The world is bustling, all for profit; the world is bustling, all for profit to go! Hello everyone, I am your friend Lao Cui, focusing on digital currency market analysis, striving to convey the most valuable market information to the vast number of coin friends. Welcome to all coin friends' attention and likes, and reject any market smoke bombs!

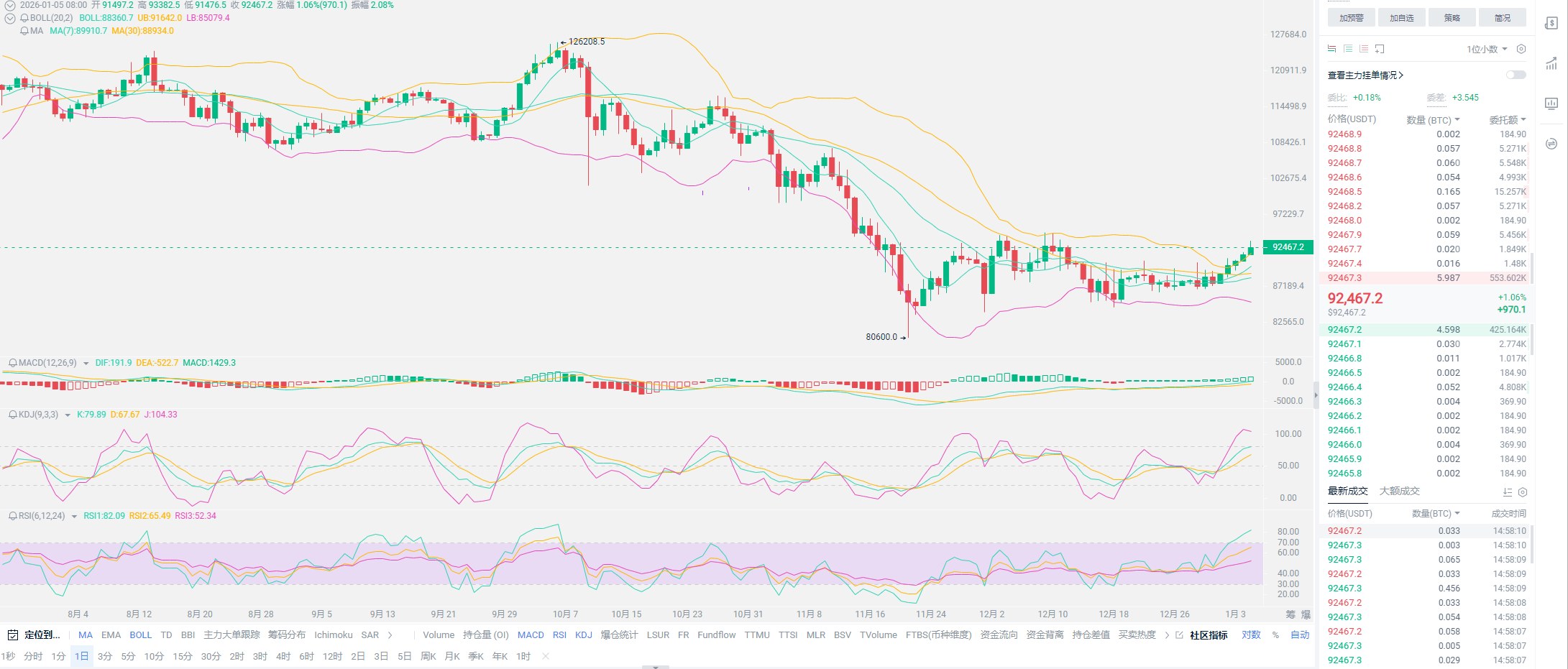

Bitcoin seems to have returned to the growth range, but it is too early to define it, yet the price has reached it. Since hitting a new low of 80600 on November 21, the entire period until January 5 has been a recovery market. The current price has reached the previous high of 94555, with a current quote of 92446. I remind everyone that risks are present, and you must protect your chips; currently, from a linear perspective, Bitcoin has not shown signs of exiting a bull market, but rather resembles the accumulation phase of a bull market. Therefore, Lao Cui will not give any smoke bombs at critical moments; many users did not enter the market earlier and missed the previous layout, so it is best not to intervene easily at this stage. Judging by the inflow of funds, Bitcoin does have the ability to challenge pressure points, but the key question is whether this wave of bubbles can be cleared sufficiently? There is a possibility that the market makers will dump again, so the result presented is a rally of over a thousand points, and many analysts believe this is a trap to lure in more buyers.

