Written by: Bloomberg

Translated by: Saoirse, Foresight News

Editor’s Note: _After reviewing the ups and downs of the crypto industry in the _2025 FN Year-End Series, let’s broaden our perspective: the pulse of global financial markets often reflects and is inseparable from the logic of the crypto space. This article focuses on 11 key transactions of the year, from cross-market trends to policy-driven asset volatility, revealing market patterns and risk insights that are equally worth considering for crypto practitioners, helping to see the full picture of the annual financial landscape.

This has been a year filled with "high-certainty bets" and "rapid reversals."

From bond trading desks in Tokyo, credit committees in New York, to forex traders in Istanbul, the market has brought unexpected fortunes and created severe volatility. Gold prices hit historic records, the stock prices of robust mortgage giants fluctuated wildly like "Meme stocks" (stocks driven by social media hype), and a textbook-level arbitrage trade collapsed in an instant.

Investors placed large bets around political changes, expanding balance sheets, and fragile market narratives, driving significant stock market gains and clustering yield trades, while cryptocurrency strategies largely relied on leverage and expectations, lacking other solid support. After Donald Trump returned to the White House, global financial markets first suffered a sharp decline and then warmed up; European defense stocks ignited a frenzy; speculators sparked one market craze after another. Some positions reaped astonishing returns, but when market momentum reversed, financing channels dried up, or leverage had negative effects, other positions faced disastrous losses.

As the year-end approached, Bloomberg focused on several of the most notable bets of 2025 — including success stories, failures, and those positions that defined the era. These transactions left investors anxious about a series of "old problems" as they prepared for 2026: unstable companies, excessive valuations, and those trend-following trades that "once worked but ultimately failed."

Cryptocurrency: A Brief Frenzy of Trump-Related Assets

For the cryptocurrency sector, "massively buying all assets related to the Trump brand" seemed like an extremely attractive momentum bet. During the presidential campaign and after taking office, Trump went "all in" on digital assets (according to Bloomberg Terminal reports), pushing for comprehensive reforms and placing industry allies in various powerful institutions. His family also jumped in, endorsing various tokens and cryptocurrency companies, which traders viewed as "political booster fuel."

This "Trump-related crypto asset matrix" quickly took shape: just hours before the inauguration, Trump launched a Meme coin and promoted it on social media; First Lady Melania Trump subsequently launched her own exclusive token; later that year, World Liberty Financial, associated with the Trump family, opened trading for its issued WLFI token for retail investors. A series of "Trump-related" trades followed — Eric Trump co-founded American Bitcoin, a publicly traded cryptocurrency mining company that went public through a merger in September.

In a store in Hong Kong, a cartoon image depicting Donald Trump holding cryptocurrency tokens, with the White House in the background, commemorating his inauguration. Photographer: Paul Yang / Bloomberg

Each asset launch triggered a wave of increases, but each increase was fleeting. As of December 23, the Trump Meme coin performed poorly, down over 80% from its January peak; according to cryptocurrency data platform CoinGecko, the Melania Meme coin fell nearly 99%; American Bitcoin's stock price dropped about 80% from its September peak.

Politics provided the momentum for these trades, but speculative patterns ultimately pulled them back to square one. Even with "supporters" in the White House, these assets could not escape the core cycle of cryptocurrency: price rises → leverage influx → liquidity exhaustion. As a barometer of the industry, Bitcoin is likely to record an annual loss after its decline from the October peak. For Trump-related assets, politics can bring short-term heat but cannot provide long-term protection.

