Original Author: Frank, PANews

Recently, the popularity of prediction markets has been on the rise, especially with smart money's arbitrage strategies being hailed as the gold standard. Many have begun to imitate and experiment, seemingly marking the start of a new gold rush.

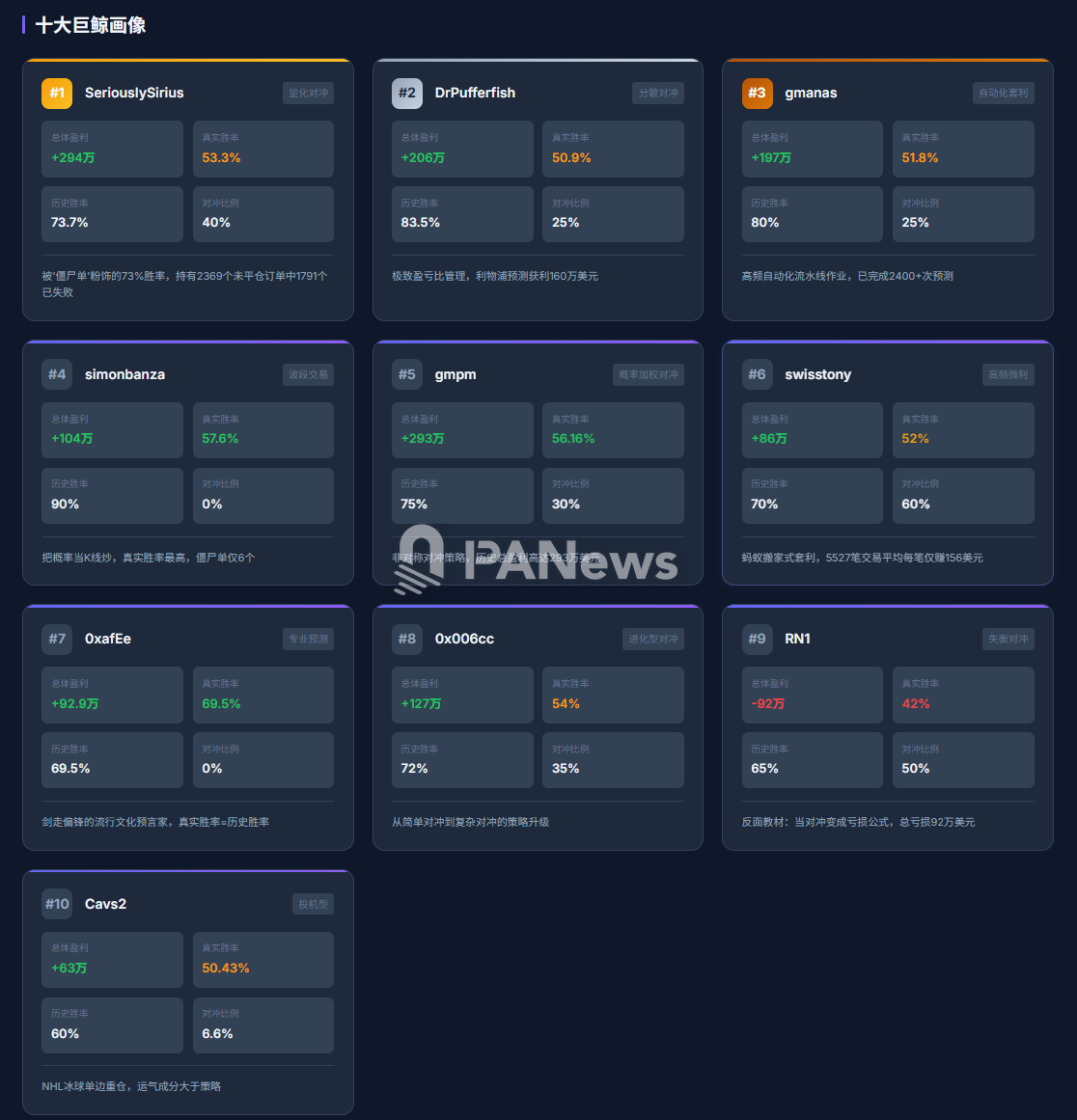

But behind the hype, how effective are these seemingly clever and reasonable strategies in practice? How are they specifically executed? PANews conducted an in-depth analysis of 27,000 operations from the top ten profit-ranking whales on Polymarket in December, seeking the truth behind their profits.