Both analyses have their reasoning because the market makers currently do not know how to proceed. The theory of luring buyers is simply that the four-year cycle has ended, and it is time to enter a bear market. Coupled with giants like BlackRock moving into spot trading on Coinbase, it seems they are preparing to dump; this is something Lao Cui is very concerned about. Everyone needs to remember that these investment giants will not store on platforms; once stored, the only option is staking. BlackRock has loaded over ten thousand Bitcoins without staking; they have their own cold wallets. Why would they take such actions is worth pondering. The support for the continuation of the bull market is also very clear. Firstly, the strength of the U.S. is evident, using the Venezuela incident to make the world reassess this hegemon. This display of strength will naturally drive up dollar assets. For those reading Lao Cui's articles, you need to understand that the business opportunities mentioned should be seized.

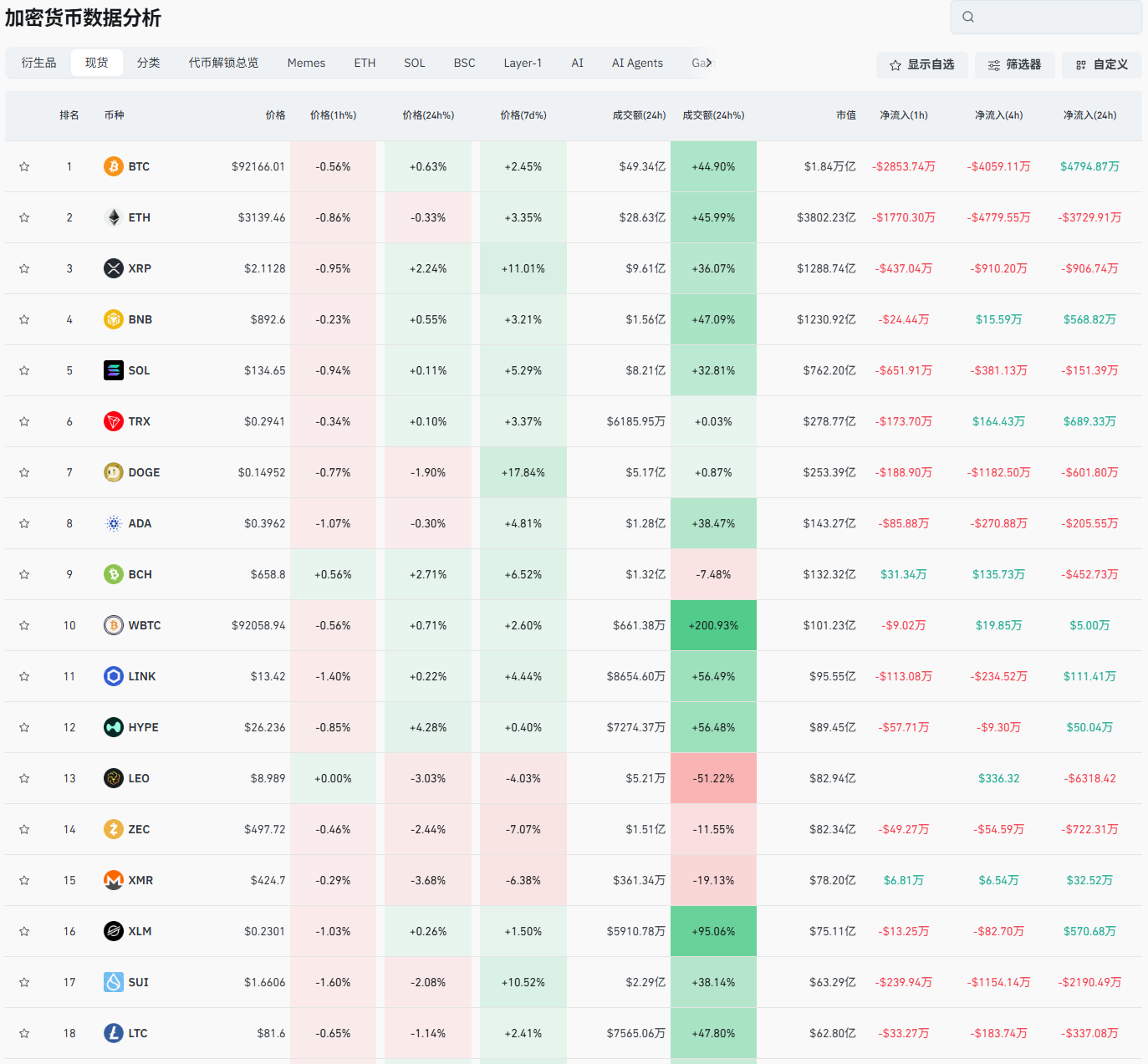

Yesterday, I mentioned crude oil, and this opportunity still exists, especially last night when many oil-producing countries jointly announced a reduction in output in 2026. Considering the actions of the U.S., energy will return to the investment spotlight. If you still have idle funds, you might consider entering; perhaps crude oil in 2026 could outperform gold. Don't ask Lao Cui about finding channels; find your own. I won't discuss the long-term perspective; Lao Cui supports the bullish trend for new highs in 2026, as I have said too much before. As long as Trump is still around, there shouldn't be too many issues in the crypto space; looking at the short-term rebound, this trend does not seem like it will directly challenge new highs. The support on the linear level suggests that the previous price action was a washout, and from the perspective of fund flows, there is currently no significant inflow; instead, a large amount of capital is fleeing at high levels, which is extremely evident.

