On December 17, Aave founder and CEO Stani.eth posted on social media that after four years, the U.S. Securities and Exchange Commission has completed its investigation into the Aave protocol.

This was supposed to be an inspiring milestone. However, as Web2 ended its entanglement with the SEC, Aave found itself facing a "fire in the backyard" of Web3. Over the past half month, the governance disputes within the Aave community have been a hot topic in the English-speaking world. Surrounding this dispute, a series of events have emerged, including whale sell-offs, the founder's "market rescue," and issues of governance and trust.

Let's take a look at the ins and outs of this event.

Cause: Revenue Distribution Controversy

On December 4, Aave Labs changed the default Swap function of its front-end interface aave.com from ParaSwap to CoWSwap.

This was initially just a minor update, but senior governance participant and independent delegate EzR3aL discovered that the fees generated by the default Swap function on aave.com no longer flowed into the Aave DAO treasury as before, but instead went to an address controlled by Aave Labs. According to EzR3aL's on-chain investigation, at the time of his writing, the most recent revenue transfer from Aave Labs was worth at least $200,000, and based on rough estimates of weekly revenue data, Aave DAO was losing at least $10 million annually.

Aave Labs did not proactively mention this change in fee distribution, which made many $AAVE holders feel "betrayed."

Aave Labs responded multiple times under EzR3aL's post, with main arguments including:

Protocols and products are different concepts. The front-end interface that caused the revenue distribution controversy is a product operated by Aave Labs, completely independent of the protocol managed by Aave DAO, and Aave Labs has the right to decide how to operate and profit.

Maintaining the front-end interface requires substantial resources, and Aave DAO has never been asked to bear these costs.

The original technical architecture integrated with Paraswap had a donation mechanism based on surplus. When the actual execution price exceeds the quoted price, the surplus portion is donated to Aave DAO. This is not a protocol fee, nor is it a mandatory requirement to give to Aave DAO. With the design change, the original donation mechanism was naturally canceled.

The new CoWSwap routing option can improve execution quality, including providing MEV protection for interface users, and this routing option was developed by Aave Labs using its own resources, without replacing or disabling the adapters owned by Aave DAO at the protocol level. Aave DAO can allow any interface to integrate its owned adapters to achieve Swap functionality.

Escalation of the Dispute: Who Owns "Aave"?

The responses from Aave Labs under EzR3aL's post were not understood or accepted by the community.

On December 13, @DefiIgnas published a lengthy article titled "Who Owns Aave: Aave Labs or Aave DAO?," which sparked widespread discussion.

On December 16, former Aave Labs CTO Ernesto released a governance proposal titled "$AAVE Alignment Phase 1: Ownership," which advocated for Aave DAO and Aave token holders to explicitly control core rights such as protocol IP, branding, equity, and revenue. Representatives of Aave service providers, including Marc Zeller, publicly endorsed the proposal, calling it "one of the most influential proposals in Aave governance history."

In the proposal, Ernesto mentioned, "Due to some past events, previous posts and comments have held strong hostility towards Aave Labs, but this proposal seeks to remain neutral. This proposal does not imply that Aave Labs should not be a contributor to the DAO or lacks legitimacy or capability in its contributions, but the decisions should be made by Aave DAO."

On December 18, Aave founder and CEO Stani.eth replied under the proposal, stating that he would strengthen communication between Aave Labs and the community but would vote against the proposal because it simplified a complex legal and operational issue into a simple "yes or no" vote, lacking a practical solution that would affect Aave's overall development progress.

This further intensified the dispute.

Whale Sell-Offs, Founder "Market Rescue"

On December 22, on-chain analyst Yu Jin monitored that the second-largest whale address holding AAVE sold 230,000 AAVE (approximately $38 million), causing the AAVE price to drop over 10% temporarily. The whale exchanged all AAVE for 227.8 WBTC and 5869.4 stETH between 5:40 AM and 7:05 AM. It is reported that this batch of AAVE was purchased from late last year to early this year at an average cost of about $223.4. This sell-off was executed at an average price of about $165, resulting in an estimated loss of $13.45 million.

A few hours after the whale's exit, Aave Labs announced that it believed the issue required a formal governance decision and officially initiated a three-day snapshot vote.

On December 23, Aave founder and CEO Stani.eth spent 1,699 ETH ($5.15 million) to buy 32,660 AAVE at an average price of $157.78. Including this purchase, he bought a total of 84,033 AAVE within a week, with an average total price of about $176, spending approximately $14.8 million.

However, after the founder's "market rescue," price volatility continued. On December 24, a new 7x leveraged AAVE short position was opened by an address starting with 0x3c7, with a position size of $2.42 million, an average price of $151, and a liquidation price of $173.

The market also had many doubts and concerns about the founder's "market rescue." DeFi strategist and liquidity expert Robert Mullins stated that the purpose of this purchase was to enhance Kulechov's voting power to support a proposal that directly harms the best interests of token holders in the upcoming vote. He added, "This is a clear example of how the token mechanism has not been adequately designed to effectively curb governance attacks."

Well-known crypto KOL Sisyphus also expressed similar concerns, stating that Kulechov might have sold millions of dollars worth of AAVE tokens between 2021 and 2025 and questioned the economic motives behind this repurchase.

Conclusion

On December 26, Wintermute founder and CEO Evgeny Gaevoy stated that Wintermute would vote against the ARFC governance proposal to "transfer brand asset control to token holders."

Evgeny stated that the current proposal lacks specific details, and it is unclear how the entity owning the front end and brand will govern, whether it is for profit, and how it will operate. The core issue facing AAVE is token value acquisition, and there is a clear mismatch of expectations between Aave Labs and many token holders. Wintermute has invested in AAVE since 2022 and participated in its governance. Evgeny hopes that Aave Labs will seriously address the token value acquisition issue, which will serve as a reference for other tokens.

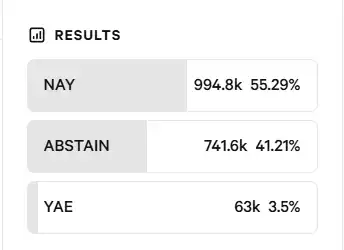

The voting results were also released this morning, and the proposal was ultimately not passed, with 55.29% opposed, 41.21% abstaining, and only 3.5% in favor.

So, is this the end of the dispute? Clearly not, as the distrust between the community and Aave Labs has not been resolved. This dispute, seemingly caused by poor communication, is actually a reflection of the long-standing contradictions between developers/operators and governance parties in the crypto space, where the boundaries of rights and interests are unclear and lack institutional constraints. The entanglement between Aave Labs and Aave DAO actually illustrates Aave's success, as there are many similar examples in the crypto space where such high-quality discussions to attempt to resolve issues do not even occur (Related reading: Why now, when acquiring crypto projects, are tokens no longer needed?)

This is a problem Aave must face, and it is also a problem that the entire cryptocurrency industry will inevitably have to confront.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。