Original|Odaily Planet Daily (@OdailyChina)

At the beginning of the new year, the crypto market has welcomed a rare upward breakthrough, with BTC successfully breaking free from the critical $90,000 level, and mainstream coins like ETH and SOL finally standing above $3,100 and $130, respectively. What is even more astonishing, prompting exclamations of "the bull is back," are the numerous altcoins with rapid rebound momentum—coins like PEPE, IP, and WLFI have all seen their prices surge over 20% in the past three days.

At the beginning of the new year, the crypto market has welcomed a rare upward breakthrough, with BTC successfully breaking free from the critical $90,000 level, and mainstream coins like ETH and SOL finally standing above $3,100 and $130, respectively. What is even more astonishing, prompting exclamations of "the bull is back," are the numerous altcoins with rapid rebound momentum—coins like PEPE, IP, and WLFI have all seen their prices surge over 20% in the past three days.

Of course, it is still early days, and whether the "altcoin season" typical of previous years will reoccur remains uncertain. However, amidst the complex macro-political and economic landscape, whether cryptocurrencies can once again perform a "miracle of soaring prices" like precious metals is already worth looking forward to. Odaily Planet Daily will briefly summarize and analyze the current market conditions and representative viewpoints in this article.

3 Major Market Indicators Analysis: Altcoin Season Has Not Truly Arrived, Currently a "Partial Rebound"

Excluding the overall market trends, it is actually difficult to conclude that "the altcoin season has returned" based on the current overall data. Looking at the rankings of tokens that have rebounded on exchanges, many of the currently rising tokens are either previously oversold targets or highly controlled speculative coins, established meme coins, or trending concept coins. From the following three major data points, it can be seen that the crypto market is still in a slow "price recovery period."

Indicator 1: Overall Market Capitalization of Cryptocurrencies Has Not Significantly Rebounded

According to Coingecko data, the current overall market capitalization of cryptocurrencies is $3.19 trillion, with BTC holding a market share of 57% and ETH 11.9%.

There is still a gap of over $1 trillion from the previous peak of over $4.3 trillion in market capitalization. This is certainly due to the significant declines of mainstream coins like BTC, ETH, SOL, and BNB from their highs, but the fact that many altcoins are facing price declines and cooling trading amidst shrinking liquidity and continuous outflow of funds is undeniable.

Thus, it can be seen that the overall environment of the crypto market has not changed much.