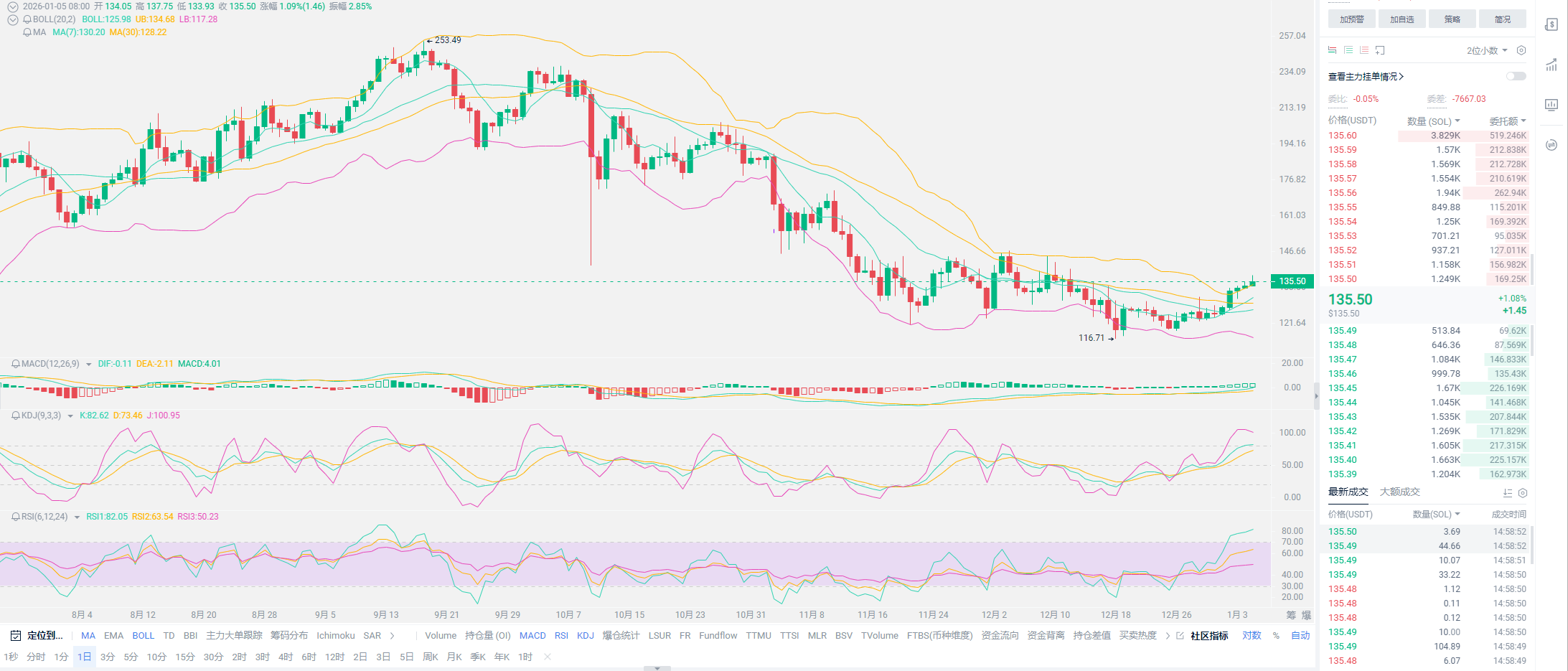

The net inflow of funds in the last 24 hours is 50 million, with the recent hour seeing an outflow of 2632, which means that the ideas of the Asian market and the European and American markets are completely at odds. Of course, in this kind of struggle, the winning side will definitely be led by the U.S., and the final trend will certainly be in the bullish segment. In the short term, if considering contract users, it is essential to pay attention to the trend before the bull market; only after a spike should you consider entering. Currently, this trend, even if a bull market arrives, will require a spike; capital's consistent practice is not to let everyone get rich together. Currently, the heavy positions are still above SOL. Let's talk about SOL; do not look at its current growth compared to many altcoins, but its inflow situation has not encountered significant issues. The SOL spot ETF had a net inflow of 10.43 million dollars in a single week. The SOL spot ETF with the highest net inflow last week was the Bitwise Solana spot ETF BSOL, with a weekly net inflow of 6.23 million dollars, and a historical total net inflow of 625 million dollars; followed by the Fidelity SOL ETF FSOL, with a weekly net inflow of 2.53 million dollars.

Lao Cui has a very high evaluation of SOL; it is one of the few "strong coins" recently. When it falls, it doesn't fall deeply; when it rebounds, it is the first to rise. From a structural perspective, the previous wave of upward movement did not directly retrace but instead consolidated at high levels, which is a standard action for strong coins. The 4-hour moving average has started to converge upwards, and the mid-line is clearly turning up. The most critical point now is between 128 and 130. This is the confirmation level for a pullback; as long as it does not break, there is still room for continuation. The upper target is 140, and whether it can reach 145 depends on the volume. The 4-hour chart of SOL is not meant to encourage everyone to bottom-fish contracts; SOL's contracts should not be touched. Meanwhile, with the final negative news of Japan's interest rate hike landing, the emotions being digested are basically over. Lao Cui currently defines this trend as, after the negative news is fully digested, it is time for the bulls to take the stage. In contrast, SOL is currently more stable than BTC; the previous trend results can prove that a new low for SOL is hard to come by.

