This report is written by Tiger Research. The cryptocurrency industry is entering the mainstream. Institutions have become key players in the market. Capital is flowing to projects that generate real returns. Short-term price fluctuations are no longer important. Sustainable business models have become crucial. Tiger Research predicts the top ten transformations in the cryptocurrency market by 2026.

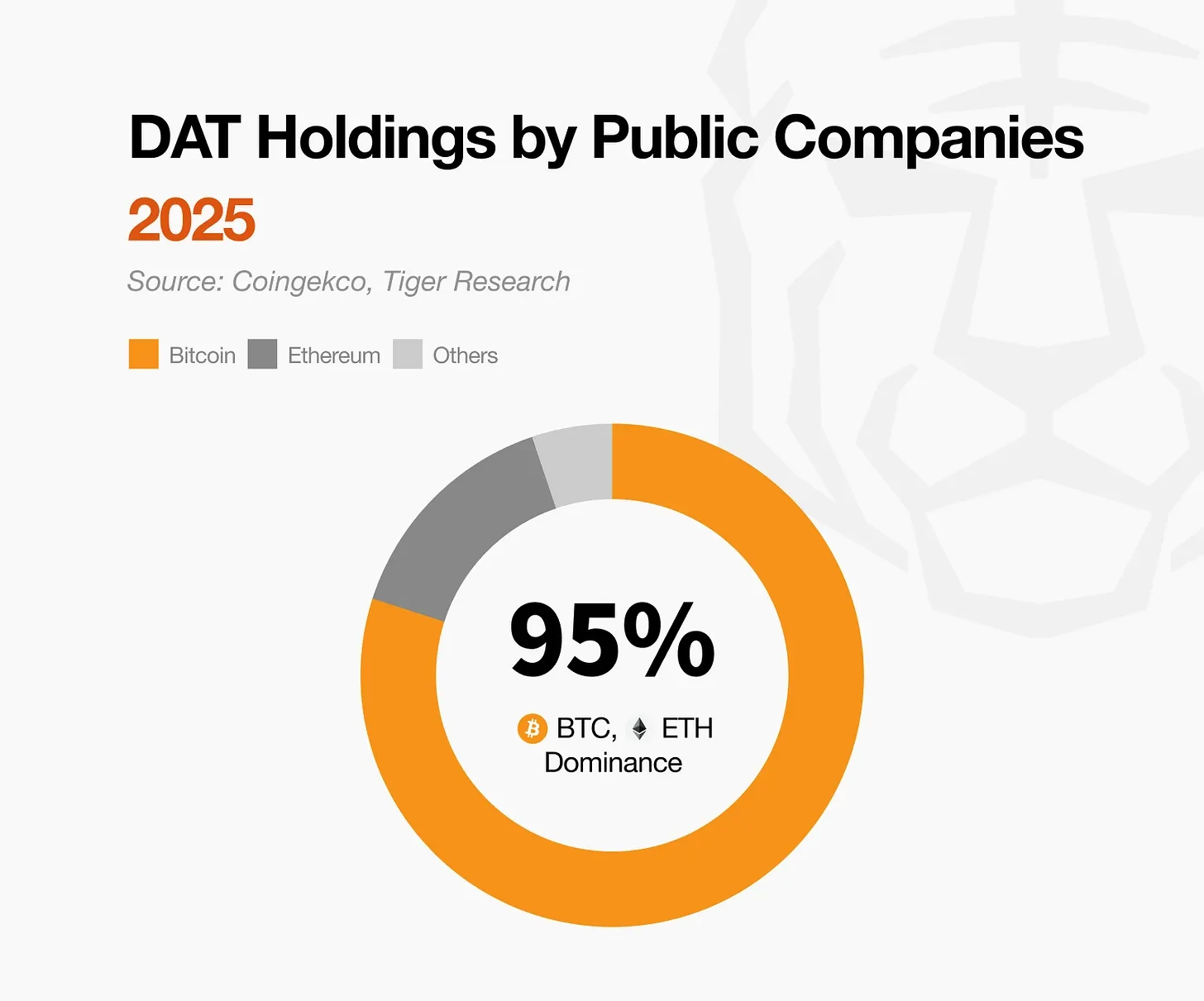

1. Institutional capital continues to stay in Bitcoin

Source: Tiger Research

As institutions dominate the market, capital flows have become more cautious. These investors avoid unverified assets, limiting their scope to Bitcoin and Ethereum. This trend is likely to continue. Market growth will only focus on assets that meet institutional standards.

