Introduction

On December 30, 2025, the TGE of Lighter once again brought the Perp DEX track into the spotlight, marking the end of the competition for on-chain perpetual contracts in 2025: at the beginning of the year, Hyperliquid dominated with over 70% market share; in the second half of the year, with the rise of new Perp DEXs like Aster, Lighter, and EdgeX, each with unique features, Hyperliquid's market share dropped to around 20%, entering a new phase of comprehensive competition involving technology, capital, incentives, and real demand.

This article will analyze the background and development process of the rise of the Perp DEX track, the market landscape and key data performance in 2025, and provide a comprehensive analysis of five representative Perp DEX protocols: Hyperliquid, Aster, Lighter, EdgeX, and Paradex. The analysis will cover various dimensions such as background teams, technical architecture and functions, token economics, market data, and performance. Furthermore, it will explore the potential risks and opportunities in the track and forecast trends for 2026.

1. Background and Development of Perp DEX

The early on-chain derivatives market was quite small. Centralized exchanges (CEX) long dominated derivatives trading, providing excellent user experience, deep liquidity, and one-stop services. However, their centralization also posed risks: the industry turmoil from 2022 to 2023, especially the collapse of giants like FTX, made users increasingly aware of custodial risks and the dangers of opaque operations, prompting funds and traders to seek decentralized alternatives, laying the demand foundation for the explosion of the Perp DEX track.

However, performance bottlenecks have always been a limiting factor in the development of on-chain perpetual contracts: on-chain matching and settlement are often constrained by blockchain throughput and latency, leading to high slippage and insufficient depth. To overcome this, early projects explored various paths: for example, dYdX utilized an order book but relied on off-chain matching (now migrated to an independent chain), while GMX adopted an on-chain multi-asset pool market-making model, providing perpetual trading but with liquidity constrained by pool size. Although these pioneers proved the feasibility of on-chain perpetuals, they failed to truly shake the dominance of CEX in terms of trading experience and scale.

In recent years, the development of Ethereum Layer 2 and application chains has provided a foundation for high-performance contract exchanges, elevating latency and throughput to unprecedented levels. Hyperliquid created an independent Layer 1 public chain specifically designed for derivatives, while EdgeX, Paradex, and others leveraged Layer 2 technologies like StarkWare to achieve sub-second on-chain trading experiences. Coupled with incentive mechanisms such as trading mining and airdrop points to attract users,

the Perp DEX track entered a period of rapid iteration in 2024-25. In 2024, Hyperliquid first gained popularity, with its HYPE token airdrop and buyback plan driving a surge in locked positions and trading volume, temporarily capturing 80% of the on-chain perpetual market. In 2025, as multiple new platforms launched and adopted aggressive market strategies, Hyperliquid's monopoly in the Perp DEX track was broken, officially entering a phase of competition among various players.

2. Current Status and Data Performance of the Track in 2025

In 2025, the overall scale of on-chain perpetual contract trading achieved a significant leap. Monthly perpetual contract trading volume exceeded $1 trillion, rapidly increasing its share of the crypto derivatives market, with on-chain perpetual contract trading volume at one point accounting for 1/10 of centralized exchanges, beginning to pose a substantial challenge to centralized giants. Notably, during the extreme market conditions on October 11, on-chain DEXs managed to handle $19 billion in position liquidations while maintaining overall stability. These data indicate that Perp DEX has grown from a niche experimental field to an indispensable component of the derivatives market.

