Written by: Nancy, PANews

As one of the most profitable DeFi protocols globally, Jupiter's "cash capability" has failed. Over the past year, it has spent more than $70 million on buybacks, yet it still cannot stop the continuous decline of its token.

Faced with the awkward situation of "the more it buys back, the more it falls," Jupiter recently sought community opinions, attempting to pause the buyback narrative and explore a brand new reward paradigm. Additionally, Helium founder Amir also stated that the market seems indifferent to the project team's buybacks from the market, so under the current circumstances, they will stop wasting funds on HNT buybacks.

When simple and crude buyback strategies fail, where is the way out to break the curse of falling token prices?

$70 million spent in vain to save token prices, Jupiter wants to halt buyback plans

While the business side is booming, the token continues to decline. This sense of disconnection is troubling the Solana leading protocol, Jupiter.

As the largest DEX aggregator in the Solana ecosystem, Jupiter is demonstrating remarkable dominance. Its business reach has extended from single transactions to multiple core areas such as data, wallets, stablecoins, lending, and prediction markets.

This comprehensive expansion has brought about strong monetization capabilities. According to Cryptodiffer data, Jupiter's total fee revenue in 2025 is expected to reach $1.11 billion, ranking second among all DeFi protocols.

However, a harsh industry reality is that a protocol's ability to make money does not equate to the appreciation of its token. The market seems unconvinced by Jupiter's profit story. CoinGecko data shows that the token JUP is expected to decline by about 76.7% throughout 2025.

To support the token's value, Jupiter has conducted large-scale buybacks, but the effect has been limited. On January 3, Jupiter co-founder SIONG publicly reflected on this strategy on social media and sought community opinions on whether to pause JUP buybacks.

SIONG admitted that Jupiter spent over $70 million on buybacks last year, but the token price has clearly not changed much. He suggested whether this portion of funds could be used to reward existing and new users to promote growth, asking, "Should we do this?"

This confusion is not unique to Jupiter. At the same time, the DePIN project Helium in the Solana ecosystem also made a similar strategic adjustment, announcing that the market seems indifferent to the project team buying back tokens from the market, so under the current circumstances, they will stop wasting funds on HNT buybacks. Just last October, Helium and Mobile generated $3.4 million in revenue, preferring to use this money to develop their business.

Stop deceiving ourselves, buybacks are not a magic remedy for price increases

Buybacks are a story many crypto projects are keen to tell, but cases like Jupiter's buyback failure are not uncommon. Even protocols with strong commercial monetization capabilities and real income rarely break the curse of ineffective buybacks. Simply relying on spending money to prop up the market often fails to offset ongoing market selling pressure or the continuous dilution of token circulation.

The market generally believes that the primary reason buybacks fail is the failure to confront the objective inflationary pressures that exist. Crypto KOL Crypto Weituo pointed out that all narratives about token rights, income, or buybacks are self-deception. As long as the tokens are not fully circulated, continuous unlocking is an unavoidable objective fact. "It's like no matter how fast you flap your arms, gravity will still pull you down. The problem is not fighting against gravity, but how to utilize it."

DeFi analyst CM further pointed out that stopping buybacks is fundamentally the wrong approach. First, the true meaning of buybacks is to reduce circulating supply, which does not equate to 100% "price support," because what truly relates to price is market supply and demand and the project's fundamentals. Buybacks are beneficial to token holders and can be imagined as a periodic deflationary model, but it does not guarantee that the token will rise.

In other words, in the face of continuously released tokens, no matter how cleverly designed the buyback is, it merely serves as a buffer against price declines, and its effectiveness depends on fundamental support and the pace of token release.

On this point, crypto analyst Emperor Osmo pointed out after comparing buyback tokens in 2025 that only HYPE and SYRUP achieved positive returns throughout the year, thanks to their explosive fundamental growth, with Syrup's revenue increasing fivefold and Hyperliquid experiencing over $5.8 billion in daily inflows with no early selling pressure. In contrast, Jupiter's DEX aggregator trading volume decreased by 74% in 2025, and under deteriorating fundamentals, relying solely on buybacks cannot reverse the trend.