—— Olga Kharif (Reporter)

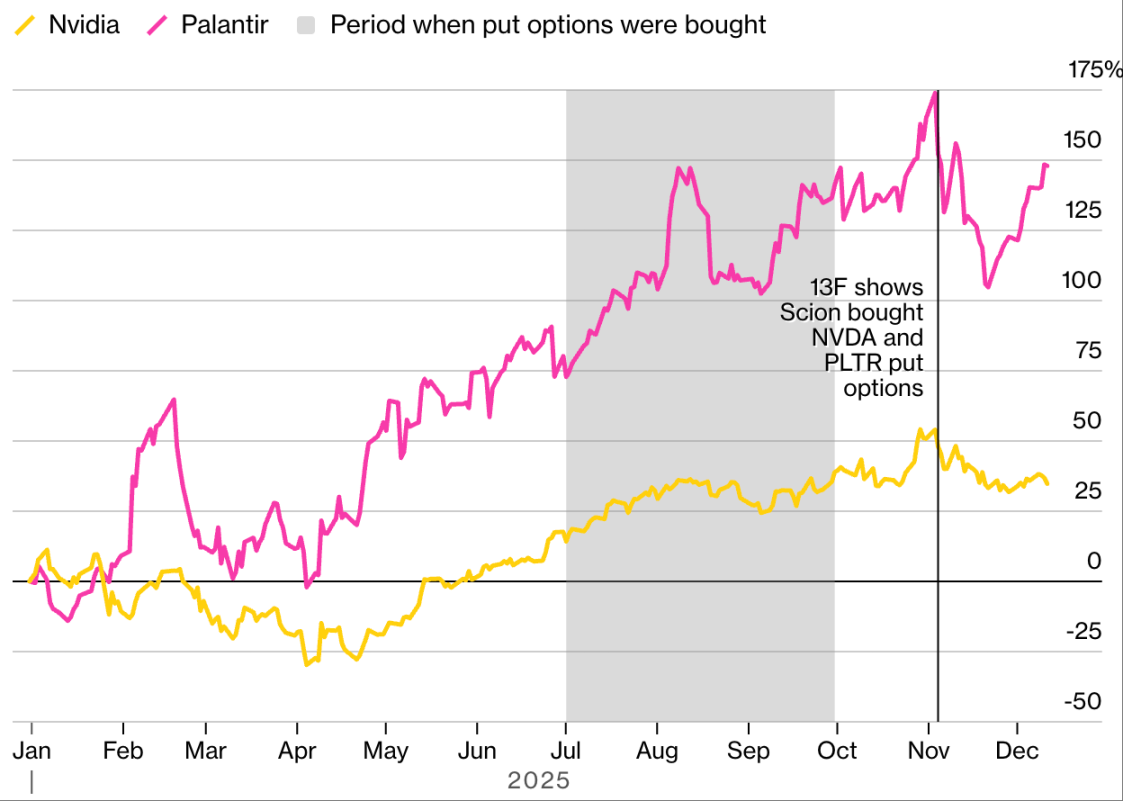

AI Trading: The Next "Big Short"?

This trade was revealed in a routine disclosure document, but its impact was anything but "routine." On November 3, Scion Asset Management disclosed that it held protective put options on Nvidia and Palantir Technologies — two companies that have driven the market up over the past three years as "core AI stocks." Although Scion is not a large hedge fund, its manager Michael Burry drew attention to this disclosure: Burry gained fame for "predicting the 2008 subprime mortgage crisis" in the book and film "The Big Short," becoming a recognized "prophet" in the market.

The strike prices of the options were shocking: Nvidia's strike price was 47% lower than its closing price at the time of disclosure, and Palantir's strike price was even 76% lower. However, the mystery remains unsolved: limited by "limited disclosure requirements," it is unclear whether these put options (contracts that give investors the right to "sell stocks at a specific price before a specific date") are part of a more complex trade; and the document only reflects Scion's holdings as of September 30, leaving open the possibility that Burry reduced or liquidated his position afterward.

However, the market's doubts about "overvalued, high-spending AI giants" had already piled up like "a pile of dry firewood." Burry's disclosure was like a match that ignited the dry wood.

Burry's Bearish Bet on Nvidia and Palantir

The investor who became famous for "The Big Short" disclosed his put option holdings in the 13F filing:

Source: Bloomberg, data has been normalized based on percentage increases as of December 31, 2024

After the news broke, Nvidia, the world's most valuable stock, plummeted, and Palantir also fell, with the Nasdaq index slightly retreating, although these assets later recovered.

