After the dark battle of the wallet track in the underlying facilities of Tee, many viewers have been urging for updates in the background, so the Fourteen Lords will roll again in 2025.

Hyperliquid is undoubtedly the annual hotspot. This time, let's take a professional look at how events are interconnected, examining how wallets, exchanges, DEXs, and AI trading are engaged in fierce competition here!

1. Background

In 2025, I basically researched all the Perps (perpetual trading platforms) available on the market, witnessing the hype market's fivefold growth and peak halving (9->50+->25).

In the ups and downs, was he really left behind by competitors? Or was it due to the developmental concerns of its hip3 and builder fee reducing platform revenue? The Perps track itself is also seeing a surge of competitors, with recent entrants like aster, Lighter, and even Sun Ge entering the fray, pushing the sunPerps that shake the track, with their promotional Twitter space even setting a new record for online attendance at a web3 industry conference.

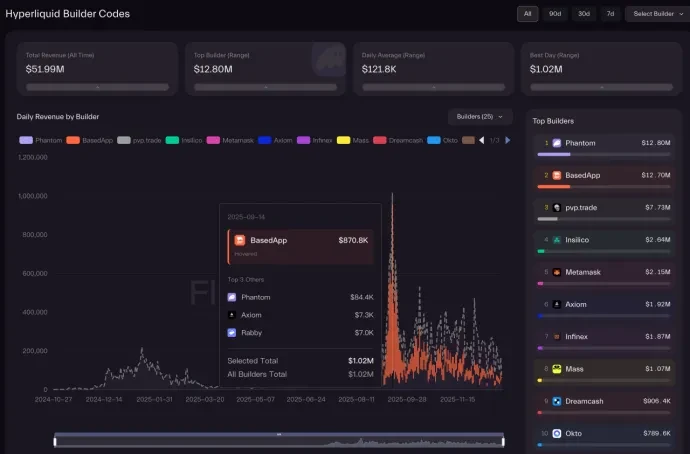

From the image below, we can see the so-called chaotic battle among the heroes. Interestingly, this is also a rare process of an established market being divided.

Recalling the competition among all DEXs during the DeFi Summer, including Uniswap, Balancer, Curve, and numerous Uniswap fork projects like Pancakeswap, etc.

The current moment for Perps is just like that moment during DeFi Summer. Some want to build platforms, some want to aggregate others, some want to challenge the leaders, and some want to take a little profit.

This year, various wallets have been competing to launch perpetual trading capabilities at the DEX entrance, with Metamask and Phantom leading the way. Last week, Bitget also announced its integration, while other startup products like axiom, basedApp, xyz (using hip3), and several AI trading platforms are also joining in to share the pie.

Thus, the wallet track is undergoing a new round of dark battles.

Everyone is eager to integrate Hyperliquid's perpetual trading capabilities. What lies behind this? Is it the dividend of technological openness, the temptation of rebate mechanisms, or merely a true reflection of market demand? Why have some leading platforms remained inactive? Have early adopters seized the market?

For further reading: In-depth discussion on the success and concerns of Hyperliquid

2. Ecological Origin, Builder Fee and Referral Mechanism

Hyperliquid's rebate mechanism mainly includes Builder Fee combined with Referral (rebate).

I have always believed this is a very disruptive mechanism. It allows DeFi builders (developers, quantitative teams, aggregators) to charge additional fees as service income when placing orders on behalf of users. The total fees remain unchanged when users place orders on these platforms and the official website.

Its essence is similar to Uniswap V4's hook mechanism, where it uses its own order book (or liquidity pool) as infrastructure, providing access to various upstream platforms. This way, it can more easily attract user groups from different platforms, while different traffic platforms (wallets) also have a more comprehensive ecological product to serve their users' diverse needs.

This mechanism has already brought some projects over ten million dollars in dividend income upon initial launch, showing significant early effects, but has since continued to decline.

From the image, we can also see many thought-provoking aspects.

• Why is there a fivefold difference in revenue between Metamask and Phantom, despite similar user volumes?

