⚡️If you have really been chasing narratives, 2025 is likely to be a year of repeated education by the market—

You will likely find that while no hot narratives have been missed, the overall returns have not improved significantly.

In the Crypto market, chasing narratives is not inherently wrong. But the problem is:

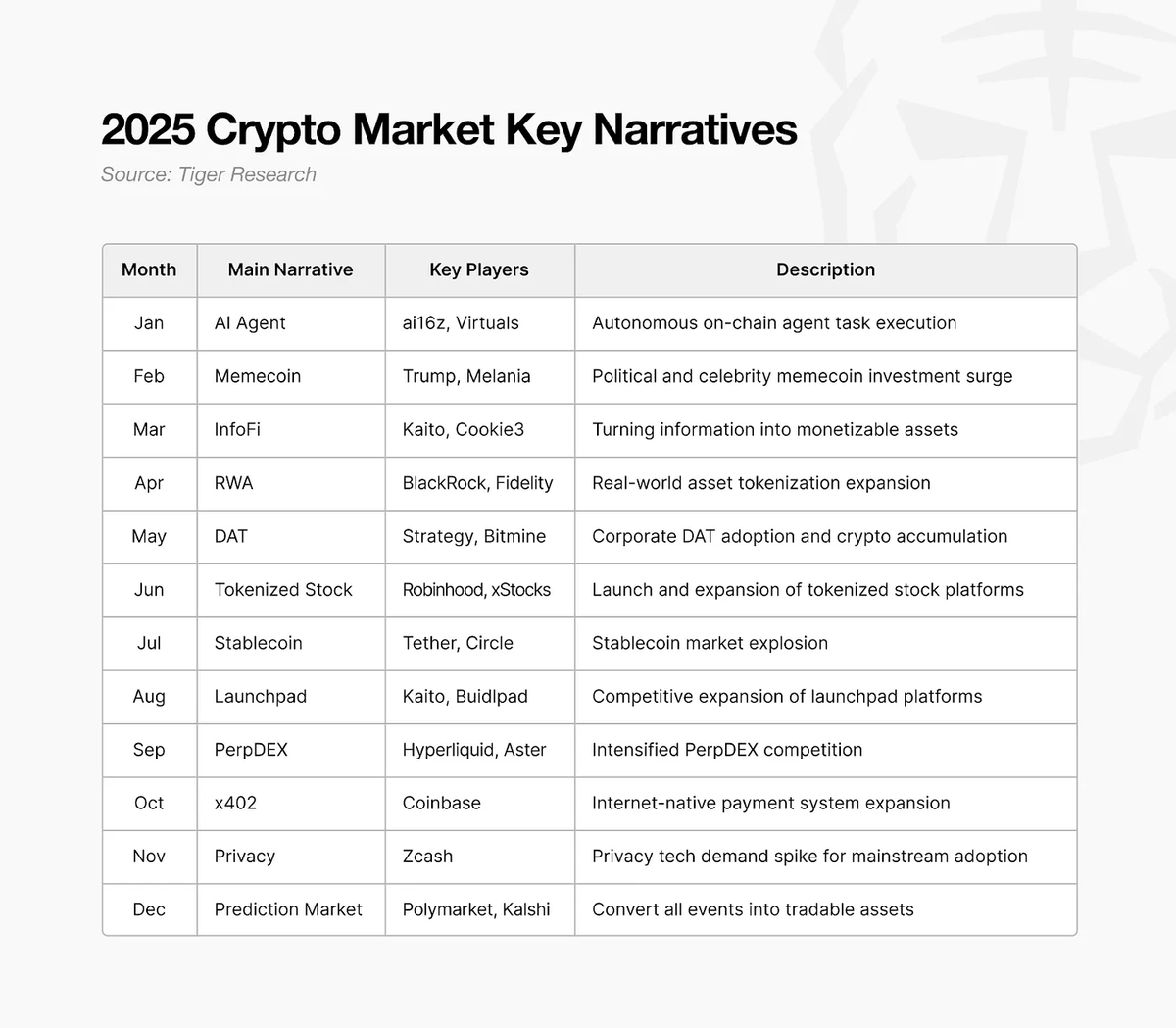

The narrative switches in the Crypto market in 2025 are just too fast!

If we lay out all the narratives, I believe they can be categorized into 4 real funding logic lines:

1️⃣ AI / InfoFi / Launchpad

I group these three together because, in my view, they address the same issue—who controls the information that enters the market.

AI Agent, InfoFi, Launchpad are essentially not creating new value scenarios, but are doing three things:

Producing, filtering, distributing, and pricing information.

This is mainly reflected in new listings and speculative trading, where platform operators make stable profits, and retail investors can indeed achieve decent returns at certain stages, but are highly dependent on the platform's access rules and early subsidies.

2⃣ MEME + Prediction Markets

The reason I categorize these two under one funding line is that I believe both carry a focus on hot topics and a gambling nature, and essentially do the same thing:

Transforming emotions, opinions, and hot events into tradable assets.

The difference is that it has upgraded from speculative gambling to gambling with specific rules and probability models.

This type of market experiences rapid liquidity depletion after high-frequency betting, making it very suitable for platforms but not for long-term holders.

3⃣ RWA / Stablecoin

A very typical institutional funding logic, including tokenized stocks, essentially addresses: how to enable traditional financial assets to circulate and settle more efficiently on-chain.

The participants in this line are also very clear: BlackRock, Fidelity, Robinhood, Tether, Circle.

The long-term support logic for BTC and ETH almost entirely comes from this line. Without this line, the upper limit of Crypto would be much lower.

4⃣ PerpDEX

This is the clearest and most sustained narrative of 2025.

From the beginning of the year with Hyperliquid, to Aster in the middle of the year, and then to Lighter at the end of the year, it has been an undisputed hot narrative throughout the year.

However, very few people can participate in it long-term and stably and make money. I can only say, very few.

So, do you think the market lacks narratives? It absolutely does not!

What is lacking is a structure that can sustain funding long-term and allow ordinary participants to continue profiting.

If you find that you are chasing narratives more and more often, but your overall returns have not improved significantly,

then the problem often lies not in your level of effort, but in the way you are participating itself!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。