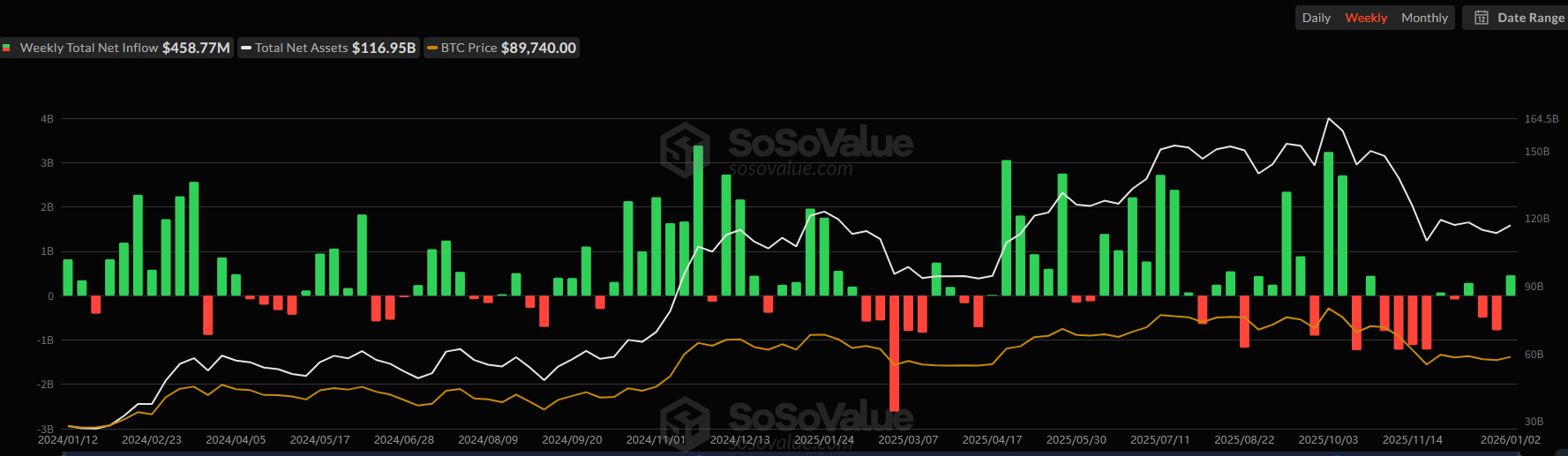

3. ETF Inflow and Outflow Data

As of the time of writing, the cumulative net inflow of the U.S. Bitcoin spot ETF is approximately $57.08 billion, with a net inflow of $459 million this week; the cumulative net inflow of the U.S. Ethereum spot ETF is approximately $12.5 billion, with a net inflow of $161 million this week.

Data Source: Sosovalue, https://sosovalue.com/zh/assets/etf

Data as of January 4, 2026

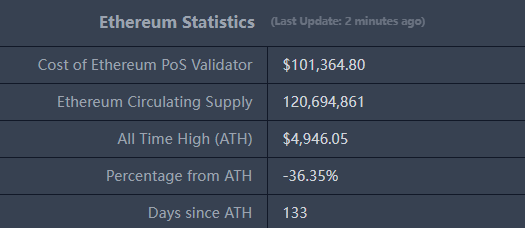

4. ETH/BTC and ETH/USD Exchange Rates

ETHUSD: Current price $3,168, historical highest price $4,946.05, down approximately 36.35% from the highest price.

ETHBTC: Currently at 0.03434, historical highest at 0.1238.

Data Source: Ratiogang, https://ratiogang.com/

Data as of January 4, 2026

5. Decentralized Finance (DeFi)

According to data from DeFiLlama, the total TVL of DeFi this week is $124.3 billion, up from $118.2 billion last week, an increase of approximately 5.16%.

Data Source: Defillama, https://defillama.com

Data as of January 4, 2026

When categorized by public chains, the top three public chains by TVL are Ethereum, accounting for 68.42%; Solana, accounting for 8.24%; and Bitcoin, accounting for 6.68%.

Data Source: CoinW Research Institute, Defillama, https://defillama.com

Data as of January 4, 2026

6. On-Chain Data

Layer 1 Related Data

Mainly analyzing the daily trading volume, daily active addresses, and transaction fees of on-chain DEXs for major Layer 1s including ETH, SOL, BNB, TON, SUI, and APT.