Source: https://coinmarketcap.com/charts/derivatives-market/

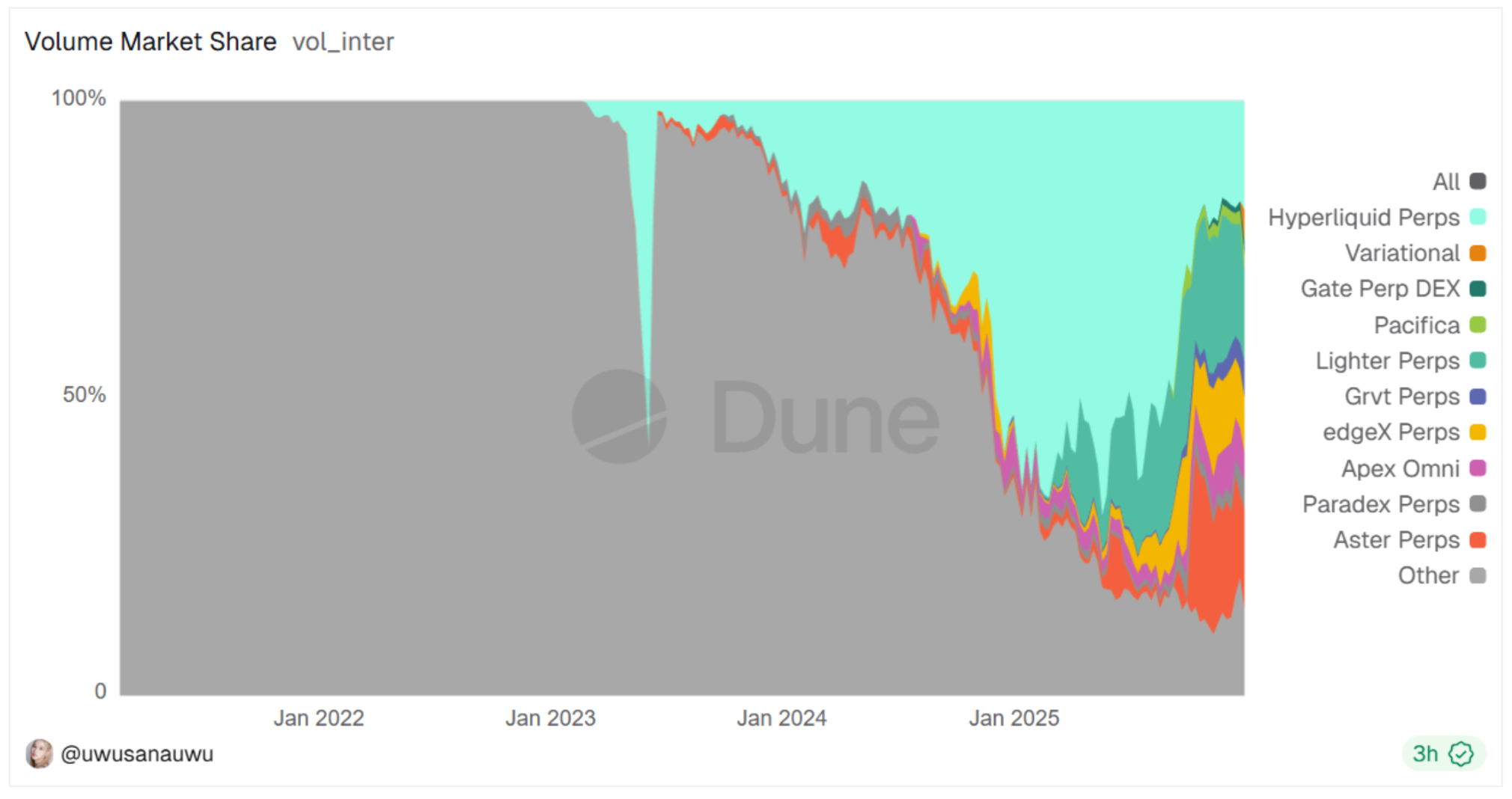

In terms of market landscape, Hyperliquid maintained its leading position in the first half of the year, accounting for about 70% of on-chain perpetual trading volume. However, in the second half of the year, as new entrants emerged, its share continuously declined. According to analysis data from Dune, by the end of December, Hyperliquid's trading volume had dropped to 17% of the total network share. In its place emerged a new competitive landscape: Lighter quickly attracted a large number of high-frequency traders with its zero-fee strategy, achieving a traffic share of 20% in December; Aster gained a 15% market share through continuous incentives and support from Binance; the robust and professional EdgeX captured about 10% of the share. Additionally, newcomers like Paradex, GRVT, and Pacifica divided the remaining share, further weakening the dominance of the leader. It can be said that in the second half of 2025, the competition among new and old platforms in the Perp DEX track around users and liquidity entered a heated phase.

Source: https://dune.com/uwusanauwu/perps

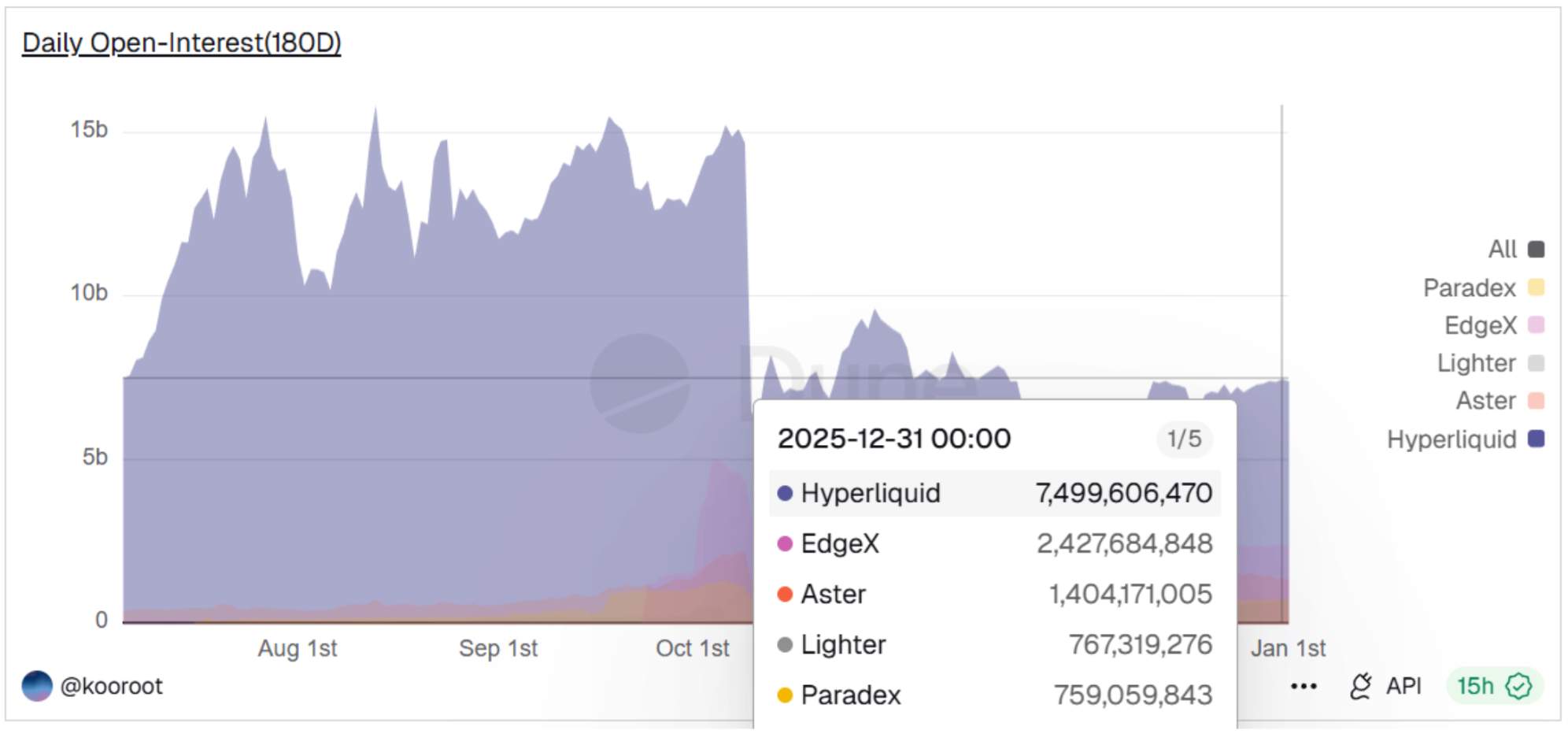

However, looking at the Open Interest (OI) indicator, data as of the end of December indicates that Hyperliquid remains the undisputed leader in OI, with an open interest scale of about $7.5 billion, accounting for 49% of the total OI across the four major platforms, indicating that nearly half of the real positions on-chain still reside in Hyperliquid. This shows that Hyperliquid still holds a structural leading position in trading depth and capital retention, while the substantial trading volume of newcomers like Aster and Lighter is largely driven by incentives and frequent wash trading, rather than long-term capital investment.

Source: https://dune.com/kooroot/top5-perpdex-comparison

In terms of revenue and profitability, the differentiation within the track is also evident. Many new platforms adopt zero-fee or significant rebate strategies, making real fee income a better reflection of their "self-sustaining" capabilities. Aside from Hyperliquid, EdgeX is one of the few projects that have achieved sustainable high revenue: its monthly fee income exceeded $20 million, annualizing to about $250 million, second only to Hyperliquid. Paradex, Extended, and other platforms also show certain revenue potential. In contrast, platforms like Lighter, which adopt a zero-fee strategy to capture market share, have almost no fee income; while their short-term trading volume may peak, their protocol revenue is zero, and their profitability model remains to be validated post-airdrop. It is evident that some new platforms are exchanging capital for market share, and whether they can truly establish commercial sustainability remains in question.

