On the battlefield of decentralized derivatives exchanges (DEX), Hyperliquid is rising at an astonishing speed. However, for professional traders accustomed to the detailed data of centralized exchanges (CEX), on-chain trading often faces a significant pain point: data black box.

Have you ever hesitated because you didn't know whether the main force was going long or short? Have you ever missed a good opportunity because you couldn't determine the real arbitrage space of the funding rate?

Now, AiCoin has created a full-dimensional data dashboard centered around Hyperliquid on-chain data trading for everyone. It is no longer just a cold pile of numbers, but a lens for you to capture market trends and follow smart money.

Data Address:

https://www.aicoin.com/zh-Hans/hyperliquid?lang=cn

1. Say Goodbye to Blind Guesses: See Through the Main Force's Cards

Traditional DEX interfaces often only display prices and basic depth. But the real game occurs in the changes in open interest.

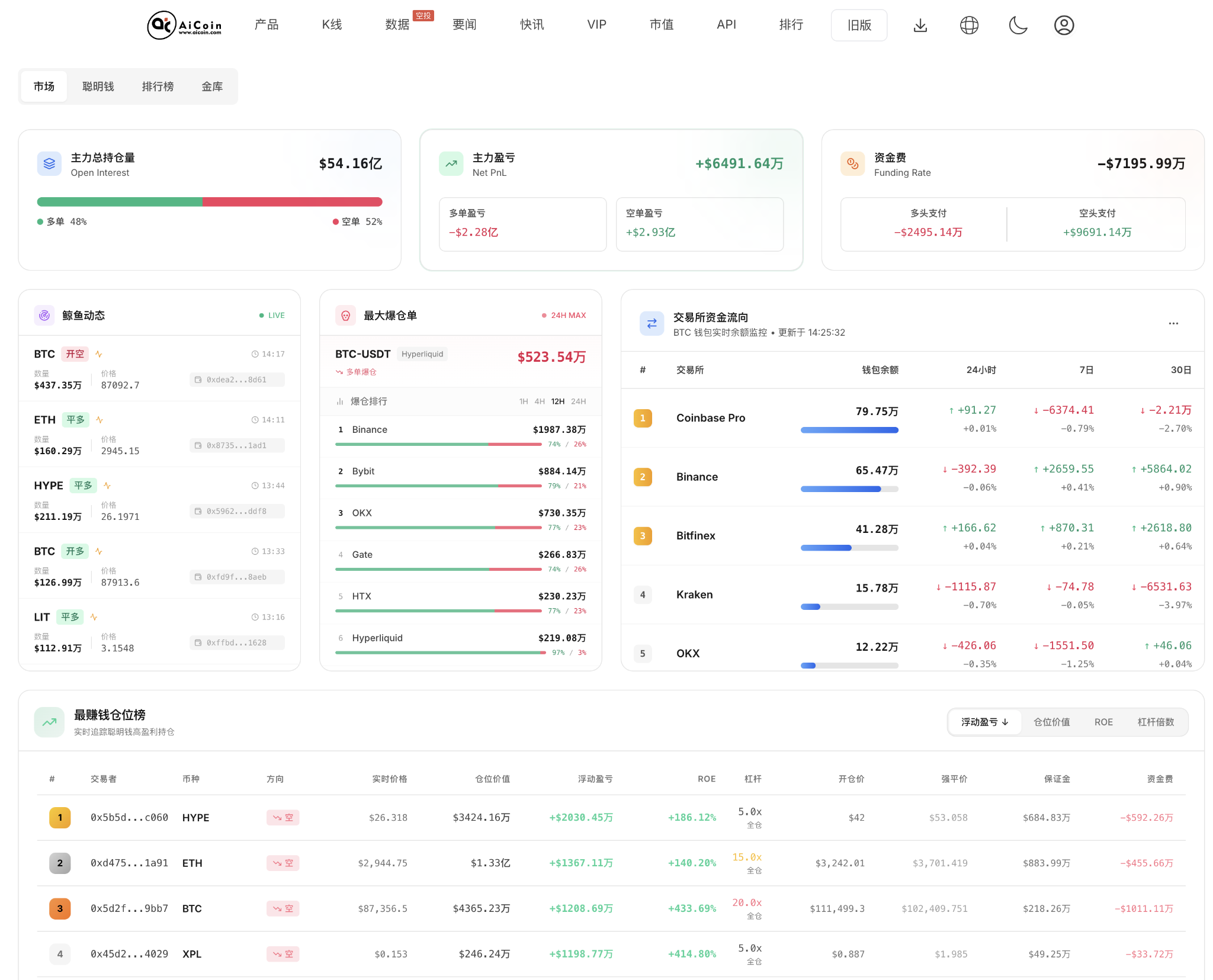

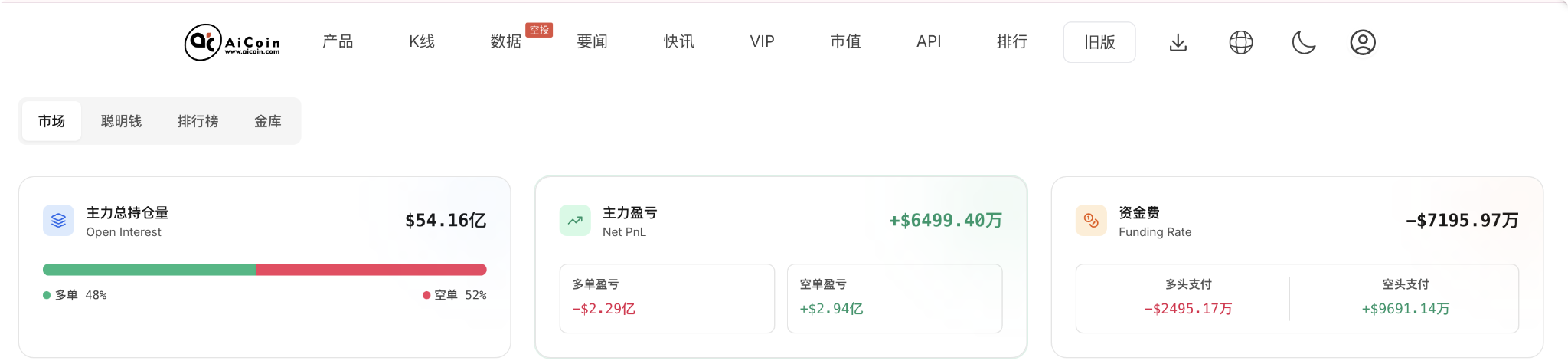

