Odaily specially invites market analyst Conaldo, a master's degree holder in financial statistics from Columbia University in the United States, who has focused on quantitative trading in U.S. stocks since college and gradually expanded to Bitcoin and other digital assets. He has built a systematic quantitative trading model and risk control system through practical experience; he possesses keen data insights into market fluctuations and is committed to continuous deepening in the professional trading field, pursuing stable returns. He will delve into changes in BTC technology, macroeconomics, and capital flow weekly, reviewing and demonstrating practical strategies, and forecasting significant recent events worth noting for reference.

Core Summary of the Weekly Trading Report:

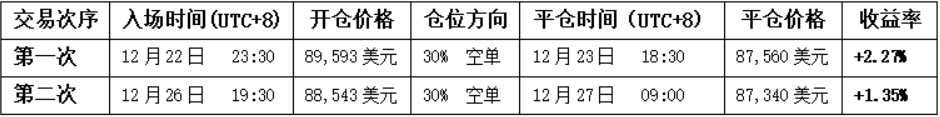

- Strategy Execution (Short-term) Effectiveness Verification: Last week's trading strictly followed the established strategy, successfully completing two operations, achieving a cumulative return of 3.62%.

- Core Viewpoint (Short-term) Verification: The core viewpoint we proposed last week, "the market will show wide-range fluctuations," has been perfectly validated by market trends. The defined core observation range of $89,500 to $91,000 and the support area of $86,500 to $87,500 have been repeatedly tested by the market. Notably, last week the coin price reached a high of $90,598, just $402 away from our upper core area ($91,000); the mid-week low of $86,400 was only $100 away from the lower support area ($86,500), demonstrating the accuracy of our point predictions.

- From a macro technical perspective, Bitcoin has been adjusting for 82 days since reaching a historical high of $126,200 on October 6, with a maximum decline of about 36%, confirming a mid-term bearish trend. However, from various technical indicators, it is currently in a low area, and the time and space for adjustment are gradually approaching historically common oversold conditions. Since November 22, the price has continued to oscillate in a low range, indicating a relatively balanced state between bullish and bearish forces, with momentum for directional breakthroughs accumulating. Although the market is increasingly calling for a rise, we believe that, barring sudden news interference, there exists a critical possibility for future trends: If the market is dominated by leading funds, a better strategy for bears may be to first break downwards, piercing the key psychological level of $80,000, clearing remaining bullish positions through panic, thus completing the final bottoming process. After that, funds can follow the trend to realize a "short to long" switch, quickly lifting the coin price out of the cost zone, thereby initiating a stronger technical recovery trend. It is important to emphasize that the above trend is merely a deduction based on market behavioral logic and not a guaranteed path. Regardless of how the market evolves, one should always remember: "The market is always right." Maintaining observation and flexible responses before making directional choices remains key at this stage.

I. Review of Last Week's Trading Results (12.22–12.28)

1. Short-term Trading Review (No Leverage):

•First Trade (Profit 2.27%): Based on the "rebound to core resistance area meets resistance and short" model. When the coin price hit the $89,500 to $91,000 area and encountered resistance, the price difference trading model simultaneously issued a top signal, allowing for the establishment of a 30% short position, which was ultimately closed for profit when the price fell back near the support area.

•Second Trade (Profit 1.35%): The logic for this trade was the same as above. When the coin price hit the $89,500 to $91,000 area and encountered resistance, two models issued a resonance signal, successfully completing this trade.

2. Review of Last Week's Trend Predictions and Operational Strategies:

In last week's forward analysis, it was clearly pointed out: the market is expected to mainly show a wide-range fluctuation pattern. The core observation range is $89,500 to $91,000, and the outcome of the competition in this area will determine the short-term direction. Below is the strategy review and analysis.

① Review of Trend Predictions:

• Core Resistance Level: The first resistance is at the $89,500 to $91,000 area; the second resistance is at the $93,000 to $94,500 area.

• Core Support Level: The first support is at the $86,500 to $87,500 area; the second support is at the $83,500 to $84,500 area.

② Review of Operational Strategies:

• Mid-line Strategy: Maintain a mid-line position of about 65% (short).

• Short-line Strategy: Last week we initially drafted two short-line operational plans, A/B. Based on the actual market trends, we ultimately executed Plan B as the core strategy.

(Plan B: Rebound verification, the $89,500 to $91,000 core area has been effectively broken down)

• Opening Position: When a resistance signal appears during the rebound verification process, a 30% short position can be established.

• Risk Control: Stop-loss set above $92,000.

• Closing Position: When the coin price drops to the $83,500 to $84,500 area and shows resistance, consider partially or fully closing positions to take profits.

II. Technical Analysis: Mid-term Trend Judgment for Bitcoin

Combining last week's market operation, the author will comprehensively use multi-dimensional analysis models to deeply analyze the internal structure and trend evolution of Bitcoin.