3. Overview of Representative Perp DEX Protocols

Based on trading volume and open interest rankings, the current top 5 protocols in the Perp DEX track include Hyperliquid, Aster, Lighter, EdgeX, and Paradex. Below, we will analyze the performance of these five representative Perp DEX protocols from various dimensions such as background teams, technical architecture and functions, token economics, market data, and performance.

1. Hyperliquid — The King of On-Chain Derivatives

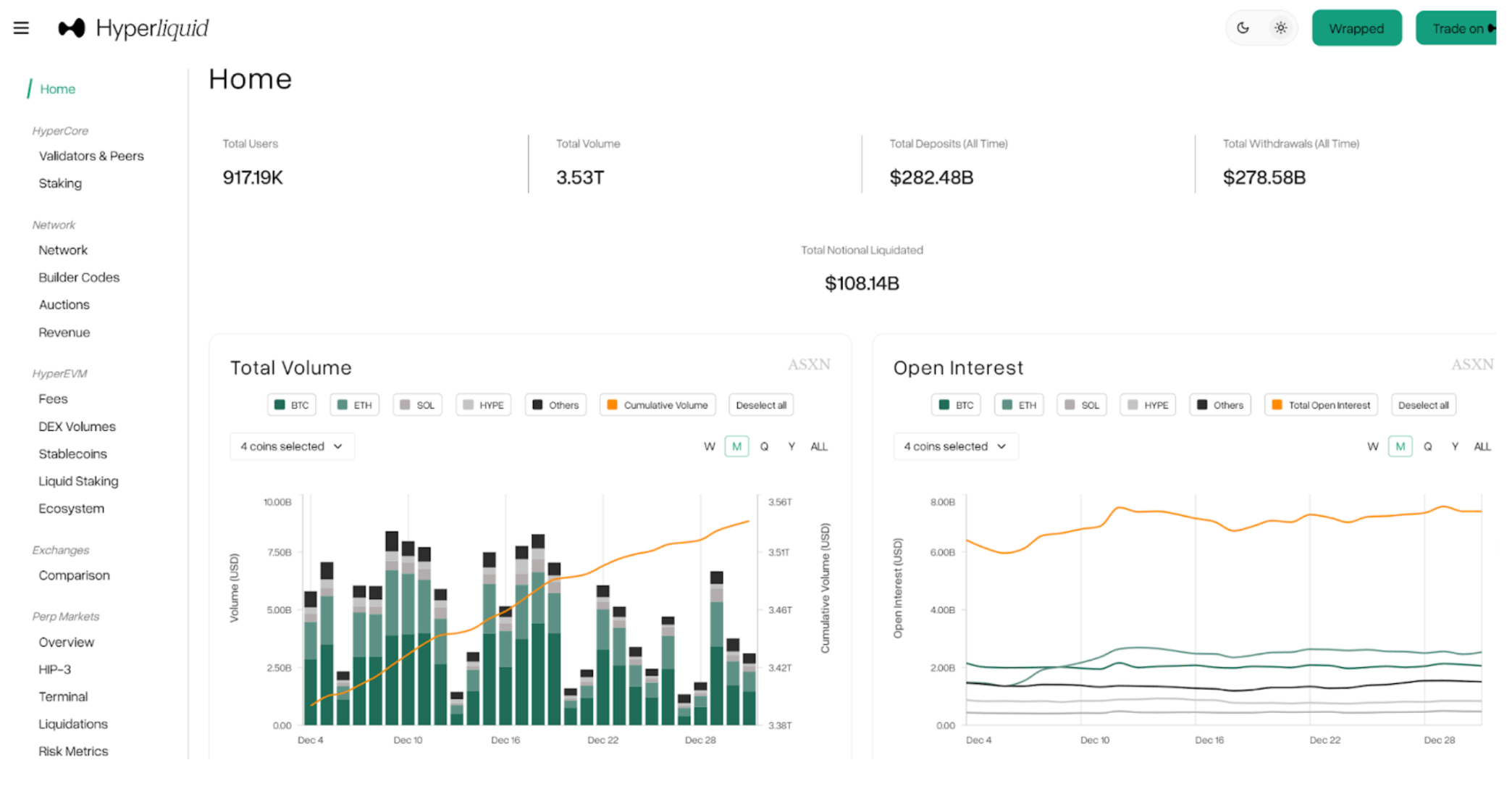

Source: https://wrapped.hyperscreener.asxn.xyz/summary

Background and Team: Hyperliquid was founded in 2023 by Jeff Yan, with an initial team of only 11 people, yet it built an on-chain "phenomenal" derivatives platform in less than two years. Hyperliquid is entirely self-funded and adheres to a community-driven approach. This self-reliant development model is rare in the crypto space but has earned Hyperliquid a reputation for being "decentralization-native." The project did not engage in much market hype when it launched in July 2023, gradually entering the public eye in 2024 through large-scale airdrops and impressive data.

Product Features and Technology: Hyperliquid's biggest differentiation lies in its self-developed dedicated blockchain, theoretically capable of achieving 200,000 transactions per second with sub-second order confirmation delays. Hyperliquid deploys all core modules such as central limit order book (CLOB) matching and settlement on this high-performance chain, allowing users to experience an interface and matching efficiency similar to Binance, while the underlying settlement is completely decentralized and does not require KYC. Additionally, Hyperliquid plans to launch a general-purpose smart contract platform, HyperEVM, to support more applications. The officially promoted HLP treasury plays a market-making role for the platform: participating as a counterparty in a large number of trades and earning a portion of the fees, funding costs, and liquidation profits, with a current TVL exceeding $390 million. This model effectively enhances platform liquidity and user stickiness, creating a win-win cycle between retail and market-making funds.

Token Economics and Incentives: Hyperliquid's governance token HYPE was launched via airdrop in early 2024, with a distribution heavily tilted towards the community, allocating 70% of the tokens to the community (through airdrops, mining, etc.). The platform also committed to using all fee income for buybacks and burning HYPE, directly converting protocol growth into token value support. This model allowed HYPE's market capitalization to rapidly expand after its launch, reaching approximately $8.2 billion by the end of 2025, ranking 15th among cryptocurrencies.

Data and Performance: Although Hyperliquid faced challenges in trading volume share in the second half of 2025, it still maintained a leading position in key quality indicators. The platform's 24-hour trading volume consistently ranged between $3 billion and $10 billion; its open interest has long occupied more than half of the total on-chain. In terms of trading depth and liquidity, Hyperliquid's BTC perpetual contracts can accommodate approximately $5 million positions within a ±0.01% price difference. Regarding stability, Hyperliquid has not experienced any major technical incidents to date, even during the peak liquidation period in October, it did not face downtime. Overall, Hyperliquid demonstrated profound dominance in 2025: despite being surpassed in trading volume by newcomers, its solid technology, genuine liquidity, and healthy economic model kept its kingly status unshakable.