• Why is there a significant revenue gap between basedApp and axiom? Where is Jupiter?

• Is a 12M dividend income considered a lot or a little? Is it short-term or long-term?

• Do platforms that only lightly integrate HypeEVM or native coins suffer losses?

• Why are Bn, okx, etc., not included?

3. PerpDex's Open Strategy

To answer these questions, we must first understand how various platforms are integrated.

3.1 Open API Integration Method

In fact, each Perp has opened their APIs, which are quite comprehensive. Almost every platform has its own definition, but the provided modules are generally as follows: query types (account status, positions, orders, market data, K-line, etc.), trading types (placing orders, canceling, modifying, adjusting leverage, withdrawing, etc.), and subscription types (WS real-time price, order book, position changes).

This system itself requires these APIs to provide market-making for market makers, while the user side merely changes the trading direction. However, users cannot connect like market makers, so some control measures must be added.

Thus, a throttling mechanism is necessary. Hype's is based on a dual throttling of address + IP, dynamically adjusting the throttling threshold with trading volume. High concurrency may face throttling challenges.

The advantage of this official API solution is rapid integration without the need to build nodes, low data latency, and good state consistency.

However, the disadvantages are also evident: it may face IP/region restrictions, is easily affected by throttling, and while throttling is less of an issue for individual users, it becomes challenging for platform providers, as user numbers can increase at any time, making dynamic scaling difficult.

There are also update issues; apps must modify code with version release limitations. If the official API is upgraded or changed, throttling can leave the app provider without control, and besides being a traffic provider, they must also bear customer complaints and risks.

3.2 Read-Only Node Integration Method

Hyperliquid has a dual-chain structure, with EVM and core integrated into one program and closed-source encapsulated, making it difficult for outsiders to crack and read specific content. The official only supports project parties deploying this read-only node (which can access orders, K-lines, transaction data but does not support sending transactions).

Moreover, it does not open all historical data, which is vast: in just two days, it can increase by about 1T+ of data. Over a year, without archiving historical data, the cost itself is hard to cover the revenue.

If project parties deploy read-only nodes to reduce the frequency of reading the official API and thus lessen throttling issues, this is currently the official recommended approach.

However, adopting this solution comes with several technical challenges: there may be occasional block drop phenomena, huge storage requirements, and missing historical data. Additionally, the data method for modifying nodes must be changed.

I believe the biggest issue is still the consistency problem brought about by this half-open mechanism.

For example, if I use K-line data from a read-only node to place an order, but the node itself is delayed (which can happen probabilistically), I can only place orders using the official API, which has no delay. Here, the data between the two may be inconsistent, making it likely that my market order will be executed at a price I do not desire.

So, who is responsible? Does the platform earn enough to cover the compensation here? How much cost does the platform need to enhance stability? Is it appropriate to directly shirk responsibility?

3.3 Market Choices

This presents a divergence, as each platform has different approaches.

• Metamask, as a typical representative of a tool-oriented positioning, directly adopts the front-end integration of open APIs, even open-sourcing the integration code, bringing rapid online efficiency through a simple and straightforward method. I rarely see such a conservative leading wallet platform act so quickly in the market.

• The same approach is taken by Rabby, Axiom, and BasedApp.

• Trust Wallet has also integrated Perps, but it connects to the BN system's aster platform, clearly giving a green light to its own products. However, how internal commissions are divided remains uncertain.

• Phantom, which rose from the Meme wave on Solana, emphasizes the pursuit of experience. It adopts the read-only node integration method, where even order operations must be relayed through the backend, rather than the client directly contacting the official API to place orders.

In fact, there are some fascinating products in the market that have made different choices.

For example, Trade.xyz is currently the platform with the highest trading volume on Hip3, not pursuing the existing market's red ocean competition but directly developing stock trading capabilities.

