Bitcoin has temporarily held above the 90,000 mark and has risen again, while Ethereum has also maintained its strength after breaking through 3,050! With such performance over the weekend, will it continue next week? Looking forward to it…

On Friday, after the New Year holiday for European and American institutions ended, market liquidity warmed up on the first day back to work. The prices of Bitcoin and Ethereum rose, breaking the consolidation range that had lasted for nearly half a month. Bitcoin returned above the 90,000 mark, and Ethereum also broke through 3,050, directly standing above 3,100. Yesterday, Saturday, the prices of Bitcoin and Ethereum remained high, although there was a pullback adjustment, they did not fall back into the previous consolidation range. This morning, there was another surge; Bitcoin tested 91,600 before pulling back, and Ethereum also rose to around 3,165, with the upward momentum easing.

On the macro front, there wasn't much news over the weekend; it was more about the warming market buying sentiment. Previously, during the Christmas holiday, the Federal Reserve's purchase of government bonds continued to boost the market. Additionally, with the outbreak of geopolitical risks over the weekend causing the precious metals market to close, funds flowing into the cryptocurrency market also provided some support.

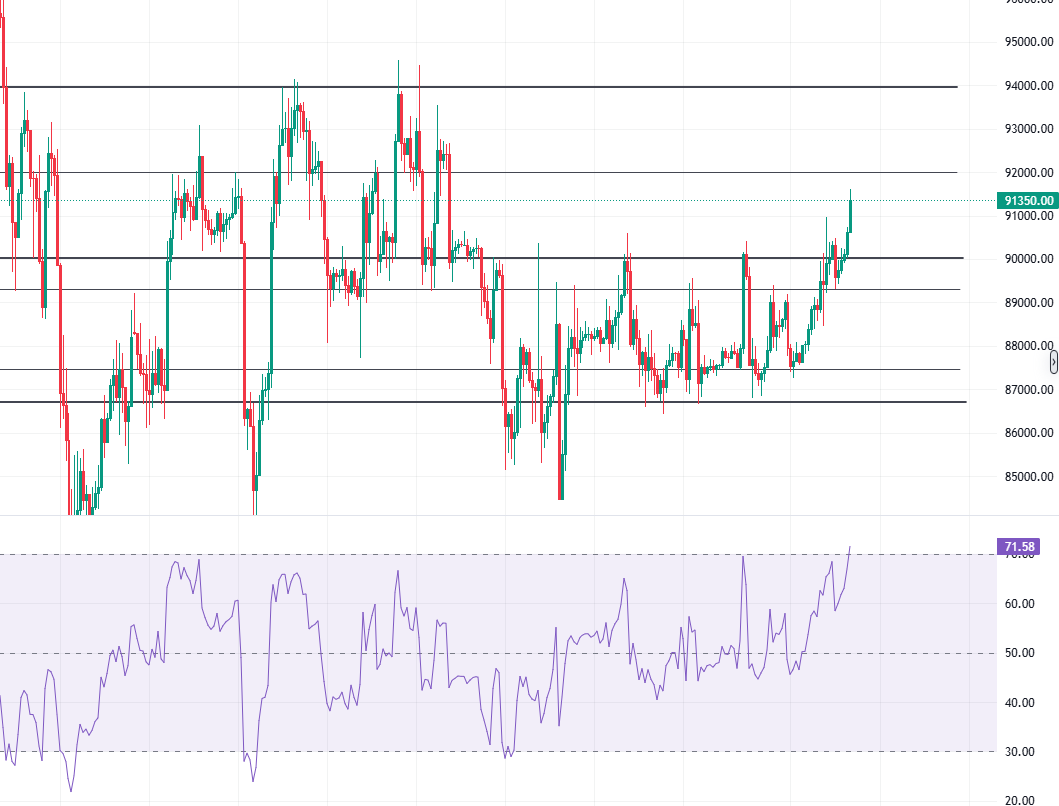

From a technical perspective, Bitcoin has opened up the upper track on the daily chart, and the short-term MA5/10 moving average indicators have formed a golden cross, providing support. The four-hour level indicators are also running bullish. In the short term, it may continue to rebound and rise; however, it faces selling pressure in the previous high rebound area of 92,000-95,000 from November and December, so the rebound is expected to encounter some resistance. The hourly RSI indicator is running in the overbought zone, indicating a need for price correction. Therefore, pay attention to the correction situation during the day, with short-term support focusing on the 90,000 mark. As long as this level is not lost, the price will maintain a temporarily strong bullish trend. As for the short-term resistance above, pay attention to the 92,000-92,500 area.

