As gold prices approach $4,550 per ounce and silver surges over 10% in a single day to set a record, the financial markets in the last week of 2025 kick off amidst a blend of historical highs and holiday quietness.

The New Year's holiday will lead to early market closures or all-day market closures in several markets, and global financial market trading liquidity is expected to be significantly lower than normal levels. In this low liquidity environment, the few events that will still be released—especially the minutes from the Federal Reserve's December monetary policy meeting—may have an amplified market impact.

Against the backdrop of a rare "three-way divergence" in the monetary policies of major global central banks, whether precious metals like gold can continue their epic year-end rally has become the core suspense of the market this week.

1. Macroeconomic Environment

● The current global macroeconomic landscape is at a crossroads of increasing policy divergence. In mid-December, major global central banks made markedly different decisions: the Federal Reserve and the Bank of England chose to cut interest rates, while the Bank of Japan raised rates against the trend, and the European Central Bank, Reserve Bank of Australia, and most other central banks opted to stand pat.

● This divergence reflects significant misalignment in the economic cycles of various countries: the U.S. and the U.K. face slowing economic growth and pressure in the job market; Japan is at a critical juncture in escaping long-term deflation; the Eurozone maintains a fragile balance of "weak growth + slow inflation."

● For the market, this divergence means that strategies that previously relied on a single central bank's guidance have become ineffective. Investors need to construct a multidimensional analytical framework that considers economic growth resilience, inflation stickiness, and policy credibility.

2. Key Events of the Week

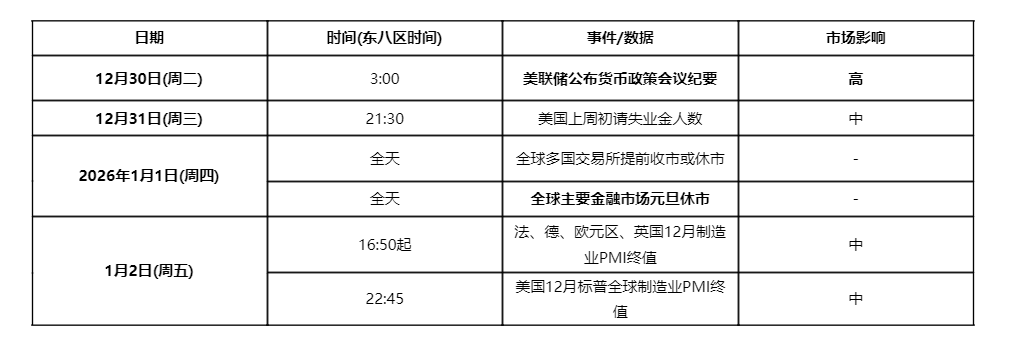

From December 29, 2025, to January 4, 2026, market attention will focus on key data from China and the U.S. as well as central bank dynamics, but overall, the event density is low due to the New Year's holiday.

Here is an overview of the core financial events for next week:

3. Federal Reserve Minutes: Recalibrating the Rate Cut Path

At 3 AM on Wednesday (December 31) in the UTC+8 time zone, the Federal Reserve will release the minutes from the December monetary policy meeting, which is the most important market event of next week.

● In the December meeting, the Federal Reserve lowered the federal funds rate by 25 basis points, marking its third consecutive rate cut. However, this decision explicitly identified "increased downside risks to the labor market" as a core basis for the policy shift for the first time.

Market attention on these minutes will focus on several aspects:

● The voting results of the December rate decision revealed significant internal disagreement within the Federal Reserve: 9 members supported a 25 basis point cut, 1 member advocated for a more aggressive 50 basis point cut, while 2 members preferred to keep rates unchanged.

● The minutes may reveal that the committee has not reached a consensus on whether the current main risk is a growth slowdown or a rebound in inflation.

● According to the dot plot released by the Federal Reserve, its forecast for 2026 is only another 25 basis point cut, which is less than the futures market's expectations, indicating that policymakers are highly cautious about the path of inflation decline.

● Some analysts suggest that the content of the December minutes may lean hawkish, reiterating the Federal Reserve's stance to slow the pace of rate cuts and indicating that inflation expectations face upward risks due to trade policies. This could strengthen market expectations for a reduction in rate cut expectations.

4. Precious Metals: A Crossroad After the Surge

● The precious metals market is at a delicate crossroad. Last week, the prices of gold, silver, and platinum soared to historical highs. Spot gold reached nearly $4,550 per ounce, while silver surged over 10% in a single day.

● In terms of driving factors, in addition to the traditional safe-haven sentiment and expectations of rate cuts, the divergence in global monetary policies is also having an impact. The relative interest rate differentials among major currencies like the dollar, euro, and yen are redefining risk premiums, prompting investors to adjust their asset allocations.

However, there are significant differences in institutional views regarding future trends:

● Goldman Sachs' commodity strategist stated that if private investors diversify alongside central banks, gold prices are likely to exceed the basic expectation of $4,900 per ounce. They expect gold prices to retreat to around $4,200 in the first quarter of 2026 but then continue to rise.

● Analysts at Heraeus warned in their outlook report that silver and other precious metal prices may trend downward at least in the first half of 2026. They believe that while prices may continue to rise in the short term, once the upward momentum weakens, a consolidation period is likely to follow.

● Analysts at BMO Capital Markets also expressed similar caution, noting that high prices are suppressing silver demand across many industries. They expect the average silver price in the fourth quarter of 2026 to be around $60 per ounce, with an annual average of $56.3.

5. Global Markets: Seeking Direction Amid Divergence and Holidays

● The U.S. stock market faces multiple tests at the end of the year. The overall performance of U.S. stocks in 2025 has been impressive, but the "Christmas rally" that investors anticipated faces uncertainty before the year ends. Since December, the S&P 500 index has actually seen a slight decline.

● Recently, the market has been oscillating between concerns over AI investments and changes in the Federal Reserve's rate cut path, adding uncertainty to the year-end market. In particular, whether the massive capital expenditures by companies on AI infrastructure will yield reasonable returns has become a focal point for the market.

● Notably, industries that have underperformed this year, such as transportation, finance, and small-cap stocks, have shown stronger performance since December, helping to stabilize the overall market. This rotation of funds indicates that the market is searching for new growth points.

As traders gradually leave for holiday breaks, the candlestick charts for gold and silver appear particularly steep in the thin trading; the hawkish hints from the Federal Reserve minutes and the market's desire for easing are engaged in a silent tug-of-war in a low liquidity environment.

The divergence in global monetary policies is not a short-term phenomenon but an inevitable reflection of structural differences in the global economy. This divergence is expected to continue or even deepen in 2026, marking the entry of the global macro environment into a more complex new phase.

Join our community to discuss and grow stronger together!

Official Telegram community: https://t.me/aicoincn

AiCoin Chinese Twitter: https://x.com/AiCoinzh

OKX benefits group: https://aicoin.com/link/chat?cid=l61eM4owQ

Binance benefits group: https://aicoin.com/link/chat?cid=ynr7d1P6Z

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。