Original Title: How Wallet Tracking Took me From $50 to $1M+ at 18

Original Author: @ugotrd, Trader

Original Translation: Luffy, Foresight News

In February 2024, I entered the world of meme coin trading with $80, only to lose it all. I had experienced such a devastating defeat twice.

It was then that I realized I had no grasp of the market and had been using the wrong methods all along.

Later, I re-entered the market with $50, this time employing a wallet tracking strategy. In less than a year, by February 2025, that $50 had grown to over $1 million.

The Pits I Fell Into Early On

My logic for buying meme coins used to be very simple: "This coin has an interesting meme, the promotional content is well done, and the official website looks clean, so it must be a good buy."

Undeniably, this method occasionally made some money, but most of the time, it was no different from pure gambling. You had no solid basis and couldn't find objective reasons to judge how high the coin price could go.

If you want to make stable profits, you need to find a way to obtain key information before the market starts moving, rather than waiting to follow the trend after it has already begun.

I used to be obsessed with various rumors on platform X and Telegram groups: "This coin will definitely reach a market cap of $100 million this week, just wait and see." Later, I learned that most of the people making these claims were paid shills or had already accumulated 15% of the token's circulating supply at a low price. You excitedly entered the market, only to end up being the bag holder.

If your profit-taking targets are not based on real information, then your actions are merely passive responses to others' interests, rather than genuinely following market trends.

Turning the Tide with Wallet Tracking

I quickly realized that my previous operations were missing a crucial element. I was always watching the actions of top traders, pondering, "How can they predict the market while I can't?" So I had to find a solution.

Wallet tracking completely changed my understanding of trading. I no longer tried to guess the market's tops and bottoms, chase various narrative hotspots, or be led by the hype on platform X. Instead, I focused solely on one thing: where the smart money was flowing.

The initiation of any major market movement does not originate on social platforms but within a small number of wallets. These wallets are either the project's initial wallets, large holding wallets, or early institutional wallets. Insiders, KOLs, industry leaders, market makers, and newly created anonymous wallets are all hidden within these addresses.

I relied not on luck from a single trade but on repeatedly capturing replicable market patterns.

At that moment, I completely understood: I didn't need to be smarter than the entire market, nor did I need to mix in any subjective judgments, and I certainly didn't have to pay attention to market hype. I just needed to focus on the data, analyze the flow of funds, and then decisively execute my trading strategy.

From that point on, my goal became crystal clear: to establish a trading system that reacts solely based on the movements of smart money, rather than being swayed by rumors.

My Practical Wallet Tracking Method

Keep an Eye on KOL Wallets

When I first started in February 2024, the wallet tracking method was actually very simple. At that time, very few people frequently changed their wallet addresses.

What you need to do is find the secret wallet addresses of those KOLs who truly have traffic appeal, and then follow their actions, that’s it.

They accumulate at low prices → loudly promote → the coin price skyrockets 10 times.

Using this method, I turned $50 into $5,000 in the first month. Then, in the second month, I turned $5,000 into $30,000.

For example, on February 24: a project team issued a token specifically for a KOL. This industry leader quietly built a position using multiple secret wallets when the token's market cap was only $20,000. When the market cap rose to $30,000, I followed his lead and bought in. He then created a frenzy on Telegram and platform X, and the token's market cap instantly surpassed $400,000. I took partial profits at this price level.

Later that day, the token's market cap surged to $1 million, and I seized the opportunity to cash out again. In just a few hours, my initial investment multiplied by about 30 times.

At that time, my capital was still small, so I didn't have to worry about liquidity issues and could exit cleanly.

Tracking the Wallets of Conspiracy Groups

A few months later, I stopped focusing on individual KOLs and began tracking the wallet movements of conspiracy groups (small trading teams). At that time, the frequency of wallet address changes was increasing, and tracking the consensus formed by a group of people was much more reliable than looking at a single wallet. For example, if 10 different people's wallets, all from the same circle, were synchronously executing the same operations.

This signal gave me confidence far beyond that of a single wallet.