It is unclear how much Burry profited from this, but he left a clue on social media platform X: he stated that he bought Palantir put options at a price of $1.84, which surged by 101% in less than three weeks. This disclosure document thoroughly exposed the underlying doubts in a market dominated by "a few AI stocks, a large influx of passive funds, and low volatility." Whether this trade ultimately proves to be "prescient" or "premature," it confirms a pattern: once market confidence wavers, even the strongest market narratives can quickly reverse.

—— Michael P. Regan (Reporter)

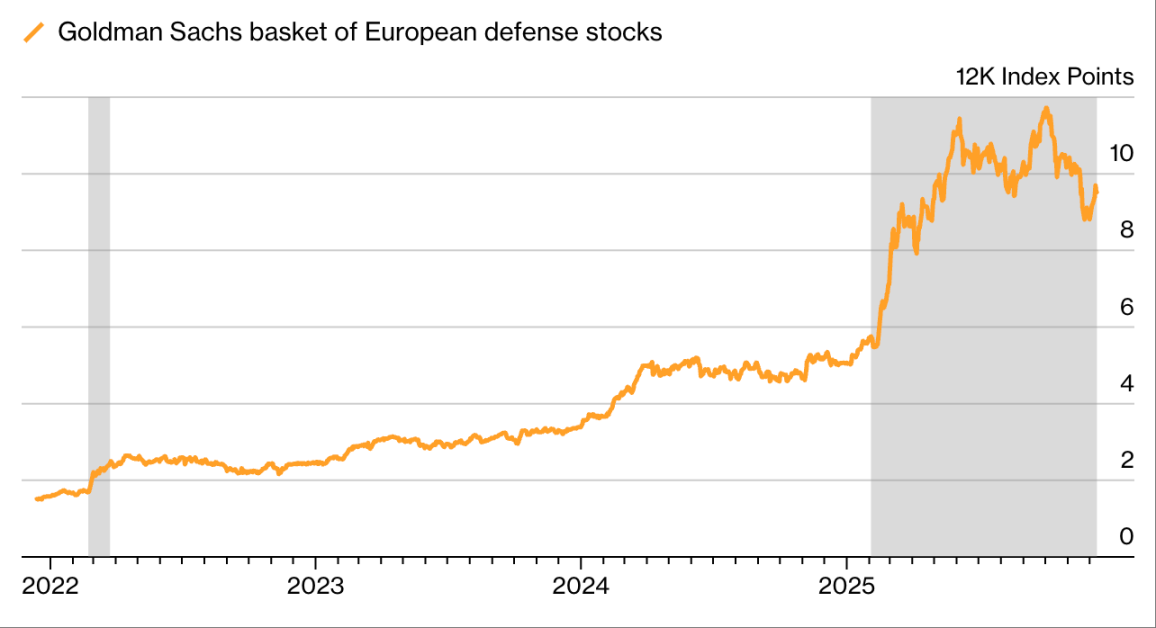

Defense Stocks: A Surge in the New World Order

The shift in geopolitical dynamics has led to a surge in "European defense stocks," a sector previously viewed as "toxic assets" by asset management companies. Trump's plan to reduce funding for the Ukrainian military prompted European governments to embark on a "military spending spree," significantly boosting the stock prices of defense companies in the region: as of December 23, shares of Rheinmetall AG in Germany rose about 150% this year, while Leonardo SpA in Italy saw an increase of over 90% during the same period.

Previously, many fund managers avoided the defense industry due to "environmental, social, and governance" (ESG) investment principles, deeming it "too controversial"; now, they have changed their stance, with some funds even redefining their investment scope.

Significant Rise in European Defense Stocks in 2025

Military stocks in the region have surged since the early days of the Russia-Ukraine conflict:

Source: Bloomberg, Goldman Sachs

"Only at the beginning of this year did we reintroduce defense assets into ESG funds," said Pierre-Alexis Dumont, Chief Investment Officer of Sycomore Asset Management. "The market paradigm has shifted, and when paradigms shift, we must take responsibility while defending our values — hence we are now focusing on assets related to 'defensive weapons.'"