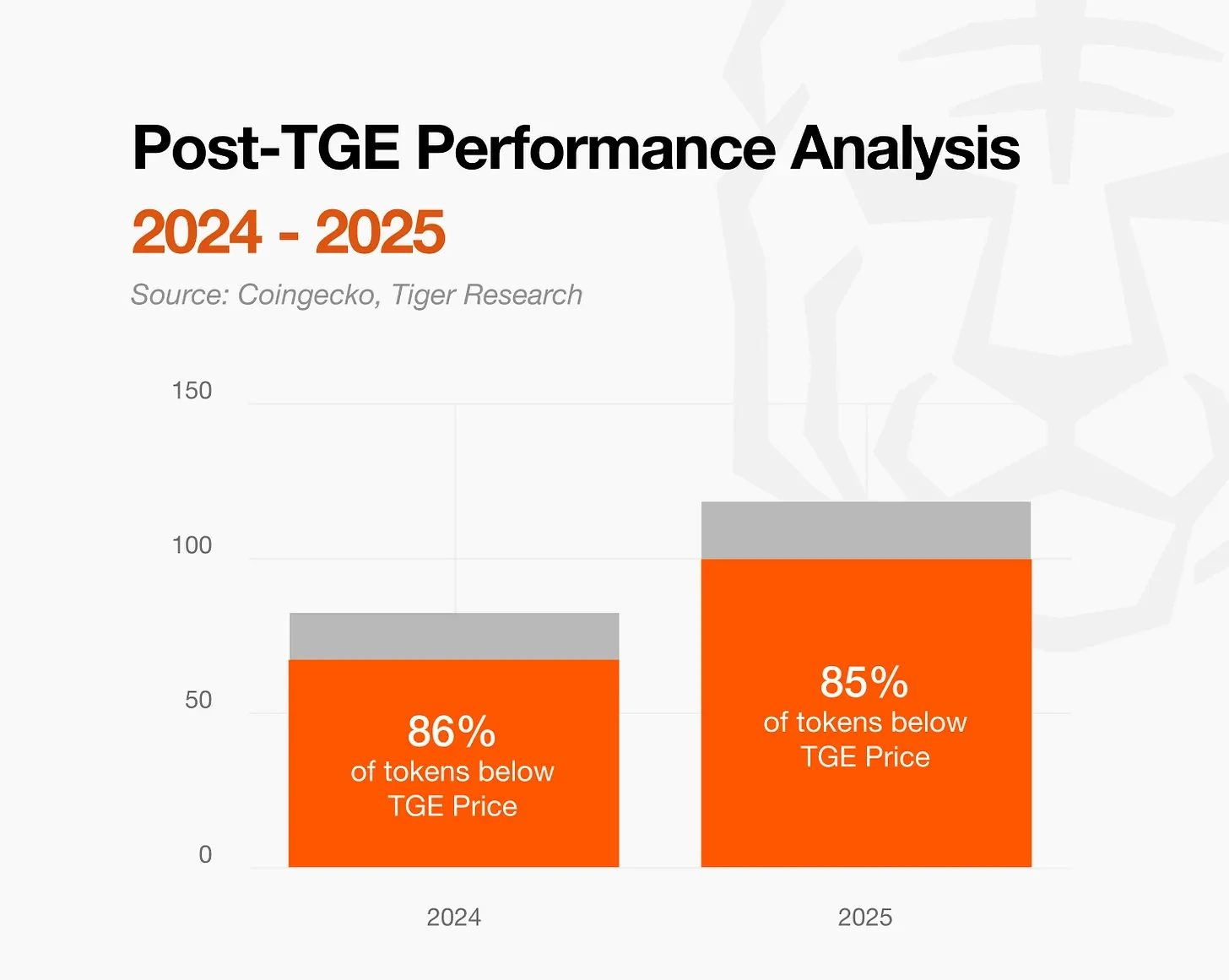

2. Non-profitable projects face market elimination

Source: Tiger Research

85% of new tokens drop in price after TGE, exposing the limitations of narrative-driven growth. Speculative projects will be replaced by new trends at an increasingly rapid pace. The market will shift towards projects that generate real returns and demonstrate robust fundamentals.