The total open interest module in the section not only shows a massive open interest of $5.416 billion but, more importantly, it algorithmically strips away retail noise, intuitively presenting the long-short ratio (48% vs 52%).

- Practical Use: When the price is consolidating, but the main force's short position ratio continues to rise, this is often a precursor to a downward trend. Combined with the exclusive main force net PnL data in the data section, if the main force's short position has already made significant profits, you should be wary of a potential rebound from their profit-taking; conversely, if the main force is trapped, it might be your best opportunity to enter and "squeeze" the shorts.

2. Funding Rate: More Than Just Positive and Negative Signs

For arbitrage traders, the funding rate is a lifeline. But simply looking at the funding rate percentage is not enough.

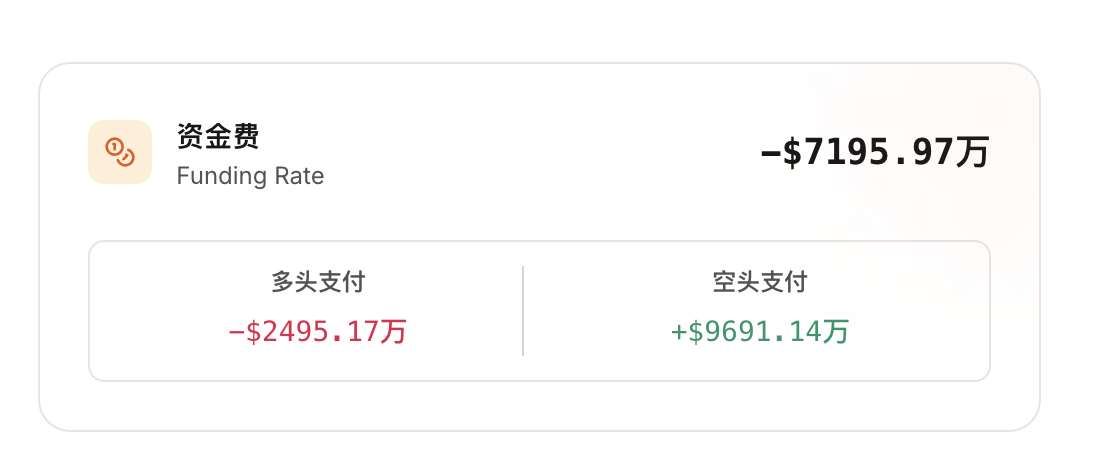

The data dashboard has pioneered the funding fee payment details feature, directly displaying the actual dollar amounts paid/received by longs and shorts (e.g., shorts paying +$9,691,140).

