1. Overview of This Week's Market

Today is Friday, and the market for this week is basically coming to an end, with overall fluctuations being minor.

From the current state, it is highly likely that the weekend will mainly see sideways fluctuations, and any new market rhythm will need to be observed next week.

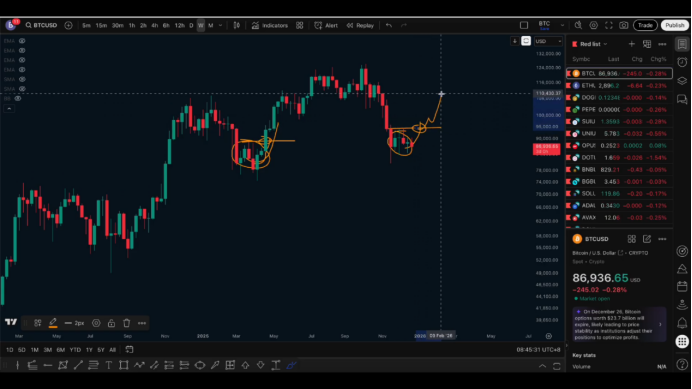

2. Explanation of Weekly Fluctuation Range

From the weekly structure, for nearly a month, the price has consistently operated below 94,000 and above 84,000, which is a fluctuation range of 10,000 points.

Although there is some space within the fluctuation range, the volatility has clearly converged in the last two weeks, indicating that there has been no further involvement of new major funds at this stage.

3. Overall Structure Judgment

Current trading expectations remain unchanged.

From a structural perspective, whether on the weekly, daily, or hourly levels, the overall situation is still in a bearish structure.

4. Question of "Will There Be a Reversal?"

Many people are concerned whether the market will follow a path similar to before, "sharp decline—sideways for a month—then sharp rise."

This possibility cannot be completely ruled out, but the premise is that there must be a clear confirmation signal, which means a significant breakout and stabilization above key resistance levels. Currently, such signals have not appeared.

Until the price breaks out above 94,000, reversals on the daily and weekly levels cannot be confirmed, and all judgments can only remain in the realm of speculation, which cannot serve as a basis for trading.

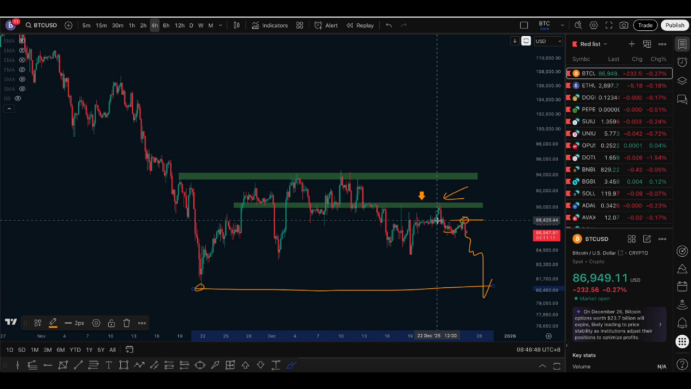

5. Why Focus on Smaller Timeframes

Structural changes must begin from smaller timeframes.

If there are no clear and confirmable breakout signals on the hourly level, then daily and weekly reversals cannot be confirmed.

Therefore, the current focus of analysis remains on whether the hourly structure has changed.

6. Key Resistance and Verification Situation

Since last week, we have repeatedly pointed out that there is significant pressure at the 94,000 level above. Subsequently, the price experienced a decline of about 10,000 points and rebounded below 84,000.

During the rebound, the resistance level around 90,500–91,000 has been repeatedly validated as effective resistance.

As long as the price cannot effectively break above 91,000, it indicates that selling pressure above still exists, and the structure has not reversed.

7. Current Trading Logic

The current trading logic is actually very simple:

The structure remains unchanged, and the trend is bearish.

The key resistance level is at 91,000, with defense placed above 91,000.

When the price rebounds to relatively high levels, prioritize considering short positions, with the short-term target still looking at the previous low.

8. Confirmation Conditions for Upside Scenarios

If the price subsequently breaks out and stabilizes above 91,000, there is a high probability of continuing to test 94,000.

Only after 94,000 is effectively broken can the market structure potentially undergo substantial changes.

Follow me, join the community, and let's progress together.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。