2. Aster — The Surging Dark Horse and Trust Crisis

Source: https://www.asterdex.com/

Background and Team: Aster is a multi-chain perpetual contract exchange that launched in early 2025, formed from the merger of Asterus and APX Finance. YZi Labs provided early support, and CZ has repeatedly promoted Aster on social media. This gave Aster an inherent advantage from its inception. Its goal is to create a high-speed derivatives platform supporting multi-chain deployments on BNB Chain, Ethereum, Arbitrum, Solana, etc., allowing users to trade different on-chain assets without cumbersome cross-chain processes.

Product Features and Technology: Aster indeed has notable features. Firstly, its multi-chain deployment: it provides trading ports on BNB Chain, Ethereum, Arbitrum, and Solana, allowing users to trade across chains through a unified account without complicated chain transfers. Secondly, Aster offers an astonishing leverage of up to 1001 times and advanced features like hidden orders to meet the needs of high-risk preference traders. Additionally, its planned Aster Chain is a dedicated chain based on zero-knowledge proofs, enhancing transaction privacy and efficiency. Aster also allows users to earn yields on some collateral assets, and margin positions can earn interest, improving capital efficiency.

Token Economics and Incentives: The total supply of the ASTER token is 8 billion, with a high airdrop ratio of 53.5%, 30% for the ecosystem and community, and 5% for the team. The original design included monthly ecosystem unlocks, leading to a continuously increasing circulation that created ongoing selling pressure. In October, the Aster team announced changes to the token economics, delaying a large number of tokens originally scheduled for unlocking in 2025 to the summer of 2026 or even 2035, but the market seemed unresponsive. Currently, the ASTER token price fluctuates around $0.7, significantly down from its peak.

Data Performance and Controversy: In September 2025, Aster launched its mainnet and the ASTER token. Its token price skyrocketed from the issuance price of $0.08 to $2.42 within a week, an increase of 2800%. The platform's daily trading volume also surged to $70 billion in a short time. From late September to early October, Aster briefly captured over 50% of the market share due to frenzied trading activity, becoming a true dark horse. Many investors viewed Aster as the next Hyperliquid, hoping it would replicate the latter's success. However, on October 5, the authoritative data aggregation platform DeFiLlama announced the removal of Aster's data, citing "discovery of its trading volume being almost perfectly synchronized with Binance, indicating serious anomalies." Additionally, Aster refused to provide backend trading data to DeFiLlama to prove its innocence. On-chain tracking revealed that 96% of ASTER tokens were concentrated in six wallets, with a trading volume/OI ratio as high as 58, clearly resulting from frequent wash trading. After this news broke, the ASTER token price plummeted over 10% in a single day, raising questions about its brand credibility.

3. Lighter — The Zero-Fee Technical Disruptor

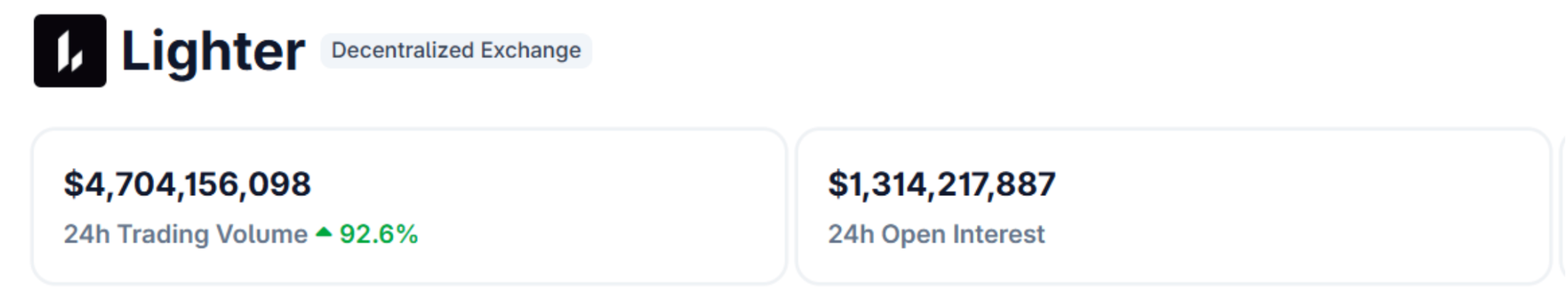

Source: https://www.coingecko.com/en/exchanges/lighter

Background and Financing: Lighter is a dark horse that entered the on-chain perpetual track in 2025. The core team was created by former engineers from Citadel hedge fund, backed by top-tier investment institutions such as Peter Thiel, a16z, and Lightspeed, raising $68 million in seed funding, with a post-investment valuation of $1.5 billion. This strong capital backing provided Lighter with ample development resources from the outset. Lighter officially launched on October 2, 2025, with the name "Lighter" symbolizing a "lighter and faster trading experience," reflecting the team's technical strength and ambition.

Product Features and Technology: Lighter chose to build on ZK Rollup, fully leveraging the security of the Ethereum mainnet while achieving scalability through Layer 2. A key technical highlight is that each transaction uses zero-knowledge proofs for encrypted verification, ensuring the privacy and validity of transaction data. The solution provided by StarkWare is used to accelerate proof generation, allowing the platform to achieve high-frequency matching while ensuring security. Additionally, Lighter has designed a unique "escape pod" mechanism: if the L2 platform itself fails, users can use pre-deployed smart contracts to withdraw funds from Layer 2 back to the mainnet, avoiding prolonged fund entrapment. Overall, Lighter's choice of technical route is quite bold, aiming for a significant leap in performance while uncompromising on security and decentralization.

Token Economics and Incentives: The token $LIT had its TGE on December 30, 2025, with 50% allocated to the ecosystem (of which 25% was directly airdropped, redeemable at a 1:20 ratio), and the other 50% allocated to the team and investors (with vesting lock periods). Protocol revenue will be used to buy back LIT or for ecosystem incentives, aiming to align community and project interests in the long term. As of January 3, 2026, the latest price is $2.50, with a circulating market cap of $650 million and an FDV of $2.6 billion.

Market Performance and Controversy: Lighter employs an aggressive zero-fee strategy to attract users, with trading fees set at 0% for both limit and market orders, with all protocol revenue coming from HFT and market makers. The results show that Lighter's zero-fee model has indeed been effective; within just a few weeks of launch, the user count surged to over 56,000, with daily trading volume stabilizing between $7 billion and $8 billion. A large influx of arbitrageurs and quantitative teams flooded in to boost trading volume, making it the top on-chain DEX by volume. However, Lighter's Vol/OI ratio once exceeded 8, indicating that most funds were being frequently cycled in and out rather than held long-term. Once the airdrop ends, this speculative flow may quickly recede. The highly aggressive expansion also tested Lighter's system stability. In mid-October, the platform experienced downtime for about 4 hours, during which users were unable to place orders or withdraw funds, resulting in approximately 10% losses in Lighter's LLP fund pool, exposing shortcomings in system stability and risk control under extreme market conditions. Additionally, the platform experienced UI lag and minor bug feedback during peak times, which somewhat affected user experience.

