The 12.5 million token airdrop of Lighter has ignited a frenzy in the crypto market, but just as the community was caught up in the excitement on the eve of the TGE, its co-founder admitted during an AMA that the platform recently cleared a large number of "Sybil" bot accounts.

With a market cap potentially exceeding $3 billion and trading volume once surpassing industry leader Hyperliquid, Lighter has staged a remarkable performance in the Perp DEX space by combining capital narratives with user growth by the end of 2025.

This project, backed by top VCs, completed a $68 million financing round, achieving a valuation of up to $1.5 billion, with monthly revenue exceeding $10 million and trading volume reaching an astonishing $248.3 billion.

However, while the market was immersed in calculating airdrop profits, a fundamental question was overlooked: how much real value has this prosperity, woven from capital, points, and airdrops, actually created?

1. The Commotion and Controversy on the Eve of TGE

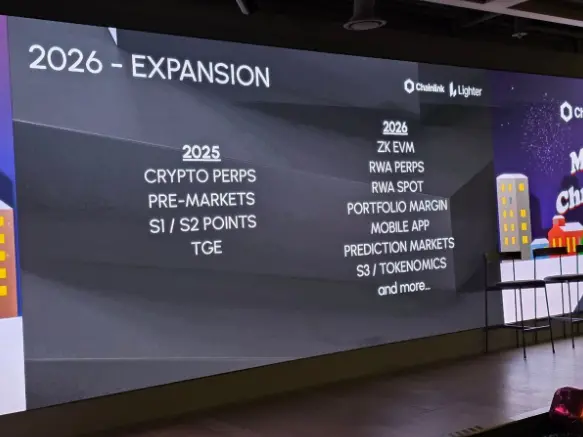

As 2025 comes to a close, Lighter's TGE (Token Generation Event) process is entering the countdown phase, pushing market sentiment to a peak. According to information revealed by Lighter's market head, both the TGE and airdrop will be completed within 2025, with the airdrop accounting for 25% of the total supply and no lock-up restrictions.

This promise has sparked a huge response in the community, especially after mainstream exchanges like Binance and OKX announced the launch of LIT token pre-trading, further intensifying the market's FOMO (fear of missing out) sentiment.

● However, behind the celebration, a controversy regarding account authenticity quietly erupted. Lighter's founder, Vladimir Novakovski, admitted during a recent AMA that the team used various data science methods to clear a large number of "Sybil" bot accounts.

● The so-called "Sybil" accounts refer to users creating multiple wallet addresses to gain more airdrop points. This cleanup resulted in some users losing their accumulated points, sparking heated discussions on Discord and Twitter.

● When asked whether there were special point rules set for certain major clients (such as Sun Yuchen), Vladimir explicitly denied this claim, calling it a "joke." He emphasized that although the current points system has not yet been fully validated through ZK circuits, any claims of privileges for large holders in the algorithm or points system are untrue.

2. The Real Operational Status Beneath the Glossy Surface

● On the surface, Lighter's performance is impressive. Lighter's open interest reached $1.572 billion, with monthly revenue of $10.27 million, and annualized revenue approaching $125 million.

● In terms of trading volume, Lighter recorded $227.19 billion in the past 30 days, even briefly surpassing the industry benchmark Hyperliquid's $175.05 billion. These numbers seem to support the market's positioning of Lighter as a "dark horse" in the Perp DEX space.

● However, deeper analysis reveals another side: Lighter Season 2 attracted over 500,000 new users, but analysis shows that 80% of them are multi-wallet Sybil accounts. This means the number of genuinely active addresses is far less impressive than the surface data suggests.

● Another set of comparative data illustrates the issue: although the monthly trading volume across the entire Perp DEX space reached a historic high of $1.2 trillion in October 2025, the number of globally active addresses remained at a scale of tens of thousands to a hundred thousand.

