Written by: Charlie.hl

Translated by: Block unicorn

Why should I hold stocks on-chain when I already have IBKR (the stock code for Interactive Brokers LLC, a well-known U.S. online brokerage that offers trading in various assets such as stocks, options, futures, and forex)? Why mix my stock holdings with my crypto asset holdings?

These are reasonable questions, and I believe the answers will become clearer over the next year. In this article, I will outline my views on the direction of on-chain spot stocks, particularly in light of two recent developments:

A substantial improvement in the regulatory environment, and

The emergence of faster and cheaper large-scale blockchains, making the minting, transfer, and use of on-chain stocks increasingly feasible.

The Analogy of Stablecoins

Stablecoins have become the most compelling example of bringing traditional off-chain assets onto the blockchain. Most stablecoins are used to access the U.S. dollar on-chain (although other currencies, such as EURC, are also becoming increasingly important), and their early adoption was driven by a specific user group: those already operating on-chain. For these users, stablecoins addressed an urgent need. They made trading between crypto assets more convenient, allowed for the storage of earnings without offshore payments, and simplified peer-to-peer payments. Over time, more advantages emerged, such as earning yields through stablecoin lending and products that pass underlying government bond yields to users, creating higher-yield savings accounts.

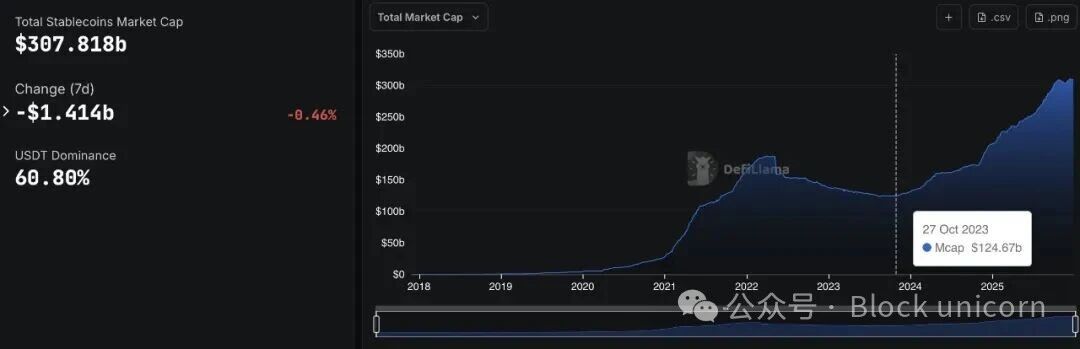

The recent change is that stablecoins are no longer just native tools in the cryptocurrency space. They are increasingly recognized as a more efficient, cost-effective, and scalable global dollar transfer mechanism. This shift has driven significant growth in the supply of stablecoins. In 2021, the total market capitalization of stablecoins was approximately $26 billion. In just the past year, its supply has grown from about $190 billion to over $300 billion, increasing more than tenfold in less than five years.

Growth of Circulating Stablecoins - Defillama

This growth has spawned new business models like Rain Cards, Felix Pago, and OpenFX, which leverage stablecoin platforms but do not position themselves as "cryptocurrency" products. In many cases, the abstraction layer of the blockchain is invisible to the end user.

Stablecoins provide a better, faster, and cheaper way to transfer and store dollars. But what does this have to do with stocks?

Two Key Differences of On-Chain Spot Stocks

The investment thesis for on-chain spot stocks is similar to that of stablecoins, but there are two key differences.

First, the growth of on-chain spot stocks is closely tied to the growth of stablecoins. As more individuals and institutions begin to hold their preferred currency (primarily the U.S. dollar) on-chain, it becomes increasingly natural to make more asset purchases on-chain. We are already seeing this phenomenon today: the users most likely to purchase crypto-native assets are also those holding stablecoins. Bringing the unit of account on-chain will inevitably pull investment activities onto the chain as well.

If stablecoins were to fail (which I believe is unlikely), the potential market size (TAM) for on-chain spot stocks would also be significantly reduced. (Unless there is a broader collapse of the underlying fiat currency, in which case the overall value of stocks may still exist, and the adoption of on-chain trading may continue to accelerate, but this falls into the realm of black swan events, which is beyond the scope of this article.)

Second, on-chain spot stocks not only provide convenience but also unlock new utility value. Their value proposition is not limited to faster settlement speeds or global accessibility. On-chain stocks can enable functionalities that most traditional brokerage users cannot truly benefit from, particularly in the areas of lending.

In terms of lending, securities lending is already a massive business, but most of the economic benefits flow to intermediaries rather than end users. For example, Robinhood's Q3 2025 earnings report showed that net interest income grew 66% year-over-year to $456 million, primarily due to interest-earning assets and securities lending. However, eligible users can receive at most 15% of the income generated from lending securities on the Robinhood platform. For reference, this is similar to Felix protocol taking $85 from every $100 of interest charged to borrowers—an extremely high commission rate.

Another example is Interactive Brokers, which generated approximately $314 million in revenue from securities lending in Q3 2025, but most of that revenue was also not distributed to users. On Felix, enabling users to capture this portion of revenue is very simple; they just need to set up a Felix vault on Felix Vanilla, allowing users to lend tokens like HOOD, which other users can borrow at any time without permission.

Lending against stocks follows a similar pattern. On traditional brokerage platforms, margin trading requires applications, approvals, strict loan-to-value (LTV) ratios, and is often limited to margin trading only. However, on-chain, lending against approved collateral does not require permission (but must comply with sanctions), allowing borrowers to freely use the borrowed funds.

Securities lending and mortgage lending are both large and mature markets. On-chain trading makes them cheaper, faster, and easier to access.

Open Access?

Regarding spot stock trading, it is important to clarify that bringing spot stocks on-chain is not primarily aimed at popularizing the U.S. stock market; most individuals in developed economies can already open brokerage accounts and access this trading opportunity. The goal is to meet the growing demand for capital: to trade on-chain.

As capital continues to flow on-chain, spot stocks provide a more convenient way to buy, hold, and use stocks. On-chain spot stocks are a natural extension of the same forces that drive the adoption of stablecoins, which are now also being applied to the stock market.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。