Introduction

The year 2025 was dramatic for the cryptocurrency market: at the beginning of the year, driven by a warming macro environment and favorable policies, the prices of Bitcoin and Ethereum soared to new historical highs, with institutional funds rushing in, and the wave of Digital Asset Treasury (DAT) companies sweeping the capital markets. However, after a summer of exuberance, market sentiment took a sharp downturn, and the "10·11 Panic Night" in early October triggered a deleveraging stampede, causing Bitcoin prices to plummet, while altcoins faced a "Waterloo" style crash, resulting in a rollercoaster trend of "first rising and then falling" throughout the year.

This article will conduct an in-depth review of the 2025 cryptocurrency market from multiple perspectives, including the macro environment, policy regulation, institutional participation, market trends, sector hotspots, and on-chain data. Based on this, it will also look ahead to the development trends and investment opportunities for 2026. The article aims to outline the key events and data of 2025, distill the inherent logic of market evolution, and provide investors with forward-looking insights for the coming year.

I. Macro Shift and Favorable Policies: The "Tailwind" for the Cryptocurrency Market

1. Global Macro Environment Warming

The global economic environment improved in 2025, with easing inflation pressures prompting major central banks to shift their monetary policy stance towards easing. The Federal Reserve ended a two-year rate hike cycle in the first half of the year and initiated a rate cut cycle before the end of the year, officially concluding its quantitative tightening (QT) plan on December 1, 2025.

The expectation of lower borrowing costs enhanced market preference for risk assets, leading to a bull market in U.S. stocks driven by the AI boom in 2025, with technology stocks leading the charge and the S&P 500 index reaching new highs. However, the strength of the U.S. stock market also diverted some attention and funds away from cryptocurrency assets, resulting in the overall performance of the cryptocurrency market lagging behind that of U.S. stocks in 2025.

In the commodities sector, as the U.S. dollar weakened and geopolitical risks rose, gold prices steadily climbed, continuously reaching historical highs due to safe-haven demand; meanwhile, prices of commodities like oil rose moderately due to a global demand recovery.

Overall, the macro environment was relatively friendly to the cryptocurrency market in the first three quarters of 2025, with a weaker dollar and peak interest rates providing a favorable backdrop and ample liquidity for risk assets. However, in the fourth quarter, global market volatility intensified, and soaring U.S. Treasury yields triggered a return of risk-averse sentiment, impacting high-beta cryptocurrency assets.

2. U.S. Regulatory Easing

With the conclusion of the U.S. presidential election at the end of 2024, pro-crypto Trump returned to the White House and quickly fulfilled his campaign promises upon taking office in January 2025, releasing unprecedentedly friendly policy signals for the cryptocurrency industry and accelerating the "regulatory reversal": the passage of the "GENIUS Act" stablecoin bill provided a clear framework for the reserve regulation and compliance operation of U.S. dollar stablecoins; at the same time, bipartisan lawmakers collaborated to advance a new digital asset market structure bill, clearly delineating the regulatory boundaries between security tokens and commodity tokens, and legitimizing the legal status of mainstream cryptocurrencies like Bitcoin and Ethereum. These measures marked a shift in the U.S. regulatory attitude from previous high-pressure crackdowns to a more rational and inclusive approach, injecting a strong dose of confidence into the cryptocurrency market.

On the enforcement side, the SEC and CFTC also adjusted their strategies, placing greater emphasis on collaboration with the industry and providing clear guidance, supporting innovative development while protecting consumers and financial stability. For example, the CFTC adopted an open attitude towards prediction markets, viewing them as derivative contracts based on real events and allowing compliant platforms to offer such trading.

The significant improvement in the U.S. regulatory environment not only boosted domestic market confidence but also had a demonstration effect on other jurisdictions worldwide. Europe officially implemented the MiCA framework in 2025, establishing unified regulatory standards covering issuance, trading, custody, and more; Hong Kong launched a comprehensive virtual asset exchange licensing system and drafted stablecoin regulatory regulations, aiming to create a cryptocurrency financial center in the Asia-Pacific region; while regions like the Middle East and Singapore further optimized tax and compliance policies to attract cryptocurrency entrepreneurship and capital accumulation. In contrast, mainland China maintained a strict regulatory stance on cryptocurrency trading, even reiterating its crackdown on cryptocurrency speculation at the end of 2025, highlighting the policy divergence among countries.

Overall, the global cryptocurrency regulatory environment in 2025 improved significantly compared to previous years, with the easing of U.S. policies allowing compliant funds to enter the market on a large scale and prompting other countries to explore regulatory frameworks that adapt to the new asset class, creating a "competitive cooperation" dynamic. This series of favorable policies laid the foundation for the prosperity of the cryptocurrency market in the first half of 2025.