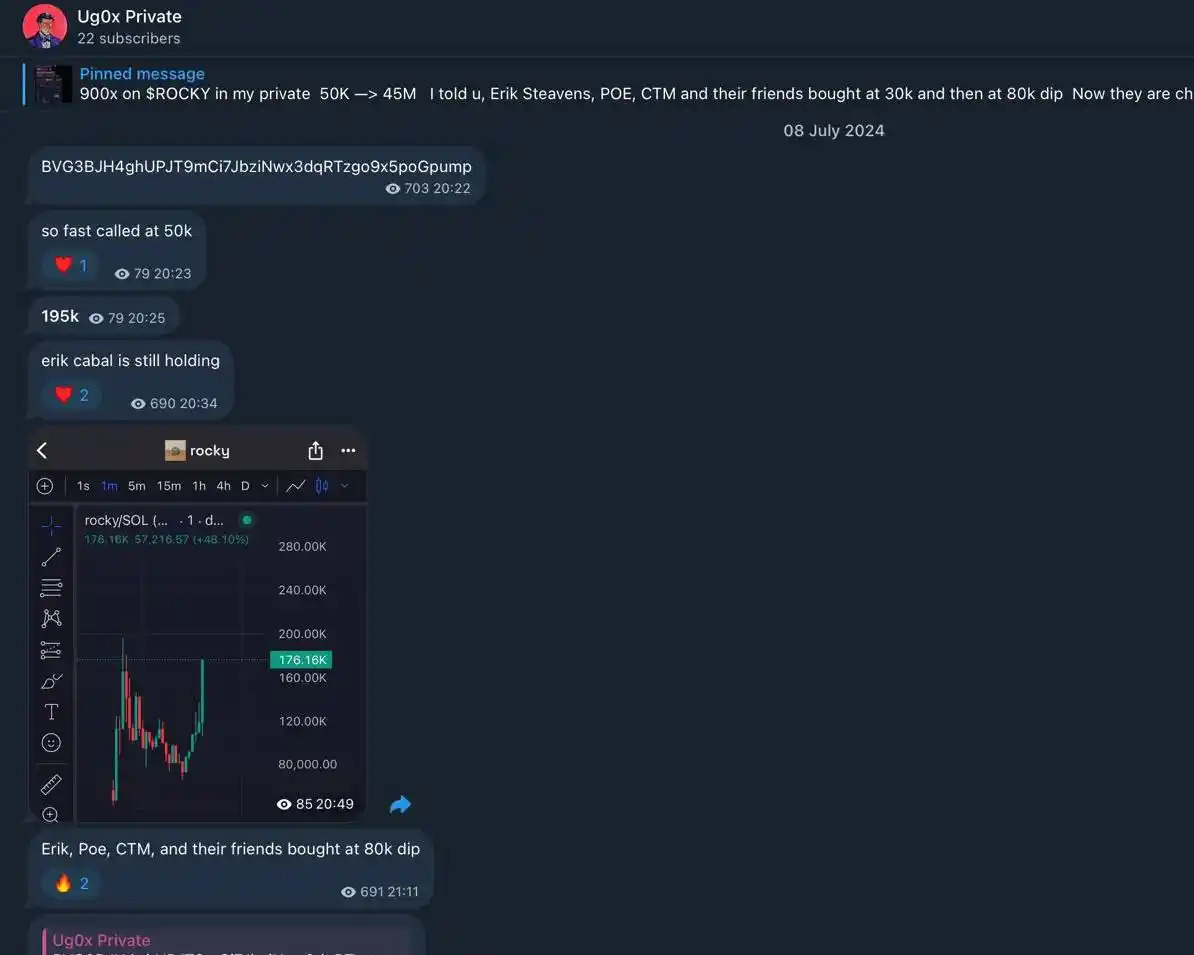

On July 8, 2024, a wave of operations around the $ROCKY token was a perfect example. At that time, Erik Steavens, POE, DOGEN, and CTM were quietly buying in when the token's market cap was between $10,000 and $80,000.

Seeing this signal, I was certain it was no coincidence; they were definitely brewing a price increase.

