The year 2025 has come to an end, and it can be said that some in the financial markets are celebrating while others are in despair.

Thanks to the Federal Reserve's interest rate cuts and a significant rise in AI investment enthusiasm, global stock markets have nearly achieved the largest annual increase in six years. Gold, silver, and platinum have repeatedly set historical highs, and traditional assets have delivered impressive results.

However, the cryptocurrency market has become the biggest loser in this feast. Bitcoin's closing price in 2025 was lower than at the beginning of the year, marking the first time in history that an annual decline was recorded in the year following a halving event. Once regarded as "digital gold," Bitcoin has fallen behind in this round of asset class increases.

The market's divergence regarding Bitcoin's long-term cyclical structure continues to widen. Some say the halving narrative has failed, and the four-year cycle has been broken; others believe this is just a temporary adjustment, and the real bull market is still ahead.

As 2026 begins, while wishing everyone a Happy New Year, the Rhythm editor also wants to discuss several important monetary policy and political events in 2026 and see how they might impact the cryptocurrency industry.

Market Bets on the Federal Reserve Cutting Rates 3 Times

After the Federal Reserve held its last meeting of the year, the released interest rate forecast was quite conservative, suggesting only one rate cut in 2026, which would be a reduction of 25 basis points.

However, most institutions and economists do not feel so pessimistic. Due to the political pressure from the midterm elections and changes in the Federal Reserve's personnel structure, they believe the Fed's rate cuts in 2026 may exceed market expectations, with 2 to 3 cuts being more appropriate.

Major institutions like Goldman Sachs, Morgan Stanley, and Bank of America are essentially betting on 2 cuts, predicting that rates will drop from the current 3.50%-3.75% to around 3%-3.25%. Citigroup and China Galaxy Securities are a bit bolder, believing there will be 3 cuts, totaling 75 basis points.

Currently, the highest probability for the number of rate cuts in 2026 on Polymarket is 2 times.

There are also many analyses regarding the specific months for the rate cuts.

For those in power, low interest rates help stimulate the economy, thereby increasing the chances of electoral success. Therefore, to show policy effectiveness before the midterm elections on November 26, 2026, the Trump administration needs the Federal Reserve to make significant rate cuts beforehand. Considering the lag in monetary policy transmission to the real economy, rate cuts need to be completed before October 28, 2026, making the December meeting too late for the elections.

Thus, major institutions' predictions for the timing of rate cuts in 2026 are mostly in the first half of the year.

For example, Nomura Securities predicts specific months as June and September; Goldman Sachs believes it will be March and June; Citigroup and Rabobank predict January, March, and September.

Currently, the consensus is that a rate cut in June is quite strong, as the new Federal Reserve Chair will preside over the FOMC meeting for the first time on June 17-18, 2026. Institutions are betting that the likelihood of announcing a rate cut at this meeting is very high, as the new chair needs to express loyalty to the White House.

Federal Reserve Resumes "Buy, Buy, Buy"

After discussing rate cuts, we must also talk about another important action taken by the Federal Reserve at its last meeting in 2025: the reintroduction of a "Reserve Management Purchase" (RMP) mechanism to start buying government bonds again.

Starting from December 12, 2025, the New York Fed will purchase approximately $40 billion in short-term Treasury bills each month. The official explanation is that this is a "technical operation," not considered monetary policy, merely to maintain "adequate reserves" in the banking system and to prepare for the tax season in April next year, as money will flow from banks to the Treasury at that time.

The Federal Reserve's balance sheet is currently about $6.54 trillion, and if it buys $40 billion each month until April next year, it will add approximately $160 billion in assets.

In addition to the Federal Reserve buying government bonds, another data point worth noting is the Treasury General Account (TGA), which can be understood as the government's checking account at the Federal Reserve.

The last time the U.S. government shut down, the TGA balance reached a peak of $959 billion, with a large amount of cash accumulated in the Treasury account.