3. Traditional Finance Embraces Cryptocurrency

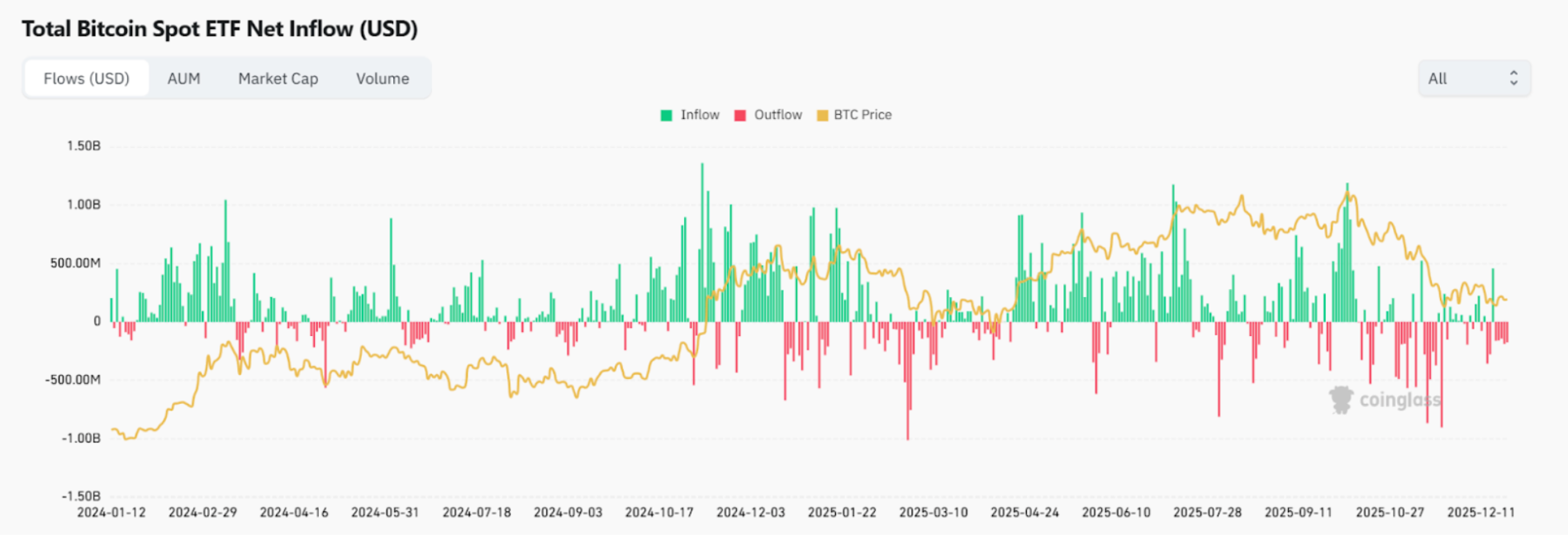

As policies broke the ice, traditional financial institutions embraced cryptocurrency assets on a large scale in 2025, further pushing the industry towards mainstream acceptance. First, the large-scale launch of spot Bitcoin ETFs occurred. Following the approval of the first Bitcoin spot ETF in the U.S. at the end of 2024, 2025 saw a massive influx of funds. By December 25, 2025, the total assets under management (AUM) of U.S. Bitcoin spot ETFs reached approximately $117.3 billion, holding over 1.21 million Bitcoins, accounting for about 6.13% of the total Bitcoin supply. The AUM of Ethereum ETFs was approximately $17.1 billion, about one-tenth of that of Bitcoin ETFs. In the second half of 2025, an "Altcoin ETF boom" emerged, with various mainstream altcoin ETFs receiving approval and listing for trading, including Ripple (XRP), Solana (SOL), Litecoin (LTC), Dogecoin (DOGE), Hedera (HBAR), and Chainlink (LINK).

Source: https://www.coinglass.com/bitcoin-etf

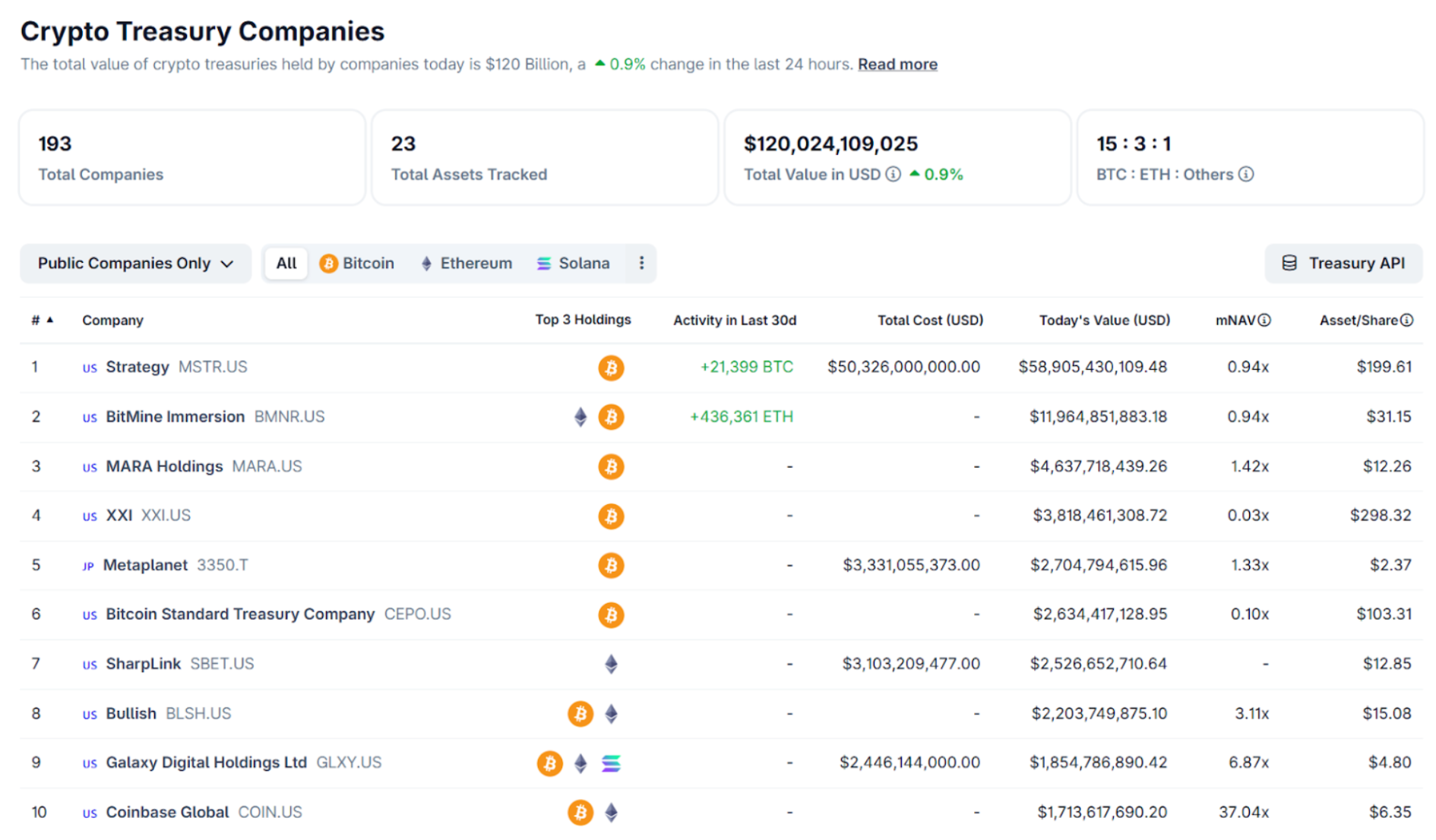

Benefiting from accounting standard reforms (allowing cryptocurrency assets to be measured at fair value) and a shift in venture capital preferences, a large number of small and mid-cap listed companies announced plans to follow MicroStrategy by allocating part of their cash reserves into Bitcoin, Ethereum, and other cryptocurrency assets, transforming into "Digital Asset Treasury (DAT) companies." According to CoinGecko data, a total of 193 listed companies have announced cryptocurrency treasury plans, raising over $120 billion for the purchase of BTC, ETH, SOL, BNB, and other cryptocurrency assets. Many traditional industry companies attempted to share in the cryptocurrency bull market's dividends through this move, with their stock prices soaring several times due to news of their holdings.

Source: https://www.coingecko.com/en/treasuries/companies

In terms of institutional investors, traditional hedge funds and sovereign wealth funds also showed increased interest in cryptocurrency: products like Grayscale Trust continued to see incremental buying in the secondary market, and some sovereign wealth funds from the Middle East and Asia were reported to have quietly increased their Bitcoin holdings during the fourth quarter amid the sharp decline in prices, positioning for long-term investments. Additionally, the U.S. Department of Labor relaxed restrictions on retirement plans investing in digital assets in 2025, allowing 401(k) and other pension plans to allocate a small percentage to approved cryptocurrency funds or ETFs, opening the door for potentially trillions of dollars in retirement funds to flow into the cryptocurrency market in the future.

In 2025, several traditional financial institutions attempted to introduce stock trading on the blockchain, marking the dawn of on-chain stock trading. Nasdaq and others established pilot programs to issue shares of some listed companies in token form on permissioned chains, with xStocks, Ondo, and others launching tokenized stocks and integrating them with mainstream trading platforms. This indicates that the integration of traditional securities markets and cryptocurrency technology is accelerating, and in the future, digital assets are expected to not only represent emerging tokens but also encompass the on-chain forms of traditional assets.

