Original Title: In Defense of Exponentials

Original Author: Haseeb Qureshi, Managing Partner at Dragonfly

Original Translation: Azuma, Odaily Planet Daily

Editor's Note: Do you remember the news not long ago about Russian cryptocurrency tycoon Roman Novak and his wife Anna being found dismembered and buried on a beach in Dubai? In 2025, another dark trend in the cryptocurrency industry is the increasing frequency of violent attacks against holders (especially the wealthy).

As a highly recognizable figure in the industry, Dragonfly Managing Partner, the bald Haseeb Qureshi, today conducted a data review of violent incidents in the cryptocurrency field in recent years and explained that he wrote this article because he is "increasingly afraid." Data shows that in 2025, there were a total of 65 violent incidents in the industry, including 4 fatal cases— not only is the number of attacks rising rapidly, but the attacks themselves are also becoming more violent. To this end, Haseeb kindly included some personal safety tips at the end of the article.

Below is the full text by Haseeb, translated by Odaily Planet Daily.

Are violent attacks against cryptocurrency holders on the rise?

Jameson Lopp has been quietly maintaining a database known as "wrench attacks"— incidents where cryptocurrency holders are violently coerced into surrendering their crypto assets. This is currently our closest source to "real-world benchmark data" to determine whether holding crypto assets is becoming more dangerous over time.

I have recently become increasingly afraid of such attacks, so I took Lopp's dataset and did some visualizations using a somewhat Vibe Coding approach to see what is really happening. Here are my findings.

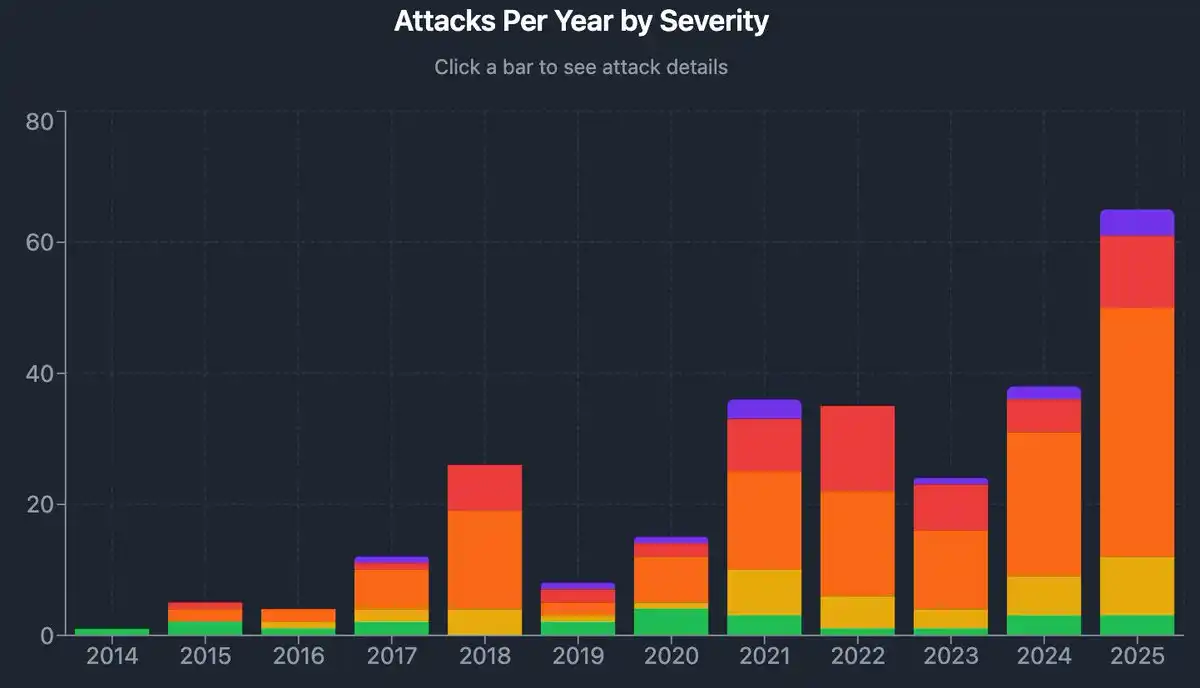

You are not mistaken—the number of attack incidents is indeed increasing over time (a total of 65 in 2025). Moreover, the attacks themselves are becoming more violent.