Data Source: CoinW Research Institute, Defillama, https://defillama.com

Data as of January 4, 2026

Daily Trading Volume and Transaction Fees of On-Chain DEXs: The daily trading volume and transaction fees of on-chain DEXs are core indicators of public chain activity and user experience. In terms of daily trading volume on on-chain DEXs, Solana saw the largest increase, rising approximately 45.5%; BNB Chain saw the largest decrease, falling approximately 42.2%; Ethereum rose approximately 27.4%; Ton saw slight growth but remains at a low volume; Sui and Aptos fell approximately 30.8% and 12.5%, respectively. In terms of transaction fees, the overall Gas level remains stable, with only Sui seeing a slight increase, while other public chains are basically flat compared to last week.

Daily Active Addresses and TVL: Daily active addresses reflect the ecological participation and user stickiness of public chains, while TVL reflects users' trust in the platform. In terms of daily active addresses, Solana saw the largest increase, rising approximately 9.5%; Aptos saw the largest decrease, falling approximately 10.2%; Ton also fell about 9.6%; Ethereum and BNB Chain grew approximately 8.8% and 5.9%, respectively; Sui saw slight growth. In terms of TVL, Sui had the most significant increase, rising approximately 7.6%; Ethereum rose 6.0%; Solana and BNB Chain saw slight growth; Ton and Aptos remained stable overall.

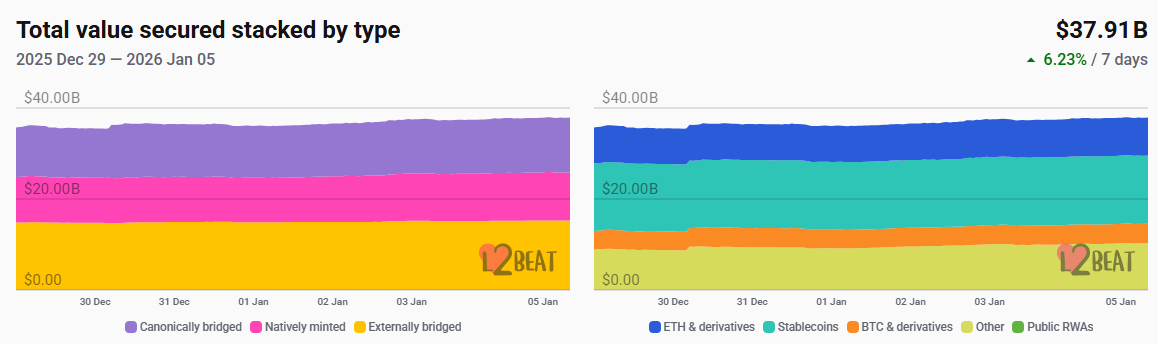

Layer 2 Related Data

According to data from L2Beat, the total TVL of Ethereum Layer 2 is $37.91 billion, up from $35.82 billion last week, an increase of approximately 6.23%.

Data Source: L2Beat, https://l2beat.com/scaling/tvs

Data as of January 4, 2026

Base and Arbitrum hold the top positions with market shares of 37.54% and 34.84%, respectively, with Base ranking first in Ethereum Layer 2 TVL this week.

Data Source: Footprint, https://www.footprint.network/public/research/chain/chain-ecosystem/layer-2-overview

7. Stablecoin Market Capitalization and Issuance

According to Coinglass data, the total market capitalization of stablecoins this week is $312 billion, down from $313 billion last week, a decrease of 0.32%. Among them, the market capitalization of USDT is $187 billion, accounting for 59.9% of the total stablecoin market capitalization; followed by USDC with a market capitalization of $75.44 billion, accounting for 24.2%; and DAI with a market capitalization of $5.36 billion, accounting for 1.7%.

Data Source: CoinW Research Institute, Coinglass, https://www.coinglass.com/pro/stablecoin

