Original | Odaily Planet Daily (@OdailyChina)

The year 2025 marks a significant breakthrough in the regulatory framework of the cryptocurrency market, as it gradually moves away from chaotic growth and aligns more closely with mainstream financial systems. In terms of scale, the total market value of global crypto assets has reached $3.2 trillion, and the trading volume of stablecoins has exceeded $50 trillion, far surpassing traditional payment giants like Visa and PayPal. Behind these numbers are two core legislative advancements.

First, the stablecoin-related legislation has officially been enacted. The legislation clarifies the issuing entities, reserve requirements, and regulatory mechanisms, providing a clear legal positioning for "on-chain dollars." This not only reduces the policy uncertainty surrounding stablecoin operations but also directly stimulates investment and financing activities in the stablecoin, payment, and settlement sectors. Secondly, the cryptocurrency market structure legislation is also progressing steadily, incorporating crypto assets into a classified regulatory framework to avoid a "one-size-fits-all" approach, thus providing predictable compliance pathways for project teams and investors.

The combination of these two legislative advancements will, to some extent, reshape the primary market's assessment of risk and return.

However, contrasting with the improvement in the regulatory environment, the secondary market in 2025 has not provided a strong response. Bitcoin's price has been highly volatile, and altcoins have shown weak performance. In this context, the primary market has not exhibited the same level of enthusiasm as in the previous bull market, instead showing a prudent active stance, with significant changes in financing rhythm and preferences.

Four-Year "Cycle" Review: Divergence in Financing Quantity and Amount

Looking back at the trends in crypto financing over the past four years, we can clearly see the evolution of the relationship between the primary and secondary markets.

At the beginning of 2022, benefiting from the residual heat of the bull market, both the number and amount of financing events were high; subsequently, as Bitcoin entered a downward cycle, financing activities gradually shrank. Between 2022 and 2023, investment and financing activities were highly correlated with price trends, remaining overall sluggish under the pressure of the bear market.

2024 became an important turning point, marking the first divergence between financing amounts and quantities.

That year, with the narrative of Bitcoin halving being reignited, the number of financing events showed a clear recovery, but the amount of financing remained restrained. Quarterly financing scales hovered between $1.8 billion and $2.8 billion, not significantly different from the bear market period. The main reason for this is that during this period, the crypto market was dominated by Bitcoin and the meme sector, contrasting sharply with the previous cycle's performance. In the last cycle, VC projects were typically at the core of market hotspots, while in 2024, VC projects overall performed poorly, failing to exert substantial influence on the market, which to some extent suppressed the emergence of large-scale financing.

Entering 2025, the divergence phenomenon reappeared, but this time the direction reversed.

The number of financings has significantly declined, but the amount of financing has risen again. Quarterly financing scales have rebounded to the range of $3.7 billion to $5.1 billion. This indicates that the scale of individual financings has significantly increased, with investors actively reducing the number of transactions and instead concentrating their bets on a few projects deemed to have certainty and growth potential.