I bought 2.8% of the circulating supply when the market cap was $40,000.

In the following days, this group of big players joined forces to pump the price, and the token's market cap soared to $45 million.

I took partial profits between a market cap of $2 million and $10 million, with an average exit price around $6 million.

In this trade, my initial investment multiplied by 150 times. Although I could have made 1,100 times if I had held to the peak, I strictly followed my exit plan and earned my first six-figure profit from this trade, which I was already very satisfied with.

Tracking New Wallets, Project Wallets, and Large Holding Wallets

By January 2025, the trading atmosphere in the cryptocurrency market was unprecedentedly hot, but the difficulty of wallet tracking was also increasing. To continuously obtain first-hand insider information, I had to constantly optimize my methods and adapt.

Tracking the wallets of insiders is key to finding their new wallets that have just withdrawn funds from centralized exchanges like Binance. This means accurately tracing the transfer records and timestamps of funds between multiple Binance addresses. Although this process is time-consuming, it is absolutely worth it.

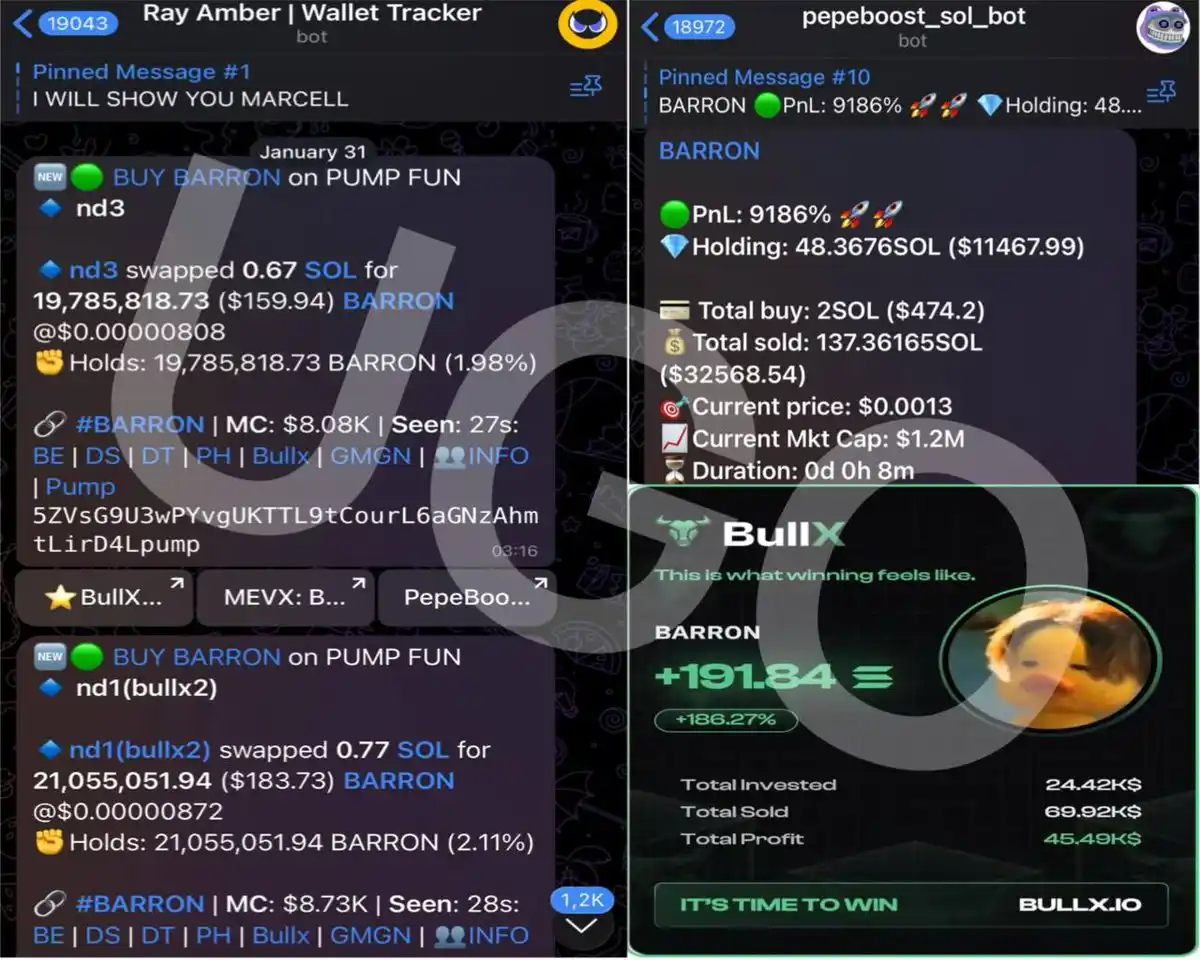

For example, I was closely tracking Marcell's wallet movements, so I could see his newly funded wallets every day. On January 31, he personally issued and held a large position in the $BARRON token.

I built my position in three wallets when the token's market cap was between $15,000 and $25,000. About three minutes later, Marcell started posting to pump the price. I quickly took profits between a market cap of $1 million and $2.5 million.

This was one of the fastest trades I had ever executed: an initial investment of $1,300 ultimately earned me over $110,000. (The trading platform BullX showed my buying amount as $24,000 because I later added to my position in this wallet to maximize profits).

Tracking Market Maker Wallets

Market maker wallets are wallet addresses directly controlled by the token project team, primarily used to manipulate coin prices for the benefit of the project or the token itself.

Common manipulation tactics include: triggering stop-loss orders to harvest retail investors through large buy/sell orders, or crashing the price by 30% within minutes to incite panic selling in the market, allowing new investors to enter at a low price.

However, market makers often conduct token transfers between wallets shortly after a token is issued. If these wallets are not newly created or are easily identifiable, we can directly track the project team's movements and accurately capture every new token issuance opportunity.

On January 31, 2025, I executed my trade for the $HOOD token in this manner.

