This article is from: Fisher8 Capital

Translation|Odaily Planet Daily (@OdailyChina); Translator|Azuma (@azuma_eth)

Editor's Note: 2025 has become a thing of the past. At the beginning of the new year, many VCs are rushing to publish their reviews of 2025 and predictions for 2026. However, due to their business model orientation, VCs often focus more on the primary market perspective, which does not provide strong guidance for retail investors focusing on the secondary market. The review and preparation content from the leading liquidity fund Fisher8 Capital is somewhat different, as it fully records the institution's successful and failed secondary operations in 2025 and offers some more secondary-focused thoughts on the market direction for 2026.

Below is the original content from Fisher8 Capital, translated by Odaily Planet Daily.

Summary

2025 was an exceptionally difficult year for most liquidity funds, characterized by aggressive capital rotation and the overall underperformance of crypto assets compared to traditional assets. Although Fisher8 Capital achieved some results in mainstream and on-chain assets, we chose to continue holding related positions amid significant drawdowns due to our strong belief in several long-term themes (such as AI, DePIN, etc.) despite poor performance in some emerging sectors.

Ultimately, Fisher8 Capital closed the year with a 16.7% annual return. We are confident that the discipline and insights accumulated during this highly volatile year will help us continue to outperform the market in the future. However, from a risk-adjusted perspective, we might have been better off investing the money in a daycare center (note: this is a jab at the Minnesota daycare scandal).

If you are interested in collaborating with us or are working on some interesting and innovative projects, feel free to contact us on X. We hope you enjoy our annual review and wish everyone a smooth new year.

Trading Records

Our best trading operations in 2025 are as follows.

The worst trading operations are these.

2025 Market Review

The Clear Connection Between Trump and the Crypto Market

Before the 2024 presidential election, the market widely anticipated that if Trump won, it would mark a significant turning point for the regulatory environment and valuation scale of cryptocurrencies. Related expectations included:

- Ending the "enforcement instead of regulation" approach to regulation;

- Clear support for stablecoins;

- Exploring the establishment of a "strategic Bitcoin reserve";

- And launching Trump-related projects in September 2024, such as World Liberty Financial (WLFI);

These factors collectively made crypto assets one of the highest beta expressions in the broader "Trump Trade," pricing in significant policy optimism before the election results were announced.

However, as this optimistic sentiment began to retract, the overall "Trump Trade" reversed. This phenomenon was evident not only in crypto assets but also in stocks highly correlated with Trump, such as DJT, which peaked before the election and then significantly retreated. Although the post-election environment confirmed more favorable policy statements for the crypto industry, the market faced inertia in legal and regulatory advancements, along with a series of scattered, incremental policy outcomes, which could not offset the overall de-risking impact on "Trump concept assets."

Additionally, Trump himself, through his association with WLFI and the emergence of TRUMP, created a direct economic exposure to the cryptocurrency industry. This heightened market concerns — crypto assets have, to some extent, been financialized around Trump's personal popularity, introducing a "perceived risk" — should his political capital decline, it could directly translate into a weakening of related asset prices.