4. EdgeX — An Institution-Level Robust Exchange

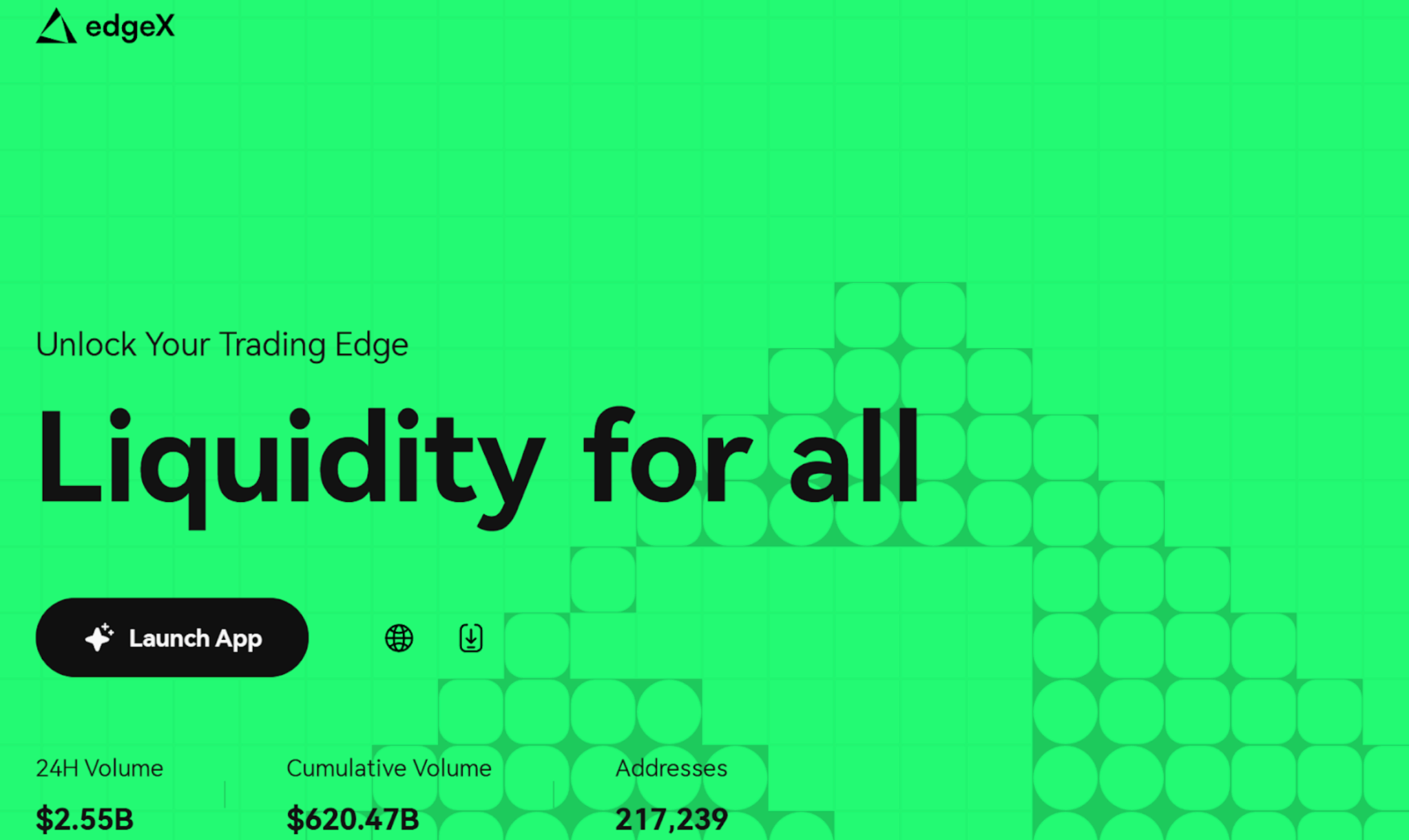

Source: https://www.edgex.exchange/

Background and Team: EdgeX is a specialized perpetual contract platform incubated by Amber Group, a leading crypto financial institution in Asia, launched in September 2024. EdgeX carries the genes of TradFi, built by a team of experts proficient in institutional services. Amber Group, managing around $5 billion, not only provided seed funding but also injected deep liquidity support and market operation capabilities into EdgeX, drawing attention from the institutional circle and Asian market right from its launch.

Product Features and Technology: EdgeX is built on StarkWare's StarkEx engine, adopting a hybrid model of centralized matching and decentralized settlement: order matching is executed on StarkEx, while trading results are packaged on-chain. EdgeX emphasizes low fees and deep liquidity, with its fee rates slightly lower than Hyperliquid: limit orders at 0.012% (HL at 0.015%), and market orders at 0.038% (HL at 0.045%). In terms of liquidity, thanks to Amber Group's support, the depth and spreads on EdgeX are exceptionally good. Data shows that within a ±0.01% range, EdgeX's BTC perpetual can accommodate $6 million positions (better than HL's $5 million), and the slippage for various mainstream trading pairs is generally lower than that of competitors. Additionally, EdgeX places great importance on mobile experience: the official app for iOS/Android integrates MPC wallet technology, allowing users to operate without memorizing seed phrases, significantly lowering the entry barrier.

Token Economics and Incentives: EdgeX has not yet issued its platform token EGX. To compensate for the lack of a token, EdgeX has designed a trading points reward mechanism, which is relatively transparent and restrained. The sources of points are clearly allocated: 60% from trading volume, 20% from referrals, 10% from TVL/LP, and 10% from liquidations/OI, with a public statement that it will never reward wash trading. Users have a rational expectation for the future EGX token. The community predicts that EdgeX will allocate about 20-35% of tokens to points holders during the TGE.

Market Data and Performance: EdgeX's performance in 2025 can be described as "steady with an upward trend." According to CoinGecko data, EdgeX has a 24-hour trading volume of approximately $2.5 billion and an OI of about $1.3 billion, ranking fourth among Perp DEX platforms. Although its market share in trading volume is only 5-6%, EdgeX's annual revenue is about $500 million, second only to Hyperliquid. In summary, EdgeX excels in stability and professionalism, performing well across various aspects but lacking any absolute standout features. With a later token issuance, how it attracts attention after missing the airdrop frenzy remains to be seen in the market.