VOOI Light is also quite capable (in engineering), being a cross-chain perpetual DEX based on intent, with its core being the simultaneous integration of multiple Perps DEXs, effectively taking multiple paths of the above platforms through engineering efforts. However, it falls short due to the complexity of multi-integration reserves, leading to a less smooth experience.

Finally, I have recently experienced several AI trading platforms, almost all of which use open API integration + backend integration solutions for multiple Perps. The experience feels very cutting-edge, with some using pure LLM large model text interaction, while others employ AI decision-making + following traders (which can also link with Tee custodial solutions like Privy), achieving the ability to assist in Perps trading without passing private keys to the project parties.

For details on the private key custody battle, see: The dark battle of blockchain wallets in 2025, what exactly is being rolled?

Different solutions bring different experiences, which can somewhat explain the differences in the final rebate effect data.

4. Reflection

The previous social login can only solve recovery issues but cannot address automated trading problems.

4.1 Complexity of Reserves

This aspect is often the most overlooked. The complexity of Hyperliquid far exceeds expectations; it is not simply "integrate and use."

Various platforms initially optimistically viewed the integration of Hyperliquid as an aggregation DEX approach, but they overlooked that it is not a Lego model. If the market declines after integrating Hyperliquid, will those functions still be available? How many wallets are now discontinuing previously established protocols? And will users who left the platform return to the official platform?

Moreover, if Hyperliquid does not gain traction, and perhaps aster or lighter does, will they migrate to the new platform? Each platform's APIs are not entirely consistent; how will migration and parallel operation be handled?

To smooth out these issues, it inevitably increases the complexity of the experience.

Ultimately, if users want a comprehensive entry point, why not use the official platform itself?

Front-end integration brings a quick experience and coverage, but it seems Metamask has suffered a silent loss, not earning much money while providing its user traffic for free.

The high-quality experience brought by back-end integration is currently the core point of Phantom's maximum earnings, but it also incurs significant costs. Ultimately, the ROI (return on investment) may only be known to them.

4.2 Why Can't Total Revenue Break Through Higher Levels?

Looking back at our own (focusing on advanced Perps players) preferences for platforms like Hyperliquid, we still prefer a complete official entry point and tend to operate more on the PC side. The main reason is the direct visibility of advanced features like take-profit/stop-loss settings, chart monitoring, and margin models. After all, this track is inherently populated by high-end players.

The demand for mobile use is to "monitor market changes anytime and anywhere, managing position risks and prices, rather than performing complex analyses."

Thus, Phantom's advantage, after bringing in new users for the initial experience, has been continuously declining because its focus remains on the mobile side.

Platforms like BasedApp, which have both app and web entry points, cater to both demands. However, due to competition from the official entry on the web side, the upper limit is not significant.

However, Hyperliquid's own app will also be launched soon, so this market will become increasingly limited.

One can only say that architectural differences determine the value of integration, but the magnitude of that value depends on the depth of integration. Ultimately, the ceiling of this model is still determined by competition within the industry, making it difficult for user contributions from entry platforms to remain on the original platform.

If wallets can provide advanced mobile features (advanced charting, alerts and notification systems, auto trading), then there is indeed differentiated value. We can see that Phantom is quickly updating and launching various advanced features to retain this segment of users.

The breakthrough lies in AI trading, auto trading (trading modes not available officially), and aggregating multiple Perps, which are also DEXs. However, issues like the complexity of multi-platform reserve management and the high inefficiency of AI losses remain. Even with the current industry-standard private key custody methods (prvy, turnKey), it still belongs to the realm where users who know will naturally know, and those who don't cannot learn.

4.3 User Growth and Ecological Niche Supplementation

Of course, many platforms' original intention is to accept that they do not make money, as relying on transaction fees is like fishing for scraps in the soup. However, if they can attract users who use Perps or meet the perpetual trading needs of existing users, it is also a good ecological niche supplement.