It can be said that in 2025, traditional finance fully embraced cryptocurrency assets across regulatory, product, and capital levels, with cryptocurrency rapidly integrating into mainstream investment portfolios, and the "liquidity handshake between Wall Street and the cryptocurrency market" has already begun.

II. Market Review: A Rollercoaster of Bull and Bear Transitions

1. Overall Market Characteristics: Big Ups and Downs

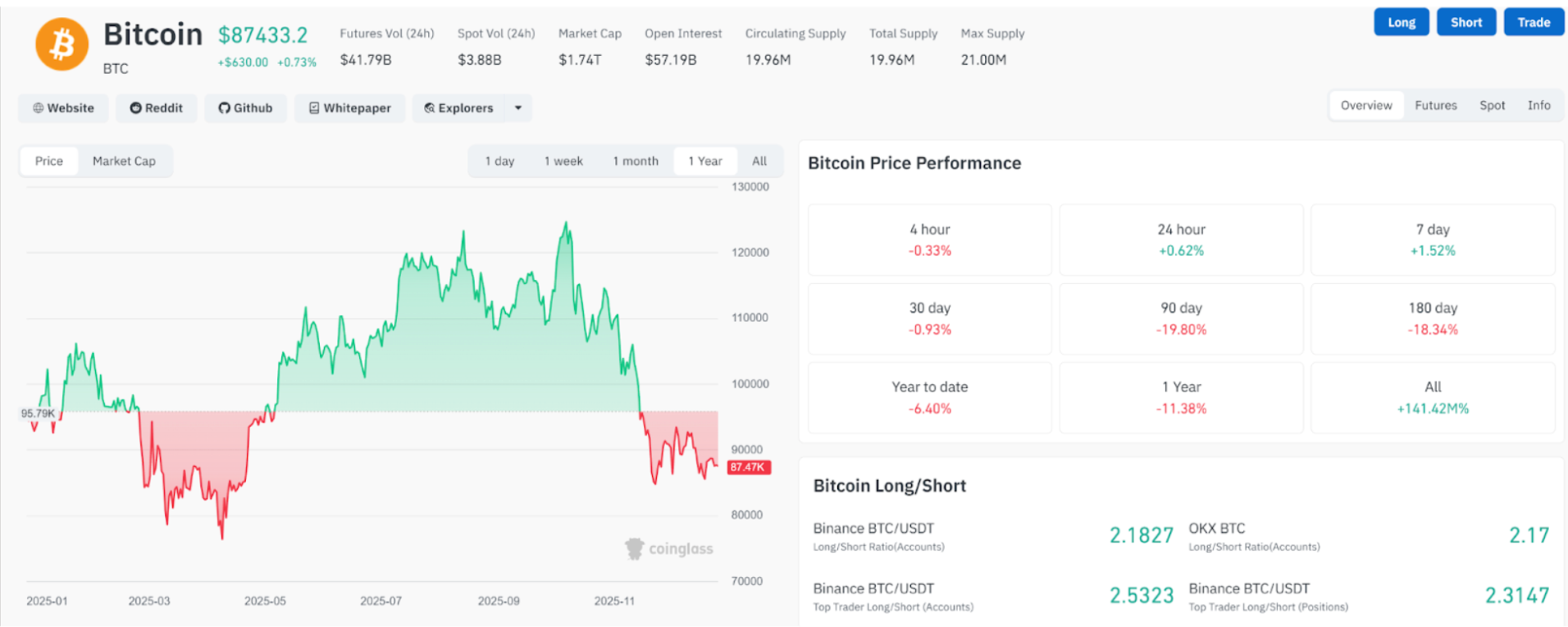

In 2025, the cryptocurrency market experienced a "rollercoaster" trend of significant ups and downs: at the beginning of the year, the strong upward momentum from the end of 2024 continued, with mainstream coins like Bitcoin and Ethereum climbing steadily, reaching historical highs around the third quarter. However, in the fourth quarter, the market rapidly declined under the pressure of leverage and panic sentiment, resulting in an overall trend of "highs followed by lows" for the year.

Source: https://www.coinglass.com/currencies/BTC

After Bitcoin broke through the $100,000 mark at the end of 2024, it continued to surge in inertia. In January 2025, MicroStrategy announced another significant purchase of BTC, pushing the price close to $107,000. Following this, the market entered a brief consolidation period, with BTC prices slightly retracing in February and March but remaining above $80,000, setting the stage for the next round of increases. As favorable regulatory news from the U.S. emerged, ETF funds continued to flow in, and news of the Trump administration's intention to position Bitcoin as a strategic reserve asset gained traction, Bitcoin regained its upward momentum in the second quarter. Bitcoin rose from around $95,000 at the beginning of the year to about $120,000 by early third quarter, marking an increase of nearly 7-8 times from the bear market bottom of approximately $16,000 in 2022. Unlike previous bull markets, this round of increases was relatively steady, without the irrational frenzy of vertical surges, with new funds primarily concentrated in BTC and a few leading assets.

Just as many investors believed the market would continue to rise towards the end of 2025 in line with the "four-year cycle," a sharp turning point occurred. In early October, Bitcoin surged to an all-time high of around $126,000 without any obvious negative news. However, on October 11, market liquidity suddenly reversed, with multiple trading platforms experiencing unusually large sell orders almost simultaneously, triggering a chain reaction. Bitcoin's price broke through the psychological barriers of $120k, $100k, and $90k within days, dropping to around $80,000, a nearly 37% decline from its peak. Mainstream coins like Ethereum also plummeted, with ETH prices falling from around $5,000 to about $3,000. Smaller market cap tokens fared even worse, with statistics showing that the vast majority of altcoins fell between 80% to 99% from their yearly highs, with many small tokens nearly reaching zero. This tragedy, comparable to the "5·19 crash" in 2021 and the "3·12 crash" in 2020, was referred to in the industry as "10·11 Panic Night," marking the abrupt end of the bull market.

After the crash, the market entered a prolonged recovery period. In mid-November, Bitcoin briefly dipped close to $80,000, then gradually stabilized and rebounded. By the end of December, BTC prices returned to around $90,000. Ethereum hovered just above $3,000 at year-end, not far from its level at the beginning of the year. Altcoins, however, were severely wounded: many second and third-tier coins saw declines exceeding 50% for the year, and investor confidence plummeted. In contrast, traditional risk assets like U.S. stocks only experienced slight corrections during the same period, remaining close to their annual highs. This suggests that the deep pullback in the cryptocurrency market in 2025 was more a result of internal leverage bubble bursts rather than being entirely driven by a deteriorating macro environment.

2. On-Chain Ecosystem Performance

Behind the dramatic fluctuations in market prices, on-chain data more accurately reflects the changes in capital flows, user behavior, and ecosystem structure in 2025.

