On the first trading day after the New Year's holiday, $471 million in institutional funds surged into the U.S. Bitcoin spot ETF market like a floodgate opening, with BlackRock's single fund attracting $287 million, setting a record high since mid-November of last year.

On the first trading day of 2026, the U.S. Bitcoin spot ETF market attracted a remarkable net inflow of $471 million, with BlackRock's IBIT accounting for $287 million.

The price of Bitcoin responded by returning to over $90,000, while Ethereum also broke through the $3,100 mark.

1. Record Start to the Year

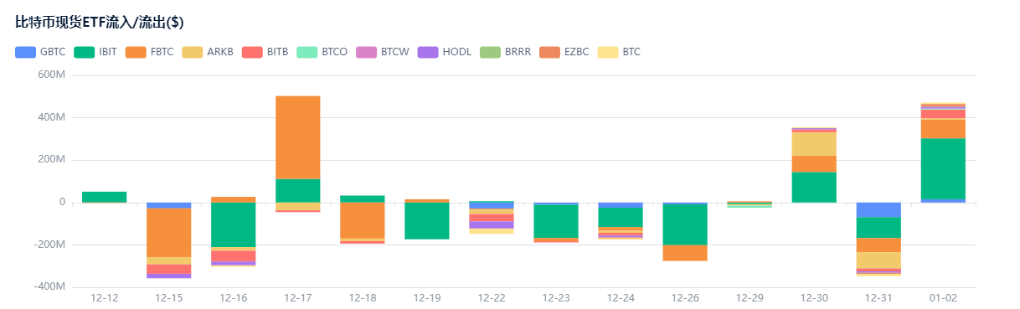

● On January 2, 2026, the net inflow into U.S. Bitcoin spot ETFs reached $471 million, the highest single-day net inflow since November 19, 2025.

● This figure marks a significant shift in market sentiment. At the end of 2025, the crypto market underwent a substantial adjustment, with Bitcoin falling about 30% from its historical high of nearly $126,000 in early October, ending the year down about 6%.

The strong inflow of funds at the start of the new year seems to have broken this downward trend. Market analysts generally believe that this wave of capital may signal a positive start for the crypto market in 2026.

2. Giants Leading the Charge

● In the funding feast on January 2, BlackRock's iShares Bitcoin Trust Fund stood out, with a net inflow of $287.4 million, accounting for over 60% of the total inflow.

● Fidelity's FBTC ranked second with a net inflow of $88.1 million, while mainstream products like Bitwise's BITB and Grayscale's GBTC also saw net inflows.

● This pattern of differentiation continues the trend of 2025. As of December 2025, BlackRock's IBIT managed approximately $85.5 billion in assets, about four times that of the second-largest Bitcoin ETF, Fidelity's FBTC.

3. Market Structure

This round of capital inflow is not an isolated event; the U.S. Securities and Exchange Commission's policy adjustments have provided a systemic foundation for ETF growth. In September 2025, the SEC approved general listing standards for cryptocurrency ETPs, shortening the product listing cycle to 75 days.

Bitwise predicts that based on the new regulations, over 100 cryptocurrency-related ETFs will be launched in 2026. However, Bloomberg's senior ETF analyst James Seyffart warns: "We will witness a large number of ETF liquidations."

Market infrastructure is also under pressure. Coinbase currently provides custody services for about 85% of Bitcoin ETFs globally, with custodial assets reaching $300 billion in the third quarter of 2025.

4. Supply Squeeze

● The continuous inflow of institutional funds is reshaping the supply dynamics of Bitcoin. Bitwise research shows that since the approval of the U.S. spot Bitcoin ETF in 2024, these products have seen a cumulative net inflow of $57.27 billion.

● This figure creates significant structural demand. In 2025, institutions accumulated 944,330 Bitcoins, while miners only produced 127,622 new coins during the same period, meaning institutional purchases were 7.4 times the new supply.

● Bitwise's outlook for 2026 predicts that U.S. cryptocurrency ETFs' purchasing volume may exceed the total new issuance of BTC, ETH, and SOL for the year. This supply-demand imbalance could exert upward pressure on crypto asset prices.

5. Regulatory Variables

The crypto market in 2026 faces three key variables: the Federal Reserve's interest rate cut policy, the risk of an AI industry valuation bubble, and the legislative progress of the CLARITY Act.

● The market generally expects the Federal Reserve to potentially cut interest rates by 100 basis points in 2026, which would be favorable for risk assets. Citigroup's research department estimates that based on the assumption of ETF inflows reaching $15 billion, Bitcoin's price scenario over the next 12 months could range between $78,000 and $189,000.

● Regulatory clarity is seen as a key catalyst for market development. If passed, the CLARITY Act would clarify the jurisdictional boundaries between the SEC and CFTC regarding crypto assets, providing a survival space for DeFi protocols and altcoins.

6. Underlying Risks

Beneath the market euphoria lies hidden risks. An analysis from December 22, 2025, warned that the crypto market in 2026 will face a "life-and-death test," with the first quarter's performance determining whether the bull market continues or reverses.

● CoinTelegraph's market director Ray Salmond pointed out that the key factors driving Bitcoin's rise in 2025—adoption rates at the institutional, corporate, and government levels—remain uncertain for 2026.

● The potential collapse of the AI industry valuation bubble is viewed as the biggest risk. If investors sense risks associated with heavily indebted, cash-strapped AI and quantum computing companies in 2026, their negative reactions could ripple through the entire crypto market.

7. Future Landscape

Despite the risks, several institutions hold an optimistic view of the crypto market in 2026. Bitwise anticipates that as more institutions gain access to investment channels, ETF demand will continue to grow.

● Nate Geraci, president of NovaDius Wealth Management, believes: "2026 will be the year of true mainstream adoption for cryptocurrencies."

● Nick Ruck, director of LVRG Research, noted that although the overall returns of cryptocurrency assets in 2025 were negative, the significant developments in Ethereum, Solana, and Ripple have led to substantial maturation of cryptocurrency ETFs.

As of December 2025, the global assets under management of crypto funds have surpassed $250 billion. Market analysts are watching the rolling fund flow data on Bloomberg terminals, and Citigroup's projected $15 billion annual ETF inflow target now seems like a conservative starting point.

U.S. Bancorp has restarted its institutional Bitcoin custody program, and Citigroup and State Street are also exploring custody collaborations for cryptocurrency ETFs. These traditional financial institutions are cautiously yet firmly stepping into the once-marginalized crypto asset space.

The market holds its breath for the next key data release, with Bitcoin's price hovering around the $90,000 mark.

Join our community to discuss and grow stronger together!

Official Telegram community: https://t.me/aicoincn

AiCoin Chinese Twitter: https://x.com/AiCoinzh

OKX benefits group: https://aicoin.com/link/chat?cid=l61eM4owQ

Binance benefits group: https://aicoin.com/link/chat?cid=ynr7d1P6Z

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。