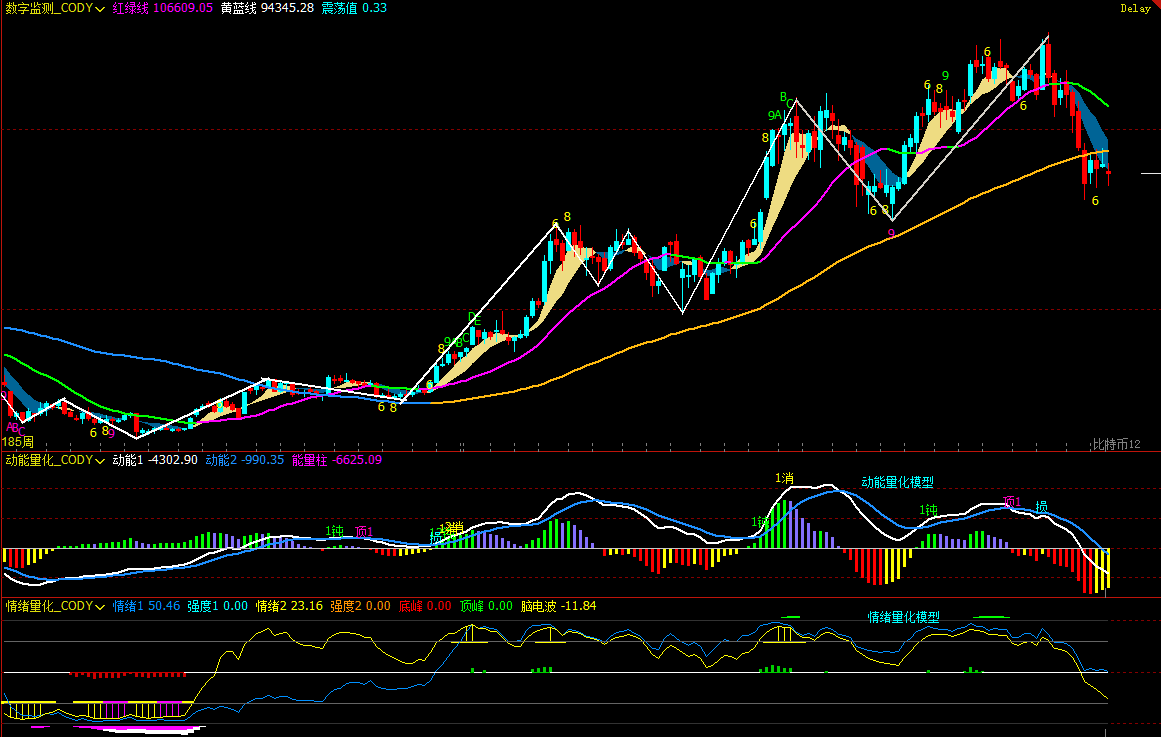

Bitcoin Weekly K-line Chart: (Momentum Quantitative Model + Sentiment Quantitative Model)

Figure Two

- As shown in (Figure Two), from the weekly chart analysis:

• Momentum Quantitative Model: After last week's adjustment, the two momentum indicator lines are still running below the zero axis, and the negative momentum bars are gradually shortening, indicating that although the weekly line has entered a bearish market, the bearish momentum has not been fully released.

Momentum Quantitative Model Indicates: Coin price decline index: High

• Sentiment Quantitative Model: The blue sentiment line value is 49.74, with an intensity of zero; the yellow sentiment line value is 19.99 (close to the low threshold), with an intensity of zero, and the peak value is 0.

Sentiment Quantitative Model Indicates: Coin price pressure and support index: Neutral

• Digital Monitoring Model: The coin price has been below the bullish-bearish (yellow-blue line) boundary for 6 weeks; short-term bottoming signals (above 9) have not yet appeared.

The above data indicates: The Bitcoin weekly line has established a bearish trend, and caution should be exercised regarding the subsequent release of bearish forces.

Bitcoin Daily K-line Chart:

Figure Three

- As shown in (Figure Three), from the daily chart analysis:

• Momentum Quantitative Model: In last week's trend, the two momentum lines were almost glued together, slowly rising below the zero axis and gradually approaching the zero axis. Affected by the holidays, daily trading volume continued to shrink, and the positive momentum bars showed no significant changes.

Momentum Quantitative Model Indicates: Buying momentum is weak, and the volume bars have shrunk to "star point" shape, indicating a temporary balance between bullish and bearish forces.

• Sentiment Quantitative Model: After last week's Sunday close, the blue sentiment line value is 16 (close to the low threshold), with an intensity of zero; the yellow sentiment line value is 40, with an intensity of zero.

Sentiment Quantitative Model Indicates: Pressure and support index: Neutral

The above data suggests: The daily level is in a bearish market, and the short-term market is about to choose a direction.

