Original author: 1912212.eth, Foresight News

As some projects are forced to adopt token buyback strategies due to low coin prices and overwhelming calls from investors, some project teams are beginning to reflect on this approach.

On January 3, Helium founder Amir Haleem tweeted that he would stop buying back tokens, and the reason given was simple and direct: the market does not "care" about the project team's token buybacks, implying that the effect of buybacks on coin prices is not significant. Therefore, he will "stop wasting funds."

Helium is a decentralized telecommunications infrastructure project that completed a $200 million Series D funding round in March 2022, led by a16z and Tiger Global. Its token HNT is primarily used for network incentives and governance.

In October of this year, the project planned to implement a buyback mechanism, mainly using a portion of the revenue generated by the network (such as mobile services and data transmission fees) to buy HNT from the open market.

Specific details include: allocating a fixed percentage (about 10-20%) from the monthly revenue of Helium Mobile and other businesses for buybacks, with the buyback funds coming from real business cash flow rather than newly issued tokens; buyback operations executed through automated scripts in the secondary market, prioritizing exchanges with high liquidity; a portion of the bought HNT will be burned to reduce circulating supply, while the remaining part will be locked in the project treasury for future network incentives or ecosystem development. Haleem emphasized that the original intention of the buyback was to "reward holders and stabilize prices by reducing supply."

The project team originally planned to continue until the end of 2026. However, the coin price has doused cold water on the project founders.

Since reaching a local high of $4.57 in July this year, it has since declined, hitting a low of $1.3. The effectiveness of the buyback is minimal.

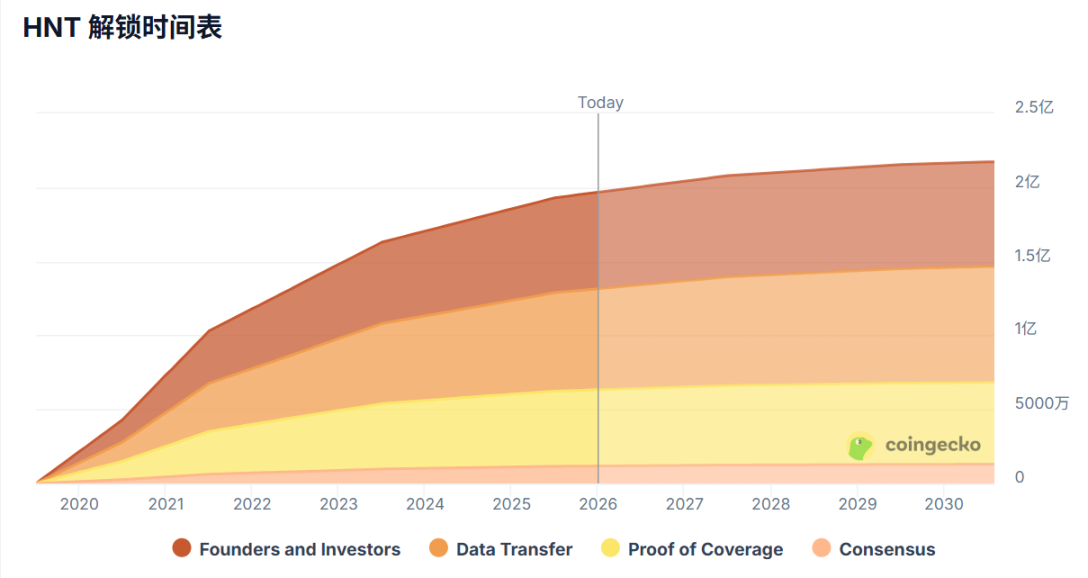

Haleem stated that in October, the Helium + Mobile business had a monthly revenue of $3.4 million. Currently, its token is almost fully circulating, with no large amounts of tokens being unlocked. If buybacks were conducted at 20% of monthly business revenue, the buyback funds would be about $680,000.

In a bearish crypto market, buyback funds of less than a million dollars seem insignificant.

It is no wonder that Haleem stated, "We need to focus on developing Helium Mobile users, expanding its network installation, and increasing operator diversion usage. All funds will be invested in these areas until morale improves."

If the buyback of this "old" star project did not spark heated discussions, then Jupiter co-founder Siong Ong has once again brought the buyback issue to the forefront of public opinion.

Jupiter's $70 million buyback fails to reverse coin price decline

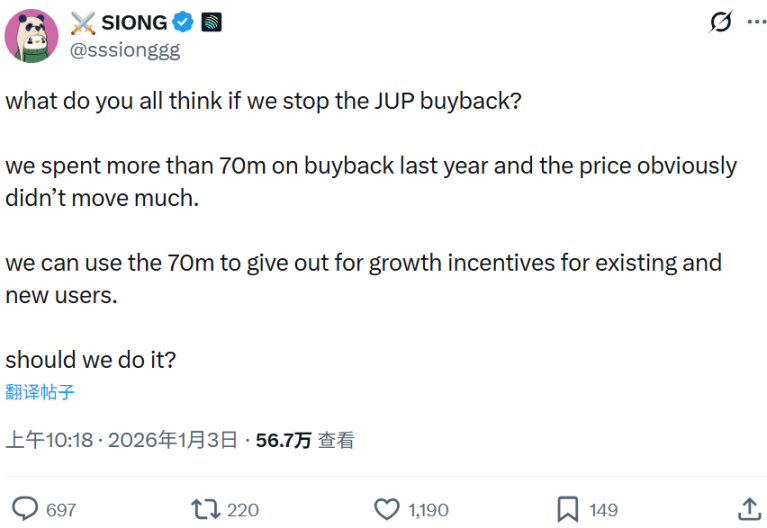

Jupiter is the largest DEX aggregator in the Solana ecosystem, and its token JUP is used for governance and incentives. On January 3, one of Jupiter's founders, Siong Ong, posted to ask the community whether to pause the JUP buyback.