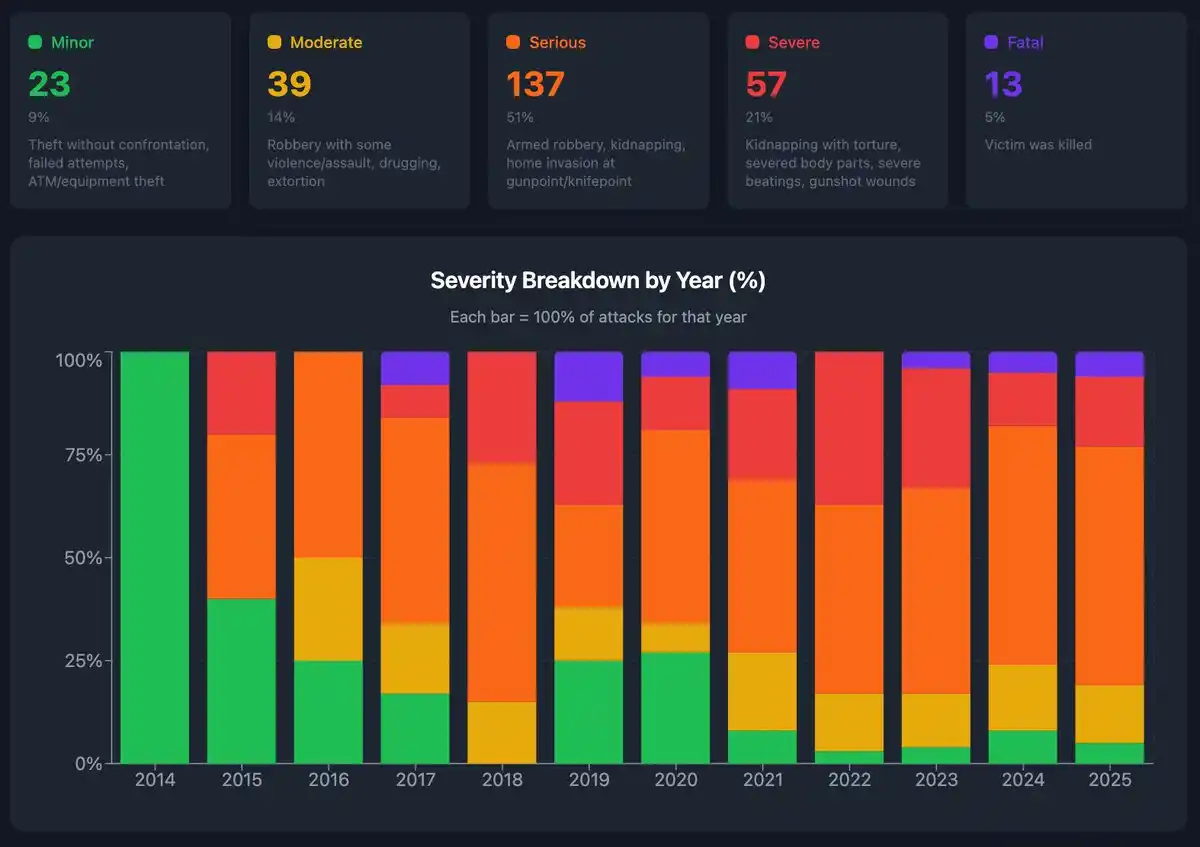

I had Claude categorize each attack into 5 levels, with the specific classification scheme as follows:

· Minor (3 incidents in 2025): Thefts without direct confrontation, attempted thefts, ATM/device thefts.

· Moderate (9 incidents in 2025): Robberies accompanied by some violence or assault, drugging, extortion;

· Severe (38 incidents in 2025): Armed robberies with guns or knives, kidnappings, armed home invasions;

· Extremely Severe (11 incidents in 2025): Kidnappings accompanied by torture, dismemberment, severe beatings, gunshot wounds;

· Fatal (4 incidents in 2025): Victim deaths.

From the results, it can be seen that on average, the level of violence per attack is continuously rising.