12 Tracks, $17.89 Billion: Structural Changes in the Primary Market

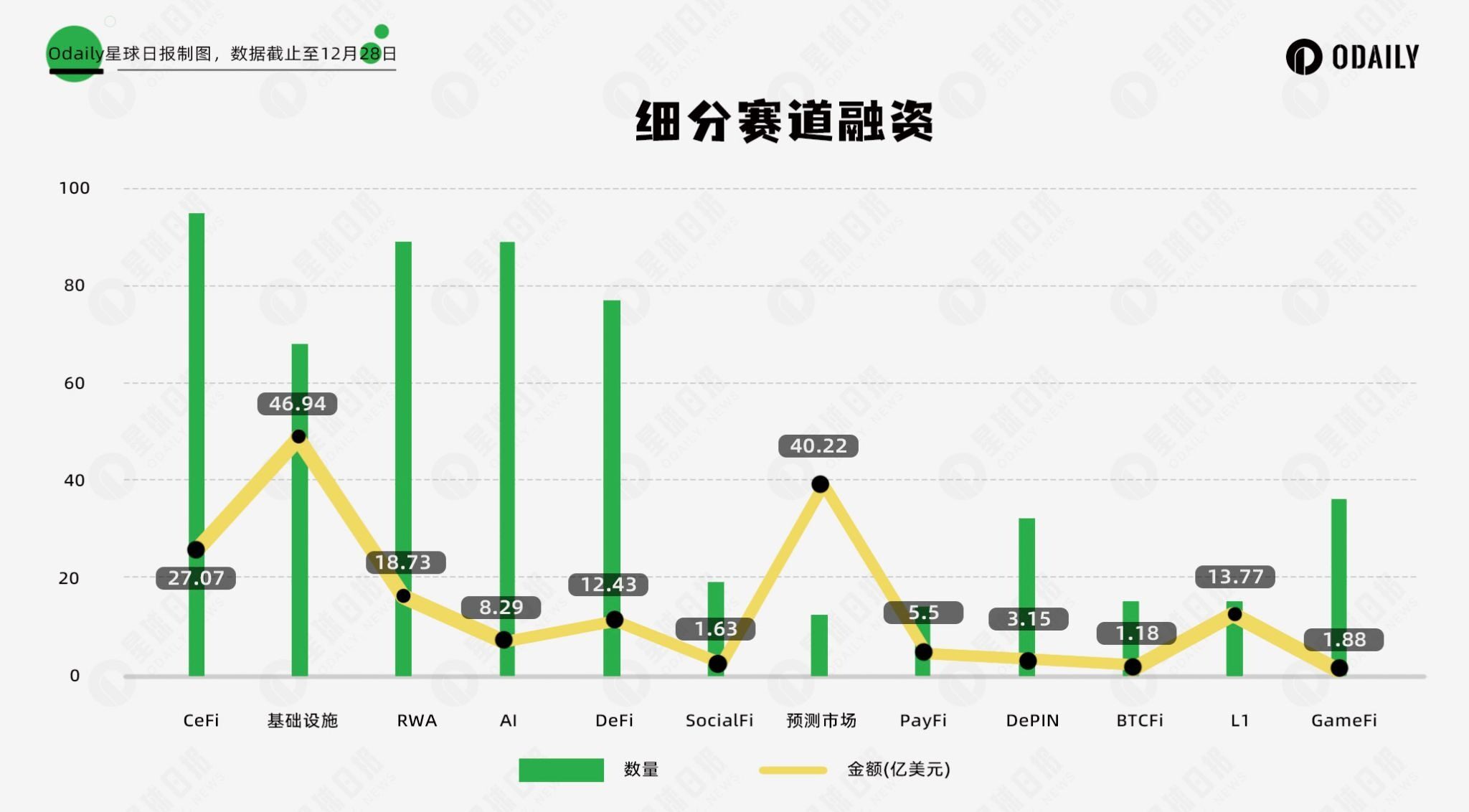

According to incomplete statistics from Odaily Planet Daily, the total amount of investment and financing in the primary market in 2025 reached $17.89 billion, with a total of 569 financing events. To more accurately depict the changes in financing preferences, we categorized all disclosed financing projects (with actual close times often earlier than announcements) into 12 tracks based on business type, target audience, and business model, including: CeFi, infrastructure, RWA, AI, DeFi, SocialFi, prediction markets, PayFi, DePIN, BTCFi, L1, and GameFi.

From the financing situation of the segmented tracks:

- CeFi and infrastructure rank at the forefront in both financing amount and quantity. Core capabilities such as trading, custody, clearing, security, and cross-chain remain key areas of continuous capital investment, and the consensus on "infrastructure first" has not wavered.

- DeFi projects continue to maintain a high level of activity, with strong market demand for innovative DeFi protocols, especially the success of Hyperliquid directly proving that decentralized exchanges can effectively accommodate large-scale capital inflows, making perp DEX a new financing hotspot.

- AI and RWA have become new narrative focal points. The former aligns with the main line of the global technology cycle, while the latter directly benefits from the institutional dividends of traditional financial assets being brought on-chain. Both paths share a common characteristic: the growth logic no longer solely relies on the crypto-native market but extends into broader technology and traditional financial systems.

- A true standout has emerged from the prediction markets. Although the number of projects in this track is not particularly prominent, the financing amount has surged to become the second-largest track after infrastructure. This indicates that funds are highly concentrated on a few leading projects.

- In contrast, once-popular tracks like DePIN and GameFi still have several projects emerging, but their financing attractiveness has sharply declined, with funds shifting towards areas with greater certainty and scale effects.

Overall, the primary market is shifting from a "broad net" approach to "precision farming."