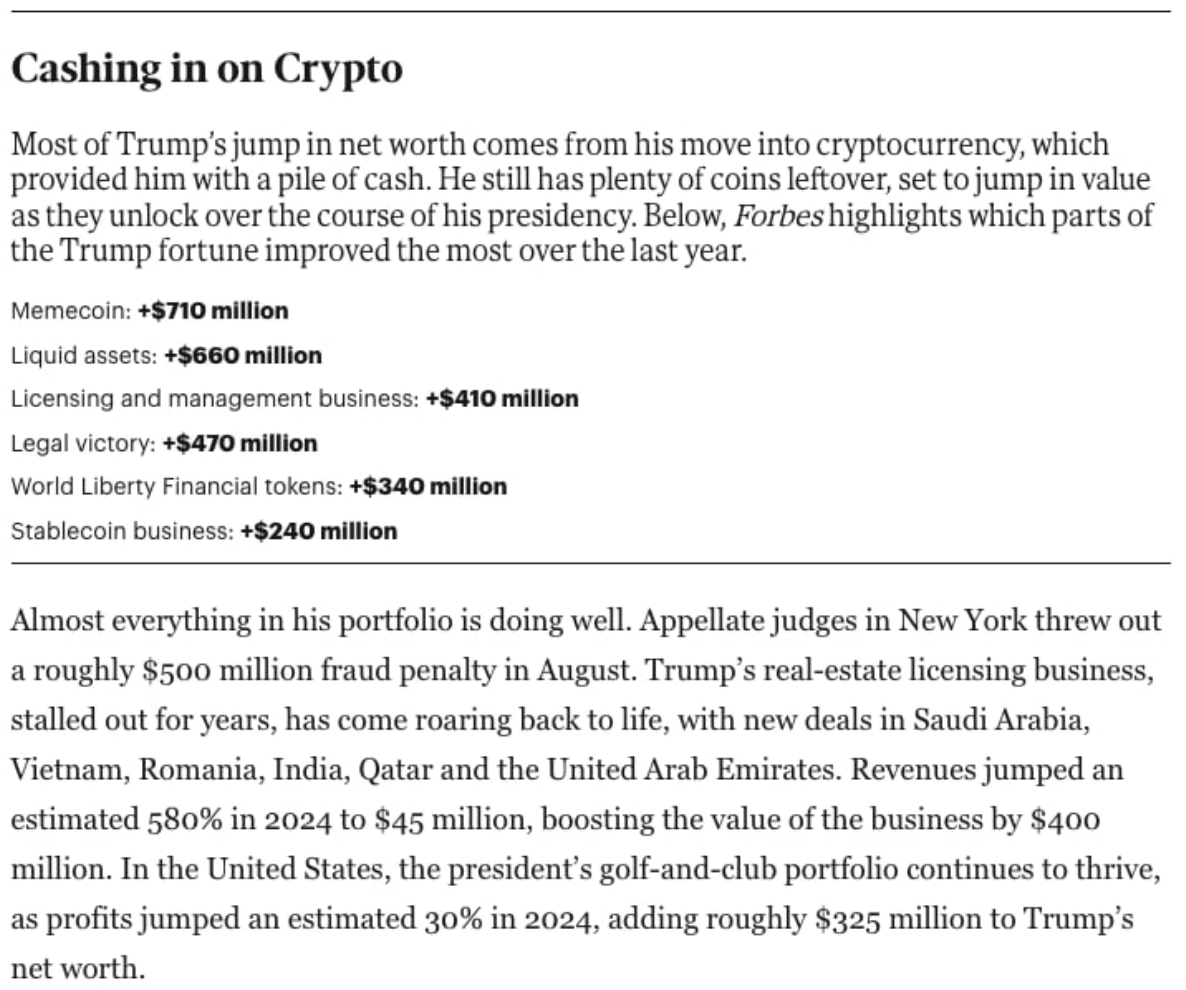

Odaily Note: Forbes reported that Trump's net worth increased by $3 billion within a year due to his presidential term.

While these concerns are not without merit, they can be alleviated through the implementation of long-term policies or by reducing reliance on demand driven by personal charisma. Most notably, the executive order signed in August 2025 on "Promoting Alternative Asset Investment" expanded the permission for 401(k) retirement plan trustees to include digital assets in their portfolios. Although this order does not mandate allocation, it effectively lowers the legal and reputational barriers for institutional participation, reshaping cryptocurrencies from a speculative fringe asset to one that can at least be permitted in long-term capital pools.

The real significance of this shift lies not in whether a large influx of funds will occur immediately in the short term, but in the change in market demand structure. As long-term capital related to pensions becomes a possibility, the crypto market is beginning to transition from a purely supply-driven halving cycle to a demand cycle regulated by policy, characterized by longer-term, stickier capital. Even marginal adoption in a scaled context has the potential to elevate price equilibrium levels and compress the downward volatility space compared to the 50-80% deep drawdowns seen in past cycles.

Narrowing of the "Risk Appetite" Trading Range

The connotation of "risk appetite" trading is becoming more complex. Unlike previous cycles, where speculative capital would flood into meme and long-tail assets during the risk appetite recovery phase, the yield differentiation among beta assets in 2025 was exceptionally pronounced. This was particularly evident in early October when BTC reached an all-time high while meme performance remained relatively subdued.