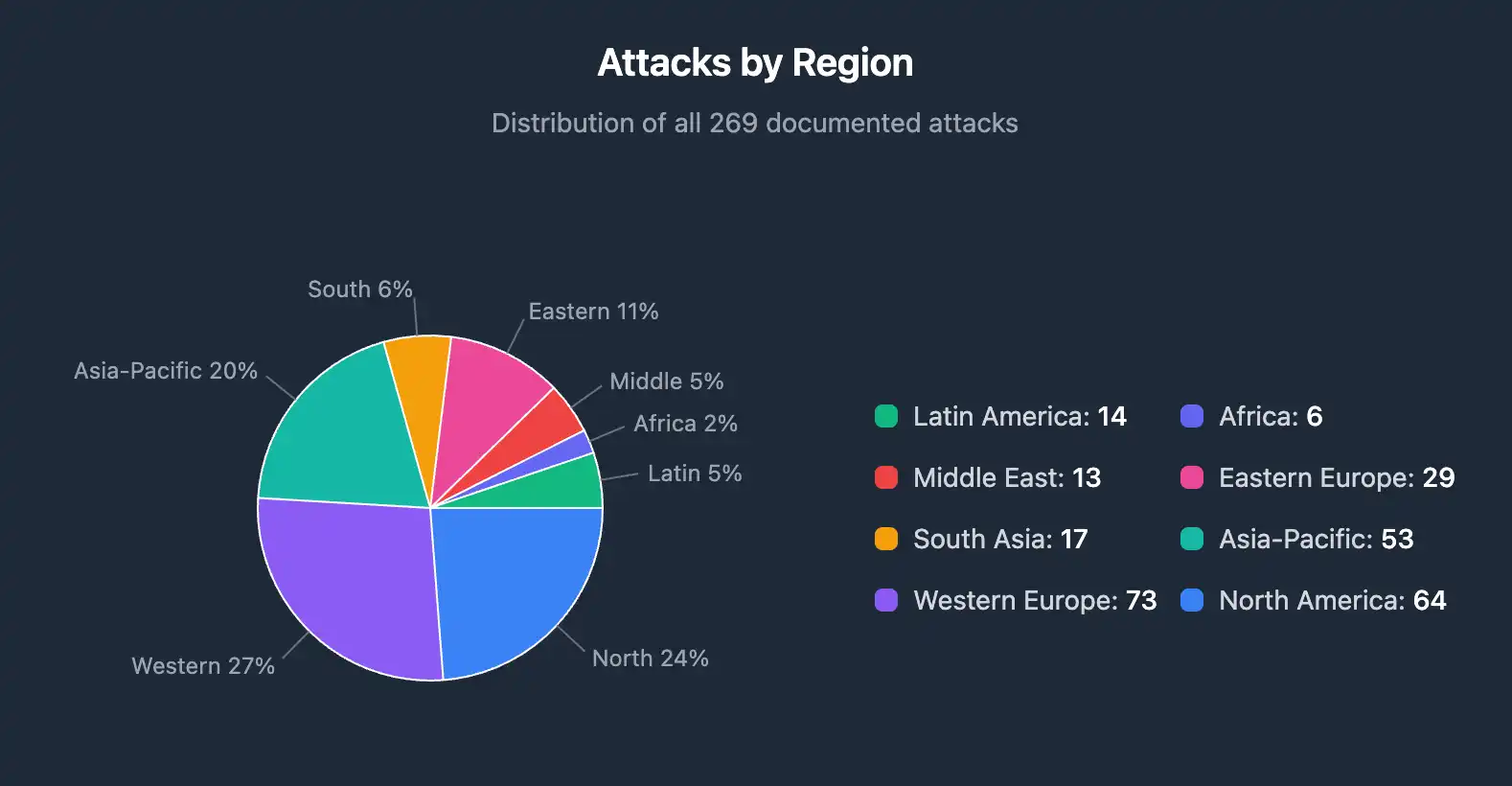

In terms of geographical distribution, Western Europe and the Asia-Pacific region have seen the largest increase in violent incidents. North America remains relatively the safest region, but even in North America, there is an upward trend in absolute numbers.

So, what is causing the rise in violent incidents?