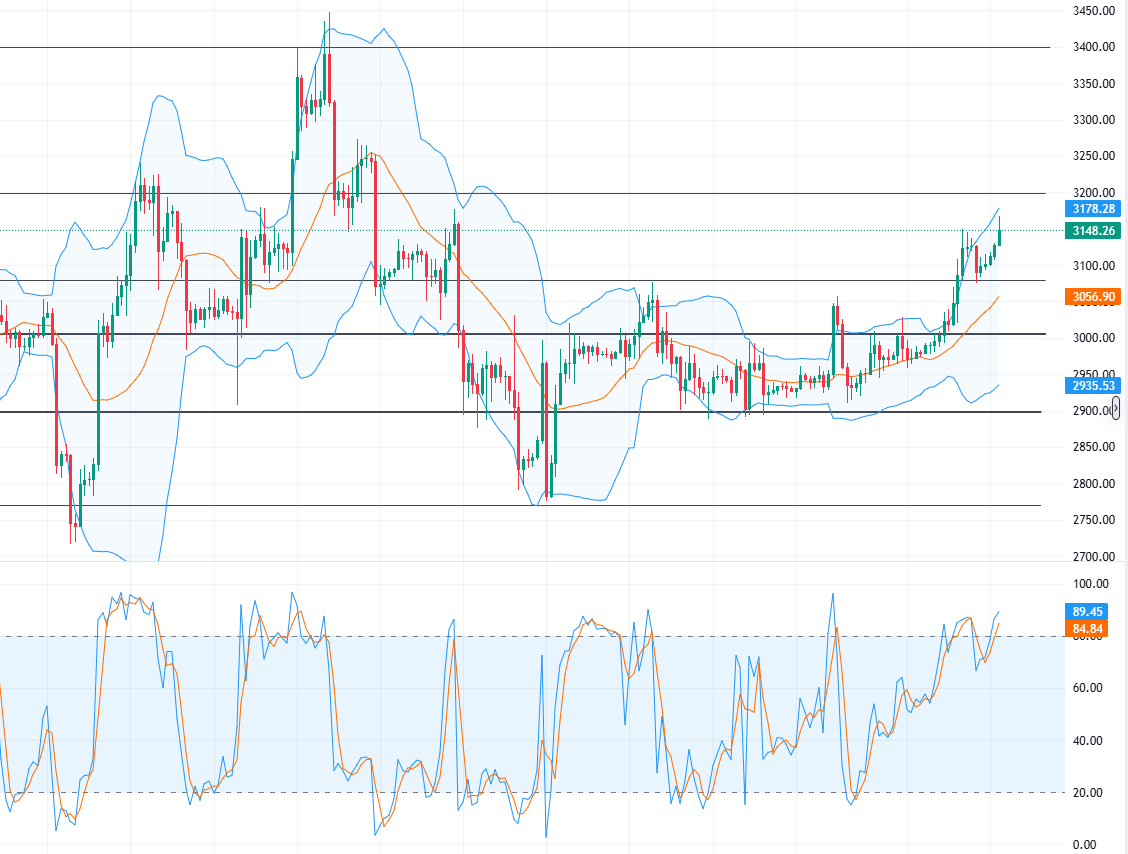

Ethereum's bullish performance is also strong, and it is now opening up the daily upper track to further test the strong resistance area above. The four-hour moving averages are diverging upwards, indicating that prices are likely to continue bullish. However, the RSI has entered the overbought zone, and the hourly RSI has already turned down from the overbought area, suggesting that while the price outlook is bullish, there may be a short-term pullback. For today, first look at the correction situation. The short-term support below focuses on the low points of yesterday's pullback in the 3,080-3,060 area, with the key being to defend the 3,000 mark. As for the short-term resistance above, pay attention to the 3,200-3,250 area. If the strong momentum continues and breaks through in the late night, next week will again test last month's high point area of 3,300-3,450.

On Sunday, market sentiment is relatively stable, but next week is crucial, with several Federal Reserve executives speaking and non-farm payroll data being released, which will continue to affect market sentiment. Stay alert!

This article is exclusively published by (WeChat public account: Jian Crypto) and is for reference only. Trading itself is not difficult; the challenge lies in human nature and self-discipline. I hope we can all continuously improve ourselves through learning, refine ourselves, and strive for long-term strength.

Market conditions fluctuate in real-time and have time limits. Feel free to scan the QR code to follow the public account for daily market information and real-time communication.

Warm reminder: This article is solely owned by the column public account (as shown above) Jian Crypto. Any advertisements at the end of the article and in the comments section are unrelated to the author!! Please be cautious in distinguishing between true and false, and thank you for reading.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。