Instead, investors began to concentrate their capital allocations on a narrower subset of crypto assets, such as "stock-like assets" (DAT, CEX, and funds) with crypto exposure, market predictions, or tokens with clear value capture mechanisms. This differentiation reflects the maturity of market structure: capital is becoming increasingly selective and rapidly rotating, with fund flows becoming more short-term and narrative-driven. Investors chase local momentum, quickly harvest profits, and continuously roll liquidity into the next narrative. In 2025, narrative cycles were compressed, and the duration of trades was shorter than in previous cycles.

In this environment, the idea of holding altcoins for substantial returns has largely become an illusion. Aside from major tokens like BTC, ETH, and SOL that benefit from institutional capital accumulation, other tokens often only appreciate when compelling narratives are active. Once that narrative fades, liquidity dries up, and prices revert. The narrowing of the risk appetite trading range has not extended the lifespan of altcoins; rather, it has accelerated the pace of capital testing, squeezing, and discarding new narratives. This further reinforces a judgment — true long-term crypto investment remains concentrated in a very small number of assets.

Expansion of Digital Asset Treasuries (DAT)

The rise of Digital Asset Treasuries (DAT) has introduced a new capital formation mechanism designed to replicate the successful path of MicroStrategy. DAT allows publicly traded companies to raise funds and directly allocate them to crypto assets, creating an embedded crypto exposure proxy and circumventing regulatory vacuums before altcoin ETFs are approved.

As this structure rapidly spreads, the market quickly shows signs of bubbling — numerous new vehicles compete to package themselves as a "DAT" for some altcoin, even if there is no real and sustained demand for that asset.

Many of the capital structures adopted by altcoin DATs can be classified as predatory structures. Specifically, these structures often engage in financial engineering by exchanging token physical contributions for equity, aiming to create exit liquidity while introducing a batch of new participants; supplemented by extremely low-cost, highly favorable lock-up conditions in private rounds.

These mechanisms allow insiders to offload large amounts of stock under extremely limited buying pressure, leading to retail investors being rapidly extracted of value in both the stock and token markets. This scale mismatch is particularly evident in some aggressive DAT schemes — the amount of funds some companies attempt to raise far exceeds their market capitalization in the public market.

Investment Themes for 2026

Conclusion 1: Asymmetric Returns Will Appear at the Application Layer

The "currency premium era" enjoyed by the new generation of Layer 1 altcoins is coming to an end. Historically, this premium has been primarily supported by the "Fat Protocol Thesis" and "Moneyness" narratives — which suggest that infrastructure disproportionately captures value, and its tokens will ultimately evolve into global value reserve assets.

However, the market has already integrated this monetary function around mainstream assets like BTC, ETH, and SOL, as well as stablecoins, completely stripping away the "moneyness" imagination space for new Layer 1s.

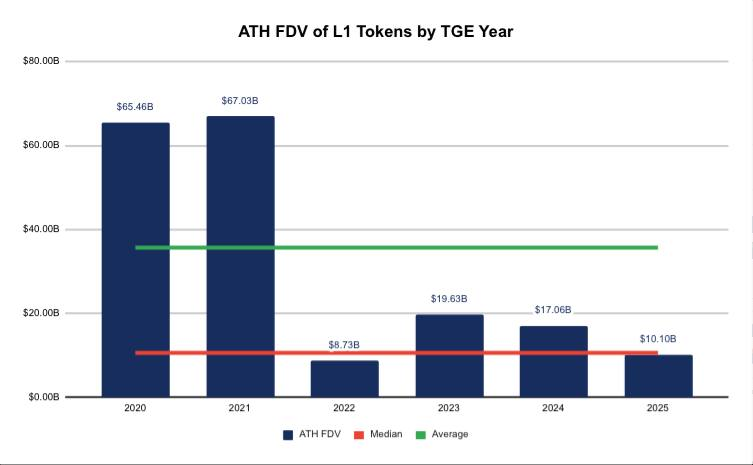

Odaily Note: Statistics on the historical all-time high fully diluted valuation (ATH FDV) of Layer 1 tokens for each year of TGE.

