In today's issue, I will systematically outline my overall view on the current market from the perspectives of monthly, weekly, daily, and hourly charts.

The key takeaway is still one sentence: The direction hasn't changed, we need to wait for the rhythm.

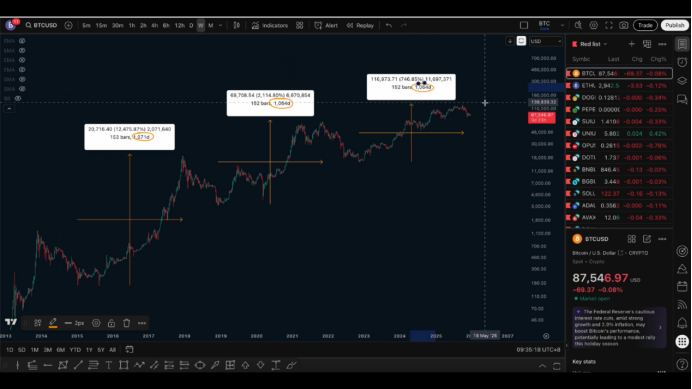

I. Monthly Level: The Downtrend Cycle is Still Ongoing

From the monthly level, at the position of 126,000, we have already provided a clear warning, believing that Bitcoin will gradually shift from a bullish trend to a bearish trend on the weekly and monthly levels.

As of now, the market has been declining for nearly 3 months, with the price dropping from 106,000 to around 80,000, a decline of several tens of thousands of points. However, I personally believe that this round of decline is far from over.

As for where the price bottom will be, I cannot provide an accurate prediction at this moment, but we can refer to the time cycles.

Historically, each round of Bitcoin's upward cycle lasts approximately 1,000–1,100 days, while the downward cycle is generally around 400 days. In the past two rounds of decline, the actual duration was around 365 days, nearly a full year.

The peak of this round of increase occurred in October this year. If we calculate the downward cycle as lasting a year, the end time will likely fall around October 2026, which is before or around the end of the third quarter of next year.

Therefore, I tend to believe:

While it's hard to judge the price, the time-based bottom is likely around the third quarter of next year.

II. Do Not Use the Rise of Other Assets to Deny Bitcoin's Decline

Recently, many people have compared the rise of gold, precious metals, and U.S. stocks, believing that Bitcoin "has no reason to continue declining."

But this logic does not hold.

If in 2026, the overall financial market experiences a phase correction, Bitcoin's decline will often be even greater, not smaller. Therefore, from a medium to long-term perspective, I still maintain a bearish judgment on Bitcoin.

The more reasonable time window for bottom-fishing in the spot market should be considered after the end of the third quarter of next year.

III. Weekly Structure: MACD Risk Signal is Clear

From the weekly perspective, the MACD has formed a high-level death cross, with a significant divergence.

After the death cross confirmation, the fast line has been below the slow line for two consecutive months, and the energy bars are running below the zero axis.

Comparing to the previous round of decline, it took about 8 months from the energy bar breaking below the zero axis to complete a full adjustment. If we continue to project from the current point, the time also points to the third quarter of next year.

Some friends may feel that the bearish monthly line and the potential golden cross on the weekly line are contradictory; in fact, these are different indicators providing different guidance under different cycles.

However, from the weekly structure itself, we are still in a downtrend, and the probability of a pullback still exists.

IV. Key Levels: 80,000 and 75,000

I have mentioned multiple times that this round of decline will likely need to break below the 80,000 level and further test the 75,000 previous low area.

75,000 is an important defensive position for bulls and a key threshold that the market pays high attention to. Once it is effectively broken, it can easily trigger emotional panic and complete a more thorough liquidation of bulls.

Only after the liquidation is completed can the market have better conditions for a rebound.

From the weekly perspective, I tend to believe:

First, break down, then talk about a rebound, rather than a direct reversal.

V. Daily Level: This is an Adjustment, Not a Reversal

From the daily perspective, we are currently in a normal adjustment after a decline.

However, many people view this as a reversal structure, which I believe is unreasonable.

The trend is bearish, and the structure is also bearish.

The fluctuations and convergence that occur in a downtrend are more likely to belong to a continuation structure rather than a reversal.

Before there is a clear reversal signal, any adjustment during the decline should be treated primarily as a continuation, which actually has a higher win rate.

VI. Hourly Level: Key Resistance Not Broken, Direction Unchanged

From the 4-hour and hourly levels, the core focus remains on the key resistance level of 91,000.

This position has repeatedly switched between support and resistance in the past, making it a very clear upper pressure point. Until this position is effectively broken, there are no conditions to turn bullish.

Recently, some people have preemptively placed long orders in this range, which I personally believe is unreasonable. Because from the price action perspective, there is neither a reversal motive nor a confirmation signal.

The real conditions for turning bullish should be:

Key resistance breaks with volume → Converts to support → Completes a retest confirmation.

If 91,000 is effectively broken, the upper 94,000 will likely also be driven to break, completing the liquidation of shorts within the range. But before that, we still maintain a bearish outlook below the resistance.

VII. Core of Trading and Risk Control

The current short-term focus is still whether 80,000 will form an effective breakdown.

If it breaks down, then observe whether it will push towards the 75,000–73,000 range.

Under the premise that resistance has not been broken, the defense point can only be placed near 91,000, rather than at 94,000, which is too far off.

It needs to be emphasized:

Trading is a matter of probability.

A stop loss occurring does not mean the plan is wrong;

Occasional profits do not mean the logic is correct.

Long-term stable trading must be based on trends, structures, and price actions.

Follow me, join the community, and let's improve together.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。