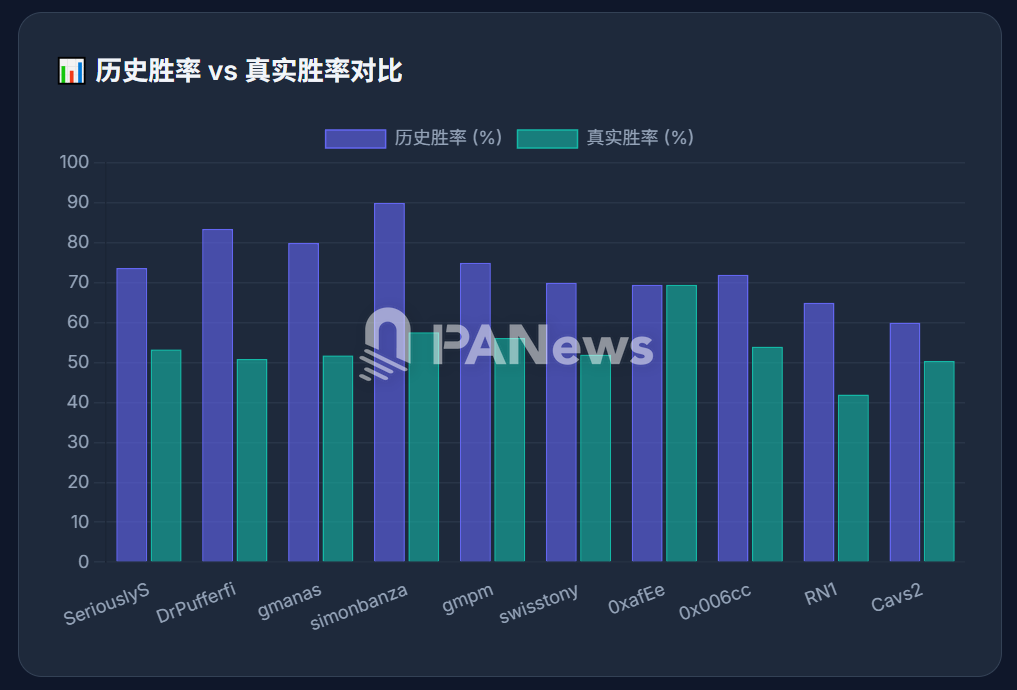

After analysis, PANews found that while many of these "smart money" operations executed hedging arbitrage strategies, this hedging is significantly different from the simple hedging interpreted on social media. The actual strategies are much more complex, far from a simple "yes" or "no" combination, but rather involve fully utilizing rules like "over/under" and "win/loss" in sports events to complete combination hedging. Another important finding is that behind the historically significant high win rates, there are a large number of "zombie orders" that remain unclosed, which embellish the results; the real win rate is far lower than the historical win rate.

Next, PANews reveals the true operations of this "smart money" through actual cases.