- Practical Use: When you find that a certain cryptocurrency has an extremely high funding rate and the short payment amount is huge, it means that shorts are bearing significant holding costs. This is not only a feast for arbitrageurs but also a signal for trend traders—shorts may be forced to close their positions due to unbearable high fees, thus pushing up the coin price.

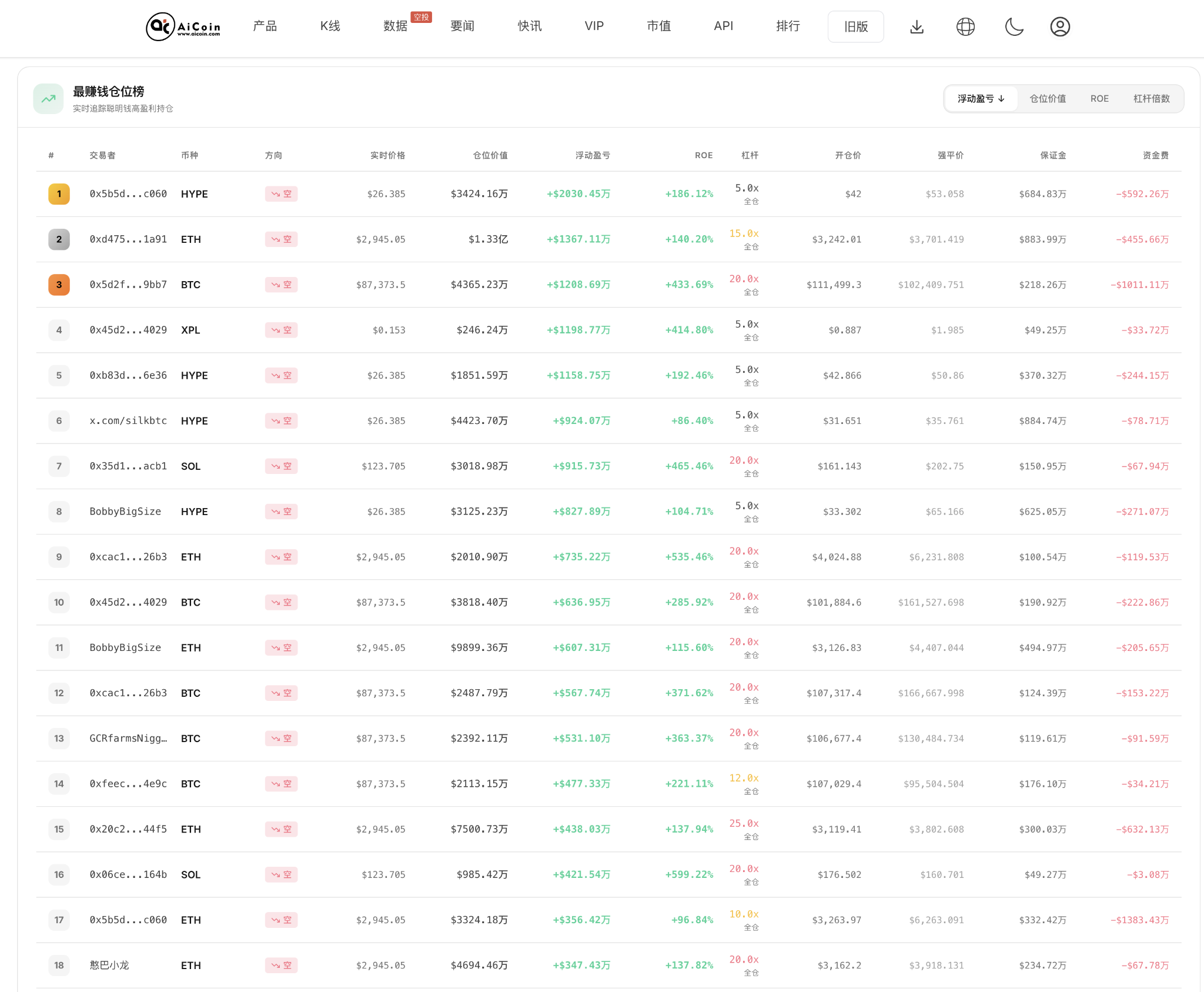

3. Whale Dynamics & Profit Leaderboard: Copy the Smartest Homework

In the crypto market, following Smart Money is always the simplest profit strategy. But who is the real Smart Money?