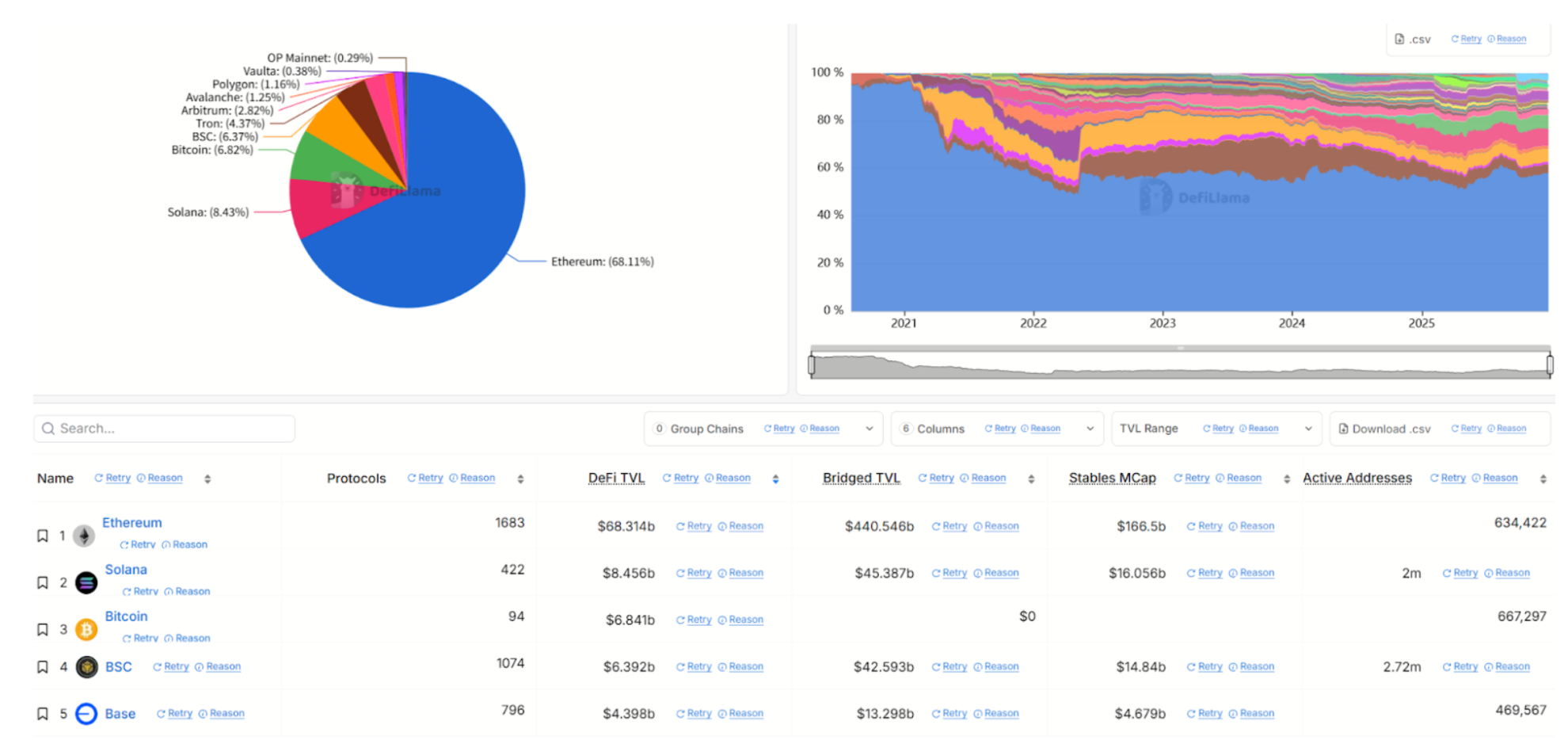

1) "Main Chain Division of Labor" Further Solidified: Ethereum continued to serve as the secure settlement layer and the largest liquidity base, while Solana, BNB Chain, and Base functioned more as "traffic chains" for high-frequency trading and consumer applications. From the perspective of DeFi Total Value Locked (TVL), Ethereum maintained its core asset status throughout the year, with its on-chain stablecoin scale still in an absolute leading position by the end of 2025.

Source: https://defillama.com/chains

2) Structural Migration of Trading Volume and User Activity: Solana frequently competed with Ethereum for the top spot in weekly metrics in 2025, even briefly leading at times. BNB Chain absorbed a large amount of spot and liquidity demand through leading applications like PancakeSwap, and in 2025, the on-chain fee structure experienced "unit fee compression," meaning transactions could be cheaper and more frequent. The rise of Base leaned more towards "productization": by year-end, its on-chain metrics exhibited typical characteristics of "high transaction counts + high active addresses," becoming one of the strongest new traffic entry points in the Ethereum ecosystem.

3) Shift in Fees/Revenue Dynamics: In 2025, on-chain transaction fees were not solely driven by L1/L2 itself; an increasing contribution came from the application side, with trading, wallets, and consumer applications pushing the narrative of on-chain from "infrastructure" to "cash flow." This is why, when Q4 risk events or macro tightening occurred, on-chain liquidity exhibited characteristics of "quick in and out."

4) Stablecoins and Yield Strategies as Ecosystem Adhesives: Ethereum remained the core battleground for stablecoins and yield products, with a noticeable expansion of yield-bearing stablecoins and strategy products in 2025: Ethena's USDe maintained a scale of several billion dollars by year-end, becoming one of the representative assets for "dollar-like yields" on-chain. Yield-splitting/market products like Pendle had accumulated billions in TVL by mid-2025, with numerous combination strategies revolving around yield-bearing stablecoins like sUSDe, accelerating the "deposit—yield—re-staking—recycling" cycle.

5) Staking and Lending as Major Vehicles for Large Funds: Lido on the Ethereum side and Jito on the Solana side jointly promoted the "financialization of staked assets." The lending sector leaned more towards "stablecoin and blue-chip collateral" efficiency competition: leading lending protocols continued to absorb collateral and borrowing demand, providing infrastructure for yield strategies and leveraged trading.

6) CEXs Entering On-Chain Trading: Taking Binance Alpha as an example, its core selling point is integrating on-chain discovery and trading within the exchange, reducing the barriers of wallets and gas fees. Bybit Alpha also clearly strengthened the "account-based on-chain trading" product path in 2025. Bitget emphasized a unified on-chain trading entry across multiple chains, further amplifying the hybrid model of "CEX responsible for users and risk control, on-chain responsible for assets and settlement." Such products significantly increase the speed of asset dissemination and trading frequency on-chain during bull markets, but during Q4's abrupt risk halt, they also lead to more concentrated and synchronized liquidity withdrawals.

3. Investor Sentiment and Capital Flows: A Tale of Two Extremes

In 2025, investor sentiment experienced a rollercoaster shift from extreme heat to extreme cold. In the first half of the year, retail investors returned to the market, and cryptocurrency social media became active again, with various narratives taking turns in the spotlight. From AI concepts to memes, hot topics emerged continuously. However, unlike in previous years, the lifespan of these narratives was noticeably shorter—topics that could sustain interest for months in the past were now often replaced by the next story within days.