5. Paradex — A Full-Featured On-Chain Derivatives "Super DEX"

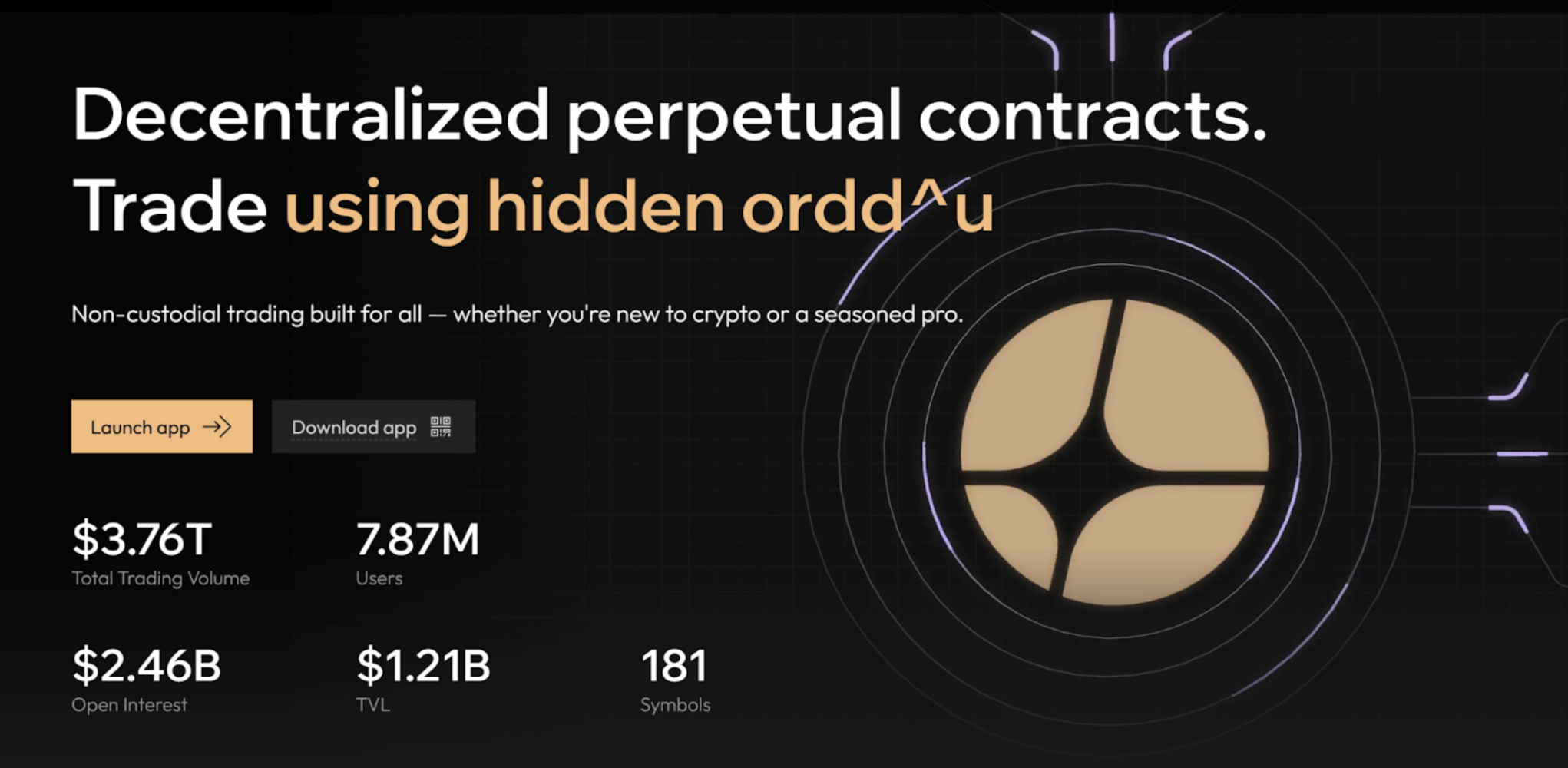

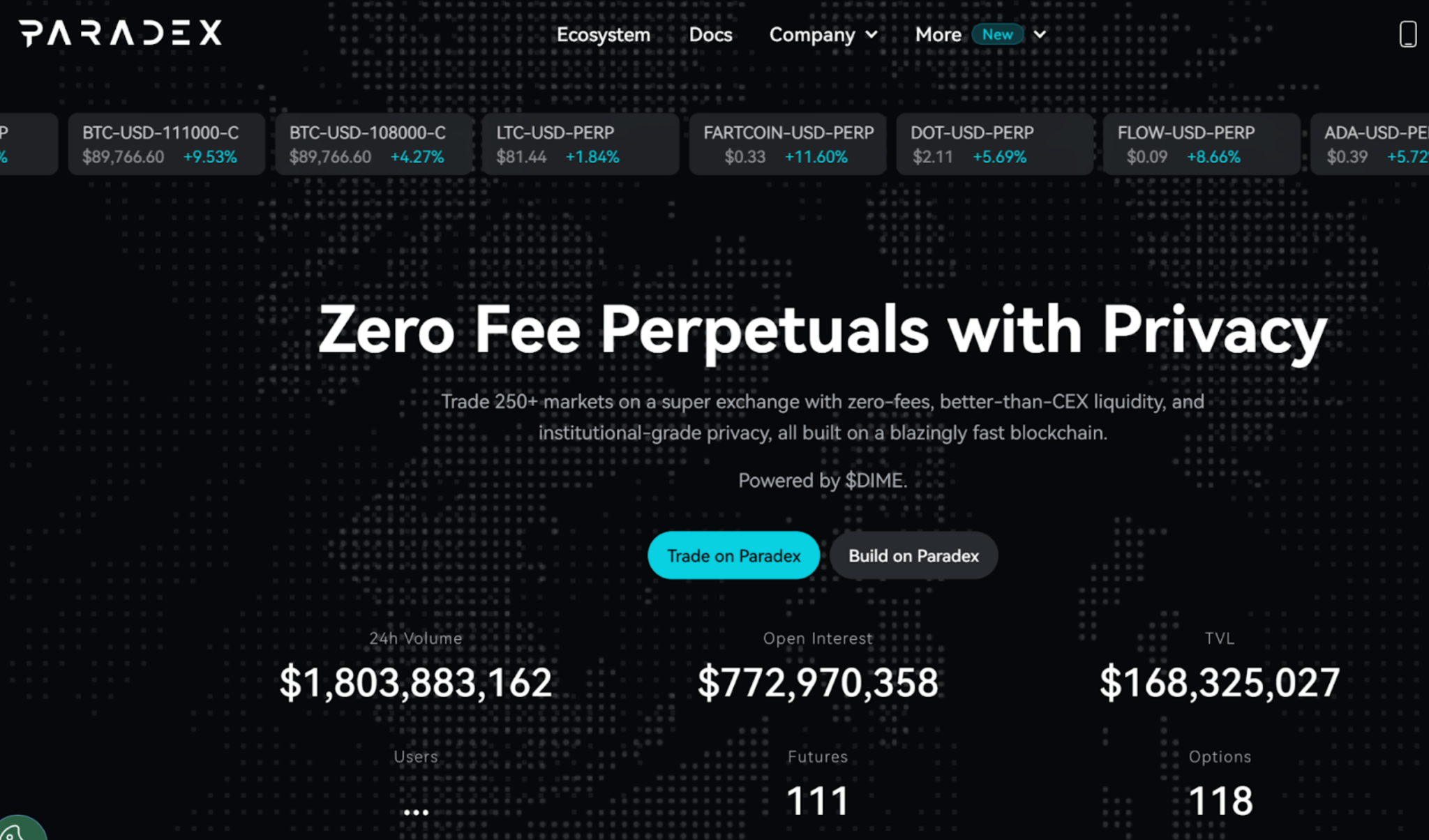

Source: https://www.paradex.trade/

Background and Team: Paradex was incubated by the crypto institutional trading network Paradigm. Established in 2019, it focuses on serving hedge funds, market makers, and other institutions, initially providing over-the-counter options matching services, once capturing 30% of the global crypto options market. In early 2025, Paradex launched its testing phase, gradually opening public access by mid-year, positioning itself as a high-performance decentralized trading and asset management platform.

Product Features and Technology: Paradex has built a dedicated Ethereum Layer 2 blockchain, Paradex Network, based on the Starknet framework, allowing for highly customizable on-chain parameters. Trading on the Paradex web platform is fee-free for all markets except BTC/ETH, and professional users accessing via API are charged only a 0.02% taker fee, with no maker fee. Paradex also plans to launch various products in the future, including perpetual futures, perpetual options, and spot trading, with all transactions settled through a unified account, supporting isolated, cross-margin, and even combined margin modes. Paradex has also embedded a series of DeFi asset management features, allowing direct lending within the same account to enhance capital efficiency. Additionally, Paradex may introduce privacy trading modes in the future to meet the needs of some institutional users who prefer not to disclose their positions. In summary, while other perpetual DEXs compete on incentives and performance, Paradex seeks product innovation to create a comprehensive and diversified on-chain exchange.

Token Plans and Incentives: Paradex has not yet issued a token, but the official token economics have been announced: community rewards account for 26.6%, foundation budget 6%, core team 25.1%, future contributors 3.8%, and Paradigm shareholders 13.5%. The platform token is named DIME, which has multiple uses: as gas fees for the Paradex Chain, trading fee discounts, staking rewards, liquidity mining, and governance voting, serving as a value carrier throughout the ecosystem. Paradex announced that it will launch DIME in 2025, allocating 20% of the tokens for the genesis airdrop. The incentive structure of Paradex is relatively mild and transparent, with no outrageous wash trading phenomena; its Vol/OI ratio typically hovers around 1-2, close to normal levels like Hyperliquid, with officials repeatedly emphasizing a focus on long-term value rather than short-term speculation.

Market Data and Performance: The Paradex platform has a TVL of approximately $170 million, a daily trading volume of about $2 billion, and an OI of around $770 million. These figures are relatively small compared to giants like Hyperliquid, but the growth rate is steady, with no significant fluctuations. Paradex has a good reputation among professional derivatives traders, especially favored by those looking to explore on-chain options and advanced strategies. Its product line is still rapidly expanding: according to the official X account, spot trading will launch in mid to late January 2026, followed by the introduction of community-created meme token trading and the DIME token issuance, among other significant developments. If its "unified account, all-in-one trading" model operates successfully, it will create differentiated competitiveness in the market.