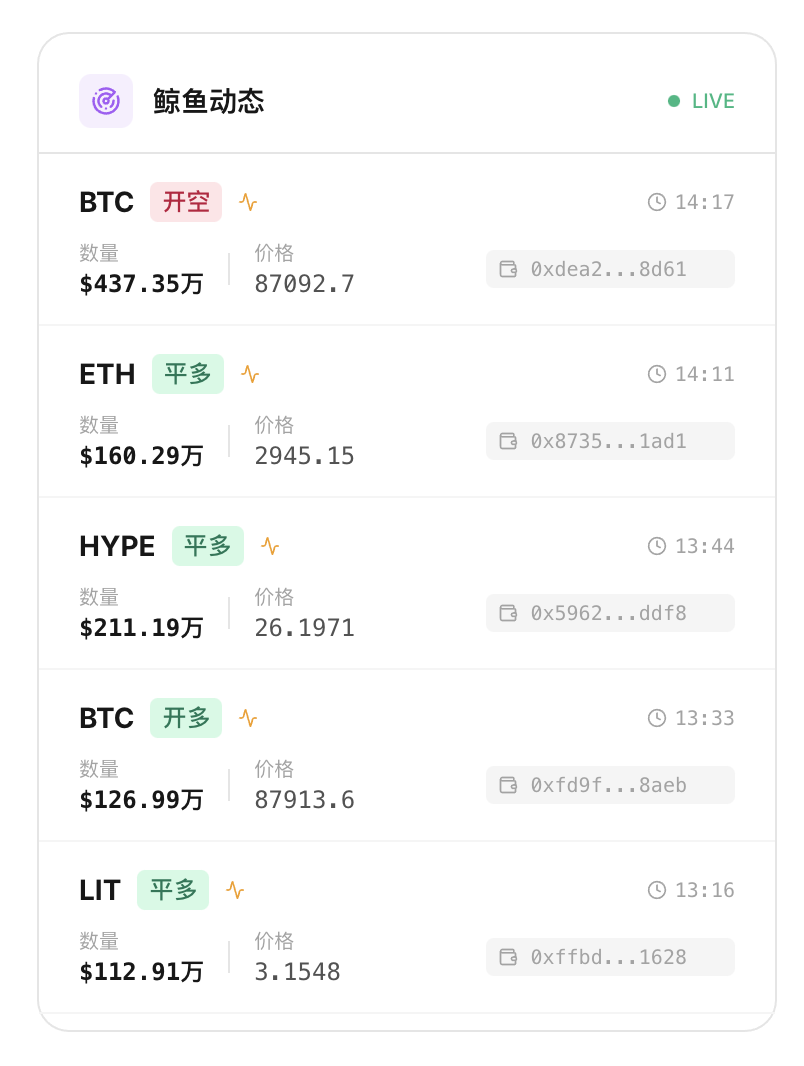

1. Whale Alert: Real-time monitoring of large on-chain movements. When you see a real-time short position of $4.3735 million in BTC on the LIVE list, it itself is a strong signal to go short.

2. Most Profitable Positions Leaderboard: This is a powerful trump card. Investment is not about who shouts the loudest, but who earns the most. The leaderboard displays in real-time top traders like 0x5b5d..., with a single short position on HYPE earning over $20 million.

- Core Strategy: Pay attention to the opening direction and entry price of the top 5 on the leaderboard. If your judgment aligns with these high ROE (197%+) winners, your win rate will significantly increase.