III. Bitcoin Market Prediction for This Week (12.29–01.04)

- It is expected that this week the market will likely focus on oscillating to find a bottom, with the core observation range looking at $86,000 to $86,500.

• If effectively broken down: The coin price may continue to drop, testing the lower support area of $83,500 to $84,500.

• If effectively stabilized: The market may continue the current $86,500 to $91,000 range fluctuation pattern.

- Core Resistance Levels:

• First Resistance Area: $89,500 to $91,000

• Second Resistance Area: $93,000 to $94,500

• Important Resistance Area: Near $97,000

- Core Support Levels:

• First Support Level: $86,000 to $86,500

• Second Support Level: $83,500 to $84,500

• Important Support Level: Near $80,000.

IV. Bitcoin Operational Strategy for This Week (Excluding Sudden News Impact) (12.29–01.04)

Mid-line Strategy: Maintain a mid-line position of about 65% (short).

Short-line Strategy: Utilize 30% of the position, set stop-loss points, and look for "price difference" opportunities based on support and resistance levels. (Using 30 minutes as the operational cycle).

Focus on observing the competition between bulls and bears in the $86,000 to $86,500 area. To respond to market evolution, we have drafted two short-line operational plans, A/B:

• Plan A: If effectively stabilizing in the $86,000 to $86,500 area:

• Opening Position: When the coin price rebounds to the $89,500 to $91,000 area and shows a resistance signal, a 30% short position can be established.

• Risk Control: Stop-loss for the short position set above $92,500.

• Closing Position: When the coin price drops to the $86,000 to $86,500 area and shows a stabilization signal, close all short positions to take profits.

• Plan B: If effectively breaking down the $86,000 to $86,500 area:

• Opening Position: If the coin price effectively breaks down, a 30% short position can be established.

• Risk Control: Stop-loss set above $88,000.

• Closing Position: When the coin price drops to the $83,500 to $84,500 area and shows a stabilization signal, gradually close positions to take profits.

V. Special Reminders:

When opening a position: Immediately set the initial stop-loss level.

When profit reaches 1%: Move the stop-loss to the opening cost price (break-even point) to ensure capital safety.

When profit reaches 2%: Move the stop-loss to the position of 1% profit.

Continuous Tracking: After that, for every additional 1% profit, the stop-loss level will move 1% accordingly, dynamically protecting and locking in existing profits.

(Note: The 1% profit trigger threshold mentioned above can be flexibly adjusted by investors based on their own risk preferences and the volatility of the asset.)

VI. Key Events to Watch This Week (12.29–01.04)

1. Federal Reserve Meeting Minutes Signal "Real Divergence"

On Wednesday at 03:00, the Federal Reserve will release the latest monetary policy meeting minutes. Compared to the interest rate decision itself, the minutes are more critical in terms of the degree of divergence among internal members regarding the "timing, magnitude, and persistence of rate cuts."

If the minutes show that officials are more confident about a decline in inflation and discuss an earlier or faster path to easing, it will strengthen the market's expectations for "real interest rate declines," which would be a medium-term positive for Bitcoin; conversely, if the minutes emphasize concerns about persistent inflation or overly rapid easing of financial conditions, it may temporarily lift the dollar and U.S. Treasury yields, creating emotional pressure on BTC.

For Bitcoin, this is not a short-term directional signal but an important node that affects the medium-term funding pricing anchor.

2. Initial Jobless Claims: A Thermometer for Liquidity Expectations

On Wednesday at 21:30, the U.S. will announce the initial jobless claims for the week ending December 27.

The current market is more focused on whether "the labor market is experiencing structural cooling" rather than on single data fluctuations.

If initial claims remain above trend levels, it will further validate the logic of economic cooling and strengthen market expectations for the continuation of easing policies, benefiting the valuation recovery of non-yielding assets like Bitcoin; if the data falls back again, it may reinforce the judgment that "the economy remains resilient," which would be unfavorable for the expansion of risk appetite for BTC in the short term.

The impact of this indicator on Bitcoin mainly reflects interest rate expectations rather than the fundamentals themselves.

3. Manufacturing PMI Final Value Validates Direction of the Real Economy

On Friday at 22:45, the final value of the U.S. S&P Global Manufacturing PMI for December will be released.

As a leading indicator, PMI will help the market assess whether a "soft landing" is still on track.

If the final value confirms stabilization or even improvement in the manufacturing sector, the overall sentiment for risk assets is expected to be maintained, with limited systemic pressure on BTC; if the PMI is revised down again, it may trigger a repricing of economic downturn risks, negatively impacting risk assets in the short term, but in the medium to long term, it may actually strengthen expectations for monetary easing.

Financial markets are constantly changing, and all market analyses and trading strategies need to be dynamically adjusted. All viewpoints, analytical models, and operational strategies mentioned in this article are derived from personal technical analysis and are for personal trading logs only, not constituting any investment advice or operational basis. The market carries risks, and investments should be made cautiously; DYOR.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。