This project team typically issues a new token every month. They completed a large position configuration when the token's market cap reached about $2 million, and I decisively bought in at this price, ahead of the top KOL's promotion. A few hours later, I took profits between a market cap of $80 million and $120 million, achieving about 50 times the return on this trade.

At the same time, during the gap of handling initial position profits, I also took advantage of the market maker's large sell-off to re-enter heavily, earning a price difference of 40% to 70% in just a few minutes.

The total profit for that day reached $152,000. Before the ASTER token trade in September of the same year, January 31 remained my most profitable trading day.

My Trading Principles

I always strictly adhere to money management rules. For example, the amount invested in each trade never exceeds 5% of the total position, and I flexibly adjust my risk exposure based on the quality of trading opportunities and my level of confidence.

When trading with a wallet tracking strategy, you must never go all in. Once your target realizes your presence, they can easily turn the tables and harvest you.

You also need to learn to think from the perspective of the targets you are tracking, understanding their interests, operational habits, and rhythm control, so you can minimize the risk of being cut and achieve sustained stable profits.

Of course, I strictly follow the trading plan I set, never allowing emotions to influence my decisions. In fact, I rarely encounter issues in this regard because I started learning forex trading at the age of 14, and discipline has long been ingrained in me.

That said, I have experienced several painful lessons of profit drawdown. But these setbacks did not crush me; instead, they became my motivation to push forward. Fueled by this unwillingness, I worked even harder to study and continuously refine my trading advantages.

In Conclusion

I write this article not to show off. On one hand, I want to use it as a diary to reflect on my growth in five years; on the other hand, I hope to inspire and help more people understand that as long as you are willing to actively seek change and put in the effort, there is always a way to achieve your goals.

I must clarify one point: I never use these tracking techniques against friends or people around me. Everything I do is purely to understand the underlying logic of market operations and then go with the flow.

I am also very grateful to those I have tracked, and to the project teams that genuinely work hard. I always approach trading with a sense of reverence, without any hostility. I sincerely thank all the friends I have met on this journey; they have given me so much help. Thank you all, and I am grateful for the blessings from above.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。