Crypto researcher Route 2 FI pointed out the fundamental differences between crypto buybacks and traditional finance from a more macro perspective. On Wall Street, if a company decides to buy back shares, it is because the founders or the board believe it is the best use of funds and typically only buy back shares when the stock price is severely undervalued. In the crypto field, the situation is quite the opposite; buybacks are a defensive mindset, and protocols will continuously buy back tokens regardless of price. In his view, Hyperliquid's success stems from its early lack of selling pressure and a clear value cycle, while Jupiter currently lacks strong reasons for holding tokens. Without strong reasons to hold, users will naturally sell tokens to buyback liquidity.

From the perspective of valuation bubbles, Jordi Alexander, founder of Selini Capital, pointed out that during this cycle, star projects including HYPE, ENA, and JUP often launched millions of tokens at absurdly high prices in the early stages, leading to a large number of retail investors following suit and ultimately getting trapped. The founders of these projects are too immersed in this self-reinforcing mindset, believing these multiples are reasonable. After months of decline, some began to blame the buyback mechanism for being ineffective, but this is also a misjudgment. Moreover, if a project is successful and has stable income, what is the meaning of the token's existence if there are no buybacks, dividends, or clear financial utility? Crypto is finance, and finance is crypto. If you are a serious project, it doesn't matter if you don't have internal financial experts, but you should at least hire top external consultants or professional companies for assistance.

"The essence of buybacks is to return excess funds to stakeholders," said Spark's strategic director monetsupply.eth. He bluntly asked whether stopping buybacks would really improve token performance or just worsen sentiment further. More importantly, does the market really believe the team will "reinvest in growth"? In his view, (the claim to stop buybacks) sounds more like an excuse for the founders who have already profited handsomely from the tokens and do not want to incur a bunch of useless operational expenses.

Goodbye to passive price support, a guide to improving token economics

Faced with the frequent failure of buyback strategies, many crypto practitioners have proposed remedies for improving token economics.

