As we enter the end of 2025, the global commodity market has been shaken by an epic rally that has stunned all investors. Gold and silver prices have reached new historical highs, with annual increases surpassing 70% and 170% respectively, creating a fervent market atmosphere.

However, amidst the celebration, a core question arises: after gold and silver complete their historic "surge," where will the market's funds and attention turn? Historical patterns and the latest market signals reveal that a rotation from precious metals to a broader range of commodities, particularly industrial metals, is about to unfold.

I. The Conclusion of the 2025 "Surge": Reviewing the Deep Logic of the Gold and Silver Bull Market

The precious metals market in 2025 cannot simply be described as a "bull market"; it resembles a value reassessment triggered by multiple historical factors resonating together.

● Market Data: By late December, the London spot gold price had once touched $4549.96 per ounce, with an annual increase of 72.72%; silver performed even more astonishingly, breaking through $79 per ounce, with an annual increase exceeding 170%. Other precious metals like platinum and palladium also reached historical highs, showing a broad upward trend.

● Change in Driving Logic: The core driving force behind this round of increases has transcended the traditional framework of "weak dollar - declining interest rates," undergoing a fundamental shift.

○ Reassessment of Monetary Credit: Concerns about the dollar's credit and the global trend of "de-dollarization" form the foundation of this bull market. Central banks around the world have been continuously purchasing gold on a large scale to diversify their foreign exchange reserves, establishing a solid strategic bottom for gold prices. This gold purchasing behavior is not a short-term trade but a long-term strategic allocation.

○ Elevated Safe-Haven Demand: The intensification of global geopolitical games and rising trade frictions have elevated the safe-haven attributes of precious metals from merely responding to economic cycle fluctuations to hedging against uncertainties in the international order.

○ Tight Supply-Demand Structure: Taking silver as an example, its strong rise is driven by both "financial + industrial" attributes. The demand from industries like photovoltaics and artificial intelligence has surged, while mining supply is constrained by long investment cycles, leading to a persistent structural shortage in the market.

Latest Market Dynamics and Institutional Views:

● Institutional Consensus: The mainstream view holds that the logic driving this round of market activity possesses strategic and sustainable characteristics, suggesting that the market may be at the starting point of a new long-term bull market rather than at the "end of the feast." CITIC Securities points out that expectations of the Federal Reserve's easing policies, downward pressure on the U.S. economy, and sticky inflation will continue to support precious metals.

● Risk Warnings: At the same time, rational voices are rising. Current prices are at absolute historical highs, and market sentiment is overheated. Institutions warn to be cautious of potential sharp fluctuations triggered by changes in Federal Reserve policy expectations or easing geopolitical tensions. The Shanghai Gold Exchange has also issued a warning about market risks.

II. Signs of Rotation: Historical Patterns Indicate a "Passing the Baton" to Commodities

Historical experience shows that there is a significant rotation effect within the commodity market. After precious metals undergo substantial valuation recovery, funds often begin to seek segments of the industrial chain with greater growth potential.

A key leading indicator—the "Commodity/Gold Ratio"—has sent an important signal. When this ratio drops to extremely low levels and begins to turn upward, it often indicates the start of a comprehensive bull market cycle for commodities. Currently, gold prices appear expensive compared to other basic commodities, creating a significant valuation gap that allows for subsequent "catch-up" in industrial metals and other varieties.

The macro logic behind this is:

Diffusion of Driving Forces: The monetary easing, weakening dollar, and global re-inflation expectations that previously boosted gold will ultimately benefit all commodities priced in dollars.

Shift in Demand Expectations: The market's focus is shifting from purely "safe-haven" and "credit hedging" to expectations of substantial industrial demand related to global economic growth, particularly in energy transition, artificial intelligence, and power grid construction.

III. After Silver, Focus on the "Twin Stars" of Industrial Metals

Following the internal rotation of precious metals (the repair of the gold-silver ratio), market attention has naturally turned to industrial metals that are more closely linked to the pulse of the global economy. Among them, copper and aluminum are seen as the most promising "successors."

1. Copper: The Core Carrier of "Green Inflation"

Copper prices have recently accelerated, reaching historical highs and becoming one of the leaders in the "non-ferrous feast." The logic is solid:

● Rigid Supply Constraints: Global copper mines face challenges such as declining ore grades, insufficient investment, and frequent production accidents. A notable event is that the processing fee for long-term copper concentrate contracts for 2026 has been set at zero dollars/ton, reflecting that supply at the mining end has become extremely tight, squeezing profits for smelters.

● Broad Demand Prospects: The global energy transition (electric vehicles, charging networks, renewable energy generation) and the construction of artificial intelligence data centers all rely on copper as the "electrification metal." CITIC Construction points out that insufficient capital expenditure, strong AI demand, and resource nationalism are reshaping the pricing paradigm of resources.

2. Aluminum: The "Lightweight Cornerstone Metal"

Aluminum prices are also in an upward channel. The logic is:

● Energy Attributes and Cost Support: Aluminum is "solid-state electricity," and its production costs are highly dependent on electricity. Global energy price fluctuations and adjustments in the power structure under the "dual carbon" goals provide long-term support for aluminum prices.