From goggle manufacturers and chemical producers to a printing company, stocks related to defense have been frantically bought up. As of December 23, the Bloomberg European Defense Stock Index has risen over 70% this year. This frenzy has also spread to the credit market: even companies "indirectly related" to defense have attracted a large number of potential lenders; banks have even launched "European Defense Bonds" — modeled after green bonds, but funds are specifically allocated for manufacturers of weapons and similar entities. This change marks a repositioning of "defense" from "reputational liability" to "public good," and confirms a principle: when geopolitical shifts occur, the speed of capital movement often outpaces ideological changes.

—— Isolde MacDonogh (Reporter)

Devaluation Trades: Fact or Fiction?

The heavy debt burdens of major economies such as the United States, France, and Japan, along with the "lack of political will to address debt," prompted some investors in 2025 to flock to "anti-devaluation assets" like gold and cryptocurrencies, while enthusiasm for government bonds and the dollar waned. This strategy was labeled as "devaluation trades," inspired by history: rulers like the Roman Emperor Nero once responded to fiscal pressures by "diluting the value of currency."

In October, this narrative reached a climax: concerns over the U.S. fiscal outlook, combined with the "longest government shutdown in history," led investors to seek safe-haven tools outside the dollar. That month, gold and Bitcoin both reached historic highs — a rare moment of synchronization for these two assets often seen as "competitors."

Gold Record

"Devaluation trades" helped precious metals reach new highs:

Source: Bloomberg

As a "story," "devaluation" provides a clear explanation for the chaotic macro environment; but as a "trading strategy," its actual effects are much more complex. Subsequently, the overall cryptocurrency market corrected, and Bitcoin prices plummeted; the dollar stabilized; U.S. Treasury bonds not only did not collapse but were also expected to have their best performance since 2020 — reminding us that concerns over "fiscal deterioration" may coexist with "demand for safe assets," especially during periods of slowing economic growth and peak policy interest rates.

The price movements of other assets showed divergence: the volatility of metals like copper, aluminum, and even silver stemmed partly from "concerns over currency devaluation" and partly from Trump's tariff policies and macro forces, blurring the lines between "inflation hedging" and "traditional supply shocks." Meanwhile, gold continued to strengthen, constantly setting new historical highs. In this domain, "devaluation trades" remain effective — but they are no longer a complete denial of "fiat currency," but rather a precise bet on "interest rates, policies, and demand for safe havens."

—— Richard Henderson (Reporter)

Korean Stock Market: "K-Pop Style" Surge

When it comes to plot twists and excitement levels, this year's performance of the Korean stock market is enough to make Korean dramas "take a back seat." Under President Lee Jae-myung's policy to "boost the capital market," as of December 22, the benchmark stock index (Kospi) had risen over 70% in 2025, moving towards Lee's proposed "5000-point target," easily ranking first among major global stock indices in terms of growth.

It is uncommon for political leaders to publicly set "index points" as targets; when Lee initially proposed the "Kospi 5000" plan, it did not attract much attention. Now, an increasing number of Wall Street banks, including JPMorgan and Citigroup, believe this target is likely to be achieved in 2026 — partly due to the global AI boom, as the Korean stock market has seen a significant increase in demand due to its status as a "core trading target for Asian AI."

Korean Stock Market Rebound

The Korean benchmark stock index soared:

Source: Bloomberg

In this "globally leading" rebound, there is a notable "absentee": local retail investors in Korea. Despite Lee frequently emphasizing to voters that "he was also a retail investor before entering politics," his reform agenda has yet to convince domestic investors that "the stock market is worth holding long-term." Even with a massive influx of foreign capital into the Korean stock market, local retail investors are still "net sellers": they have poured a record $33 billion into the U.S. stock market and are chasing higher-risk investments like cryptocurrencies and overseas leveraged ETFs.