He stated, "Last year, we spent over $70 million on buying back JUP, but the coin price has obviously not changed much. We could use this $70 million to provide growth incentives for existing and new users." He ended with a question: Should we do this?

In January 2025, Jupiter announced that 50% of its protocol fee revenue would be used to buy back the JUP token and locked for three years.

However, after a year of buying back $70 million, the performance of its coin price has been lackluster, currently declining to $0.2, a drop of 10 times from its $2 peak in 2024.

Although Jupiter's buyback details are designed rigorously, the token price trend shows its effectiveness is almost zero.

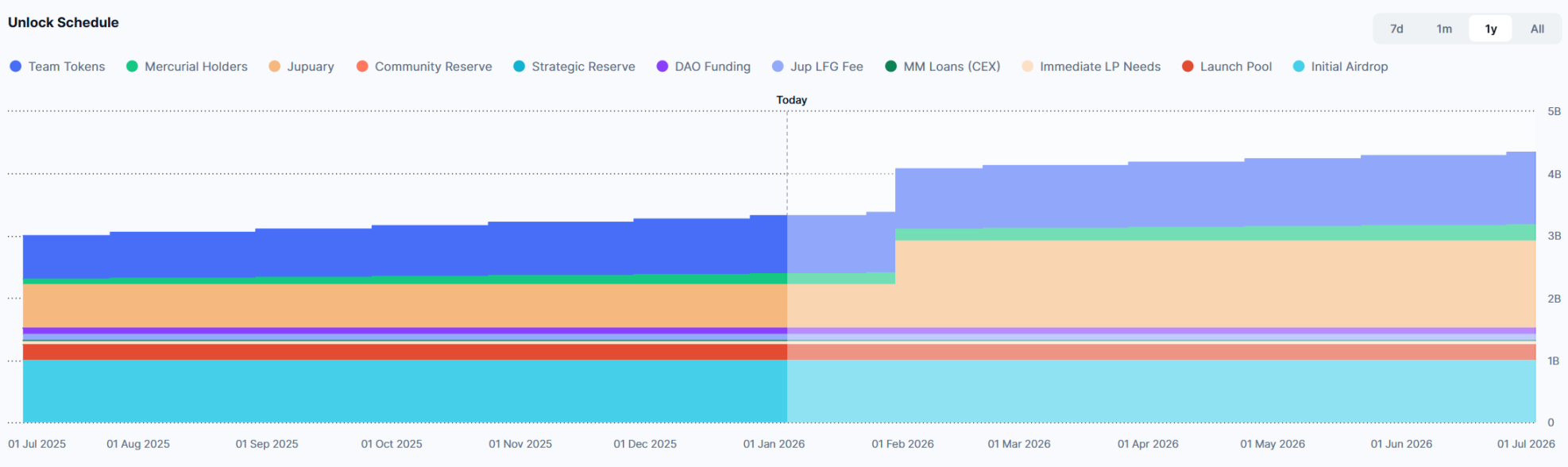

To make matters worse, on January 31 of this year, it will unlock 700 million JUP (10% of the maximum supply), worth $147.88 million. When buying pressure weakens and selling pressure is huge, the coin price is predictable.

Staking? Continue buybacks? Industry leaders engage in heated debate

The actions regarding buybacks by Helium co-founders and Jupiter co-founders have sparked considerable discussion. Solana co-founder Anatoly Yakovenko (Toly) clearly opposes traditional buybacks, believing that "long-term capital formation takes years, not quarters." Toly suggests that projects should build a balance sheet and lock profits through staking mechanisms as claimable assets, similar to equity dilution in traditional finance. This can incentivize long-term holders rather than short-term speculators.

Toly's viewpoint was supported by Kyle, a partner at Multicoin Capital, who stated that cryptocurrency teams should allow long-term holders to receive disproportionate value returns, although the specific mechanisms still need improvement.

However, some expressed opposing views.

Jito COO Brian Smith stated that during market downturns, buybacks can significantly enhance equity value for shareholders. He said, "Questioning buybacks versus growth investments is reasonable. However, using poor prices as a reason does not hold water. Without buybacks, what does price mean? Most importantly, are you underinvesting in positive ROI growth opportunities due to funding constraints? If so, then buybacks should absolutely not be conducted. But most crypto projects still have ample funds, and the funding allocation situation in decentralized autonomous organizations (DAOs) is very chaotic."

Selini Capital partner Jordi provided his perspective, stating that the most successful projects in this cycle have actually disrupted their price charts due to automatic buyback operations, causing confusion for users. Early popular projects like HYPE, ENA, and JUP bought back millions at absurd prices based on fair multiples, leading many retail investors to buy in at high prices due to FOMO (price dominating market narratives), resulting in significant losses. The founders of these projects were overly immersed in this self-reinforcing mindset, believing that high multiples were justified. After months of decline without a clear path back to previous highs, some began to blame the buyback mechanism, claiming it was ineffective. This assertion is equally misguided. For centuries, financial markets have continually forced us to re-examine fundamental economic truths; how many more times will this situation play out?

Jordi stated that if funds are insufficient to pay developers' salaries for project development, then limited funds should not be used for token buybacks. However, once a project succeeds and has sustainable income—if holders do not receive dividends, buybacks, or at least have super clear financial utility, then what is the point of holding the tokens?

He also provided specific targeted solutions, suggesting that buyback amounts should be determined by price. When prices are low, buy back more; when the market is overheated, slow down the buyback pace. Additionally, buybacks could be conducted based on price-to-earnings ratios, for example, 100% full buyback when below 4, and 75% buyback in the 4-6 range.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。