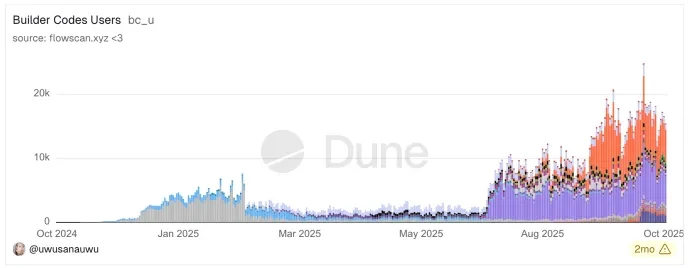

We can draw conclusions from on-chain data of HL, as this group is actually quite small.

From the image below, the user engagement across various integrations only reflects a daily active user count in the thousands, totaling just over 10,000 to 20,000.

Moreover, looking at Hyperliquid's monthly active users, its revenue is fundamentally based on a whale service model, typical of the contract trading market's Matthew effect and inverted pyramid capital structure.

Currently, HL has about 1.1 million total wallet addresses, with 217,000 monthly active users and 50,000 daily active users. The key point here is that the top 5% of users contribute over 90% of the OI and volume, forming a typical pyramid structure.

Only 0.23% of top users (with funds over $1M, totaling over 500 individuals) control 70% of the open contracts ($5.4B), with over 100 top users having an average position of $33M, and their OI (Open Interest) being 920 times that of the user proportion.

In contrast, the bottom 72.77% of users (150,000 users) contribute only 0.2% of the contract volume, with an average position of only $75.

This structure indicates that the contract market is essentially a battleground for professional institutions and high-net-worth individuals. While a large number of retail investors constitute the user base and activity, their capital volume is almost negligible.

This structure reflects a very counterintuitive reality: indeed, Hyperliquid itself has high earnings, having quickly risen to one of the most profitable exchanges in just one year.

However, its revenue fundamentally comes from high-end players and whales, motivated by either anti-censorship, transparency, or quantitative trading drives.

The significance of various platforms' integrations is that they only bring in regular users, so there needs to be a long-term user education process to potentially shift users who play Perps in CEXs to the homogenized competition of Web3 Perps.

5. In Conclusion, Is Integrating Perps Really a Good Business?

Generally, projects need to adapt to the market, but when a platform reaches its peak popularity, the market can adapt to it. Currently, Hyperliquid enjoys such treatment, but it may not be able to maintain this status. Although it can explain the recent surge in trading volumes of other competitors in the market due to expectations of new airdrops, leading to non-genuine trading results.

Moreover, many of HL's initiatives are relatively correct. Compared to many past platforms that often think about doing everything themselves and reaping all the benefits, I specifically criticize Opensea for creating a forced royalty system that only allows the market to follow the leaders. Each time incurs fixed high costs, interfering with the liquidity of goods and affecting the true pricing of the market, ultimately leading countless NFTs to become heirlooms.

In HL, it has opened up EVM and various DEX Perps APIs, so we quickly see a plethora of derivatives in the market.

RWA assets, especially U.S. stocks and gold, are becoming new traffic entry points and differentiation growth areas in the current Perp DEX field. TradeXYZ has accumulated a perp volume of $19.1B, with a weekly average of $320M and a daily average of $45.7M, which is the best proof.

Hyperliquid's generosity in airdrops and buybacks is also evident; many times, staking HYPE and pursuing ADL profits can yield promising returns.

After all the twists and turns, the competition among leading platforms is a concern for them. Returning to this year's dark battle of wallet integrations, integrating third-party Perps is mostly a low ROI business. Whether in terms of user growth revenue or platform commission earnings and stability investments, it does not count as a good business.

One can imagine that after seeing the real revenue situation post-integration, many platforms will still be reluctant to give up the dividends of the Perps track, opting for self-research and extensive new user promotions. The battle for the track is not over and will continue to burn for another year, but only new users brought in from non-CEXs will be truly effective users.

Disclaimer

This article is dense with information, as many architectural overviews are highly condensed, and the technology is not fully open-sourced, based on publicly available information analysis.

Additionally, the discussion purely from a technical solution perspective does not imply any positive or negative evaluation of each product.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。