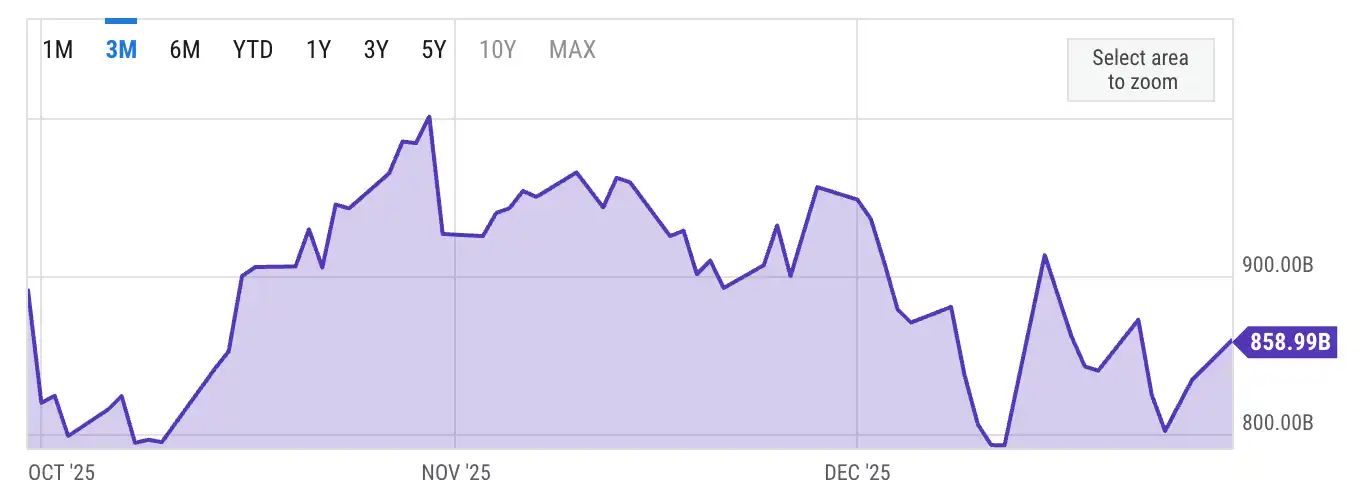

Changes in TGA Balance

It has been a month and a half since the U.S. government reopened, and the current TGA balance is about $850 billion. This means that $100 billion in spending has already been released, providing significant liquidity to the market.

For the cryptocurrency market, what matters is whether total liquidity is increasing or decreasing.

So optimistically speaking, the combination of RMP purchases + significant declines in TGA + the potential issuance of some form of tariff dividends by the end of 2026 could provide a substantial boost to global liquidity, thereby helping the cryptocurrency market rise.

Why Does Japan Insist on Raising Interest Rates?

After discussing the Federal Reserve, let's shift our focus to Japan across the Pacific.

The minutes from the Bank of Japan's December meeting show that policymakers are discussing the necessity of continuing to raise interest rates, with some members calling for "timely" action to control inflation. A Bloomberg survey indicates that economists believe the Bank of Japan will likely raise rates again in about six months, with most expecting this round of rate hikes to ultimately stop at 1.25%. Former Bank of Japan executive Hideo Hayakawa even stated that rates could rise to 1.50% by early 2027.

While global markets are cutting rates, why does Japan insist on raising them?

This situation stems from Japan's circumstances. For decades, Japan has been battling deflation, with interest rates long near zero or even negative. But now the situation has changed; inflation has risen, and wages have started to increase, giving the Bank of Japan a chance to "normalize" its monetary policy.

The problem is that Japan is burdened with a massive debt, with government debt accounting for about 200% of GDP, and Japanese government bond yields have now fallen to levels not seen since before 2008. With such a high debt level, if interest rates rise too quickly, the government's interest expenses will explode, and the bond market may not be able to withstand it.

Even more troublesome is the yen. Before the meeting, the yen had already fallen to its weakest level in 10 months, nearing the threshold of 160 yen to 1 dollar, a level at which the Japanese government directly intervened in the currency market last time. Logically, raising interest rates should lead to currency appreciation, but the yen has instead continued to decline.

The core contradiction lies here: Japan's economy is in a dilemma: either save the bond market or save the yen, but both cannot be saved simultaneously. The Bank of Japan is saying it wants to raise rates to control inflation while also needing to buy a large amount of Japanese government bonds to stabilize the bond market. Raising rates makes the yen more expensive, but simultaneously buying bonds injects liquidity, which is somewhat like hitting oneself with the left hand while using the right hand.

Now, Japanese government bond yields have fallen to levels not seen since before 2008, but the yen against the dollar is almost at its lowest point in 35 years. Therefore, it can be said that the Bank of Japan is actually "sacrificing the yen to save the bond market."

The negative impact of Japan's interest rate hikes on the cryptocurrency market is also directly visible; in the past few instances of Japan raising rates, the cryptocurrency market has experienced significant drops. The reasons have been discussed in previous articles such as "Why Does Japan's Rate Hike Lead to Bitcoin's Collapse?" and "From Yen Rate Hikes to Mining Operations Closing, Why is Bitcoin Still Falling?." In simple terms, Wall Street and global speculators borrow yen at nearly 0% cost, convert it to dollars, and invest in high-yield assets like Bitcoin and U.S. stocks. It's like someone is lending you money for free to speculate on cryptocurrencies; would you be happy? That's how tens of trillions of dollars have been borrowed.