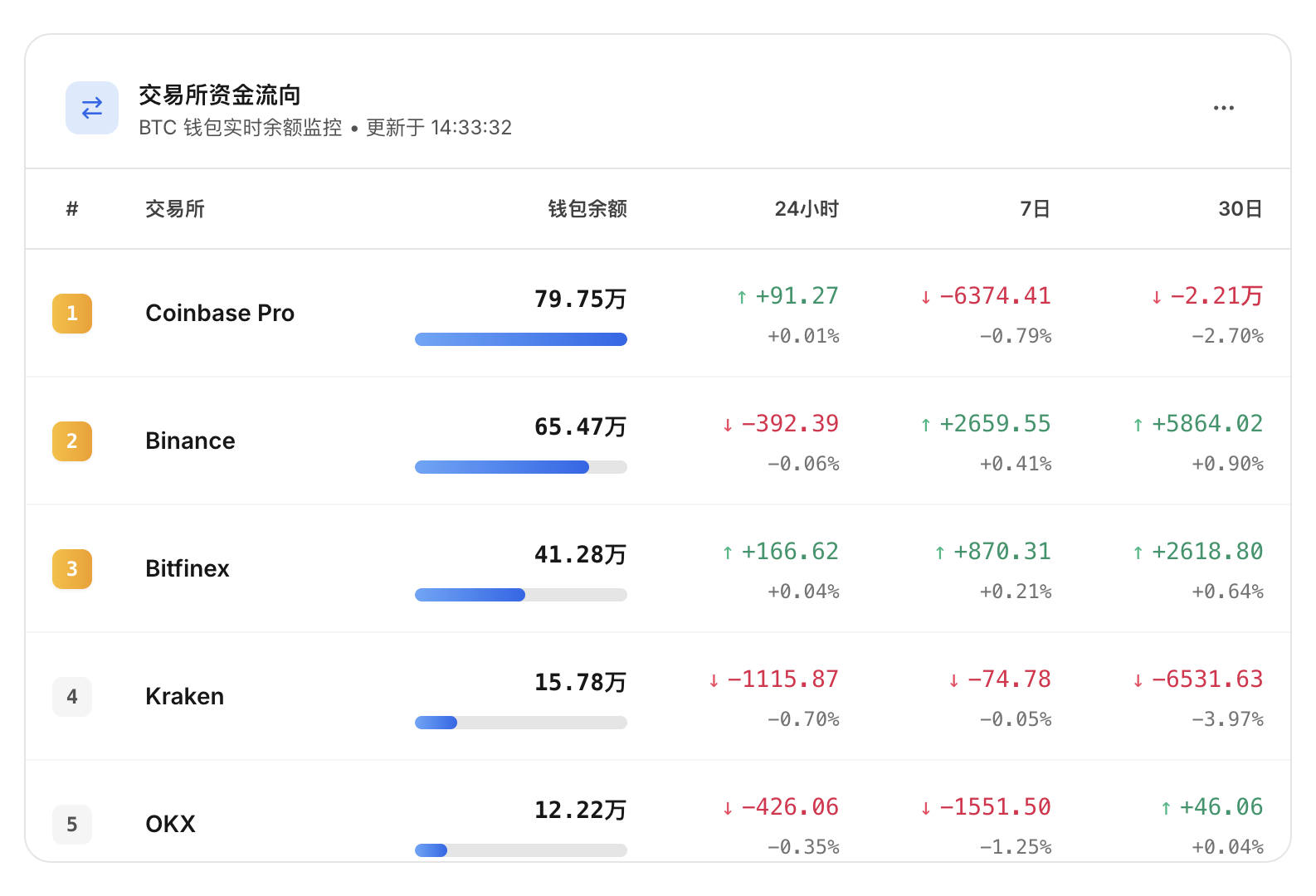

4. Global Perspective: Cross-Platform Liquidation Comparison

Hyperliquid is not an island. In the exchange fund flow and maximum liquidation ranking modules, Hyperliquid is compared horizontally with mainstream CEXs like Binance, OKX, and Bybit.

- Practical Use: When the market is highly volatile, observe the liquidation data. If only Hyperliquid experiences large-scale liquidations while CEXs remain relatively calm, this may just be a liquidity squeeze within the platform, and prices often quickly revert; if the entire network experiences massive liquidations, that is a true trend reversal.

Conclusion

Trading on Hyperliquid requires more than just speed; you also need eyes that can see through the market.

This data dashboard is your "God's eye view." From main force positions to whale movements, from funding rates to profit leaderboards, we have placed all the data that can help you make money on this one page.

Don't let your opponents see this data before you.

You have successfully initiated your first Hyperliquid trade! It is recommended to start with a small amount to familiarize yourself with the interface and order types.

If you are also interested in Hyperliquid's DEX on-chain trading, it is recommended to use the exclusive link to bind (save 4% on each transaction)

AiCoin User Exclusive link:

https://app.hyperliquid.xyz/join/AICOIN88

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。