Data as of January 4, 2026

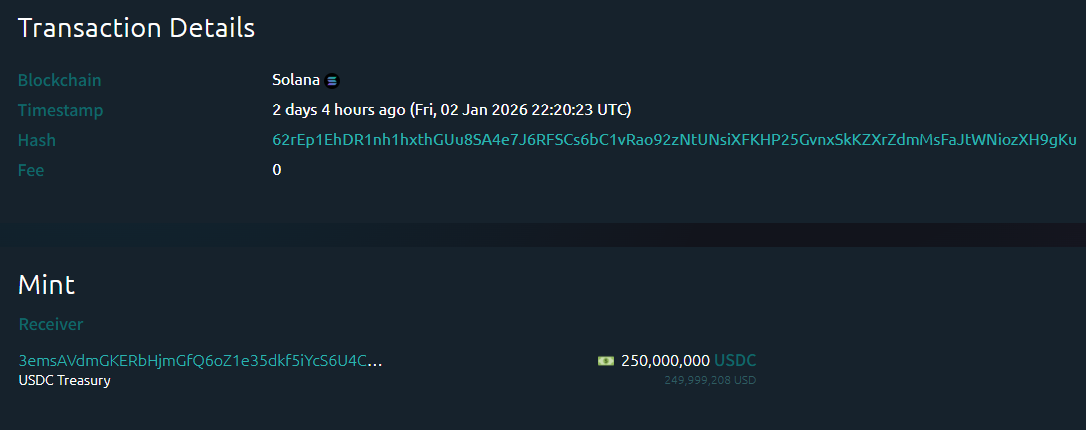

According to Whale Alert data, this week USDC Treasury issued a total of 1.111 billion USDC, and Tether Treasury issued a total of 1 billion USDT. The total issuance of stablecoins this week is 2.111 billion, up approximately 5.1% from last week's total issuance of 2.008 billion.

Data Source: Whale Alert, https://x.com/whale_alert

Data as of January 4, 2026

II. This Week's Hot Money Trends

1. Top Five VC Coins and Meme Coins by Growth This Week

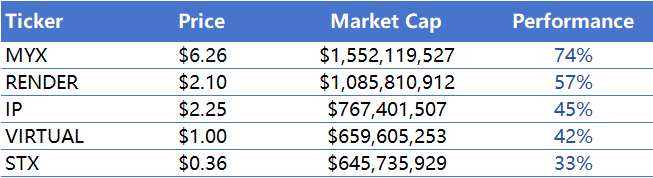

The top five VC coins by growth in the past week

Data Source: CoinW Research Institute, Coinmarketcap, https://coinmarketcap.com/

Data as of January 4, 2026

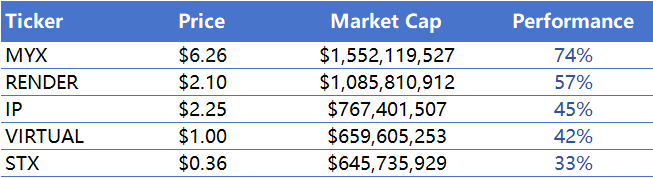

The top five Meme coins by growth in the past week

Data Source: CoinW Research Institute, Coinmarketcap, https://coinmarketcap.com/

Data as of January 4, 2026

2. New Project Insights

Kumbaya is a DEX built on MegaETH, not positioned as a traditional liquidity-driven trading platform, but rather focused on cultural consensus and community cohesion, primarily promoting the issuance, discovery, and trading of cultural tokens. Kumbaya aims to merge Launchpad and DEX, lowering the barriers for creating culture and narrative-driven assets, providing a native trading venue for early communities.

Reflect is a synthetic currency trading protocol based on Solana, aiming to provide high-yield, low-volatility "dollarized" financial products for global users. Reflect differentiates itself by using liquid staking tokens (LST) as a basis, combining perpetual contract strategies to create a Delta-Neutral synthetic currency mechanism, capturing both native staking yields and derivative funding rate yields while maintaining a neutral risk exposure, thus achieving a stable and attractive yield structure. Reflect was established in 2022 and has completed approximately $3.75 million in financing, with core investors including a16z CSX and Solana Ventures.

CipherOwl is a programmable smart layer for institutional-level crypto applications, aimed at providing automated, controllable, and transparent compliance infrastructure for public institutions, financial institutions, and protocol developers. CipherOwl modularizes, standardizes, and programs compliance logic, enabling key functions such as KYC, AML, transaction monitoring, and compliance reporting to be executed efficiently in a collaborative manner on-chain and off-chain, thus meeting institutional rigid demands for regulatory compliance without sacrificing system flexibility and privacy boundaries.

III. Industry News

1. Major Industry Events This Week

The second phase of the Stable pre-deposit event has ended, and deposits are now available for claims. All users who received quota allocations in the second phase can now claim funds through Merkl, and users with excess refunds can also claim through the Merkl dashboard. Users who were not approved to participate in the second phase can withdraw their USDC at any time through the application or directly from the underlying smart contract.

Web3 wallet brand SafePal has launched a limited edition Mastercard card design for its banking function users, available to new and existing users who meet the criteria before January 31. Once successfully claimed, the card will be permanently valid. After claiming, users can customize the card design within the app.

Multi-chain trading platform Magic Eden has announced the start of its fourth season, which will run until January 31. Magic Eden is a cross-chain NFT trading market dedicated to building a user-friendly platform powered by industry-leading minting and trading solutions. Magic Eden brings representative cultural and narrative scenes into the blockchain world, empowering users to create, discover, and collect NFTs, with a focus on serving the creator economy and the circulation and accumulation of on-chain cultural assets.