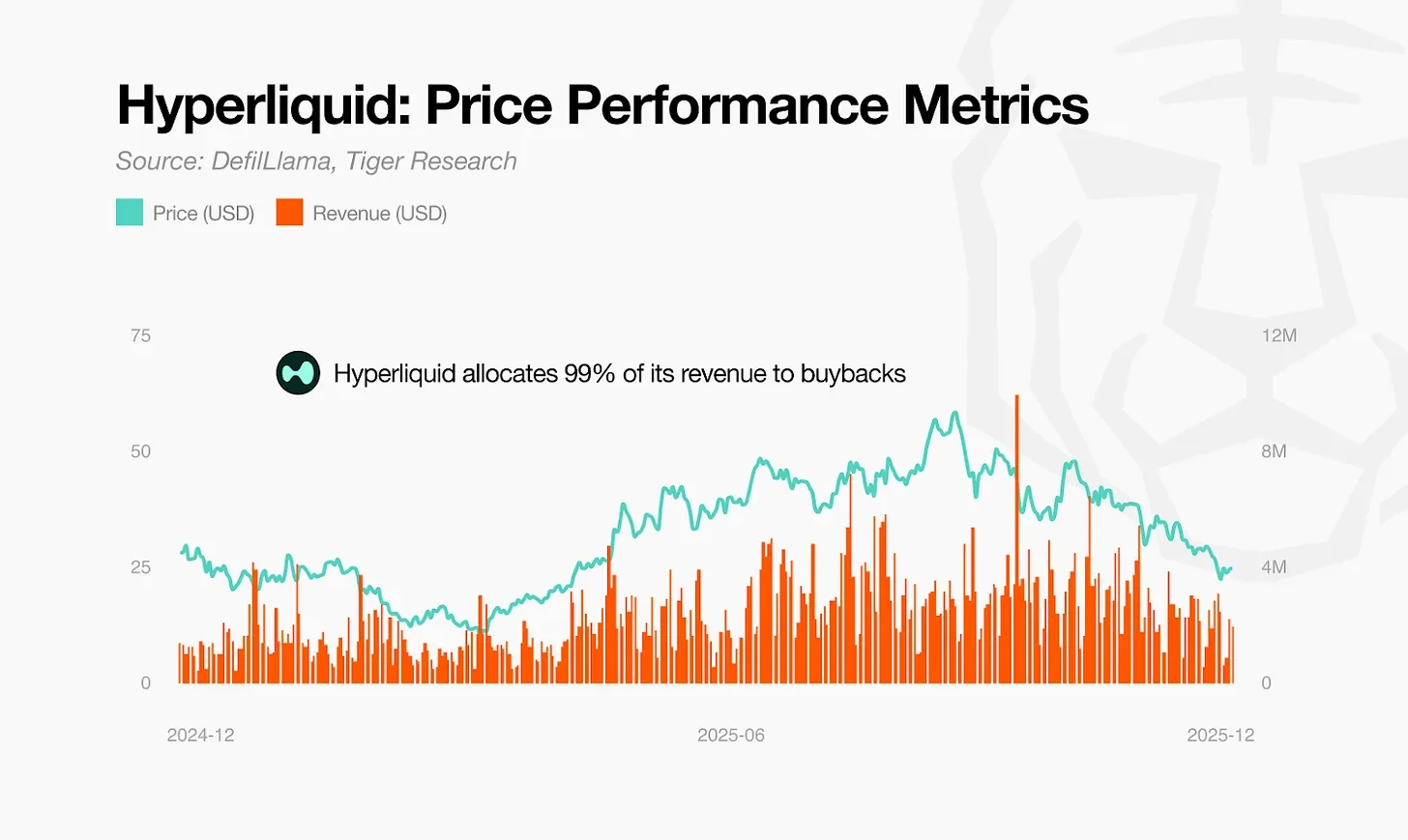

3. Utility fails, buybacks are the only answer

Source: Tiger Research

Utility-focused token economics have failed. Governance voting rights have failed to attract investors. Complex structures are unsustainable. The market now demands clear value returns. Models that achieve direct returns through buybacks and burns will survive. Structures where protocol growth directly impacts token prices will also endure. New innovative models will emerge from this shift.