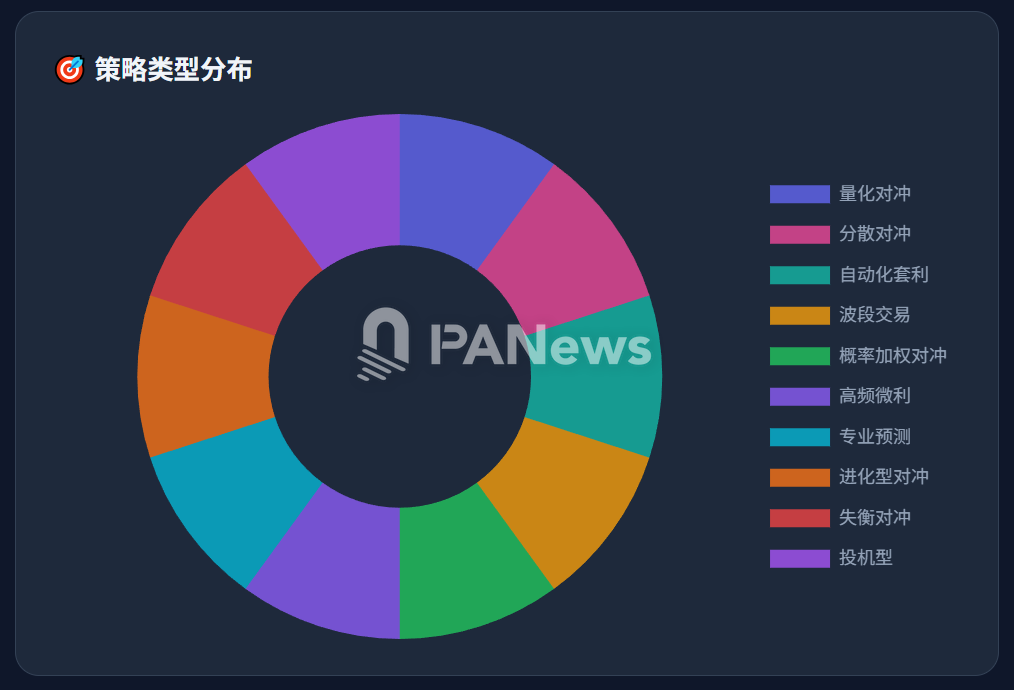

1. SeriouslySirius: A 73% win rate embellished by "zombie orders" and a complex quantitative hedging network

SeriouslySirius is the top-ranked address in December, with profits of approximately $3.29 million for the month and a total historical profit of $2.94 million. If we only look at his completed order records, his win rate is as high as 73.7%. However, the reality is that this address still has 2,369 open orders, while 4,690 orders have been settled. Among these, 1,791 of the current open orders have actually completely failed, but the user has not closed them one by one. On one hand, this saves a lot of effort and transaction fees. On the other hand, since he usually closes profitable orders, the historical settled order data shows an extremely high win rate. When considering these unclosed "zombie orders," the true win rate of this address drops to 53.3%, which is only slightly better than random coin tossing.

In his actual trading, about 40% of the orders are hedging orders betting on multiple directions for the same event. However, this hedging is not a simple "YES" + "NO." For example, in the NBA game between the 76ers and Mavericks, he simultaneously bought Under, Over, 76ers, Mavericks, and 11 other directions, ultimately profiting $1,611. In this process, he indeed employed an arbitrage strategy with insufficient probability, as he bought the 76ers' win at a probability of 56.8% and the Mavericks at 39.37%, with a total cost of about 0.962, achieving a state where he would profit regardless. Ultimately, he made $17,000 in this game.

However, this strategy does not always yield profits; for instance, in the Celtics vs. Kings game, he participated in 9 directions and ultimately lost $2,900.

Additionally, there are many instances where the fund allocation ratios for orders are severely imbalanced. For example, although both directions were ordered, the investment amounts differed by more than ten times. This outcome is likely due to insufficient market liquidity, which also shows that while arbitrage strategies may seem appealing, liquidity can become the biggest issue in actual operations. Opportunities may arise, but they do not necessarily allow for a hedging effect with equal positions on both sides.

Moreover, due to automated execution, the buying and selling in such cases are likely to result in significant losses.

However, in terms of results, the core reason SeriouslySirius can achieve substantial profits through this strategy lies in his competent position management, with a profit-loss ratio of about 2.52. This allows him to achieve profits despite a low true win rate.

Furthermore, this strategy does not always yield profits; before December, this address's profit-loss situation was not optimistic, having long been below the breakeven line, with maximum losses reaching as high as $1.8 million. Whether the current mature strategy will maintain such profit expectations remains uncertain.

2. DrPufferfish: Turning low probabilities into high probabilities, the art of extreme "profit-loss ratio" management

DrPufferfish is the second-highest profit address in December, with profits of approximately $2.06 million for the month, and his historical win rate is even more exaggerated at 83.5%. However, considering the large number of "zombie orders" he holds, his win rate returns to 50.9%. Nevertheless, this address's strategy has a clear distinction from SeriouslySirius's trading strategy. Although he also has nearly 25% of his orders as hedging orders, this hedging is not a reverse hedge but rather a diversified bet. For example, regarding the final champion of Major League Baseball, he simultaneously bought 27 teams with lower probabilities, and the combined probability of these teams exceeded 54%. Through this strategy, he turned low-probability events into a high-probability event.

Moreover, the main reason he can achieve huge profits is his ability to control the profit-loss ratio. Taking Liverpool as an example, this Premier League team is his favorite, and he has predicted the results of this team 123 times, ultimately earning about $1.6 million. Among the profitable predictions, the average profit is about $37,200, while the average loss for failed predictions is about $11,000. Additionally, he often sells these losing orders in advance to control position losses.