With the disappearance of the "moneyness" moat, the social consensus that once granted new public chains valuations in the tens of billions is disintegrating. Since 2020, the historical highest FDV of altcoin Layer 1s has shown a clear structural downtrend, strongly indicating that the currency premium is continuously fading.

Moreover, the current existing valuation "bottom" is largely artificially created: in recent years, many Layer 1s have launched through fixed-price ICOs or direct listings on CEXs, with teams artificially setting initial prices. If these assets are forced to accept true price discovery upon launch, we believe their valuations are unlikely to approach the historical average levels of past cycles.

This trend of valuation collapse is further amplified by the inertia advantages of existing public chains. Mature ecosystems already have a large number of "sticky applications" that firmly lock in users, creating extremely high entry barriers for newly entering Layer 1 altcoins.

From the data, since 2022, approximately 70-80% of DEX trading volume and TVL have consistently been concentrated on three chains. Among them, Ethereum has always held a position, while the other two positions have rotated during different periods. For new entrants, breaking this oligopoly structure is almost an uphill battle, and historical experience shows that most projects ultimately fail to secure a long-term position.

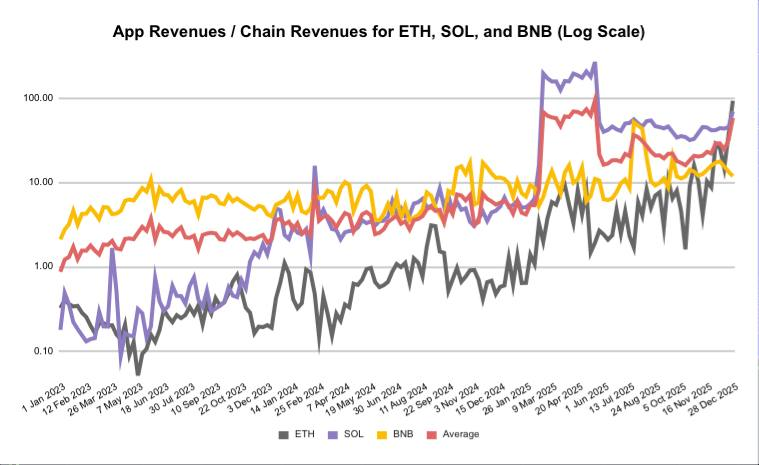

Odaily Note: Comparison of application revenue / chain layer revenue for ETH, SOL, and BNB.

We believe that the revaluation of application tokens has already begun, driven primarily by a significant divergence in the value capture ability between Layer 1 tokens and the underlying applications. As shown in the chart above, over the past two years, there has been a clear decoupling between application layer revenue and infrastructure revenue: application revenue in the ETH and SOL ecosystems has grown by as much as 200-300 times.

Despite this, the market capitalization of applications still represents only a small fraction of the market capitalization of their respective L1s. As the market matures, we expect this mismatch to be corrected through capital rotation from overvalued infrastructure assets to applications with real revenue.

Conclusion 2: The Midterm Elections Will Shape a High-Volatility Environment

The current policy focus of the Trump administration is clearly on ensuring victory in the 2026 midterm elections, with overall policy design leaning towards supporting short-term economic momentum. The "One Big Beautiful Bill Act (OBBBA)" stimulates demand through deficit financing, marginally increasing the probability of a reflation environment. For digital assets, this fiscal expansion is favorable for hard assets like Bitcoin, making it once again the ultimate "scarcity hedge."

At the same time, this fiscal expansion is likely to encounter supply-side constraints in certain areas, such as grid capacity and manufacturing capacity. These bottlenecks will create inflationary pressures on input costs and wages in related industries, even as overall levels remain suppressed by structural deflationary forces such as tariff normalization and AI productivity improvements.

The macro environment characterized by this will be — nominal growth is relatively high, but volatility will also rise, and the market will periodically reprice inflation risks. This tension will structurally elevate volatility. The market may oscillate between "reflation optimism" and concerns about "inflation re-emergence," especially as economic data gradually reveals capacity constraints rather than insufficient demand.