After the October crash, market sentiment plummeted, with the greed index falling into deep fear territory, and by the end of 2025, Bitcoin's 30-day volatility had dropped to a low point in recent years. However, on-chain data showed that after the October crash, the number of large Bitcoin addresses (holding over 10,000 coins) began to rise, indicating that long-term funds, such as sovereign wealth funds, were accumulating at lower levels. It can be anticipated that the market in 2026 will be more rational and mature compared to 2025, with investment styles potentially shifting from chasing hot topics to long-term value allocation, creating a fertile ground for steady growth.

III. 2025 Cryptocurrency Industry Hotspots Review

Despite the significant price fluctuations in the market, the cryptocurrency sector in 2025 was not solely about rising and falling numbers. The year still saw many memorable technological breakthroughs, application innovations, and industry trends that laid the foundation for future development.

1. Institutionalization and Compliance: The Maturation of the Cryptocurrency Industry

Many viewed 2025 as the "coming of age" for the cryptocurrency industry, marking the transition from a retail-driven speculative phase to an infrastructure phase with institutional participation. By 2025, institutions had become the marginal price setters for cryptocurrency assets, with weekly inflows into U.S. spot Bitcoin ETFs exceeding $3.5 billion in the fourth quarter, far surpassing the net trading flows of retail investors during the same period.

The entry of institutions brought a dual impact: on one hand, long-term funds have a low risk appetite and trading frequency, leading to decreased market volatility and more effective pricing; on the other hand, these funds are highly sensitive to macro interest rates, causing the cryptocurrency market to become more closely tied to macro cycles, making prices more susceptible to pressure in environments of liquidity tightening.

Compliance gradually became a moat for cryptocurrency projects: platforms with licenses, robust risk control, and regulatory technology frameworks gained institutional trust, leading to rising trading volumes and market shares; conversely, non-compliant gray platforms were marginalized or even eliminated. For example, the compliant exchange Coinbase in the U.S. saw record highs in users and revenue, while a number of decentralized compliant financial infrastructures began to emerge, such as trustless custody solutions based on Ethereum.

2. Stablecoins: Bill Passage and Application Expansion

The U.S. stablecoin bill established that issuers of fiat-backed stablecoins must hold high-quality short-term assets as reserves and undergo regular audits. This measure enhanced the credibility of mainstream stablecoins like USDC and USDT and encouraged more traditional financial institutions to participate in the issuance or use of stablecoins.

The total on-chain trading volume of stablecoins reached $46 trillion, making it a "killer application" in the cryptocurrency space. At the same time, several risk events related to stablecoins occurred during the year, such as the high-yield algorithmic stablecoin XUSD collapsing to $0.18 due to excessive reliance on endogenous leverage, resulting in user losses of nearly $93 million and leaving $285 million in bad debts for the protocol. These incidents reminded the industry to approach complex stablecoin designs with caution.

However, overall, the position of fiat-backed stablecoins became more solidified. By the end of 2025, the circulating market value of U.S. dollar stablecoins continued to grow steadily, with new use cases emerging: businesses used stablecoins for cross-border trade settlements to avoid the high costs and delays of SWIFT; consumers used stablecoins for everyday shopping through third-party payments; residents in some high-inflation countries in Latin America and Africa treated U.S. dollar stablecoins as savings accounts. Forbes' outlook indicated that in 2026, stablecoins would be ubiquitous, further penetrating traditional financial transactions and corporate treasury management.

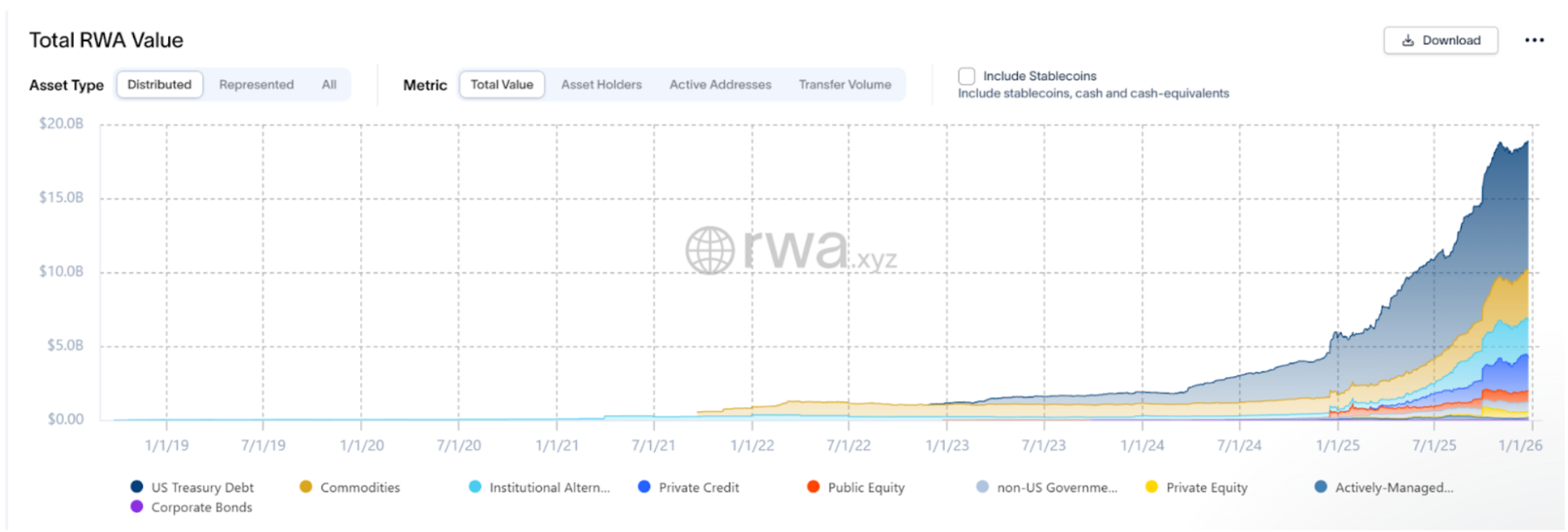

3. RWA: From Concept to Reality

2025 witnessed the tokenization of real-world assets (RWA) transitioning from conceptual hype to large-scale implementation, becoming an important component of the cryptocurrency capital market. As institutions sought to obtain traditional yields on-chain, government bonds, real estate, stocks, and other real assets were tokenized and brought onto the chain. According to statistics, by the end of 2025, the total market value of various RWA tokens exceeded $19 billion, with about half of that value coming from tokenized products related to U.S. government bonds and money market funds. BlackRock issued $500 million in tokenized U.S. government bonds (code: BUIDL) via blockchain. Meanwhile, established Wall Street institutions like JPMorgan and Goldman Sachs developed RWA infrastructure that transitioned from experimentation to production, with JPM's Onyx and Goldman Sachs' GS DAP platforms beginning to handle actual transactions, bringing corporate loans, accounts receivable, and other assets onto the chain.

Source: https://app.rwa.xyz/

Stablecoin issuers are also riding the wave of RWA: the companies behind USDT and USDC have begun to increase their holdings of short-term U.S. Treasury bonds as reserves to enhance transparency; the decentralized central bank MakerDAO has introduced on-chain commercial paper and government bonds into its DAI collateral pool, supporting the supply of stablecoins with real income. Stablecoins backed by government bonds have become vehicles for digital dollars. The biggest breakthrough for RWA in 2025 was the shift in investor mindset: people are no longer satisfied with purchasing synthetic tokens pegged to gold or stocks but are directly buying assets issued natively on-chain.