The decentralized AI smart network DGrid AI officially launched its Genesis Membership program on January 1. The DGrid AI Genesis Membership program aims to recruit the first batch of network co-builders, allowing users to subscribe through the official website to obtain Genesis Membership status and unlock multiple core benefits, including high-volume AI model calls and API rights, dual token rewards, and priority in ecological co-construction. Currently, the DGrid Genesis Membership dual token reward airdrop has also been launched, and subscribing to the Genesis Membership will immediately unlock dual token rewards of DGAI and IOTX. DGrid AI is a decentralized AI smart network aimed at providing low-cost, highly available, and verifiable decentralized AI capabilities for Web3 developers and AI applications.

2. Major Upcoming Events Next Week

Web3 robotics company XMAQUINA will collaborate with Virtuals Protocol for a DEUS community sale on January 8, with the auction starting on January 8 and an FDV of $60 million. At TGE, 33% will be liquid assets, and 67% will vest linearly over 12 months. The public sale is open to all non-U.S. contributors, and eligible wallets can receive a 20% DEUS reward, including rewards for any previous Genesis auction participation. Contributing 10,000 USDC using the same wallet will also earn a 20% DEUS reward.

Omnichannel trading platform Based announced plans to officially launch its native token BASED in the first quarter of 2026. Based is a cryptocurrency trading and consumption platform that allows users to trade spot and perpetual contracts on Hyperliquid, focusing on providing a unified, low-friction trading and asset usage experience based on high-performance on-chain trading infrastructure.

The Solana ecosystem crypto derivatives exchange Ranger will launch a four-day ICO on the MetaDAO platform on January 7, with a minimum fundraising target of $6 million and a public pool of 10 million RNGR, accounting for approximately 39.02% of the total supply. The tokens will be 100% unlocked at TGE. Ranger will adopt an "oversubscription and project party determined acceptance amount" mechanism and introduce "Ranger Points" to ensure early user priority allocation. Additionally, the project will enable a "buy wall" mechanism within 90 days after the ICO to stabilize initial market liquidity.

Sui will complete its development from L1 to a unified developer platform in 2026, which is an end-to-end decentralized development stack S2. It views the features released over the past few years as pieces of a puzzle paving the way for a convergence moment in 2026, unifying into a single stack. Updates to be launched in 2026 include: protocol default privacy transaction levels; USDsui as the anchor stablecoin of the Sui economy, and Slush as a consumer-facing entry point, with stablecoin transfers on the Sui network being completely free by 2026.

3. Important Investments and Financing from Last Week

Cango has completed its latest round of financing, with a total fundraising scale of $10.5 million, primarily from Enduring Wealth Capital. Cango is mainly engaged in Bitcoin mining, with its mining operations and business layout covering North America, the Middle East, South America, and East Africa, and officially entering the crypto asset field in November 2024. Relying on blockchain technology development and the increase in digital asset penetration, it aims to transform from traditional business to a diversified crypto asset business structure centered on Bitcoin mining. (December 30, 2025)

Kimi, also known as "The Dark Side of the Moon," recently completed a $500 million Series C financing round, with IDG leading the investment with $150 million. Existing shareholders such as Alibaba and Tencent oversubscribed, resulting in a post-investment valuation of $4.3 billion. Kimi is an artificial intelligence company focused on general large models and intelligent assistant products. Its product, Kimi, excels in long text understanding and processing capabilities, covering high-frequency cognitive tasks such as complex information retrieval, document analysis, reasoning, and writing. The goal is to create a general intelligent entry point for both public and professional scenarios, forming a sustainable commercialization path in the application layer of large models and productivity tools. (December 31, 2025)

IV. Reference Links

Coingeck: https://www.coingecko.com/en/charts

Sosovalue: https://sosovalue.com/zh/assets/etf

Ratiogang: https://ratiogang.com/

Defillama: https://defillama.com

L2Beat: https://l2beat.com/scaling/tvs

Footprint: https://www.footprint.network/public/research/chain/chain-ecosystem/layer-2-overview

Coinglass: https://www.coinglass.com/pro/stablecoin

Whale Alert: https://x.com/whale_alert

Coinmarketcap: https://coinmarketcap.com/

Kumbaya: https://x.com/kumbaya_xyz

Reflect: https://x.com/reflectmoney

CipherOwl: https://x.com/CipherOwl

Cango: https://x.com/Cango_Group

Kimi.ai: https://x.com/Kimi_Moonshot

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。