This phenomenon has a side effect: the Korean won is under pressure. Capital outflows have weakened the won, reminding the outside world that even with a "sensational rebound" in the stock market, it may mask the "persistent doubts" of domestic investors.

—— Youkyung Lee (Reporter)

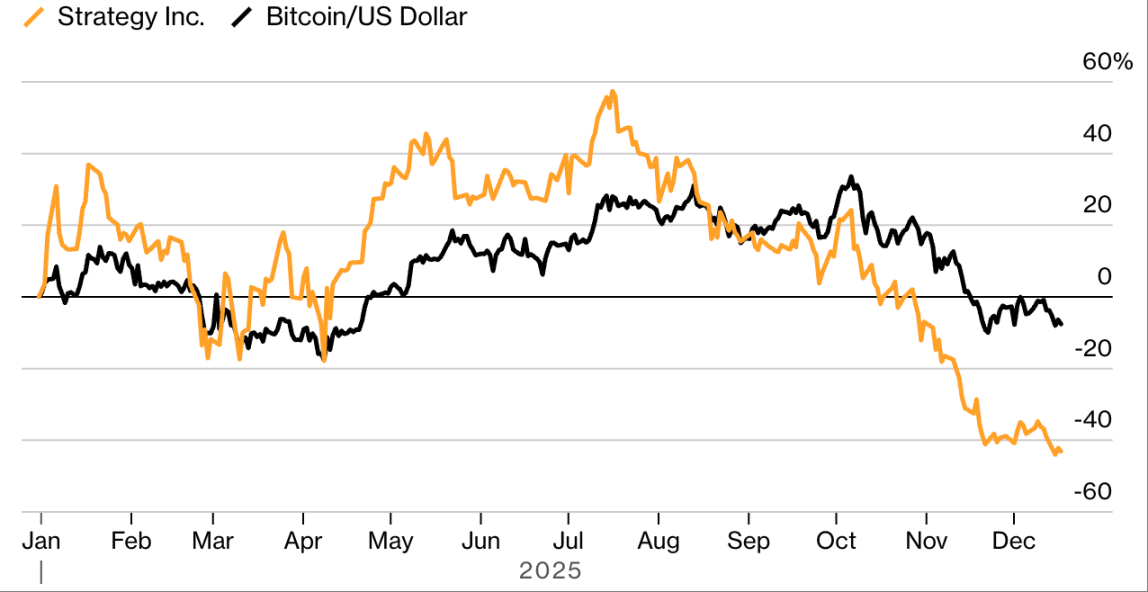

Bitcoin Showdown: Chanos vs. Saylor

Every story has two sides, and the arbitrage game between short-seller Jim Chanos and "Bitcoin hoarder" Michael Saylor's Strategy company involves not only two highly individualistic figures but has also evolved into a "referendum" on "capitalism in the cryptocurrency era."

At the beginning of 2025, Bitcoin prices soared, and Strategy's stock price surged in tandem, leading Chanos to see an opportunity: the premium of Strategy's stock price relative to its "Bitcoin holdings" was too high, and this legendary investor believed "this premium is unsustainable." Therefore, he decided to "short Strategy and go long on Bitcoin," publicly announcing this strategy in May (when the premium was still high).

Chanos and Saylor then engaged in a public debate. In June, Saylor stated in an interview with Bloomberg Television, "I think Chanos doesn't understand our business model at all"; Chanos retaliated on social media platform X, calling Saylor's explanation "utter financial nonsense."

In July, Strategy's stock price hit a record high, with a year-to-date increase of 57%; but as the number of "digital asset treasury companies" surged and cryptocurrency prices fell from their peaks, the stock prices of Strategy and its "imitators" began to decline, and the premium of Strategy relative to Bitcoin also shrank — Chanos's bet began to pay off.