● This presents a stark contrast to the hundreds of millions of users in CEXs like Binance and Bybit. The limitations of users lead to the sector's growth being highly dependent on "temporary farmers" rather than loyal users, with retention rates generally halving after the TGE.

3. The Discrepancy from $3 Billion to $12.5 Billion

There is a significant discrepancy in market valuation judgments for Lighter.

● On one hand, the Polymarket prediction market shows that the probability of its valuation exceeding $3 billion after the TGE is over 50%; on the other hand, some analysts believe its valuation could reach $6-12.5 billion.

This discrepancy stems from different understandings of Lighter's positioning.

● Proponents of the higher valuation argue that Lighter is not just a simple Perp DEX, but is committed to building decentralized trading infrastructure aimed at connecting brokerages, fintech companies, and professional market makers. This infrastructure positioning gives it a higher valuation ceiling.

● In terms of financing, Lighter has completed a $68 million financing round led by Founders Fund and Ribbit Capital, with a Pre-TGE valuation reaching $1.5 billion.

Based on the off-market trading price of approximately $90 for Lighter points and a total of about 11.7 million points, the airdrop value is estimated at around $1.05 billion, implying a fully diluted valuation of about $4.2 billion.

4. The Essential Differences Between Lighter and Traditional Perp DEXs

Understanding Lighter's valuation logic hinges on recognizing its essential differences from traditional Perp DEXs.

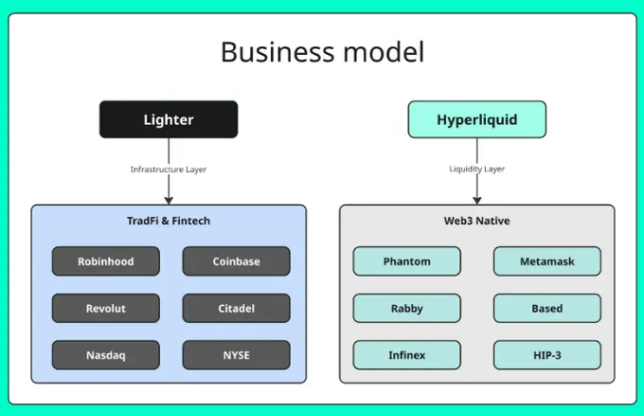

● Market analysis indicates that Hyperliquid is building a Web3-native liquidity layer, primarily monetizing through retail trading fees; whereas Lighter is constructing a decentralized trading infrastructure, with the long-term goal of connecting fintech companies, brokerages, and professional market makers.

● This positioning difference is clearly reflected in the business model: on the retail side, Lighter implements a "zero-fee" strategy similar to Robinhood.

● However, it has a latency of 200-300 milliseconds, creating excellent arbitrage opportunities for high-frequency market makers. While ordinary retail investors avoid explicit fees, they may end up paying several times the normal trading costs due to implicit slippage.

● Data also supports this difference: the OI/TVL metric, which measures leverage levels against liquidity matching, shows Lighter at 1.18, while Hyperliquid is at 1.82, and Aster is at 1.92. This indicates that Lighter's risk structure is more restrained and robust, consistent with its positioning as an "infrastructure-type trading system."

5. The Common Dilemma Facing the Entire Perp DEX Space

The challenges faced by Lighter reflect the deep-seated bottlenecks in the entire Perp DEX space.

● First, the sector's growth is highly dependent on "temporary farmers" rather than loyal users. For example, among the over 500,000 new users attracted by Lighter in Season 2, 80% are multi-wallet Sybil accounts. A CoinGecko report indicates that by the end of 2025, airdrop interactions were prevalent, with users flooding in mostly to gain points rather than engage in long-term trading, leading to retention rates generally halving after the TGE.

● Second, the awkward state of the sector is reflected in the "short-term cycle" formed by the interests of multiple parties: project teams urgently need TVL and trading volume to support valuation narratives, inducing traffic through points and zero-fee rates; VCs bet on high valuations seeking exits; while farmers rush to score points and cash out after the airdrop.