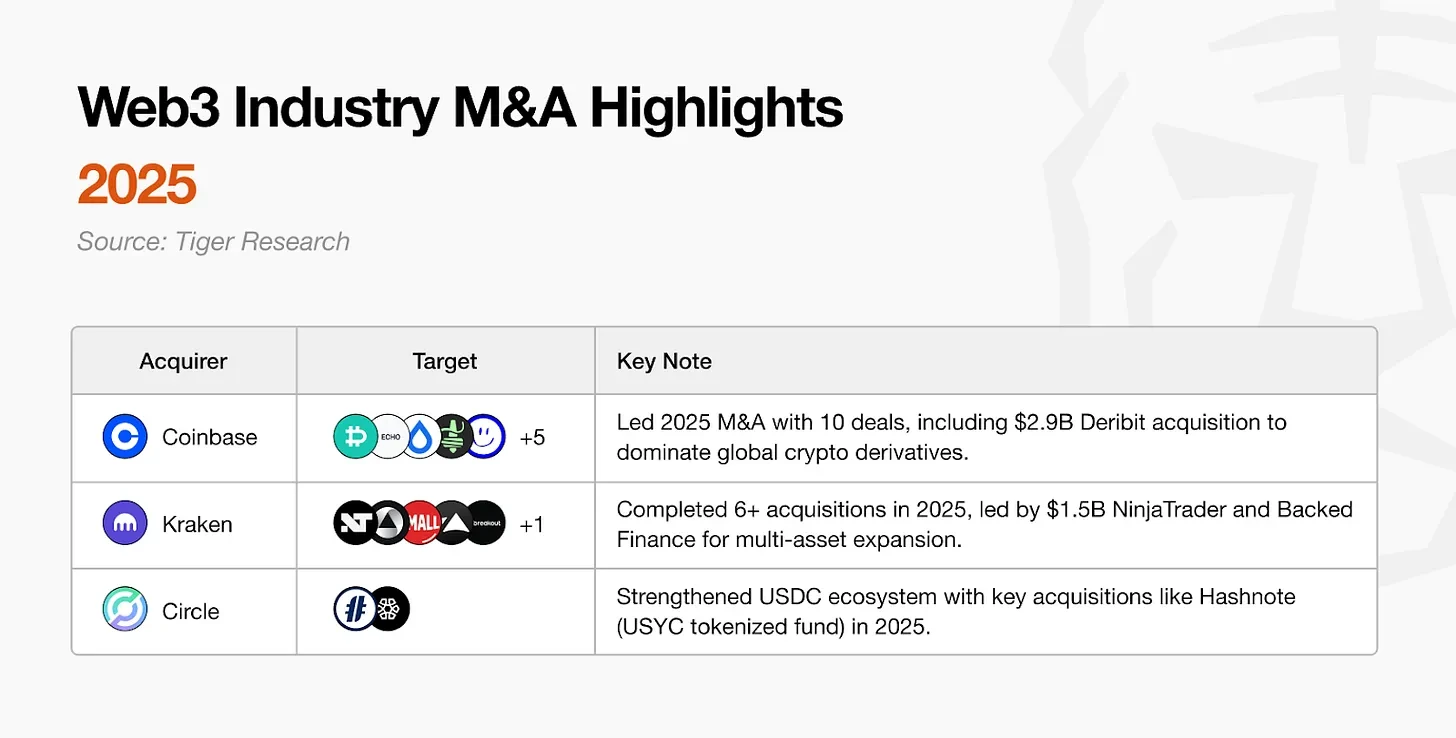

4. Increased M&A opportunities between projects

Source: Tiger Research

Web3 is maturing. Competition for market dominance is intensifying. Mergers and acquisitions are now the fastest way for companies to scale and enhance competitiveness. Winners will drive aggressive M&A activity. The market will be reshaped by those who create real profits.