This operational mindset has also allowed his overall profit-loss ratio to reach 8.62, indicating a high profit expectation. However, overall, his strategy is not a simple arbitrage hedge but rather a substantial profit achieved through professional predictive analysis and strict position management plans. Another point is that most of his hedging trades are in a loss state, with total profits and losses for this part of the orders at -$2.09 million. This suggests that this whale's hedging trades are mostly used as a form of insurance.

3. gmanas: High-frequency automated assembly line operations

The third-ranked address, gmanas, has a style similar to DrPufferfish, achieving a total profit of $1.97 million in December. His true win rate is 51.8%, close to DrPufferfish. However, his trading frequency is higher, having completed over 2,400 predictions, indicating that his strategy results from automated program execution. His betting style is similar to the previous address, so it will not be elaborated further.

4. Hunter simonbanza: Treating predictive probabilities like "K lines" for swing trading

The fourth-ranked address, simonbanza, is a professional prediction hunter. Unlike the previous addresses, his strategy does not include any hedging orders, and he has achieved profits of approximately $1.04 million, with "zombie orders" losses of only $130,000. Compared to the previous addresses, although his capital scale and trading volume are not high, his true win rate is the highest at about 57.6%. Additionally, among the settled orders, his average profit is about $32,000, while the average loss is $36,500. Although the profit-loss ratio data is not high, his higher win rate ultimately leads to good profit results.

Moreover, this address has very few "zombie orders," only six. This is because he usually does not wait until the event ends to settle but instead seeks to profit from the fluctuations in probabilities. In simple terms, he takes profits when they arise and does not cling to the final result.

This is also a unique investment approach in the prediction market. In his logic, these probability changes resemble the ups and downs of financial investments. Of course, we do not know the specific logic behind his high win rate; this is his unique survival secret.

5. Whale gmpm: Asymmetric hedging strategy, using "large positions" to seek certainty

The fifth-ranked address, gmpm, although only fifth in December's profit-loss ranking, has a total historical profit higher than the previous addresses, reaching $2.93 million. Additionally, his true win rate is about 56.16%, which is also at a high level. His operational thinking has similarities with the fourth-ranked address, but the core strategy has its unique secrets.

For example, you will see this address often placing orders on both sides for the same match, but his strategy does not seem to seek arbitrage space between the two directions; instead, he invests more funds on the side with a higher probability and less on the side with a lower probability. This way, he can achieve a hedging effect where the position is larger when the probability of winning is high, but the losses when low-probability events occur are not too significant.

From the actual effect, this is a more advanced hedging strategy, not solely relying on the mathematical arbitrage of "yes" + "no" but rather combining comprehensive judgment of events and strategies to reduce losses.

6. Workhorse swisstony: "Ants moving house" style high-frequency arbitrage

The sixth address, swisstony, is a high-frequency arbitrage address, with the highest trading frequency among these addresses, having conducted 5,527 transactions. Although he has accumulated over $860,000 in profits, the average profit per transaction is only $156. Strategically, this address follows an "ants moving house" style. Similar to other arbitrage addresses, this address usually buys into all betting lines for a match. For example, in the game between the Jazz and Clippers, this address bought into 23 betting directions. Because the investment amounts are not large, the fund allocation is relatively balanced, which can achieve a certain degree of hedging effect.

However, this strategy seems to test the details of buying; for instance, "yes" + "no" must be less than 1. For some reason, the total amount of his hedging orders often exceeds 1, leading to losses regardless of the outcome. Nevertheless, with reasonable profit-loss ratios and win rate data, his profit situation remains positively expected.

7. Outlier 0xafEe: A "pop culture prophet" taking an unconventional path

The seventh address, 0xafEe, is a low-frequency, high-win-rate player. His trading frequency is very low, averaging only 0.4 transactions per day, with a true win rate of 69.5%.

From the orders he has completed, he has earned approximately $929,000 due to his exceptionally high win rate, and he has very few "zombie orders," with only about $8,800 in unrealized losses. Additionally, he never makes hedging orders but focuses on predictions. His predictions mainly target Google search indices and pop culture-related content, such as "Will Pope Leo XIII be the most searched person on Google this year?" or "Will Gemini 3.0 be released before October 31?" In these prediction directions, he seems to have a unique analytical method, resulting in a remarkably high win rate, making him an outlier among the top whales, being the only address outside of sports.