Lao Cui summarizes: Today, I will keep it simple. The bullish pattern has not changed, but for those doing contracts, if you did not seize the previous opportunity, it is best to wait for a significant drop before entering; for users who have already entered, especially the bulls, just wait. If you are a bear, then the bears may need some time. Observing the trends of small coins, the explosion of SOL will at least continue for half a year. For users who previously bottom-fished, Lao Cui believes you have been continuously adding, and we are now seeing a rebound. This kind of rebound is still not enough; there is a possibility of a short-term pullback. Whether bullish or bearish, you must wait for a strong spike to judge the trend. As long as the position is not large, users who have incurred losses can hold on. For users holding for a year, you can enter at any time; the main wave of this bull market has not yet arrived. Remember, both USDT and USDC are still being over-issued, and once the bull market arrives, new highs will appear. In the six months to a year before Trump’s next term, just avoid the storm! If you don’t understand, feel free to ask!

Original creation by WeChat public account: Lao Cui Talks About Coins. For assistance, you can contact directly.

Lao Cui's message: Investing is like playing chess; a master can see five, seven, or even ten moves ahead, while a novice can only see two or three moves. The master considers the overall situation, strategizes for the big picture, and does not focus on individual pieces or territories, aiming for the ultimate victory. The novice, however, fights for every inch, frequently switching between bullish and bearish positions, only seeking short-term gains, and often finds themselves trapped.

This material is for learning reference only and does not constitute trading advice. Trade at your own risk!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。