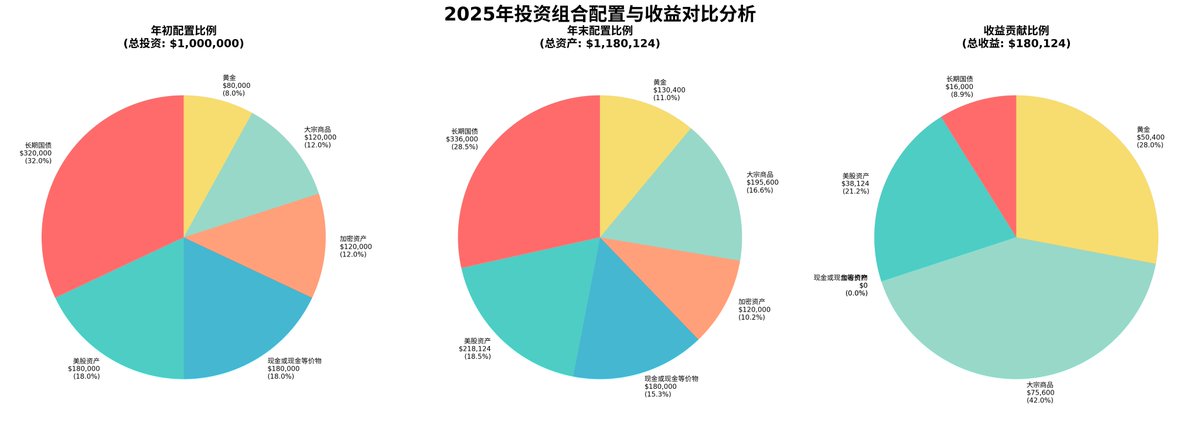

Today is the last day of 2025. Looking back at the configuration strategy written at the beginning of 2025, if you followed the initial allocation plan, the return should be quite good. Based solely on the index benchmark, the return rate is 18% (not counting excess returns), as shown in the chart below.

Long-term government bonds have a return rate of 5%, which has basically remained unchanged. However, when considering the RMB exchange rate, it seems to have underperformed a bit. Nonetheless, treating USD assets and RMB assets as separate baskets can provide a more balanced mindset.

For US stock assets, looking at the Nasdaq 100 index, the increase is 21.18%. During this period, we were quite lucky with #OKLO, #MU, and #PAAS, which all achieved excess returns and became the ballast for the entire year (these three stocks have also been introduced in previous tweets). However, there were also some failures, such as the Bullish exchange, which suffered a significant loss, but overall returns were still decent.

In the crypto assets sector, BTC fell by 6.8% over the year. However, from an operational perspective, it was relatively standard. We successfully avoided the downturn in April, and many fans and friends in the group joined us in positioning for BTC at 75,000-80,000 and SOL during the same period. Overall, large funds performed reasonably well. However, the major liquidation on October 11 caused significant damage, mainly from leveraged positions in gold RWA. One could say this year was a break-even!

For commodities and gold, the allocation mainly focused on gold. Although there was later allocation to silver (mainly through mainstream purchases of US stocks in Pan American Silver), not much paper silver was bought due to limited investment channels. The overall increase in gold was 63%, which was a pleasant surprise.

It is expected that 2026 will be an even more turbulent and uncertain year. The watershed moment is likely to be SpaceX's listing on the US stock market. Before the listing, there will still be strong speculative space, but after the listing, the market will likely be affected by liquidity. Another significant event during this period will be the US presidential midterm elections. Historically, the US stock market does not perform poorly before midterm elections.

In the first quarter, the outlook for the crypto market remains optimistic, including the upcoming crypto structural bill and crypto innovation exemption bill in January. Additionally, the new chairperson of the Federal Reserve will be announced in January, which will have a positive impact.

From a global stock market perspective, Q1 generally tends to have a small spring rally. Whether it is China's monetary stimulus plan being introduced in Q1 or the Federal Reserve expanding its balance sheet showing direct market effects in 2-3 months, both will positively influence Q1's performance, stabilizing the stock market while maintaining an optimistic attitude in the crypto market.

In 2026, the crypto market is likely to have many localized alpha opportunities, especially focusing on #RWA, predictive markets, stablecoin payments, AI+x402, etc., leading to new plays and hot opportunities.

In 2026, we will continue to maintain a dual bet, with gold in one hand and #BTC in the other, while keeping a certain cash reserve. During this time, we will focus on maintaining good health and waiting for a good opportunity to act. From a long-term perspective, a favorable time frame is expected to be around mid to late 2027. Therefore, building cash flow and reserves may be an essential task for every investor in 2026.

Finally, I wish all fans and friends a Happy New Year, good health, and a smooth passage through the 'Red Horse and Red Sheep' calamity in 2026. Let's develop steadily and take off together in 2027! 🧐

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。