When Japan suddenly raises interest rates, the cost of borrowing yen increases, and these institutions must close their positions, selling off their risk assets, including Bitcoin, to repay the yen.

So, will Japan's interest rate hikes in the new year repeat the previous downward trend? The Rhythm editor believes it may not necessarily be the case. There are several reasons:

First, the market has already anticipated Japan's interest rate hikes; in the new year, they are unlikely to be as shocking, as the market has begun to pay attention to this influencing factor and has been discussing it for several months, adjusting positions early, unlike last year when it was caught off guard.

Second, as mentioned earlier, the Federal Reserve is cutting rates on the other side. If the Fed does indeed cut rates 2-3 times in 2026, the interest rate differential between the U.S. and Japan will narrow, and the attractiveness of carry trades will naturally decline; a 0.25% increase in Japan may not have as significant an impact.

Third, the overall direction of liquidity is more important. As mentioned earlier, the Federal Reserve's leadership change, RMP bond purchases, and the potential continued release of liquidity from the TGA account, along with tariff dividends, could provide a significant boost to liquidity. After all, no one wants to improve economic data more than Trump before the midterm elections. If the faucet in the U.S. is opened wide enough, the tightening effect in Japan may be largely offset.

Of course, short-term volatility will still occur. If the Bank of Japan suddenly accelerates its rate hikes or if the Federal Reserve's rate cuts are not as aggressive as expected, the market may still experience short-term panic. However, in the medium to long term, the overall trend of global liquidity is the core variable determining the cryptocurrency market.

If the Democrats Win the Midterm Elections?

Having discussed so much about monetary policy, there is actually another factor that directly impacts the cryptocurrency industry in 2026: the U.S. midterm elections in November.

Trump and his Treasury Secretary Mnuchin are well aware that to maintain the Republican Party's seats in Congress during the midterm elections, they must ensure that American citizens feel tangible economic benefits before voting. This is why they are so eager to push for rate cuts and tariff dividends, all aimed at stimulating the economy before the midterm elections.

After all, the Democrats currently seem to have an advantage. The local elections in the past month or two have given the Democrats a boost. They have won key elections such as the mayorship of New York City, the governorship of New Jersey, and the governorship of Virginia, even making breakthroughs in some traditionally red states.

For instance, a conservative district in Georgia has unexpectedly turned blue, considering that Trump won there by a margin of 12 percentage points in last year's presidential election. The Miami mayoral election saw the Democrats win for the first time in 30 years. Even in deep red states like Tennessee, the Republicans only won by 8%, whereas previously, they wouldn't have felt comfortable unless they won by over 20%. The victories in local elections are not coincidental; they indicate that voters are dissatisfied with the current economic situation. If this trend continues into next year, the Republicans could indeed lose control of Congress.

Former House Speaker Pelosi recently expressed confidence in an interview, predicting that the Democrats will regain the House of Representatives in the 2026 midterm elections. There is a prevailing sense of optimism within the Democratic Party.

On the Republican side, however, there are numerous challenges:

Even if the Trump administration starts adjusting tariff policies and pushing for rate cuts now, it will be difficult to see results in the short term. With the midterm elections set for November, and considering the time needed for policy transmission, the window for Trump is already very tight.

Trump has also been calling for Senate Republicans to abolish the "filibuster" rule, which allows senators to delay or block a vote on a bill by continuously speaking. Trump wants to use this method to quickly advance his policies while also preventing the possibility of another "shutdown" on January 30 due to Democratic obstruction. However, there is significant opposition within the party, as many Republican senators are concerned that setting this precedent could lead to similar actions by the Democrats when they become the majority party in the future.

As 2026 begins, it is still too early to judge the outcome of the midterm elections, as there are too many variables. However, a few points can be confirmed: to maintain congressional seats, Trump will use all means at his disposal—rate cuts, fiscal stimulus, tariff dividends—everything that can be done will be done, which will be beneficial for risk assets, including cryptocurrencies, in the short term.

Therefore, from an investment perspective, the Rhythm editor believes that there may still be many operational opportunities and time windows in the first half of 2026. However, as the midterm elections approach in the second half of the year, uncertainty will sharply increase. If polls show the Democrats leading, the market may price in this expectation in advance, and the cryptocurrency industry could face adjustment pressure.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。