● This "interest roulette" may inflate surface data, but in essence, it is a short-term game among various parties rather than an ecological win-win. A typical case is Aster, which saw 400,000 wallets quickly migrate to Lighter after adjusting its point multiplier in November 2025, directly leading to a surge in gas fees and a collapse in platform depth.

● Stephan Lutz, CEO of BitMEX, warned that the Perp DEX boom may be hard to sustain, as CEXs still control 95% of the open interest share, and the DEX model relies excessively on incentive mechanisms, making its business logic extremely fragile.

6. Three Potential Growth Directions

Despite the challenges, the Perp DEX space still has enormous growth potential. Analysts have pointed out three key directions:

● The first is the "mainland strategy" for the trillion-dollar CEX derivatives market. DEXs are only competing for control over a small island, while the truly rich and vast mainland—the derivatives market of CEXs—still sleeps within centralized fortresses, with daily trading volumes in the tens of thousands of billions.

● The second is the expansion of asset classes, from BTC/ETH to an explosion of "everything can be Perp" assets. Currently, the core battlefield for DEXs still revolves around a few mainstream assets like BTC and ETH, while in the distance, a whole new territory is emerging: RWA, SocialFi tokens, AI concept assets, etc.

● The third is the next great migration of users driven by the "ownership economy." The next generation of DEXs must provide a powerful "subversion" weapon that CEXs can never replicate: a truly community-owned "ownership economy" model.

In these three directions, Lighter has already made some arrangements, particularly in the RWA field where it has taken the lead. Data shows that Lighter leads in both open interest and trading volume for on-chain RWA perpetual contracts, with open interest reaching $273 million.

7. Historical Lessons and Market Warnings

Historical experience provides important warnings for the current prosperity of Perp DEXs.

● Data from 2025 shows that high-profile "VC-backed projects" are severely disconnected from their performance and valuation in the secondary market. For example, the Humanity Protocol, valued at $1 billion by VCs, currently has a market cap of about $285 million, Fuel Network is around $11 million, and Bubblemaps is about $6 million, with discrepancies reaching several tens of times.

● Other projects like Plasmas and DoubleZero have market caps remaining at only 10% to 30% of their VC valuations. In the face of "vanity metrics" inflated by capital, Lighter may just be the next case.

● Looking back at similar projects backed by top VCs, such as Vana, although its FDV briefly skyrocketed after the TGE in 2024, it subsequently halved by 70% due to the loss of incentive support, quickly becoming a "ghost project" with depleted liquidity. The current data frenzy of Lighter and Aster mirrors the path of these VC projects with valuation discrepancies.

● What is even more concerning is that the Perp DEX space is currently still in a stage of stock game, and for small retail investors with low sensitivity to privacy, DEXs still lack sufficient migration motivation. Beneath the surface bustle, the real value may be far more pale than the data suggests.

Lighter's mobile application will be launched in a few weeks, and the founder has promised to provide both professional and casual modes, with plans to achieve seamless fiat deposits and withdrawals. Meanwhile, the team is negotiating with Robinhood for tokenized stock collaboration and plans to introduce on-chain fixed income products in the future.

However, in the secondary market, whales have already begun to act. Blockchain analysis shows that shortly after the announcement of the LIT token launch, whales deployed millions in funds to establish leveraged short positions; on the other hand, a long-dormant whale address, despite showing losses on paper, has increased its long positions, indicating confidence in LIT's long-term potential.

Market participants are facing a typical game in the crypto industry: the coexistence of enormous upside potential and significant execution risks.

Join our community to discuss and become stronger together!

Official Telegram community: https://t.me/aicoincn

AiCoin Chinese Twitter: https://x.com/AiCoinzh

OKX benefits group: https://aicoin.com/link/chat?cid=l61eM4owQ

Binance benefits group: https://aicoin.com/link/chat?cid=ynr7d1P6Z

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。