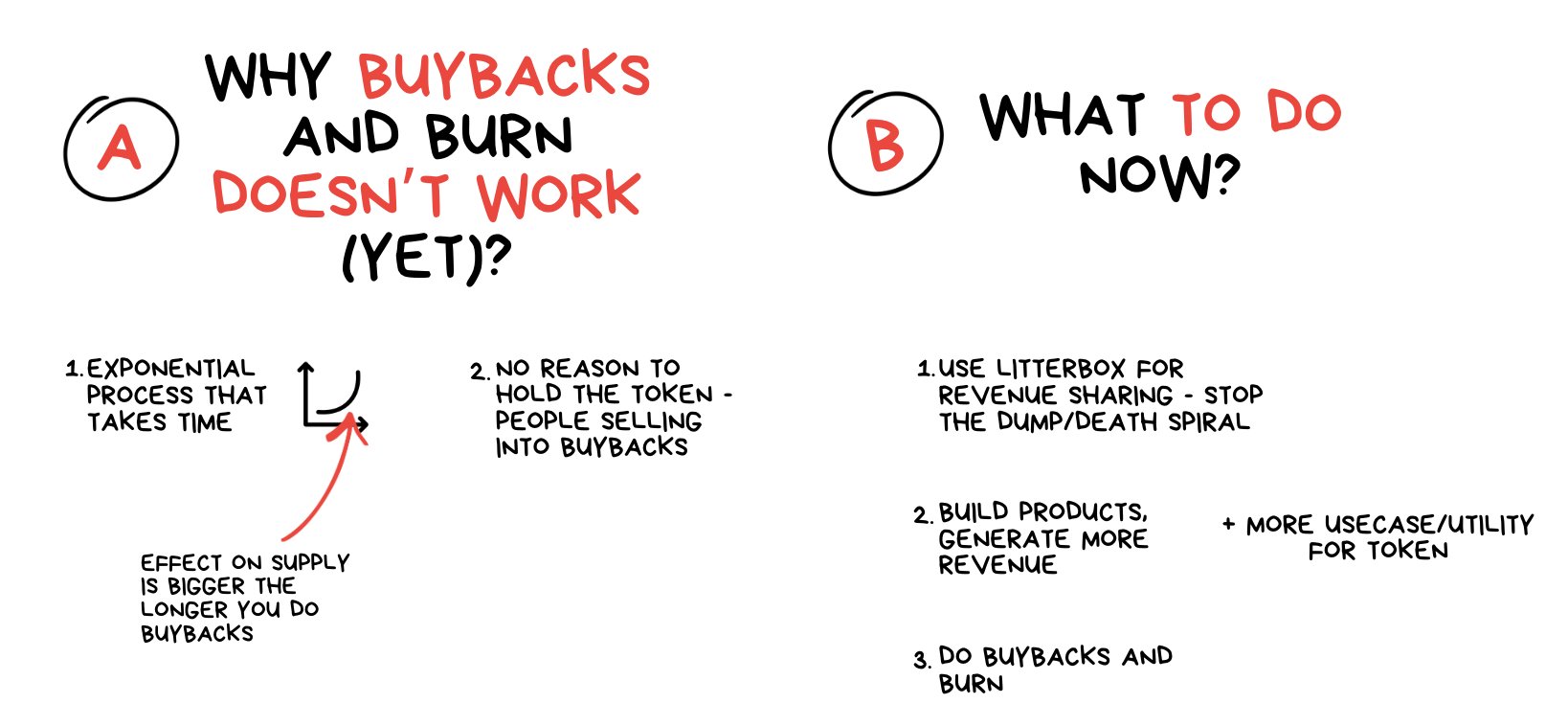

Crypto KOL fabiano.sol stated, buybacks and burns are still one of the best deflationary mechanisms, but they require time. Currently, the tokens are not tied to the company's business; the correct process should be to first give people a reason to hold before discussing buybacks. Currently, Jupiter distributes 50 million JUP (about $10 million) as staking rewards each quarter, and most people will sell the tokens. He suggested that Jupiter could use 50% of its revenue to buy back JUP and put it into the Litterbox, buying back $10 million to $20 million of JUP each quarter. Another potential plan is to use this $10 million buyback fund for staking rewards, which, at current prices, could generate about 25% APY, making it very attractive. Although this is not a direct deflationary mechanism, it is believed to be more beneficial for token prices than simple buybacks.

Solana founder toly also provided suggestions for staking incentives, believing that capital formation is inherently very difficult, and traditional finance usually takes over ten years to truly accumulate capital. Compared to buybacks, a more reasonable path is to replicate this long-term capital structure. In the crypto industry, the mechanism closest to this is actually staking. Those willing to hold long-term will dilute those unwilling to hold long-term through the mechanism. The protocol can retain profits as future protocol assets that can be claimed by tokens, allowing users to lock up and stake for a year to earn token rewards. As the protocol's balance sheet continues to expand, those who choose long-term staking will gain a larger actual equity share. The equity itself is linked to the protocol's future profits, continuously growing with future earnings. This idea has also been supported by Kyle Samani, co-founder of Multicoin, who emphasized that crypto teams must design mechanisms that can allocate excess value to long-term holders.

Jordi Alexander and CM proposed a more refined improvement plan, both suggesting that projects could adjust buyback rhythms based on price or price-to-earnings ratios: when the token price is clearly undervalued, increase buyback efforts to consume supply; when market sentiment is overheated and valuations are high, actively slow down or even pause buybacks. For decentralized protocols pursuing transparency, predictability, or legal compliance, a programmatic buyback mechanism could be adopted, setting clear price-to-earnings (PE ratio) trigger ranges based on their own situation, with any remaining income not used for buybacks retained for repurchases when prices fall.

In the view of crypto KOL Emperor Osmo and Route 2 FI, the team should retain funds and reinvest them into user acquisition, marketing, and generating sticky incentives, building long-term barriers through company expansion and protocol acquisitions. Furthermore, building long-term competitive advantages is strategically more significant than passively absorbing selling pressure in the secondary market.

However, regardless of the solution, it is essential to ensure that the protocol's profits are effectively channeled into the growth of the protocol, users, and token holders, rather than cleverly using various excuses that ultimately lead to funds flowing into the team's pockets.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。