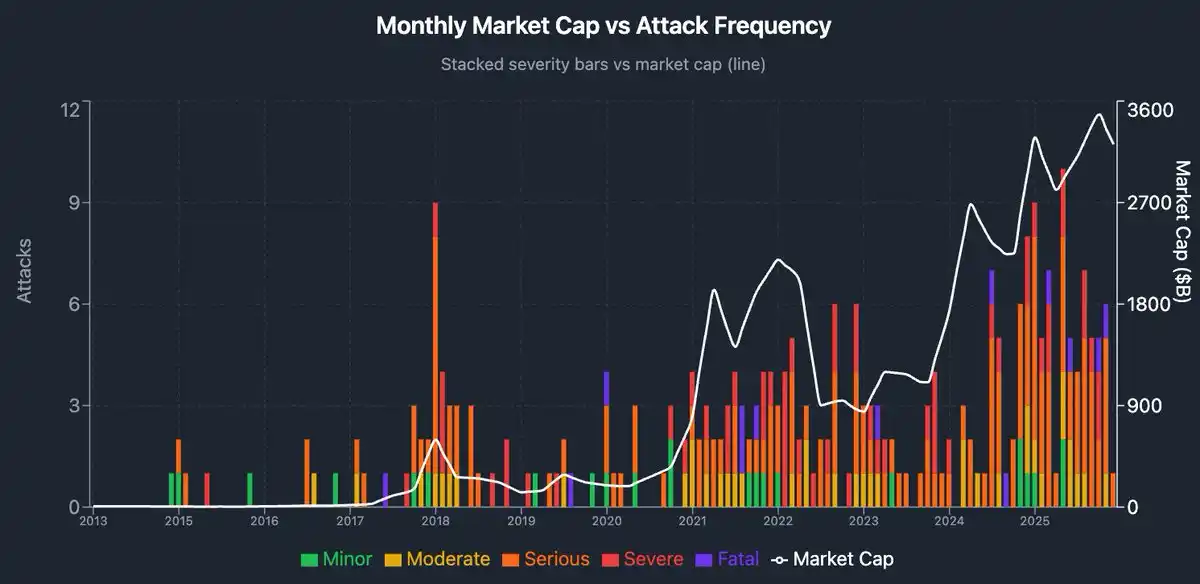

One intuitive explanation is to link the frequency of violent incidents to the overall market capitalization growth of cryptocurrencies. Simply put— the higher the price, the more crime.

Let's take a look at the results shown in the chart: the white line represents the total market capitalization of cryptocurrencies; the colored portion represents the number of violent incidents.

A simple regression analysis gives an R² result of 0.45, which means that 45% of the fluctuations in violent incidents can be explained by the price itself. That is, as mentioned earlier, when prices rise, violent incidents increase—I also ran regression analyses on other variables, but none were more convincing than total market capitalization.

So, is it really that simple? Is this enough to prove that the personal danger for cryptocurrency holders is becoming more severe?

We can conduct another "stress test" to see if there are other hypotheses that can explain why the number of violent incidents is rising.

One possible explanation is that the rise in cryptocurrency prices means that more people are holding crypto assets. In other words, the increase in crime may simply be due to a "larger population base," and the actual violence risk faced by each individual may not have truly increased.

Let's conduct a reasonableness check on this. Accurately measuring the total number of cryptocurrency users is difficult, so I chose two alternative indicators:

· The first is the monthly active users of Coinbase, noting that these are not cumulative registered users, as we want to exclude those who have dropped out and no longer hold crypto;

· The second method is more crude, analyzing the number of violent incidents per unit of market capitalization to derive a rough measure of the "probability of theft per dollar."

After standardizing the above data, you will see completely different conclusions: the blue line represents the number of violent incidents per Coinbase user; the green line represents the number of violent incidents per dollar of wealth.

This set of data indicates that the most dangerous periods for holding crypto were actually in 2015 and 2018. Indeed, while the number of attack incidents was far lower than now, at the same time, the number of cryptocurrency holders was also much smaller.

From 2015 to 2025, the number of monthly active users on Coinbase grew from 2 million to 120 million, a 60-fold increase, but violent incidents did not grow proportionally.

Of course, in recent years, the number of violent incidents per user has indeed increased, but the increase has been relatively moderate, roughly equivalent to the violence levels of 2021, and significantly lower than the levels before 2019. Meanwhile, the incidence of violent events per dollar of wealth has changed very little.

We must also consider the alternative hypothesis of "news reporting bias"—whether incidents are simply easier to report now—but this is beyond the scope of this analysis.

Overall, the number of violent incidents is indeed increasing, and the methods of attack are becoming more violent, but this can be partially attributed to the "population effect," meaning that there are now more people holding cryptocurrencies, so the risk faced by individual users has not increased as dramatically as it appears.

But ultimately, this is not just an academic discussion. This is a serious, real issue.

If you belong to a high-risk group, there are many ways to improve your personal safety. Here are some standard offline safety tips:

· Try to live in safe cities, preferably in residences with 24/7 security;

· Do not wear cryptocurrency-related clothing or anything that clearly indicates you hold crypto assets in public;

· Use services like DeleteMe to remove your personal information from data brokers;

· Apply for a PO Box to have all business mail sent there, avoiding widespread dissemination of your address;

· Prepare a hot wallet with a sum of "money that can be given away," completely isolated from your actual cold storage assets;

· Diversify your funds: use multiple services, platforms, and devices to store assets, so that in the worst-case scenario, you do not lose everything at once;

· Unless necessary, do not publicly broadcast your exact location in real-time, especially during cryptocurrency conferences;

· If you truly belong to a very high-risk group or are about to travel to high-risk areas, consider hiring private security—this can be much more useful than you might think in certain regions.

2026 has arrived, and with the year-end approaching and the long holiday coming, please be sure to pay attention to safety.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。