Overlaying this macro backdrop is the historical pattern that midterm election cycles tend to elevate political risk premiums — investors typically demand higher risk compensation ahead of elections to cope with policy uncertainty. Supporting this pattern are clear political motives — tolerating, and even expanding, fiscal deficits during the midterm election cycle. Additionally, if the Federal Reserve leadership leans dovish, it will provide a more accommodative liquidity environment for risk assets.

While this combination implies higher volatility in the short term, in the long run, the impact of OBBBA combined with the ongoing advancement of crypto-specific legislation still leads us to believe that 2026 will be a constructive year for digital assets, albeit with a bumpier path.

Conclusion 3: Selective Enhancement, Shaping a K-Shaped Token Economy

The crypto market is bidding farewell to the indiscriminate capital allocation phase and entering a harsh period of structural differentiation — a K-shaped economy dominated by selectivity. The era of rising tides lifting all boats is over. The market has shifted from blindly chasing speculative narratives to focusing more on the real alignment of interests between protocol layers and token holders.

At the core of this transformation is the market's complete rejection of the "Equity-Token Split" model. This structure was initially designed to cope with regulatory pressures during the Gensler era, but its ambiguity regarding executability has always been a significant risk. Under this model: insiders (teams and VCs) hold the real value (IP, revenue, equity); retail investors receive only "governance tokens" without any executable rights.

This mismatch creates a dual-layer system — insiders possess the fundamentals, while token holders possess sentiment. As the market struggles to distinguish the real situations of different protocols, it ultimately chooses to indiscriminately discount the entire sector. Therefore, the current downturn is essentially a repricing of trust. Future winners will depend on their ability to demonstrate clear, executable, and sustainable value capture paths.

In this new paradigm, the upper end of the "K" (Upper K) will consist of teams that replace "trust me" with "verifiable." Here, credibility no longer comes from the founder's reputation or social capital, but from their willingness to impose structural constraints on themselves. These teams prove their ability to align value by: making value engines auditable; ensuring the flow of revenue is executable; and actively stripping away their ability to transfer value off-chain. This transparency will become the foundation for token buy support — in a downturn, sticky capital is willing to support its valuation because they trust the mechanism, not just the person.

Blockworks' Token Transparency dashboard is a great tool that categorizes protocols based on the required level of information disclosure according to the framework.

Conversely, the lower end of the "K" is facing a liquidity crisis triggered by the collapse of team credibility. The market now views ambiguity as an acknowledgment of conflicting interests. If teams refuse to clarify the relationship between protocol revenue and tokens, investors often default to assuming that this relationship does not exist at all. In the absence of a high-cost signal of "executable value capture," such tokens cannot be valued fundamentally, and when the narrative recedes, there are no natural buyers to support them. Teams that require investors to rely on "goodwill" or selectively obscure future commitments are being systematically eliminated, destined to bleed out in competition with quality protocols.

Other Preliminary Judgments

The collectibles market will further expand — extending into the sports memorabilia field, especially items associated with significant historical moments that hold extremely high value. For example, Shohei Ohtani's 50/50 home run ball set a historical high at auction.

Prediction markets are expected to become the new meta. Following the demonstrative effect of Hyperliquid's TGE on the entire track, the TGEs of Polymarket and Kalshi are expected to ignite the prediction market narrative.

Doubts about the "Equity-Token" dual structure will continue to intensify. More and more investors will demand clear, auditable explanations of value distribution, clarifying how economic value is divided between equity structures and token holders; otherwise, they will shift to pure token structures.

The potential risk of DAT being removed from the MSCI index (final decision date: January 15, 2026) is being closely monitored by the market. Once this uncertainty is resolved, it may trigger a new round of early-year rebound.

"Ownership Coins" will become the new norm, structurally reducing the chronic rug risk for founders.

DApps with privacy capabilities will be welcomed to a higher degree by both retail and institutional investors. Protocols that can balance user experience and programmability while achieving high compliance will win the ultimate victory in the privacy track.

Tokenized stocks will undergo an accelerated "boom-bust" cycle, as their initial adoption scale is likely to remain limited.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。