● Upgrading Demand Structure: Continuous growth in demand in areas such as automotive lightweighting, photovoltaic frames, and consumer electronics benefits from manufacturing upgrades.

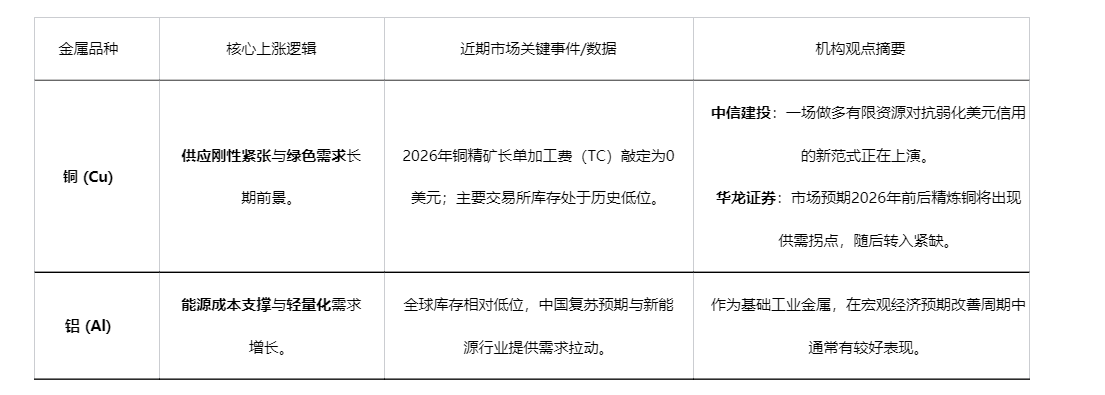

Latest Dynamics in the Industrial Metal Sector (as of the end of December 2025):

IV. The Divergence of the Crypto Market and Commodity Market

As traditional commodities thrive, an intriguing phenomenon is that the recent performance of crypto assets (led by Bitcoin) has not synchronized with this trend. A significant "divergence" has emerged between the two.

● Market Performance Divergence: Since the second half of 2025, despite regulatory boosts such as the signing of the U.S. "GENIUS Act," the crypto market has entered a phase of volatility after reaching a peak. This starkly contrasts with the unilateral strong upward trends of precious metals and some industrial metals during the same period.

● Differentiation in Attribute Recognition: This divergence reflects that the two have been assigned different attribute labels in extreme market environments.

○ Gold/Silver: Currently viewed more as "ultimate safe-haven assets" and "sovereign credit hedging tools," their rise stems from a deep-seated trust crisis in the current monetary system.

○ Crypto Assets: Despite being dubbed "digital gold," their high price volatility and complex regulatory outlook lead many mainstream funds to regard them as high-risk alternative speculative assets or tech growth stocks at this stage. As the market seeks "certainty" in safe-haven assets, their appeal has relatively diminished.

V. Outlook for 2026: Structural Market Trends and Risk Responses

Looking ahead to 2026, the market consensus is that a broad-based rally is unlikely to continue, and structural differentiation will become the main theme.

Internal Differentiation in Precious Metals: Gold, supported by central bank purchases, is "easy to rise but hard to fall," but its increase may narrow; silver's financial attributes are influenced by gold, but industrial demand (such as photovoltaics) may face growth challenges; platinum and palladium are more reliant on their own industrial demand recovery.

Clear Opportunities in Industrial Metals: Varieties like copper, which have a strongly certain supply-demand gap, are expected to continue being the market focus. Their trends will gradually transition from being driven by expectations to being driven by real supply-demand tightness.

Risk Warnings and Strategies:

a. Policy Risks: The path of the Federal Reserve's monetary policy and trade policies (such as tariffs on critical minerals) after the U.S. elections remain the biggest variables.

b. Trading Risks: All metal prices have risen significantly, and market sentiment is crowded; caution is needed for any unexpected events that could trigger sharp fluctuations at high levels and technical corrections akin to "long-killing."

c. Investment Strategies: For ordinary investors, in such a high-volatility market, avoiding chasing highs and instead considering regular investments in related ETFs or focusing on upstream mining companies with relatively lagging valuations may be a more actionable and safer choice.

The surge of gold and silver at the end of 2025 is not just a feast of assets but a clarion call, announcing the arrival of a new commodity cycle driven by the reassessment of monetary credit, energy transition, and the reconstruction of global supply chains.

Historical patterns and market signals clearly indicate that the spotlight is shifting from the shining precious metals to the basic metals like copper and aluminum, which are the lifeblood of modern industry. However, it is crucial to maintain clarity during the climax of the dance: amidst the feast, structural differentiation will emerge, and only participants who understand the fundamental logic and respect market risks can keep pace with the rhythm of rotation and move forward safely.

Join our community to discuss and grow stronger together!

Official Telegram community: https://t.me/aicoincn

AiCoin Chinese Twitter: https://x.com/AiCoinzh

OKX Benefits Group: https://aicoin.com/link/chat?cid=l61eM4owQ

Binance Benefits Group: https://aicoin.com/link/chat?cid=ynr7d1P6Z

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。