Opportunities and Risks Analysis in the Perp DEX Track

1. Opportunities Facing the Perp DEX Track

1) Significant Market Penetration Potential: Despite the explosive growth of on-chain perpetual trading in 2025, its share of the overall crypto derivatives market remains low, around 5-10%. The vast majority of contract trading still occurs on centralized platforms, with Binance's single-day futures volume reaching trillions of dollars. As the decentralized trading experience approaches that of CEX, the demand for users to avoid centralized risks and enjoy self-custody freedom will continue to grow. In the coming years, on-chain derivatives are expected to capture further market share; even an increase to 20-30% would provide several times the growth potential for current DEXs.

2) New Technological Dividends Empowering the Track: New technologies such as ZK proofs, sharding, and notary networks are maturing, which will elevate on-chain performance, reduce costs, and expand product boundaries. For example, Paradex's planned perpetual options and other innovations are achieved through breakthroughs in underlying technology. There is reason to believe that the compounding effect of technology will continue to help decentralized exchanges narrow the gap with centralized giants and even create new product forms that the latter cannot offer.

3) User Education and Habit Changes: After events like FTX, the new generation of crypto users is more receptive to DeFi products. Many users who previously only traded contracts on Binance tried Hyperliquid, EdgeX, and others in 2025 and left positive feedback. With word-of-mouth spreading and KOL influence, on-chain trading is moving from niche circles to the mainstream. This means that the potential user base for Perp DEX is expanding, and the unique attractions of DeFi, such as community governance and airdrop incentives, will also translate into retention rates.

4) Capital and Institutional Entry: In 2025, several top institutional funds began to enter the Perp DEX space: 21Shares launched an ETP product for HYPE; traditional institutions like Amber directly incubated EdgeX; and Paradigm personally engaged in Paradex. These signals indicate that compliant capital is optimistic about the future prospects of on-chain derivatives and is willing to provide liquidity and infrastructure support. With clearer regulations, more Wall Street or crypto funds are expected to participate through DAO investments, liquidity provision, and other means, injecting new vitality into the track.

5) Ecological Synergy Effects: Perp DEX has strong synergies with other areas of DeFi (lending, yield strategies, stablecoins, etc.). Paradex has begun exploring the integration of perpetual contracts with other DeFi Lego components to create new use cases. This suggests richer opportunities for cross-protocol collaboration and ecological integration. For example, perpetual DEXs can provide hedging tools for on-chain assets, and interest rate derivatives from lending protocols can also be priced through perpetual markets.

2. Potential Risks in the Perp DEX Track

Beneath the surface prosperity of the Perp DEX track in 2025 lies multiple risks that investors should be wary of.

1) Wash Trading and Over-Incentivization: Aster's alleged data fraud led to a collapse of credibility, while Lighter's excessive incentives pose a bubble risk. These remind us that while short-term trading data can be packaged, only positions and income are hard indicators; investors should avoid being misled by exaggerated trading volumes.