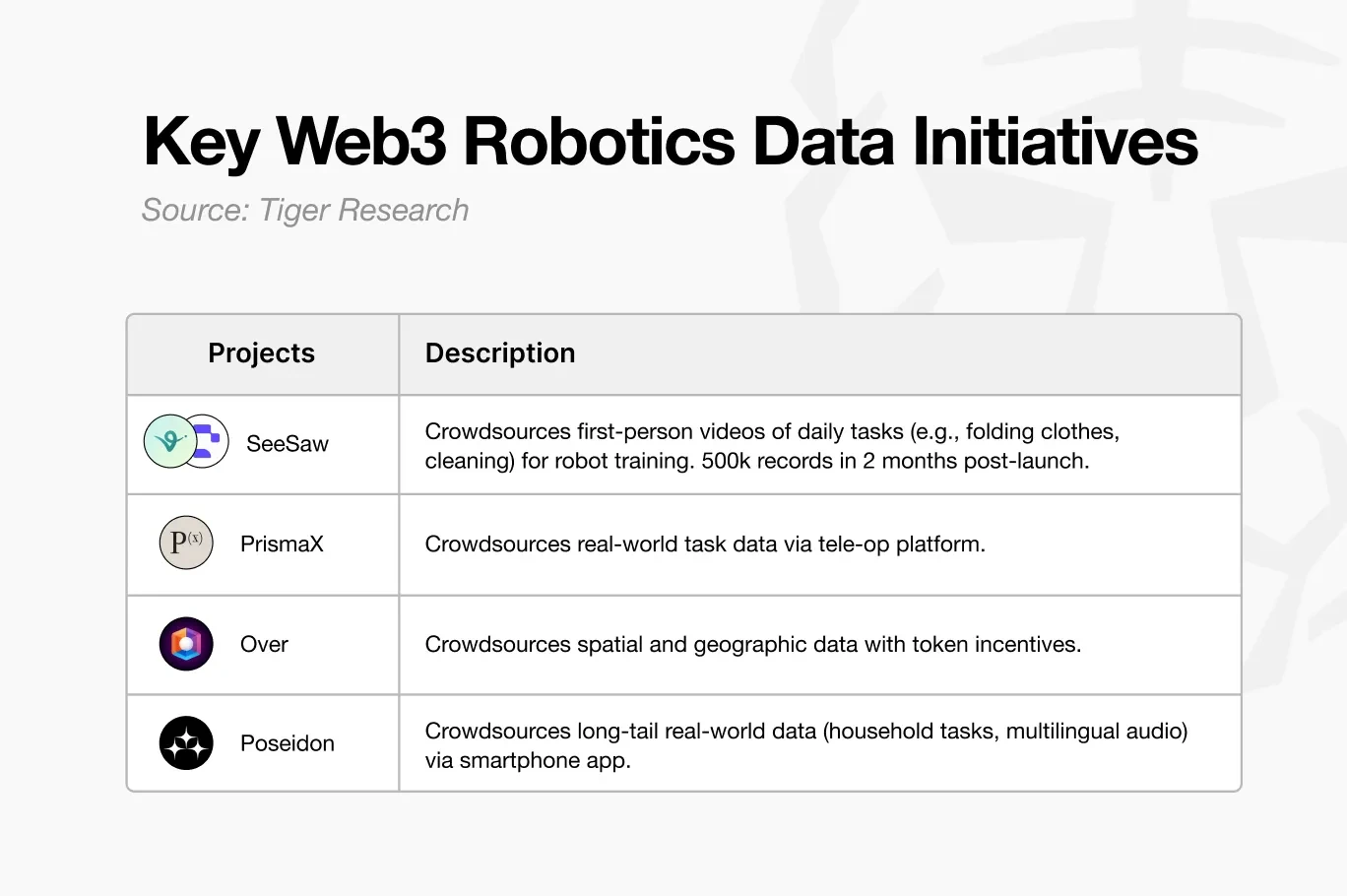

5. Robotics and cryptocurrency will usher in a new gig economy era

Source: figure.ai

The robotics industry is growing. Real-world data for training robots is becoming crucial. Traditional centralized methods cannot efficiently collect massive amounts of data. Blockchain-based decentralized crowdsourcing solves this problem. It collects vast amounts of data from individuals worldwide and provides transparent, instant rewards. A new gig economy centered around robotics will emerge.