This Year, Strategy's Stock Performance Lagged Behind Bitcoin

As the premium of Strategy disappeared, Chanos's short trade yielded returns:

Source: Bloomberg, data has been normalized based on percentage increases as of December 31, 2024

From Chanos publicly "shorting Strategy" to his announcement of "liquidating his position" on November 7, Strategy's stock price fell by 42%. Beyond the profits and losses themselves, this case reveals the "cyclical boom and bust" of cryptocurrencies: balance sheets expand due to "confidence," which in turn relies on "price increases" and "financial engineering" for support. This pattern will continue to work until "belief wavers" — at which point, the "premium" is no longer an advantage but rather a problem.

—— Monique Mulima (Reporter)

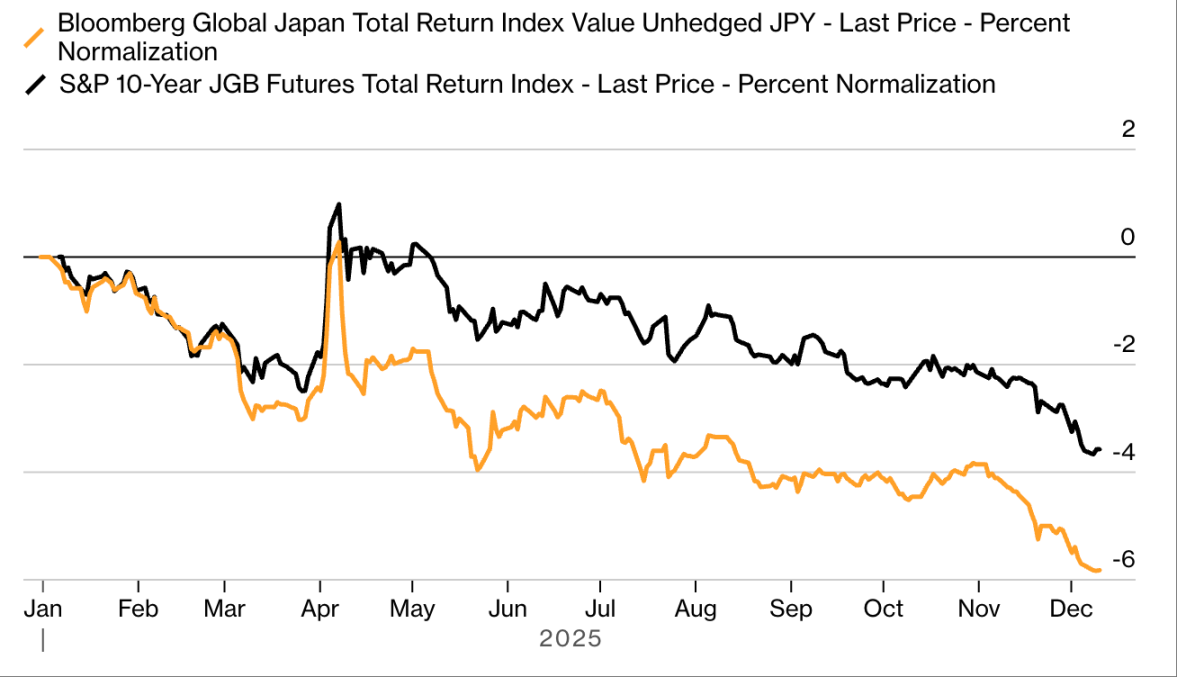

Japanese Government Bonds: From "Widowmaker" to "Rainmaker"

For decades, there has been a bet that has caused macro investors to "stumble repeatedly" — that is the "widowmaker" trade of shorting Japanese government bonds. The logic of this strategy seems simple: Japan carries a massive public debt, so interest rates "will eventually rise" to attract enough buyers; investors "borrow government bonds and sell them," expecting to profit when "interest rates rise and bond prices fall." However, for many years, the Bank of Japan's easing policies have kept borrowing costs low, causing "short sellers" to pay a heavy price — until 2025, when the situation finally reversed.

