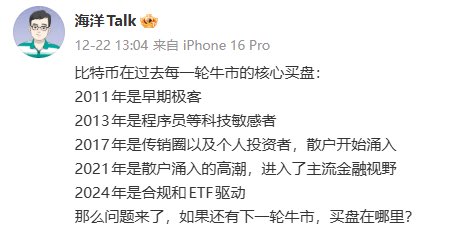

Looking back at the previous bull markets of Bitcoin, there is actually a very clear path of absorption:

Geeks → Need to understand cryptography

Programmers → Need to understand technical feasibility

Retail investors → Need to understand the narrative of getting rich quickly

Mainstream finance → Need to understand legitimacy

Each round of increase is essentially a cognitive diffusion.

This is also why past bull markets have always been accompanied by new narratives, new slogans, and new beliefs.

However, after 2024, institutional ETFs will continue to gain momentum,

New buying will not only come from emotions, judgments, or beliefs, but more from asset allocation and systems.

This directly changes the supply and demand structure.

In the past, the selling pressure of BTC mainly came from three types of people:

1️⃣ Lifecycle cashing out of early holders

2️⃣ Panic retail investors under high volatility

3️⃣ Trading funds with strong cycles

Now, ETFs and institutional holdings are converting a portion of BTC into dormant assets that no longer participate in short-cycle games.

This is very similar to the changes seen when gold entered central banks, pension funds, and insurance systems.

This means that the next round of BTC increases may occur without relying on new cognitive buying.

When a portion of the chips is locked up for the long term, and the number of sellers willing to repeatedly enter and exit in the short cycle decreases, the driving force of the price will shift from "cognitive diffusion" to "supply contraction."

The increase itself will become a passive result.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。