2) Technical and Security Risks: New platforms often adopt complex architectures or self-developed chains to achieve high performance, increasing the likelihood of vulnerabilities and failures. Lighter experienced a database crash just 10 days after its mainnet launch, and self-developed chains like Hyperliquid have also faced scrutiny regarding their consensus and security being untested over the long term. Additionally, risks from smart contract vulnerabilities, matching failures, and oracle malfunctions cannot be ignored.

3) Token Economic Risks: Many Perp DEX platforms view token prices as the lifeline of their ecosystems, stimulating token prices through buybacks and dividends. However, the secondary market is volatile; if a platform's token crashes, it may negatively impact user enthusiasm and even trigger a bank run. For instance, if Lighter's LITER price does not meet expectations after listing, a large number of wash trading users may sell off and exit.

4) Extreme Market Volatility Risks: The current scale of the on-chain contract market is still relatively small compared to CEXs, and during extraordinary volatility, liquidity depletion and sudden spikes in slippage can still occur. If an event similar to the "October 11 crash" of 2025 happens, with hundreds of billions in liquidations, some platforms with poor risk tolerance may collapse or even become insolvent.

5) Compliance Policy Risks: As on-chain derivatives trading volumes surge, regulatory scrutiny increases. Many countries and regions prohibit unauthorized platforms from offering high-leverage contract trading to their residents, and even decentralized platforms may face restrictions. While decentralized protocols themselves are difficult to shut down completely, regulatory risks may undermine user confidence and affect the scale of capital inflow.

Outlook for 2026: A New Era of Competition and Upgrades

Looking ahead to 2026, the on-chain perpetual contract market is expected to enter a more mature and competitive new phase. Based on the current landscape and development trends, the following trends can be anticipated:

1. Evolving Landscape and Continued Reshuffling: As an established leader, Hyperliquid is expected to continue solidifying its position in the top tier, leveraging its strong OI and community foundation. If Lighter can maintain user activity, it will become the most formidable challenger in terms of trading volume; Aster, with Binance's support, is likely to see its market share rebound; EdgeX is expected to capture the institutional and stable user market. Paradex, by attracting users through product differentiation, has the opportunity to rise from the second tier in 2026. The overall track landscape will present a scenario of "one strong leader and many strong contenders": Hyperliquid will remain dominant, while several others will occupy niche segments, narrowing the market share gap among leading platforms. Meanwhile, reshuffling will continue, with intensified competition leading to the survival of the fittest among smaller platforms.

2. Rational Return and Emphasis on Quality Growth: After the frenzied arms race of trading volume in 2025, market participants will become more rational, realizing that competing for trading volume rankings is of little significance, and will instead focus on metrics that better reflect real health, such as open interest, revenue, and user retention. It is expected that the Vol/OI ratios of various platforms will generally fall back to reasonable ranges in 2026, with new user growth becoming more organic, and vicious incentive wars may come to an end. Of course, marketing will continue, with various platforms likely launching trading competitions, limited-time zero-fee promotions, etc., but this competition will focus more on enhancing user experience rather than merely inflating data. At the same time, as a large number of airdrops are realized, the number of speculators will decrease, and the proportion of genuine traders with real demand will rise. Quality-first and stable operations will become the new consensus in the track.

3. The Rise of Product Diversification Models: In 2026, we may see Perp DEXs expand beyond just "perpetual contracts" to a full product line of exchanges. The perpetual options and spot trading that Paradex plans to launch will serve as a litmus test: if they operate successfully, other platforms will inevitably follow suit by developing new contract types such as options and futures (fixed-date futures), providing a richer array of derivative tools. Additionally, real-world asset (RWA) contracts may emerge, allowing users to trade contracts for traditional markets like gold and stock indices on-chain. At the same time, features like social trading and algorithmic strategies will be integrated into the platforms, deepening the trend of merging exchanges with wealth management.

4. Regulatory and Compliance Exploration: The year 2026 may become a pivotal year for the gradual formation of a regulatory framework for DeFi derivatives. Some major jurisdictions may issue guidelines or regulations targeting decentralized derivatives. There are rumors that EdgeX is considering launching a regulated version for institutional access, similar to how dYdX established its custodial version. If Hyperliquid wants to further penetrate the U.S. market, it may also evaluate the possibility of registering as a swap execution facility (SEF). Overall, the gray areas in the DeFi space will gradually be regulated in 2026, presenting both challenges and opportunities for the Perp DEX track, which primarily consists of anonymous retail users. Standardization will help attract more mainstream capital, but it may also conflict with the principles of decentralization. Platforms are likely to adopt a "dual approach": maintaining anonymous open access while establishing compliance windows to meet regulatory requirements.

5. Collision of Old and New Forces: 2026 may also witness direct confrontations between traditional giants and new on-chain players. On one hand, established centralized exchanges are unlikely to sit idly by as their market share is eroded; entering the DeFi derivatives space will be a logical strategy. Binance, OKX, and others are already deploying decentralized products, and Binance's previous investment in Aster may just be the beginning. In the future, it is not ruled out that they will launch decentralized contract trading features, linking them with their own CEX to provide a "centralized + decentralized" dual-track service. Similarly, emerging platforms like Bitget may also incubate their own DEXs. The entry of centralized platforms will bring more resources and user traffic to the track, but it also means intensified competition. On the other hand, new projects native to the blockchain will continue to emerge, attempting to challenge existing leaders with newer concepts or mechanisms.

Conclusion: The Perp DEX track in 2025 transitioned from Hyperliquid's dominance to a competitive landscape filled with contenders, marked by dramatic developments. The Perp DEX track in 2026 will move from "wild growth" to "meticulous cultivation." The overall market will become more mature and stable, bidding farewell to rough volume inflation and shifting towards high-quality competition; product forms will become richer and more diverse, evolving into comprehensive derivative platforms. Looking ahead, the battle for on-chain derivatives will continue to be exciting, and we await the emergence of new patterns and legends.

About Us

Hotcoin Research, as the core research institution of Hotcoin Exchange, is dedicated to transforming professional analysis into your practical tools. Through our "Weekly Insights" and "In-Depth Reports," we analyze market trends for you; leveraging our exclusive column "Hotcoin Selection" (AI + expert dual screening), we help you identify potential assets and reduce trial-and-error costs. Each week, our researchers will also engage with you through live broadcasts, interpreting hot topics and predicting trends. We believe that warm companionship and professional guidance can help more investors navigate cycles and seize value opportunities in Web3.

Risk Warning

The cryptocurrency market is highly volatile, and investing carries risks. We strongly recommend that investors conduct investments based on a full understanding of these risks and within a strict risk management framework to ensure the safety of their funds.

Website: https://lite.hotcoingex.cc/r/Hotcoinresearch

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。