This year, the "widowmaker" transformed into a "rainmaker": the benchmark yield on Japanese government bonds surged across the board, turning the $7.4 trillion Japanese government bond market into a "paradise for short sellers." The triggers were varied: the Bank of Japan raised interest rates, and Prime Minister Kishida Fumio launched the "largest post-pandemic spending plan." The benchmark 10-year Japanese government bond yield broke 2%, reaching a multi-decade high; the 30-year bond yield rose by over 1 percentage point, setting a historical record. As of December 23, the Bloomberg Japanese Government Bond Return Index had fallen over 6% this year, becoming the worst-performing major bond market globally.

This Year, the Japanese Bond Market Plummeted

The Bloomberg Japanese Government Bond Index is the worst-performing major bond index globally:

Source: Bloomberg, data has been normalized based on percentage increases as of December 31, 2024, and January 6, 2025

Fund managers from institutions like Schroders, Jupiter Asset Management, and Royal Bank of Canada BlueBay Asset Management have publicly discussed "shorting Japanese government bonds in some form" this year; investors and strategists believe that as the benchmark policy interest rate rises, this trade still has room to grow. Additionally, the Bank of Japan is reducing its bond purchase scale, further pushing up yields; and Japan's government debt-to-GDP ratio is "far ahead of other developed countries," leading to a "potentially sustained bearish sentiment" towards Japanese government bonds.

—— Cormac Mullen (Reporter)

Credit "Infighting": Returns from "Hardball Strategy"

The most lucrative credit returns of 2025 did not come from "betting on corporate recovery," but rather from "retaliating against peer investors." This model, known as "creditor versus creditor confrontation," has allowed firms like Pacific Investment Management Company (Pimco) and King Street Capital Management to achieve great success — they orchestrated a precise "game" around KKR Group's healthcare company Envision Healthcare.

After the pandemic, hospital staffing provider Envision found itself in trouble, urgently needing loans from new investors. However, issuing new debt required "collateralizing already pledged assets": most creditors united against this plan, while Pimco, King Street Capital, and Partners Group "switched sides" to support it — their backing allowed the proposal for "old creditors to release collateral (equity in Envision's high-value outpatient surgery business Amsurg) to guarantee new debt" to pass.

Amsurg's sale to Ascension brought substantial returns to funds including Pacific Investment Management Company (Pimco). Photographer: Jeff Adkins

These institutions then became "bondholders secured by Amsurg" and ultimately converted the bonds into Amsurg equity. This year, Amsurg was sold to healthcare group Ascension Health for $4 billion. According to statistics, these "betraying peers" institutions achieved returns of about 90% — confirming the profit potential of "credit infighting."

This case reveals the current rules of the credit market: loose document terms, dispersed creditors, and "cooperation" is not necessary; "making the right judgment" is often not enough, and "avoiding being surpassed by peers" is the greater risk.

—— Eliza Ronalds-Hannon (Reporter)

Fannie Mae and Freddie Mac: The Revenge of the "Toxic Twins"

Since the financial crisis, mortgage giants Fannie Mae and Freddie Mac have been under the control of the U.S. government, and "when and how to exit government control" has been a focal point of market speculation. Hedge fund manager Bill Ackman and other "supporters" have held long positions, hoping for "privatization plans" to yield huge profits, but due to the lack of change, the stocks of these two companies have languished in the pink sheet market (over-the-counter market) for years.

Trump's re-election changed this situation: the market optimistically anticipated that "the new government would push the two companies out of control," and the stocks of Fannie Mae and Freddie Mac were suddenly surrounded by "Meme stock-style enthusiasm." In 2025, the heat further intensified: from the beginning of the year to the peak in September, the stock prices of the two companies skyrocketed by 367% (with intraday increases reaching 388%), making them one of the brightest winners of the year.

Fannie Mae and Freddie Mac's Stock Prices Soared on Privatization Expectations

People are increasingly willing to believe that these companies will break free from government control.

Source: Bloomberg, data has been normalized based on percentage increases as of December 31, 2024.