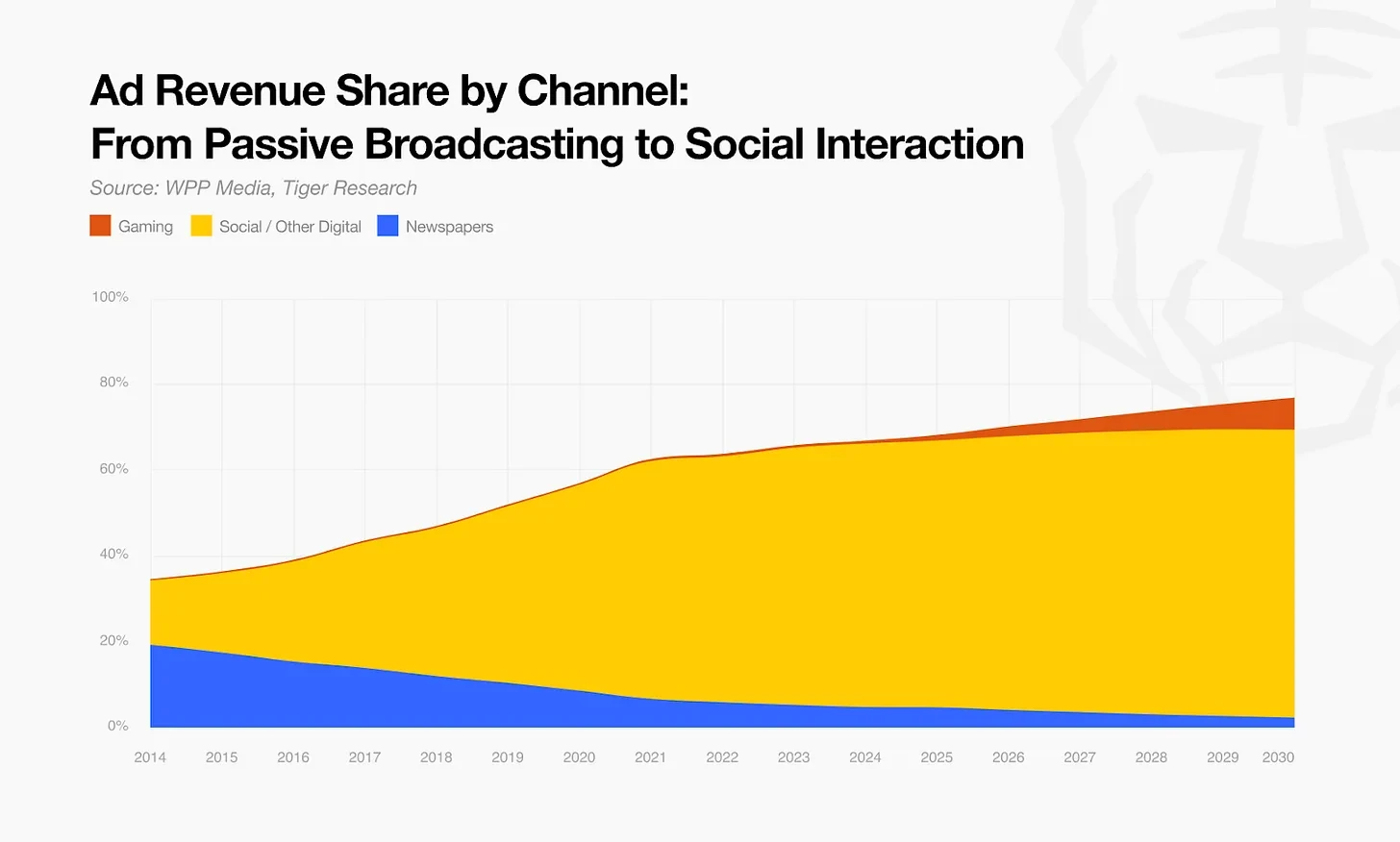

6. Media companies adopt prediction markets

Source: Tiger Research

Source: Tiger Research

As traditional revenue models reach their limits, media companies will adopt prediction markets as a survival strategy. Readers will shift from passive consumption to active participation, betting capital on news outcomes. This shift will optimize revenue structures while driving deeper audience engagement.