The popularity of RWA has also spawned dedicated platforms and protocols. A number of blockchain projects have emerged to serve the issuance, clearing, and trading of physical assets, with some focusing on real estate tokenization (selling property shares as small tokens), others on the tokenization of art and collectibles, and still others providing comprehensive compliance issuance and custody solutions. Oracles play a key role in RWA, as reliable data sources are needed on-chain to reflect the value of off-chain assets, driving collaboration between oracle networks and traditional data providers. The direct benefit of the RWA wave is the expansion of collateral options in DeFi: in the past, DeFi lending only accepted crypto assets, but now some protocols have begun to accept rigorously risk-controlled RWA tokens as collateral, such as government bond tokens being used to mint stablecoins or lend funds. This has bridged the capital markets on-chain and off-chain, granting DeFi greater stability.

4. AI × Blockchain: The Landing of the AI Economy

In 2025, the integration of AI and blockchain entered a phase of initial implementation from concept validation. Notably, the combination of autonomous intelligent agents (AI Agents) and the crypto economy gained attention. This year, we witnessed new paradigms such as AI-driven decentralized autonomous organizations, AI executing smart contract trades, and AI models participating in economic activities on the blockchain.

Driven by major companies like Coinbase, Google, and Salesforce, X402 quickly gained popularity, allowing AI to automatically pay for network resource access, achieving low-cost, second-level automatic payments that perfectly meet the needs of AI for high-frequency, small-value payments. Numerous startup projects have emerged around X402, such as AI model training data markets that allow models to autonomously purchase data; IoT devices using X402 for automatic payment of maintenance service fees, etc. X402 has opened the door to an autonomous AI economy, granting machine entities economic identities and autonomous trading capabilities.

Beyond payments, AI applications in blockchain governance and investment also made progress in 2025. AI governance DAOs began to appear: projects introduced AI decision assistants to help analyze proposals, detect contract vulnerabilities, and even automatically execute some operational decisions. AI trading agents attracted significant interest from quantitative investors. Some funds trained AI models to read on-chain sentiment indicators and macro data, automatically executing arbitrage and hedging strategies. Although AI trading still faces challenges related to opacity and regulation, its advantages in speed and big data analysis began to emerge.

The combination of AI and blockchain also gave rise to new token economic models. Some AI projects issued functional tokens, allowing holders to access AI services, such as exchanging tokens from a certain AI computing network for computing power. Additionally, some content platforms utilized AI to generate works and sell them through on-chain NFTs, with buyers simultaneously obtaining rights to value appreciation from AI's continuous iterative training. Despite many AI + blockchain projects being overvalued at the beginning of the bull market and halving as the market cooled, leading projects have demonstrated value. For example, AI security auditing tools and AI risk control model services have seen strong demand among B-end clients, generating real revenue and supporting the intrinsic value of corresponding tokens.

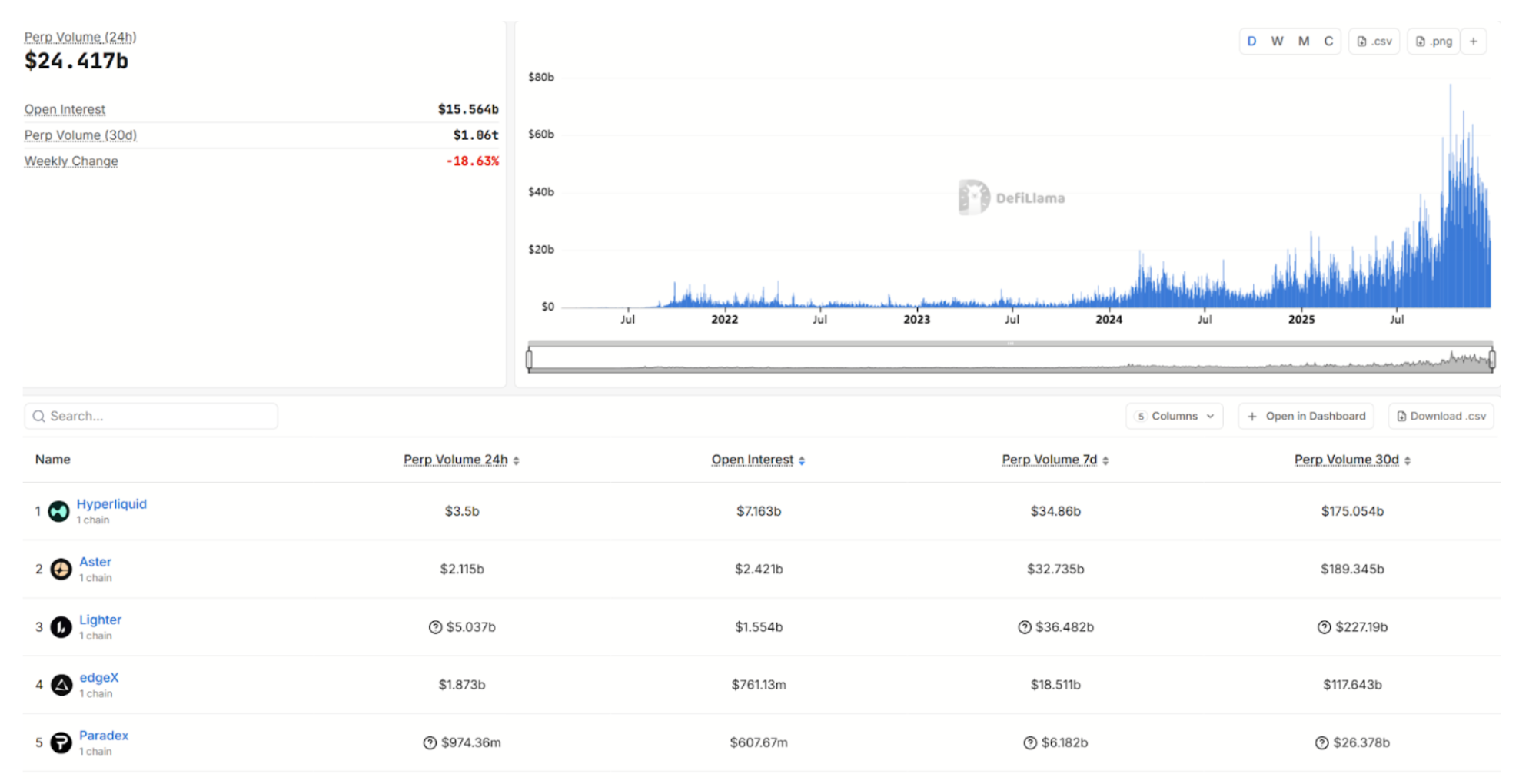

5. DeFi Ecosystem: The Rise of Perp DEX and Prediction Markets

Perpetual contract decentralized exchanges (Perp DEX) have become an undeniable force in the derivatives market. Leading Perp DEXs like Hyperliquid and Aster achieved record trading volumes in 2025, attracting numerous liquidity providers and market makers through incentives such as trading mining and fee rebates. A series of data shows that the total trading volume of decentralized derivatives reached a historical peak in 2025, with DeFi derivatives evolving from early niche attempts to a systemically important market component.