In August, news that "the government is considering pushing for IPOs of the two companies" pushed the excitement to a peak — the market expected the IPO valuation to exceed $500 billion, planning to sell 5%-15% of shares to raise about $30 billion in funds. Although the market is skeptical about the specific timing of the IPO and whether it can truly materialize, most investors remain confident about this prospect.

In November, Ackman announced a proposal submitted to the White House, suggesting the relisting of Fannie Mae and Freddie Mac on the New York Stock Exchange while writing down the preferred shares held by the U.S. Treasury and exercising government-level options to acquire nearly 80% of the common stock. Even Michael Burry joined this camp: he announced a bullish stance on the two companies in early December and stated in a 6,000-word blog post that these companies, which once needed government intervention to avoid bankruptcy, might "no longer be the 'toxic twins.'"

—— Felice Maranz (Reporter)

Turkey's Carry Trade: Complete Collapse

After a stellar performance in 2024, Turkey's carry trade became the "consensus choice" for emerging market investors. At that time, Turkish local bond yields exceeded 40%, and the central bank promised to maintain a stable dollar-pegged exchange rate, prompting traders to flood in — borrowing at low costs from abroad to buy high-yield Turkish assets. This trade attracted billions of dollars from institutions like Deutsche Bank, Millennium Partners, and Gramercy Capital, with some personnel from these institutions still in Turkey on March 19, the very day this trade collapsed completely within minutes.

The trigger for the collapse occurred that morning: Turkish police raided the home of a popular opposition mayor in Istanbul and detained him. This incident sparked a wave of protests, leading to a frenzied sell-off of the Turkish lira, and the central bank was powerless to stem the plummeting exchange rate. Keith Jukes, head of foreign exchange strategy at Societe Generale in Paris, stated at the time: "Everyone was caught off guard, and no one will dare to return to this market in the short term."

Students hold Turkish flags and slogans during protests after Istanbul Mayor Ekrem İmamoğlu was detained. Photographer: Kerem Uzel / Bloomberg

By the end of the day, the estimated outflow of funds from assets denominated in Turkish lira was about $10 billion, and the market never truly recovered afterward. As of December 23, the lira had depreciated about 17% against the dollar for the year, becoming one of the worst-performing currencies globally. This incident also served as a wake-up call for investors: high interest rates may bring returns to risk-takers, but they cannot withstand sudden political shocks.

—— Kerim Karakaya (Reporter)

Bond Market: "Cockroach Alert" Sounds

The credit market in 2025 did not become turbulent due to a single "catastrophic collapse," but rather was unsettled by a series of "small-scale crises" — these crises exposed some disturbing vulnerabilities in the market. Companies once viewed as "regular borrowers" found themselves in trouble, causing lenders to suffer heavy losses.

Saks Global restructured $2.2 billion in bonds after only making one interest payment, and the restructured bonds are now trading at less than 60% of par value; New Fortress Energy's newly issued exchange bonds lost over 50% of their value within a year; Tricolor and First Brands both filed for bankruptcy, erasing billions of dollars in debt value within weeks. In some cases, complex fraudulent activities were the root cause of the companies' collapses; in others, the initially optimistic performance expectations simply did not materialize. But in any case, investors must confront a question: why did they make large-scale credit bets on these companies when there is almost no evidence that they can repay their debts?

JPMorgan was burned by a credit "cockroach," and Jamie Dimon warned that there may be more to come. Photographer: Eva Marie Uzkategi / Bloomberg

Years of low default rates and loose monetary policies have eroded various standards in the credit market — from lender protection clauses to basic underwriting processes, none have been spared. Institutions that lent to First Brands and Tricolor did not even discover violations such as "double-pledged assets" and "commingling collateral from multiple loans."

JPMorgan was also one of these lending institutions. The bank's CEO Jamie Dimon issued a warning to the market in October, using a vivid metaphor to remind investors to be wary of subsequent risks: "When you see one cockroach, there are likely more hiding in the dark." This "cockroach risk" may become one of the central themes of the market in 2026.

—— Eliza Ronalds-Hannon (Reporter)

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。