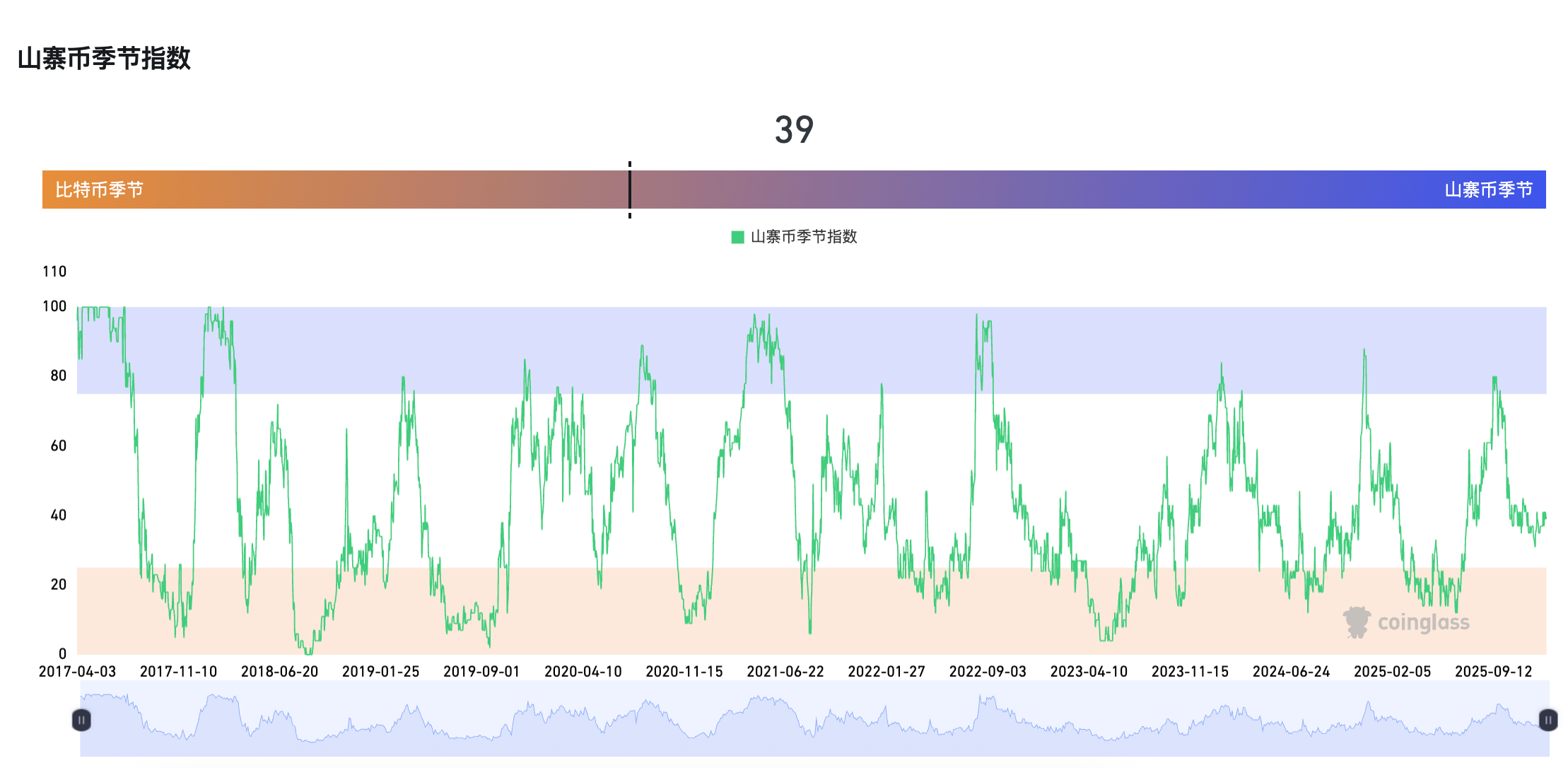

Indicator 2: Altcoin Season Index Remains Low

According to the Coinglass Altcoin Season Index, the current market's altcoin season index is 39, which is in the same range as the market index in mid-July last year, when the market was still on the eve of the DAT treasury company's explosion, with various mainstream coins and altcoins at relatively low points. Of course, as the camp of DAT treasury-listed companies continued to expand, ETH subsequently reached new highs. Compared to the incremental buying brought by listed companies at that time, the market's liquidity has shrunk to a certain extent now.

Indicator 3: Market Sentiment Remains in the Fear Zone

According to Coinglass website information, the fear and greed index of the crypto market is currently at 26, indicating a state of fear; this range is also the stage where market sentiment is the most dominant, accounting for a total time proportion of 30.86%, which aligns with the bearish sentiment in the market.

In summary, the market is still in a lukewarm phase, but does this mean there are no wealth-making opportunities? The mainstream view in the market clearly does not think so; on the contrary, many institutions and individuals point out that this may be a good opportunity to buy the dip, with the main supporting logic being the expected improvement in liquidity and progress in the macro-political and economic landscape. As the saying goes, be greedy when others are fearful, but of course, the premise is to choose the right targets.

3 Major Signs of Market Turning Point: Improvement in Liquidity, BTC Taking Over Precious Metals' Rise, Retail Investor Sentiment Remaining Rational

Currently, the mainstream view in the market has a certain consensus on a short-term bottoming rebound, but the real turning point may depend on the increase in market liquidity, BTC's market performance, and the sentiment of retail investors. Here are some representative viewpoints from the current market:

Global Market Liquidity May Rebound Next Week, Intra-Market Speculation Fuels Short-Term Rebound

Danske Bank's foreign exchange and interest rate strategist Jens Naervig Pedersen stated in a report that global market liquidity is expected to remain thin this week, but may rebound next week with the release of more economic data. During the year-end period, many market participants take vacations or close positions, leading to generally low market liquidity.

Key data for next week includes important labor market data from the U.S., such as the non-farm payroll report for December to be released on January 9 and the ISM survey.

CoinKarma also stated that the cryptocurrency market has returned to an intra-market speculation phase, with internal factors becoming key to short-term volatility direction. In the absence of clear external incremental funds, the crypto market is primarily driven by the circulation of internal funds, with short-term price fluctuations stemming from changes in the flow of internal funds and overall liquidity.

Additionally, by observing the USDC/USDT Premium (which measures the premium status of USDC relative to USDT) and Overall LIQ (the overall market weighted liquidity indicator), it is noted that when the USDC/USDT Premium turns positive, it reflects a weakening of the dominant funds' active selling behavior in BTC/USDT. Currently, the USDC/USDT Premium and Overall LIQ are resonating again, indicating a significant chance of forming a bottoming rebound in the short term. CoinKarma also pointed out that compared to previous phases, the current medium to long-term trend still leans bearish, and potential selling pressure should be monitored.

Precious Metal Prices Correct, BTC May Take Over the Rise

After gold and silver experienced a new high surge last month, many market players and analysts have begun to identify cryptocurrencies, including BTC, as the liquidity successors following their price corrections.

TD Securities' senior commodity strategist Daniel Ghali stated that within the next two weeks, up to 13% of the total open interest in the New York Mercantile Exchange's Comex silver market is expected to be sold off, which will lead to a significant revaluation and decline in prices, and the low liquidity after the holiday may amplify price volatility.