Source: https://defillama.com/perps

The soaring of prediction markets was also a major event in the DeFi space in 2025. Thanks to the CFTC's accommodating stance and a surge in user interest in event betting, prediction platforms like Polymarket saw a dramatic increase in trading volume, becoming one of the fastest-growing verticals. Prediction markets effectively took on some functions of traditional financial options and betting markets; in addition to entertaining political or sports predictions, businesses could use prediction markets to hedge performance risks, while investors could hedge against uncertainties of macro events. This expanded the application boundaries of DeFi.

Another notable trend in DeFi in 2025 was the rise of yield products and structured products. Traditional financial institutions began experimenting with DeFi lending protocols to enhance capital utilization, such as participating in the lending segment of cross-border trade financing. At the same time, to meet the stable investment needs of institutions, a batch of structured yield DeFi products emerged: for example, combining options and lending to generate two types of token shares for fixed and enhanced yields, achieving tiered interest rate markets. These innovations have shifted DeFi from merely chasing high yields to refined risk pricing.

However, various hacking attacks continued to emerge in 2025. Balancer V2 lost approximately $128 million in assets due to contract vulnerabilities affecting both the mainnet and forked projects. Some decentralized Lego-like combinations experienced collapses—complex yield aggregators and algorithmic strategy protocols faced runs due to excessive leverage and opaque manipulation, causing token prices to plummet to zero. Some information finance (InfoFi) projects also experienced significant ups and downs: these platforms claimed to generate revenue through user-contributed information but quickly collapsed after excessive expansion in the first half of 2025, as their models proved unsustainable and user attention was eroded by a flood of low-quality AI content and engagement manipulation.

6. SociaFi and NFT: New Attempts at Traffic and Content

In 2025, the exploration of "social + finance" (SocialFi) continued, with some new attempts emerging, such as content creator DAOs: tokenizing authors' works and crowdfunding support, allowing for transparent distribution of content creation revenue. However, overall, SocialFi did not see revolutionary breakthrough applications, as mainstream users primarily accessed crypto information through centralized platforms.

The NFT space also became more rational in 2025. Following the frenzy of 2021 and the lows of 2022-2023, the NFT market did not experience a new comprehensive bubble in 2025, but several sub-sectors performed outstandingly. One was the steady development of high-end art and luxury goods NFTs, with several leading auction houses successfully holding NFT-specific auctions, and well-known artists continuing to embrace blockchain works, leading to NFT art gradually being accepted by the traditional art world, with some blue-chip NFTs maintaining strong prices during the bear market. Another was the rise of utility NFTs, such as music copyright NFTs and ticketing NFTs, which provided holders with ongoing rights or services, thus having a basis for value preservation. The gaming NFT sector also saw new explorations, with some games adopting a "free NFT + in-game purchases" model to lower user barriers, while enhancing stickiness through the interoperability of on-chain assets.

IV. Outlook for 2026: A New Chapter Ready to Unfold

After the significant ups and downs of 2025, what will the cryptocurrency market look like in 2026? Based on macro trends and structural changes in the industry, we make the following forecasts for next year:

1. Macroeconomic Environment: Opportunities for Liquidity Restructuring

Expectations for the Federal Reserve to enter a rate-cutting cycle will continue to materialize in 2026. If the U.S. economy shows significant signs of slowing, the rate cuts next year may exceed current expectations. A looser monetary environment will provide "fresh water" for risk assets, including Bitcoin, and global liquidity is expected to expand again.

At the same time, there are uncertainties in the geopolitical and trade environment, but fiscal stimulus policies are also expected to take effect, maintaining a high global risk appetite. However, it is important to be cautious as the gains accumulated in traditional markets like U.S. stocks in 2025 are substantial, and some sectors (such as AI concept stocks) may have bubble concerns. If traditional assets adjust in 2026, it could temporarily drag down the cryptocurrency market.

Thus, the macro impact on crypto will be dual-faceted: liquidity easing and rising inflation will favor the value storage narrative, but if stock market bubbles burst and risk aversion rises, cryptocurrencies may not be able to remain unscathed. Overall, the macro backdrop for 2026 is more positive compared to 2025, but close attention must still be paid to cross-market risk transmission.

2. Policy and Regulation: Deepening Global Competition and Cooperation

The U.S. will continue to play a leading role in cryptocurrency policy in 2026. It is expected that the Trump administration will maintain the friendly stance of 2025 and may even push for bolder measures, such as considering including Bitcoin in national reserves, with Congress potentially reaching further consensus on the definition of security tokens and the jurisdiction of the SEC/CFTC, legitimizing many "gray area" projects.

The European Union may initiate discussions on MiCA 2.0, covering new regulations for DeFi and NFTs; Hong Kong and Singapore will compete to attract Web3 companies by offering more competitive tax and licensing treatments; countries like Japan or South Korea may relax listing restrictions on certain tokens to revitalize their domestic cryptocurrency industries. International regulatory cooperation will also strengthen, especially in areas like anti-money laundering and cross-border regulation of stablecoins. It can be anticipated that in 2026, countries will attempt to establish common regulatory standards for stablecoins and discuss frameworks for the coexistence of central bank digital currencies (CBDCs) and private stablecoins. More broadly, discussions about the systemic importance of the cryptocurrency market may come to the forefront—as the market capitalization of cryptocurrencies increases and their correlation with traditional finance rises, regulators will incorporate cryptocurrencies into macroprudential management considerations and develop contingency plans for extreme situations.

In summary, the regulatory tone for 2026 may be one of "calmness": no longer fearing it, nor blindly promoting it, but rather regulating it as part of the financial system. This is undoubtedly a positive development for the long-term healthy growth of the industry. Of course, there may still be local regressions or tightening; if significant fraud or money laundering cases occur, short-term regulatory responses may be stringent.

3. Institutional Deepening: Further Mainstreaming

In 2026, we expect to see more diverse ways for institutions to enter the market. Firstly, retirement giants like 401(k) plans may officially launch Bitcoin/Ethereum allocation options for retirement accounts, ushering in a new era of long-term capital investment. Estimates suggest that even if only 1% of U.S. pension funds flow into crypto, the potential scale could reach hundreds of billions of dollars, becoming a significant force driving the next long-term bull market. Secondly, sovereign funds and commercial banks around the world are likely to increase their exploration of digital assets. Some countries' reserve funds may follow the examples of Singapore and the UAE by directly investing in Bitcoin ETFs or supporting the issuance of digital currencies in their own countries; large banks in Europe and the U.S. may launch digital asset custody and brokerage services under compliance frameworks, incorporating crypto as a standard asset class in their wealth management offerings.