8. Manual hedging player 0x006cc: Strategy upgrade from simple hedging to complex hedging

The eighth-ranked address, 0x006cc, is quite similar to the aforementioned complex hedging addresses, with a total net profit of approximately $1.27 million and a true win rate of about 54%. However, compared to other addresses that execute automated programs, his trading frequency is very low, averaging only 0.7 transactions per day. From early operations, this address appears to be a manual operation address that adopted a "simple hedging strategy" early on.

After entering December, this simple hedging strategy has also evolved into a complex hedging strategy. From his operational history, it can be seen that as more people understand hedging strategies in this market, they are gradually upgrading.

9. Cautionary Tale RN1: When "Hedging" Becomes a "Loss Formula"

The ninth-ranked address, RN1, is currently in overall loss among the top ten profit addresses in December. His realized profits are approximately $1.76 million, but unrealized losses have reached $2.68 million, resulting in a total loss of $920,000. As a cautionary tale, there are many aspects to reflect on regarding RN1.

Firstly, his true win rate is only 42%, the lowest among these addresses, and his profit-loss ratio is only 1.62. Considering these two data points together, his profit expectation is negative, indicating that this strategy is unlikely to be profitable.

A closer look at the details reveals that this address is also a clear arbitrage strategy address. However, in many of his hedging trades, although the conditions for "yes" + "no" are met, he often invests more on the low-probability side and less on the high-probability side, leading to an actual position imbalance that ultimately results in real losses when high-probability events occur.

10. Gambler Cavs2: Heavy Betting on One Side in Hockey, Luck Over Strategy

The tenth-ranked address, Cavs2, is also a prediction gambler who prefers heavy betting on one side, with his strongest area being NHL hockey matches. However, from the overall data, his actual total profit is approximately $630,000, with a true win rate of about 50.43% and a low risk-hedging ratio of 6.6%. The data is fairly standard, and luck plays a significant role, having hit a few high-yield single match results, making the actual strategic insights not very high.

Five Harsh Truths Behind the "Smart Money" Myth

After conducting an in-depth analysis of these "smart money" trades, PANews summarizes the realities behind the "wealth stories" in prediction markets.

- The "hedging arbitrage strategy" is not as simple as just meeting probability conditions. Under the fierce competition in the market and liquidity constraints, it can easily become a counterproductive loss formula; blind imitation is inadvisable.

- "Copy trading" seems to be ineffective in prediction markets for several reasons. Firstly, the rankings or win rates seen are based on historical settled profit data, which can be "distorted." Behind such data, many "smart money" players are not as "smart" as they appear, with true win rates exceeding 70% being extremely rare; most win rates are similar to coin tossing. Additionally, the trading depth in prediction markets is currently relatively poor, and the same arbitrage opportunities may only accommodate a small amount of capital, making it likely that copy traders will be squeezed out in the process.

Managing profit-loss ratios and position ratios is more important than pursuing win rates. Among the addresses with outstanding strategy performance, a common characteristic is their adeptness at managing profit-loss ratios. Addresses like gmpm and DrPufferfish even adjust their positions based on probability changes to minimize losses and enhance profit-loss ratios.

The real secret lies beyond "mathematical formulas." Currently, there are many interpretations of "arbitrage formulas" on social media that seem reasonable at first glance. However, in actual operations, the true capabilities of these smart money players appear to lie outside these "mathematical formulas," either possessing strong judgment abilities for certain events or having unique analytical models for pop culture. These invisible decision algorithms are the key to their success; for users without such "decision algorithms," prediction markets can also be a cold "dark forest."

The profit scale in prediction markets is still very small. Among the top smart money earnings in December, the address with the highest total earnings has only around $3 million. Compared to the crypto derivatives market, this market's profit potential seems to have a clear upper limit. For those entering with dreams of overnight wealth, the market's scale is evidently not large enough. Such a uniquely specialized and small-scale market is likely to be unattractive to institutions, which may be an important reason limiting the growth of prediction markets.

In the seemingly gold-laden prediction market of Polymarket, the so-called "god-level whales" are mostly just surviving gamblers or diligent brick movers. The true wealth code is not hidden in those inflated win rate rankings but rather in the algorithms backed by real money bets from a few top players after filtering out the noise.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。