Polymarket: The Consensus Shift Behind the Top Financing in 2025

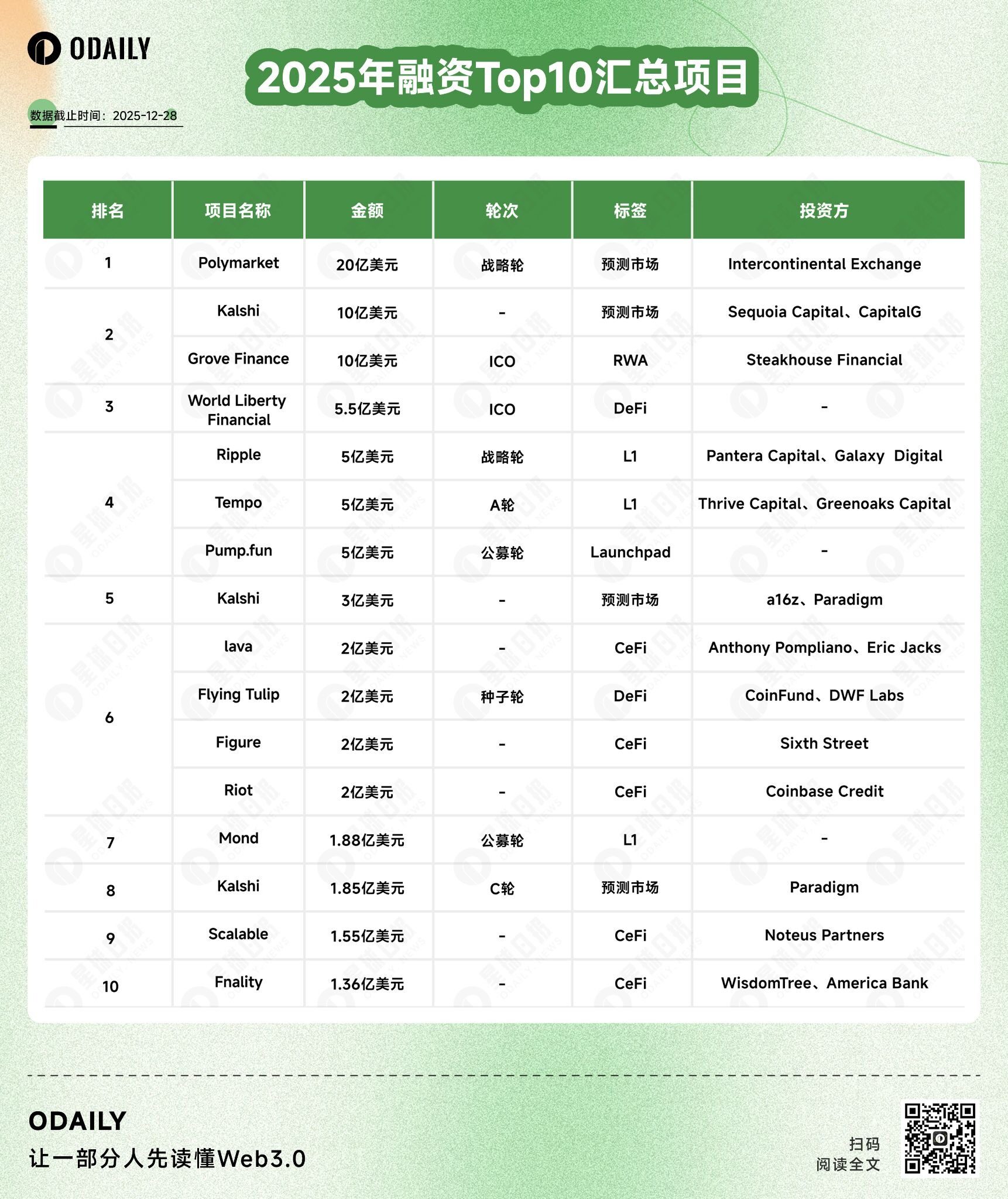

From the list of the top 10 financing amounts in 2025, it is evident that Polymarket and Kalshi almost constitute the entire narrative of financing in 2025.

Polymarket has cumulatively completed nearly $2.5 billion in multiple rounds of financing, with investors including well-known crypto venture capital funds like Polychain, Dragonfly, and Coinbase; Kalshi, on the other hand, began to ramp up in 2025, completing approximately $1.5 billion in financing, supported by Paradigm, a16z, and Coinbase. Unlike Polymarket, Kalshi emphasizes federal regulatory compliance. However, both share the view that prediction markets are seen as a financial form with real demand, currently becoming the most vibrant and positively trending track.

In the L1 track, funding preferences also continue. In the list, apart from the established public chain Ripple, other projects like Tempo and Mond are new-generation projects. Mond has issued tokens, while Tempo has yet to issue tokens. This reflects investors' ongoing investment in underlying infrastructure, with high-performance L1 still viewed as a long-term cornerstone for ecological expansion.

Conclusion

Overall, the primary market in 2025 has not cooled down but is instead actively converging and restructuring.

Funds are still flowing, but they are no longer chasing quantity; instead, they are being concentrated around certainty, compliance, and scale potential. This change does not necessarily mean fewer opportunities; rather, it may indicate that the crypto market is entering a more rational and mature stage.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。