In 2026, the industry is expected to see continuous improvements on both product innovation and compliance systems: more structured products (such as volatility ETFs and yield certificate tokens) will emerge to meet the needs of clients with different risk preferences; at the same time, exchanges and custodians will enhance transparency and capital requirements to ensure that past tragedies do not repeat. Institutional participation will increasingly change the market ecosystem—trading will be dominated by large OTC transactions and ETFs, volatility will decrease, and Bitcoin's properties as a safe haven and macro asset will become more pronounced. As Forbes analysis suggests, with broader and more institutionalized markets, the historical cycles of Bitcoin's dramatic rises and falls every four years will become a thing of the past, replaced by a sustained, gradual upward trajectory. For investors, while this may mean fewer get-rich-quick myths, it also signifies a more mature and reliable asset class that is easier for traditional investors to embrace on a large scale.

4. Technology and Applications: Six Structural Forces Paving the Way

In 2026, six major structural forces may drive the next phase of evolution in the crypto market:

1) Value Storage and Financialization: Bitcoin, Ethereum, and others will further financialize, with derivatives and lending markets maturing, bringing them closer to the performance of traditional assets like gold. As volatility decreases, they will attract more conservative capital allocations, increasing global adoption. Grayscale's research predicts that BTC will reach new highs in 2026, targeting $250,000. The magic of the Bitcoin halving cycle may fade, but its status as digital gold will be firmly established.

2) Stablecoin Surge: Stablecoins may experience a comprehensive explosion in 2026, with large tech companies potentially building their own stablecoin ecosystems, and more countries allowing banks to hold stablecoins directly for settlement. Mainstream payment networks like Visa/Mastercard may integrate stablecoins into their clearing processes, enabling seamless on-chain and off-chain payments. Meanwhile, a reshuffling will occur—less competitive small stablecoin projects will be eliminated, concentrating the market around leading players like USDT, USDC, USD1, and PYUSD. Businesses and individuals will be able to bypass the banking system for instantaneous global fund transfers, opening channels for cross-border capital flows.

3) Asset Tokenization: The trend of physical assets moving on-chain will accelerate. Some large exchanges may even partner with blockchain platforms to launch a tokenized securities sector for around-the-clock trading, serving global investors. The refinement of financial products will also advance further, with more innovative ETFs and funds (such as composite ETFs containing Bitcoin futures and tech stocks) emerging, providing investors with more choices.

4) Integration of DeFi and TradFi: The deep integration of banks and DeFi will become the new norm. We may see the first DeFi loan products issued by banks or enterprise-level payment smart contract platforms launched by Visa based on Ethereum. Dynamic yield, prediction markets, and other DeFi features will be embedded in traditional financial services. For example, an insurance company may use decentralized oracles and on-chain data to automate claims processing, reflecting the "on-chain" nature of traditional finance. Concepts of on-chain governance and compliance DAOs may also be piloted within enterprises to enhance efficiency and transparency.

5) Deep Integration of AI and Crypto: As discussed earlier, the embryonic form of the AI economy has emerged, and in 2026, we expect to see widespread participation of AI agents in economic activities. The X402 protocol may become the industry standard, being widely applied in IoT and web service payments. AI-driven on-chain investment advisors and risk control models will become more mature, and by 2026, some funds may begin publicly promoting their use of AI algorithms for investment decisions. The AI narrative in the next cycle will no longer just be storytelling but will be supported by practical applications and profit models.

6) Privacy and Security Infrastructure: As institutions and mainstream users place greater emphasis on privacy, 2026 may see breakthroughs in privacy technology. Some zero-knowledge proof and multi-party computation projects will achieve commercial viability, providing solutions for compliant privacy-protecting transactions and data sharing. Regulators may also allow the existence of privacy exchanges or privacy stablecoins under specific frameworks, serving compliant users who require anonymity (such as corporate confidential transactions). In terms of security, 2026 is likely to be stable, but continuous attention is needed on cryptographic upgrades in the face of quantum computing threats, as well as the progress of social engineering and on-chain monitoring dynamics.

V. Outlook and Conclusion

Market Trend Outlook: Bull Market, Bear Market, or Transformation?

There are differing opinions regarding the market in 2026. Some believe that the peak was reached in October 2025, and that the four-year cycle pattern remains unchanged, predicting a long bear market in 2026, with Bitcoin potentially dropping back to the $50k-$60k range to find a bottom. These views are based on macro lagging effects and market inertia, suggesting that institutions will also follow the cyclical rhythm. In contrast, investors represented by institutions and long-term asset management firmly believe that this cycle has not ended and may even extend: they point out that continuous institutional buying will extend the cycle to 4.5 or 5 years, viewing the recent 30% pullback as a normal correction within a bull market, believing that the bullish trend will persist throughout 2026 and drive BTC to new highs.

We assess that the crypto market in 2026 is likely to emerge into a new paradigm of "weak cycles, long bull markets": no longer simply replicating past patterns of dramatic rises and falls, but instead generating several moderate amplitude waves in response to macro fluctuations, while the central focus rises, potentially recording positive returns for the year. In other words, if there is no severe economic recession or black swan event globally, Bitcoin, Ethereum, and others are likely to be higher than their prices at the beginning of the year in 2026. Mainstream investment banks like BlackRock's strategic reports also support this view: they expect that after a decrease in volatility in 2026, crypto will gradually integrate into traditional asset allocation logic, and even without dramatic increases, it will be a year of continuous ecological reconstruction. Of course, investors still need to be vigilant about potential risks, including regulatory uncertainties (political factors in an election year), technical vulnerabilities, and unpredictable macro market events.

Conclusion

Looking back at 2025, the crypto market swung violently between frenzy and freezing points; we witnessed the birth of historical highs and also the sudden collapse of the market; we saw greed and fear alternating in dominance over the market, as well as innovation and transformation quietly building strength. Whether it is the shift in regulation, the entry of institutions, or the rise of new narratives like RWA, AI, and prediction markets, all indicate that the crypto industry is gradually maturing. As we approach 2026, it may no longer be characterized by the extreme joy and despair of past cycles, but rather a steady progress in rationality and construction. This may not be a bad thing for investors: fewer get-rich-quick myths, more long-term value; fewer dreamlike bubbles, more solid foundations. When the bubbles recede, truly excellent projects and assets will stand out even more. Let us embrace cautious optimism and welcome the next iteration of the crypto market. The exciting chapter of the crypto world in 2026 is waiting for us to write together.

About Us

Hotcoin Research, as the core research institution of Hotcoin Exchange, is dedicated to transforming professional analysis into your practical tools. Through our "Weekly Insights" and "In-Depth Reports," we analyze market trends for you; leveraging our exclusive column "Hotcoin Selection" (AI + expert dual screening), we help you identify potential assets and reduce trial-and-error costs. Each week, our researchers also engage with you through live broadcasts, interpreting hot topics and predicting trends. We believe that warm companionship and professional guidance can help more investors navigate cycles and seize value opportunities in Web3.

Risk Warning

The cryptocurrency market is highly volatile, and investing carries risks. We strongly recommend that investors conduct investments based on a full understanding of these risks and within a strict risk management framework to ensure the safety of their funds.

Website: https://lite.hotcoingex.cc/r/Hotcoinresearch

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。