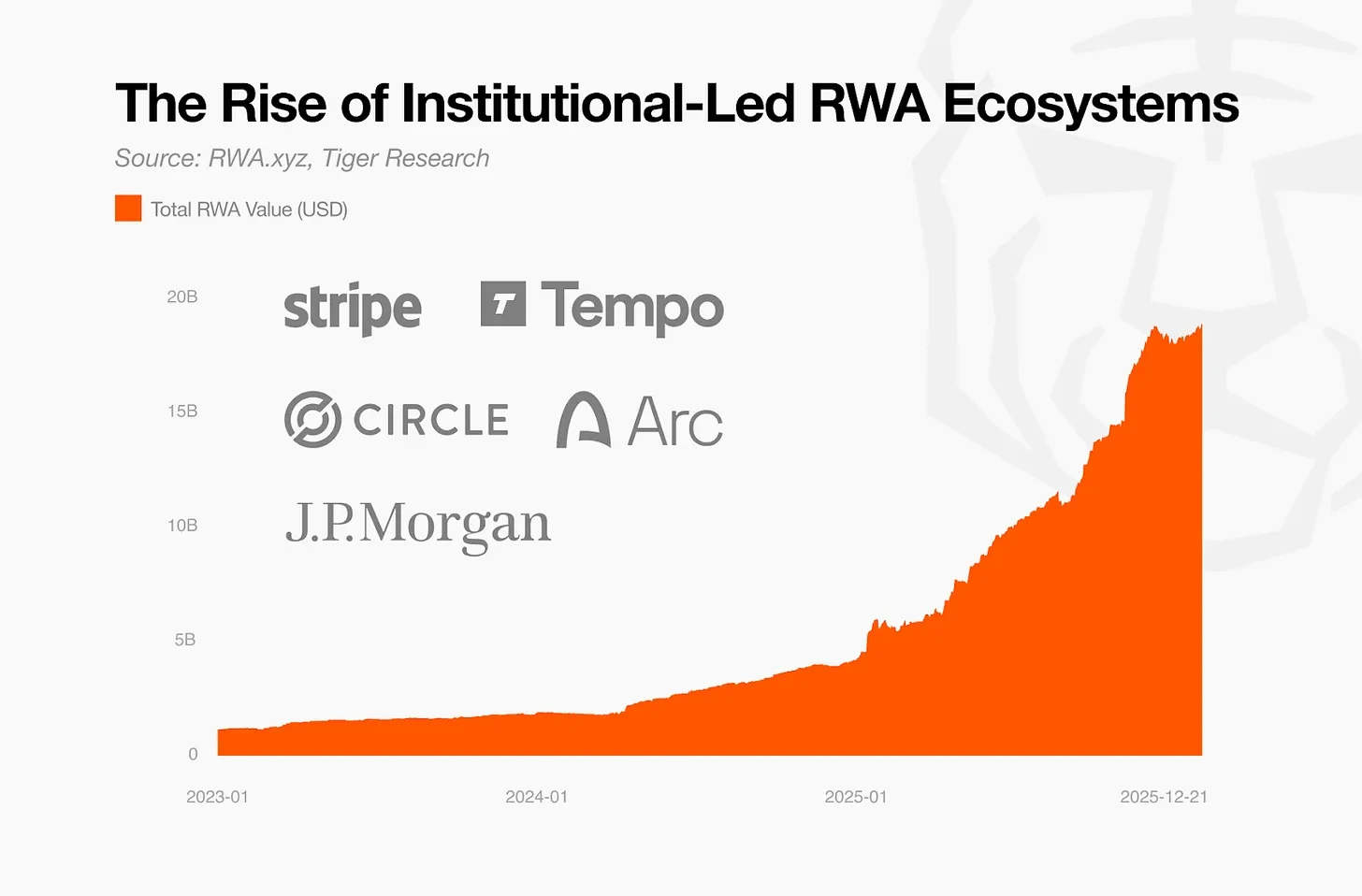

7. Traditional finance dominates RWA through self-built chains

Source: Tiger Research

Traditional financial institutions are the main suppliers in the RWA market. Given the demand for asset control and security, the benefits of using third-party platforms are minimal. These companies are likely to build their own chains to maintain market leadership. RWA projects lacking independent asset supply will lose competitive advantage and face elimination.

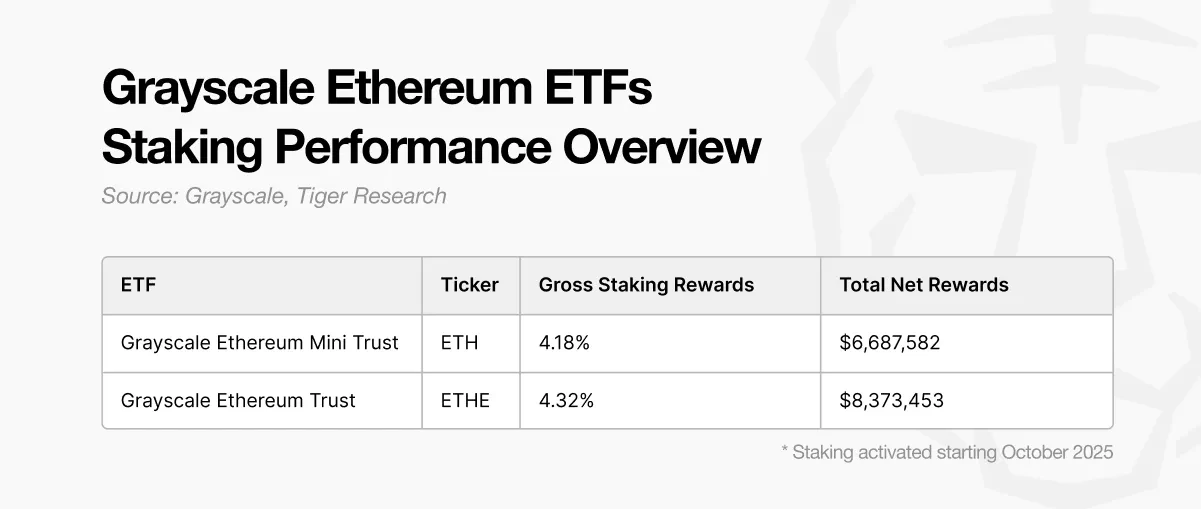

8. ETH staking ETFs will drive BTCFi growth

Source: Tiger Research

The launch of Ethereum staking ETFs will prompt Bitcoin ETF holders to seek returns. BTCFi fills this gap. As large funds flow into Bitcoin, the demand for asset utility will rise. This pursuit of returns will drive the next wave of growth for BTCFi.