Delphi Digital also stated that gold prices have risen 120% since the beginning of 2024, marking one of the strongest increases in history. Since gold historically leads Bitcoin by about three months at liquidity turning points, this trend is significant for cryptocurrencies. Currently, gold has completed the repricing for the easing cycle, while Bitcoin's sentiment is still influenced by previous cycle simulations and recent pullbacks. The performance of precious metal assets is signaling policy easing and fiscal dominance. When precious metals outperform stocks, the market tends to price in currency devaluation rather than growth collapse, and the volatility in the precious metals market may signal the subsequent trends of other risk assets.

The agent of the "10·11 insider whale," Garrett Jin also stated that, as previously analyzed, the prices of gold and silver have peaked. After the U.S. market opened today, funds have begun to shift towards the cryptocurrency market, and even if the stock market faces selling after opening, cryptocurrencies continue to rise. The inflow of funds may persist, and the upward momentum may accelerate, leading to a short squeeze without a pullback.

Retail Investor Sentiment Will Be an Important Indicator of Market Changes

Blockchain analysis platform Santiment analyst Brian Quinlivan pointed out that cryptocurrency market participants have shown strong sentiment on social media at the beginning of the year, but he also warned that whether the market can rise further depends on whether retail investors can remain rational. He stated that Santiment's social media data shows that current retail sentiment is very positive. "This is usually somewhat concerning," he said, "but this time it may just be a normal rebound after the holiday return."

Quinlivan expressed that he is not overly worried about "a surge of FOMO sentiment," but added that if Bitcoin quickly rises to $92,000, such sentiment may flood the market. When market excitement is too high, the cryptocurrency market often moves in the opposite direction of what most people expect.

Market Expectations Diverge, Intra-Market and Out-of-Market Funds Go Separate Ways

Considering the current market conditions, the trading attitude towards ETFs remains cautious, in stark contrast to the optimistic attitude of intra-market funds.

Over $900 Million Net Outflow from BTC ETFs in the Past 3 Weeks

Yesterday, Bitcoin's price rose above $90,000, reaching a near three-week high. However, the fund flows of derivatives and spot ETFs indicate that traders remain cautious, suggesting limited confidence in further price increases. Data shows that despite the price rebound, the demand for Bitcoin leveraged long positions remains stable, and the Bitcoin futures basis is below the neutral threshold, with the current annualized premium at 4%. Since December 15, Bitcoin spot ETFs have recorded over $900 million in net outflows. Additionally, Bitcoin put options traded at a premium on Saturday, indicating an increased demand from professional traders for downside risk protection.

DOGE, PEPE Drive Meme Coins to Rise, IP, ZEC, WLFI Lead Oversold Rebound Sector

Recently, Dogecoin and PEPE have led a wave of rising meme coins at the beginning of the year. Some analyses suggest that momentum traders are chasing a familiar pattern: once liquidity is restored, speculative funds will flow from major coins into meme coins. Currently, major meme coins are experiencing a price surge, including PEPE, DOGE, SHIB, WIF, and FLOKI.

Tokens like IP, ZEC, and WLFI, categorized as "hot concept tokens," have rebounded after significant declines, buoyed by relevant news and market fundamentals since the start of the year.

Among AI concept tokens, RENDER and PIPPIN are still actively traded, with both spot and contract prices showing impressive gains of over 15%.

Based on the existing information, the biggest variable in the crypto market remains focused on this month's macroeconomic data and Trump's nomination for the new Federal Reserve chair. Before that, bottom-fishing is possible, but it is advisable to choose short-term operations and avoid getting overly excited.

BTC Year-End Price Prediction Contest Begins, $120,000 to $170,000 as Main Range

Finally, we will conclude the article with the current BTC price predictions, as well as our expectations for this year's rise.

The Hong Kong Commercial Daily published an article titled "Speculative Attributes Fade, Bitcoin Volatility Stabilizes," which points out that the surge in Bitcoin in 2025 will be different from previous years, primarily due to the widespread rollout of ETFs. The recent price correction is not significant compared to the past four or five years, and this change may be related to the influence of macroeconomic factors on traditional capital operating logic. There are two opposing views in the market regarding Bitcoin's trajectory in 2026: one side believes Bitcoin may face a significant correction, potentially returning to lower price ranges, while the other side is optimistic about Bitcoin reaching $150,000 by the end of the year, with expectations of hitting $250,000 in 2027.

Forbes published an article titled "What Is Bitcoin's Price Prediction For 2026," which states that the publicly available Bitcoin price predictions for 2026 vary widely. Analysts from Tom Lee, Standard Chartered Bank, and Bernstein are bullish, but some institutions are bearish. Although there is currently no single target price for Bitcoin, predictions are concentrated in the range of $120,000 to $170,000, indicating that Bitcoin's price discovery is increasingly influenced by structural factors such as ETF fund flows and corporate treasury assets. If macroeconomic favorable factors strengthen and institutional participation accelerates, the potential upside could reach $250,000 or higher. How institutions choose to deploy capital will be a key factor in Bitcoin's price increase.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。