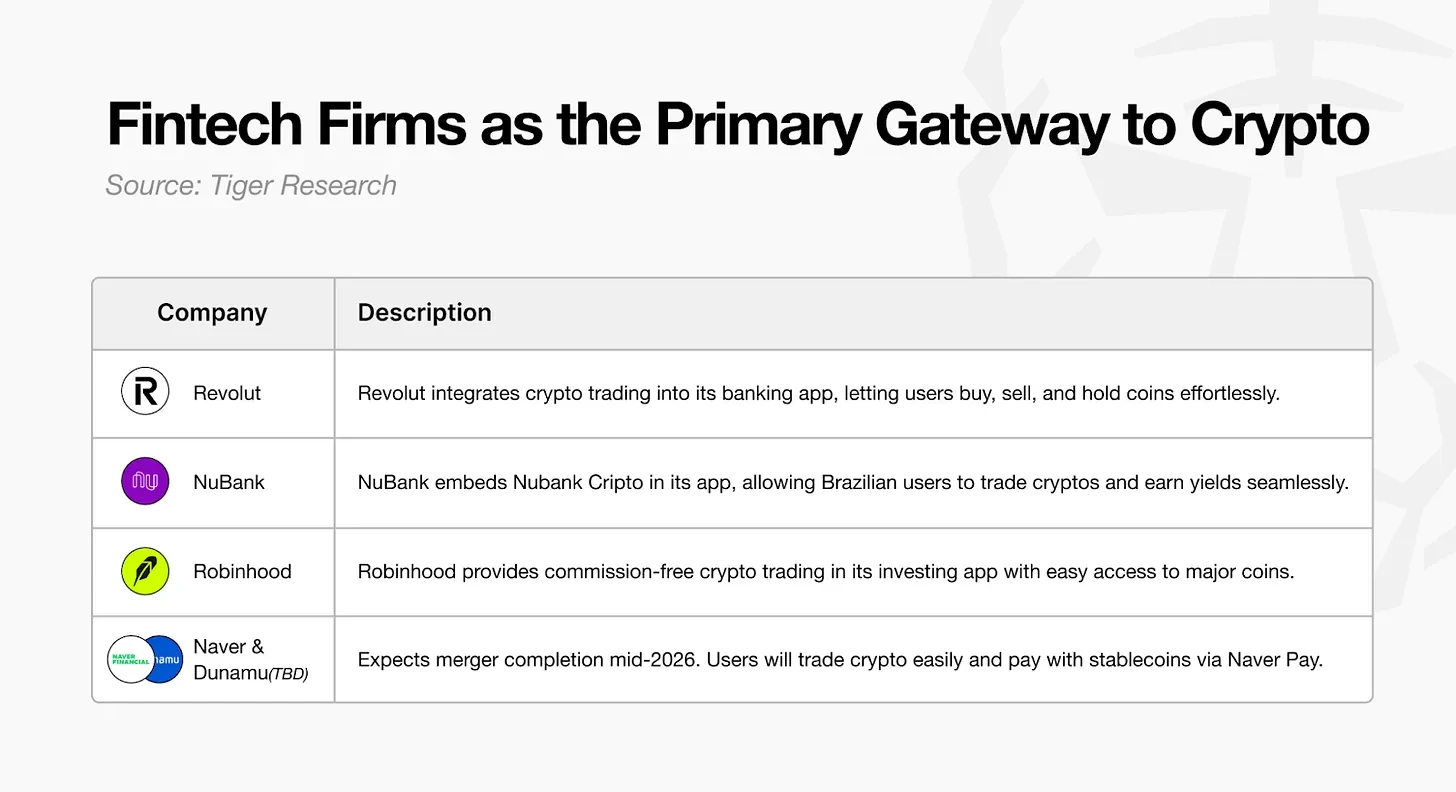

9. Fintech will surpass exchanges as the main funding channel

Source: Tiger Research

As regulations become clearer, fintech applications have become the preferred choice for cryptocurrency trading. New users no longer need to use cryptocurrency exchanges. They can buy and sell directly within the applications they use daily. The next wave of growth will be led by these fintech tools.

10. Privacy technology becomes core institutional infrastructure

Source: Tiger Research

On-chain transparency exposes trading plans. This is a vulnerability for large institutions. High-net-worth participants must conceal their movements to ensure security. Privacy technology is a key tool for these institutions to enter the market. Only with secure trading data will large capital flow in.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。